please help solve to find b, c, and d

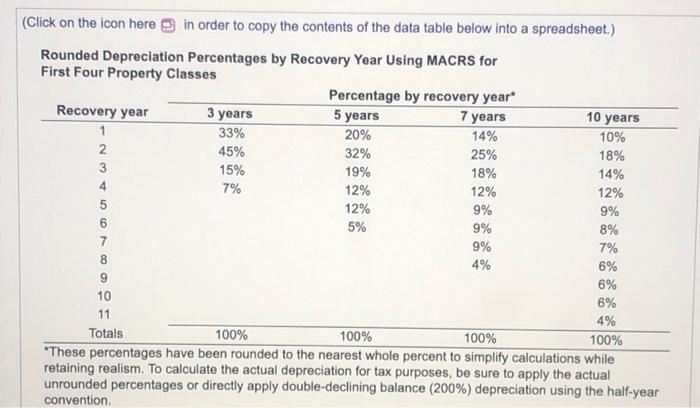

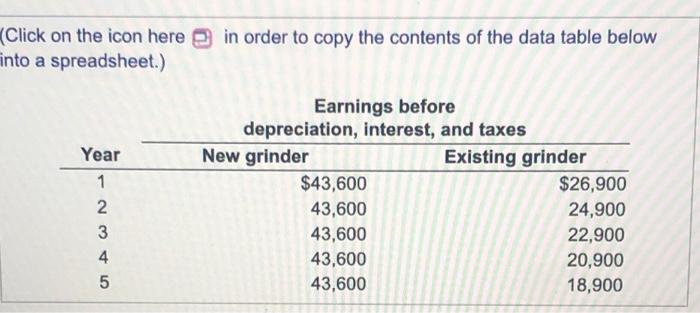

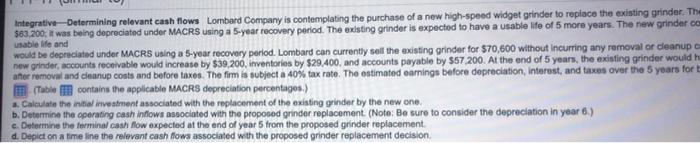

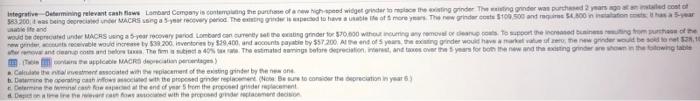

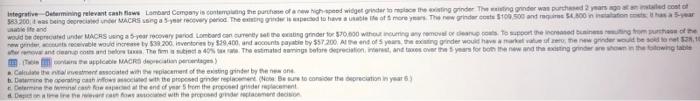

Integrative termining relevant cash flow Lombard Company is coming the pure which widget to the wonder the grinder was pred 2 years ago and cost 583 200 g decided MACRS 5 ya wypriot There is to have a life of more. The owner of 100 500 and in ons haar wand would be deprecated MACHS ng a 5-year recovery period Lombardi concurente tenggoro 570,000 wongamal To ording from the we would increase ty 538200. Inventore by 19.400 and wounts payable by 557200. And of your order would have the new gender would odont wanted to Thema 40 hestimated ning before and the years from the new things when thing The low MACRO Ages Catheted with of the existing by the one b. Din the sport show with the proped and recente to consideration in year minute of the moderne the the proposer de 4 (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year* Recovery year 3 years 5 years 7 years 10 years 1 33% 20% 14% 10% 2. 45% 32% 25% 18% 3 15% 19% 18% 14% 7% 12% 12% 12% 5 12% 9% 9% 5% 9% 8% 7 9% 7% 8 4% 9 6% 10 6% 11 4% Totals 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention 6 6% (Click on the icon here into a spreadsheet.) in order to copy the contents of the data table below Year 1 2 3 4 5 Earnings before depreciation, interest, and taxes New grinder Existing grinder $43,600 $26,900 43,600 24,900 43,600 22,900 43,600 20,900 43,600 18,900 Integrative-Determining relevant cash flows Lombard Company is contemplating the purchase of a new high-speed widget grinder to replace the existing grinder. The $63,200, it was being depreciated under MACRS using a 5-year recovery period. The existing grinder is expected to have a usable life of 5 more years. The new grinder Co usable life and would be depreciated under MACRS using a 5-year recovery period. Lombard can currently sell the existing grinder for 570,600 without incurring any removal or cleanup new grinder, accounts receivable would increase by $39,200, inventories by $29.400, and accounts payable by $57 200. At the end of 5 years, the existing grinder would h aher removal and cleanup conts and before taxes. The firm is subject a 40% tax rate. The estimated earnings before depreciation, Interest, and taxes over the 5 years for E (Table contains the applicable MACRS depreciation percentages.) a. Calculate the initial investment associated with the replacement of the existing grinder by the new one. b. Determine the operating cash inflows associated with the proposed grinder replacement. (Note: Be sure to consider the depreciation in year 6.) c. Determine the ferminal cash flow expected at the end of year 5 from the proposed grinder replacement d. Depict on a timeline the relevant cash flows associated with the proposed grinder replacement decision

please help solve to find b, c, and d

please help solve to find b, c, and d