Answered step by step

Verified Expert Solution

Question

1 Approved Answer

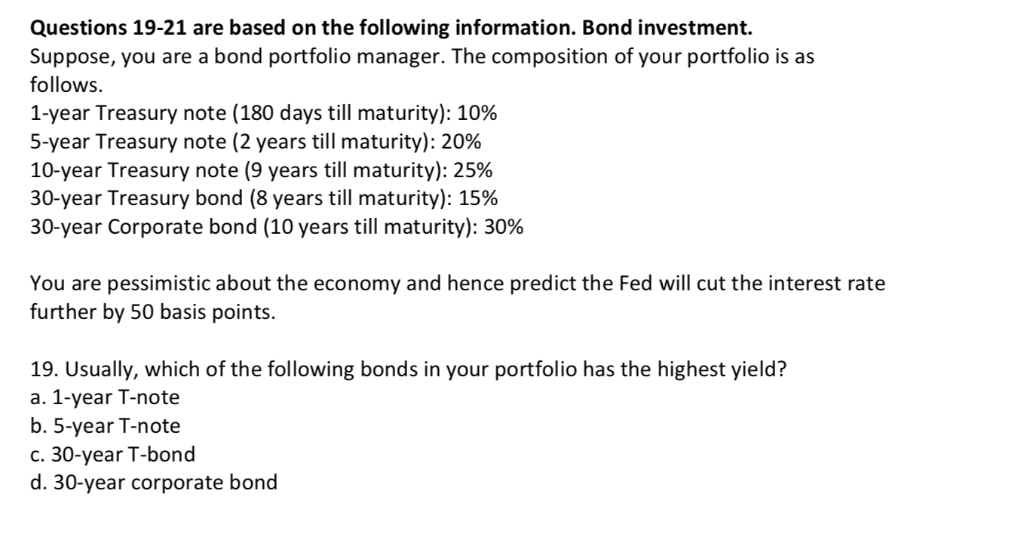

Please help solve with correct answers and explanations Questions 19-21 are based on the following information. Bond investment. Suppose, you are a bond portfolio manager.

Please help solve with correct answers and explanations

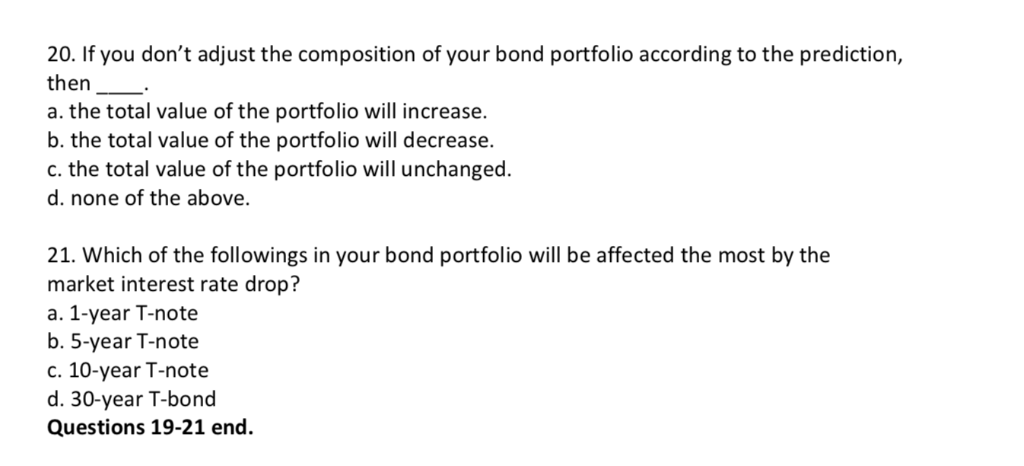

Questions 19-21 are based on the following information. Bond investment. Suppose, you are a bond portfolio manager. The composition of your portfolio is as follows 1-year Treasury note (180 days till maturity): 10% 5-year Treasury note (2 years till maturity): 20% 10-year Treasury note (9 years till maturity): 25% 30-year Treasury bond (8 years till maturity): 15% 30-year Corporate bond (10 years till maturity): 30% You are pessimistic about the economy and hence predict the Fed will cut the interest rate further by 50 basis points 19. Usually, which of the following bonds in your portfolio has the highest yield? a. 1-year T-note b. 5-year T-note c. 30-year T-bond d. 30-year corporate bond 20. If you don't adjust the composition of your bond portfolio according to the prediction, then a. the total value of the portfolio will increase. b. the total value of the portfolio will decrease. c. the total value of the portfolio will unchanged. d. none of the above. 21. Which of the followings in your bond portfolio will be affected the most by the market interest rate drop? a. 1-year T-note b. 5-year T-note c. 10-year T-note d. 30-year T-bond Questions 19-21 endStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started