Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help solve this question thank you McGlla Golf is evaluating a new golf club. The clubs will sell for $890 per set and have

Please help solve this question thank you

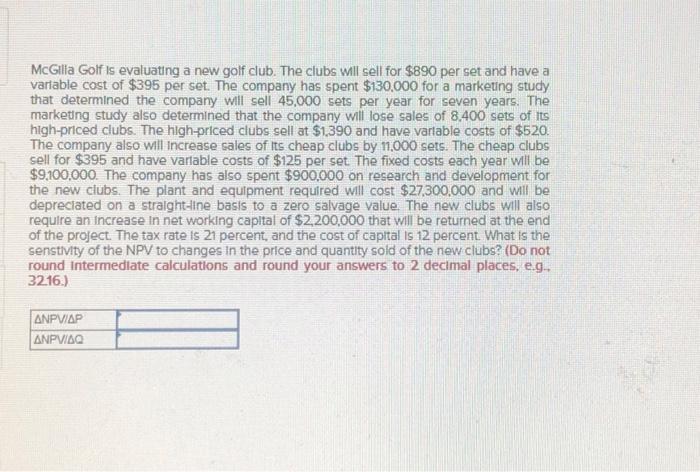

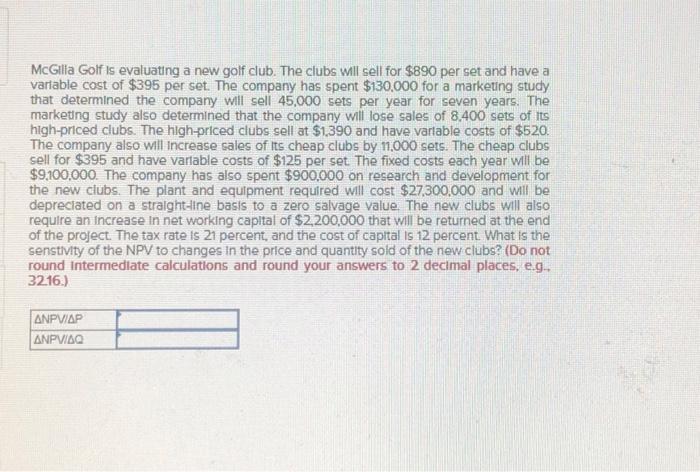

McGlla Golf is evaluating a new golf club. The clubs will sell for $890 per set and have a varlable cost of $395 per set. The company has spent $130.000 for a marketing study that determined the company will sell 45,000 sets per year for seven years. The marketing study also determined that the company will lose sales of 8.400 sets of its high-priced clubs. The high-priced clubs sell at $1,390 and have varlable costs of $520. The company also will increase sales of its cheap clubs by 11,000 sets. The cheap clubs sell for $395 and have varlable costs of $125 per set. The fixed costs each year will be $9,100,000. The company has also spent $900,000 on research and development for the new clubs. The plant and equipment required will cost $27,300,000 and will be depreciated on a straight-line basis to a zero salvage value. The new clubs will also require an increase in net working capltal of $2,200,000 that will be returned at the end of the project. The tax rate is 21 percent, and the cost of capital is 12 percent. What is the senstivity of the NPV to changes in the price and quantity sold of the new clubs? (Do not round intermedlate calculations and round your answers to 2 decimal places, e.g. 3216.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started