Question

Please help solving the 3 questions 1) Use EXCEL to calculate the net present value of the proposed 2020 Noble Rascal release. Assume that increases

Please help solving the 3 questions

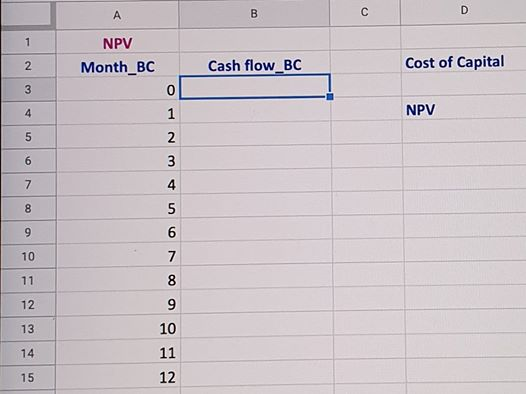

1) Use EXCEL to calculate the net present value of the proposed 2020 Noble Rascal release. Assume that increases in profits are realised at the end of each month. The cost of capital for Orange Wines is 4.73% per year compounded monthly.

2) To gauge the viability of the Cellar Door press release, you need to know how long it will take for Orange Wines to completely recoup the initial outlay of $95,000. You cant be bothered doing more calculations (who can blame you?) so you produce a rough visualisation of your analysis that will give you the upper limit on the time it will take to completely recoup the initial outlay made by Orange Wines. Include the graph here and the infographic where indicated.

3) As a sign the future is looking bright for Orange Wines, they just received the fantastic news their 2019 Noble Rogue vintage has scooped the pool at the recent Wine Industry Awards (Best Vintage 2019, Critics Choice and Best Oxymoronic Wine Name) with a combined prize money of $50,000. Rather than spend the prize money, Orange Wines have decided to invest it as part of their future funds. The prize money is invested at an interest rate of 2.5% per annum compounded monthly for a 3 year period. Orange Wines have also committed to investing regular deposits of $5,000 in a second investment account that attracts 2.5% per annum compounded quarterly. Orange Wines wants to combine the maturity of the two accounts in 3 years time. If they have at least $100,000 they will use it to grow the cellar door experience with an upgraded outdoor area and interactive wine tasting tours.

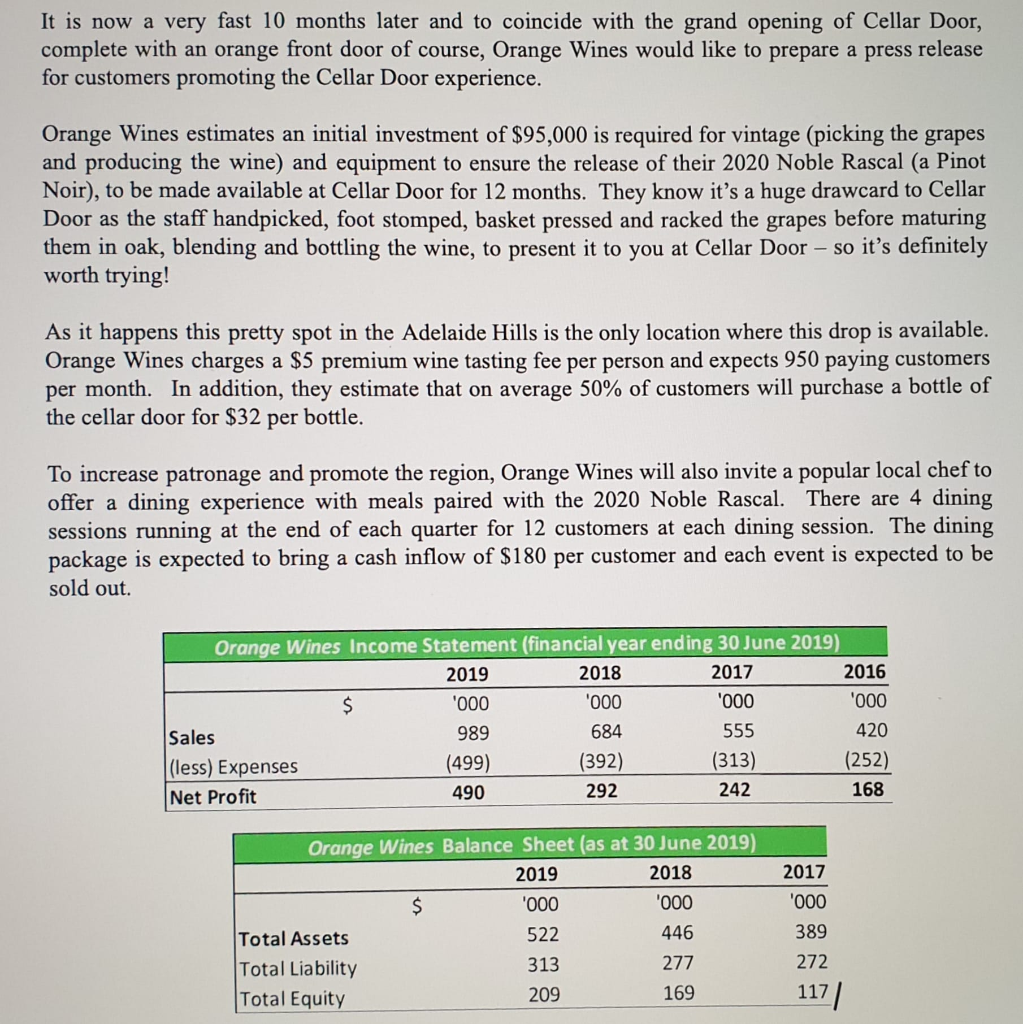

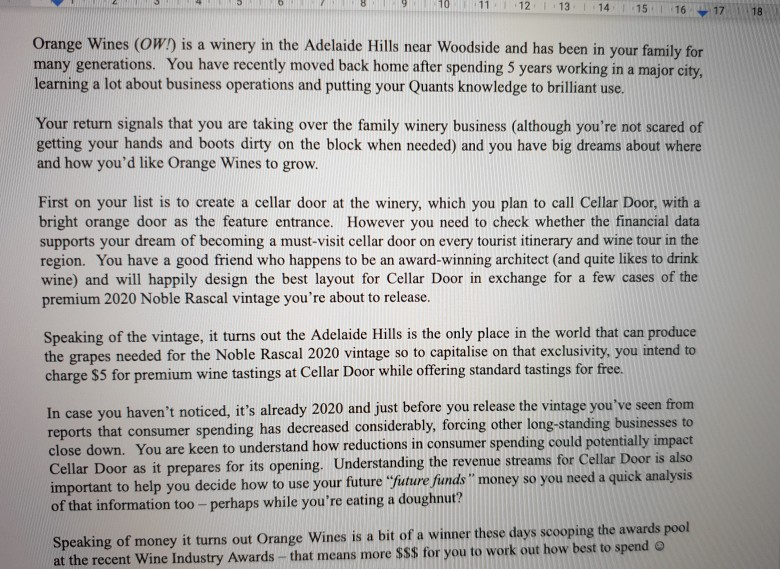

It is now a very fast 10 months later and to coincide with the grand opening of Cellar Door, complete with an orange front door of course, Orange Wines would like to prepare a press release for customers promoting the Cellar Door experience. Orange Wines estimates an initial investment of $95,000 is required for vintage (picking the grapes and producing the wine) and equipment to ensure the release of their 2020 Noble Rascal (a Pinot Noir), to be made available at Cellar Door for 12 months. They know it's a huge drawcard to Cellar Door as the staff handpicked, foot stomped, basket pressed and racked the grapes before maturing them in oak, blending and bottling the wine, to present it to you at Cellar Door so it's definitely worth trying! As it happens this pretty spot in the Adelaide Hills is the only location where this drop is available. Orange Wines charges a $5 premium wine tasting fee per person and expects 950 paying customers per month. In addition, they estimate that on average 50% of customers will purchase a bottle of the cellar door for $32 per bottle. To increase patronage and promote the region, Orange Wines will also invite a popular local chef to offer a dining experience with meals paired with the 2020 Noble Rascal. There are 4 dining sessions running at the end of each quarter for 12 customers at each dining session. The dining package is expected to bring a cash inflow of $180 per customer and each event is expected to be sold out. Orange Wines Income Statement (financial year ending 30 June 2019) 2019 2018 2017 2016 '000 '000 '000 '000 Sales 989 684 555 420 (less) Expenses (499) (392) (313) (252) Net Profit 490 292 242 168 2017 '000 Orange Wines Balance Sheet (as at 30 June 2019) 2018 '000 Total Assets 522 446 Total Liability Total Equity 169 '000 389 277 272 313 209 117/ D NPV Month_BC Cash flow_BC Cost of Capital NPV 11 12 13 14 15 16 17 Orange Wines (OW!) is a winery in the Adelaide Hills near Woodside and has been in your family for many generations. You have recently moved back home after spending 5 years working in a major city, learning a lot about business operations and putting your Quants knowledge to brilliant use. Your return signals that you are taking over the family winery business (although you're not scared of getting your hands and boots dirty on the block when needed) and you have big dreams about where and how you'd like Orange Wines to grow. First on your list is to create a cellar door at the winery, which you plan to call Cellar Door, with a bright orange door as the feature entrance. However you need to check whether the financial data supports your dream of becoming a must-visit cellar door on every tourist itinerary and wine tour in the region. You have a good friend who happens to be an award-winning architect (and quite likes to drink wine) and will happily design the best layout for Cellar Door in exchange for a few cases of the premium 2020 Noble Rascal vintage you're about to release. Speaking of the vintage, it turns out the Adelaide Hills is the only place in the world that can produce the grapes needed for the Noble Rascal 2020 vintage so to capitalise on that exclusivity, you intend to charge $5 for premium wine tastings at Cellar Door while offering standard tastings for free. In case you haven't noticed, it's already 2020 and just before you release the vintage you've seen from reports that consumer spending has decreased considerably, forcing other long-standing businesses to close down. You are keen to understand how reductions in consumer spending could potentially impact Cellar Door as it prepares for its opening. Understanding the revenue streams for Cellar Door is also important to help you decide how to use your future "future funds" money so you need a quick analysis of that information too - perhaps while you're eating a doughnut? Speaking of money it turns out Orange Wines is a bit of a winner these days scooping the awards pool at the recent Wine Industry Awards - that means more $$$ for you to work out how best to spend @

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started