Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP SOON!! the first few pictures are required info, the last two are the template to follow for parts A-N 1. Using the finarcial

PLEASE HELP SOON!! the first few pictures are required info, the last two are the template to follow for parts A-N

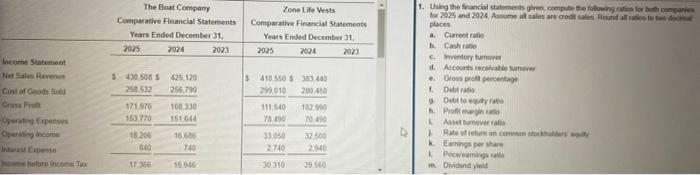

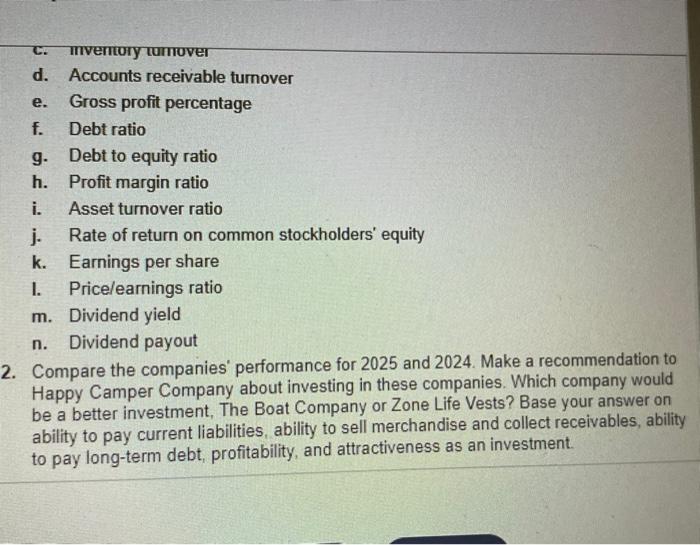

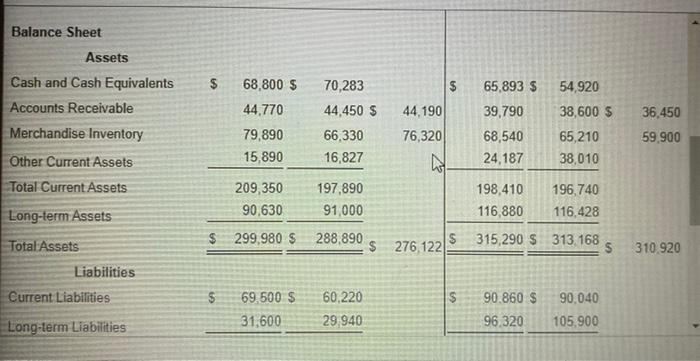

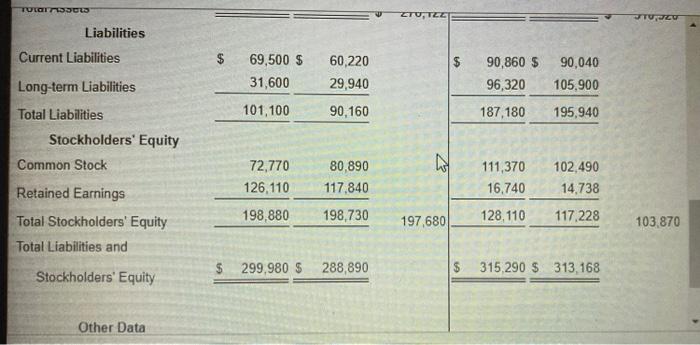

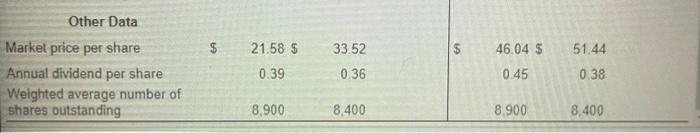

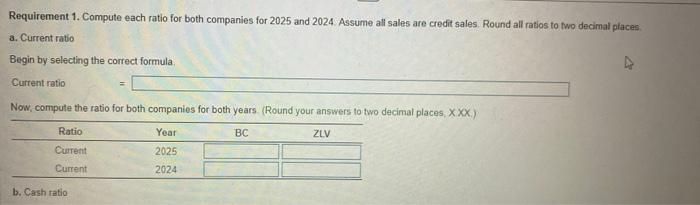

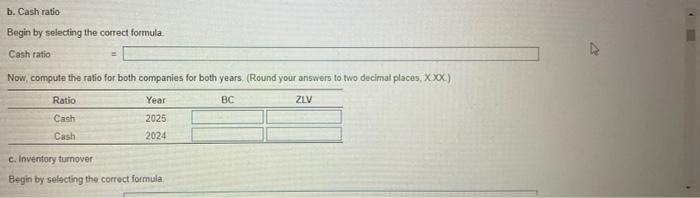

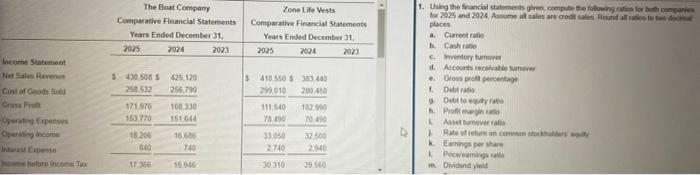

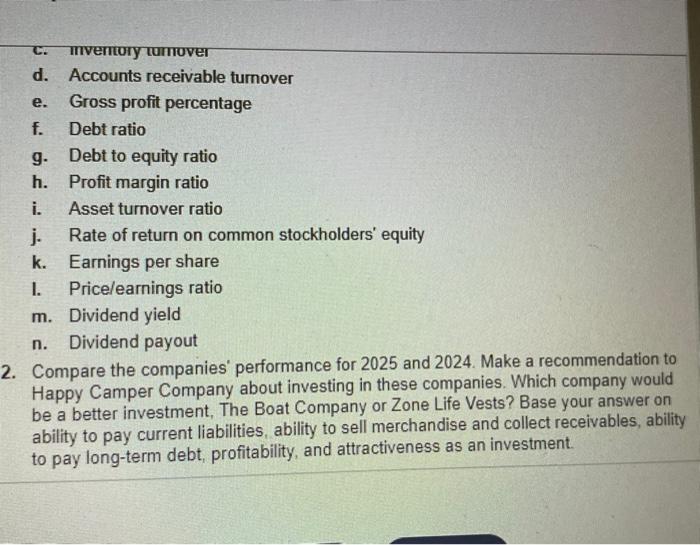

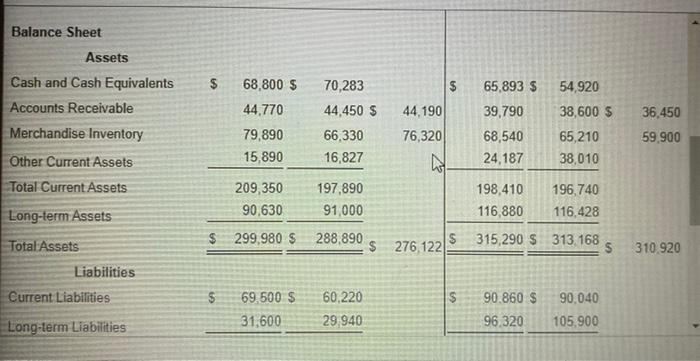

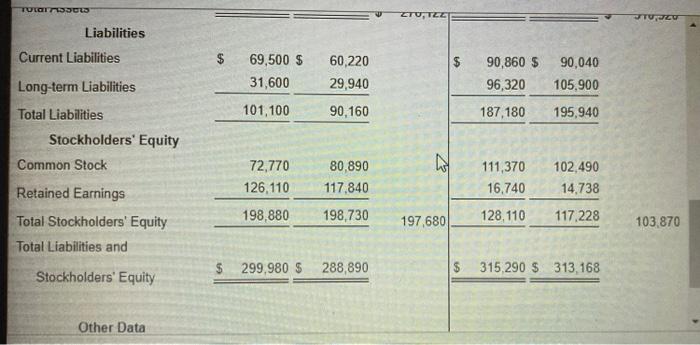

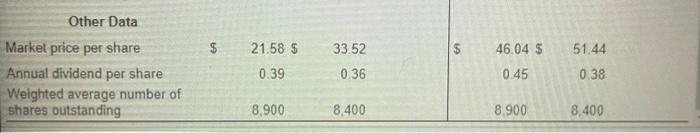

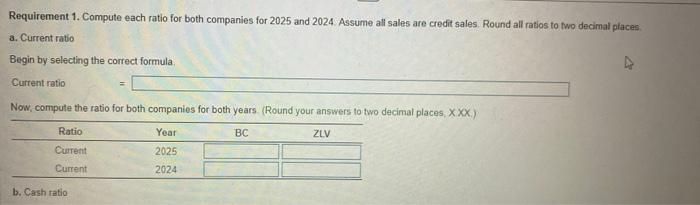

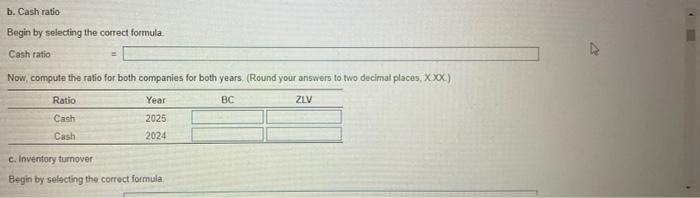

1. Using the finarcial stafements ghen, compuab the follow the ratios lar both congatist places a. Cumeril estio b. Cisthratio C. Inventory turnoven d. Aecounts recewible tumbiver e. Ceoss preds percentage 1. Deboritio 9. Dubt to equety ritio B. Profit magin tifo 1. Aeset murnover ratio 1. Rate of retum en tomnos afocitiokers os if Eaeningst ber thay 1 Priceleaming raks me. Dividend yield C. IItveritory turioveI d. Accounts receivable tumover e. Gross profit percentage f. Debt ratio g. Debt to equity ratio h. Profit margin ratio i. Asset turnover ratio j. Rate of return on common stockholders' equity k. Earnings per share I. Pricelearnings ratio m. Dividend yield n. Dividend payout Compare the companies' performance for 2025 and 2024. Make a recommendation to Happy Camper Company about investing in these companies. Which company would be a better investment, The Boat Company or Zone Life Vests? Base your answer on ability to pay current liabilities, ability to sell merchandise and collect receivables, ability to pay long-term debt, profitability, and attractiveness as an investment. Balance Sheet Assets Liabilities Other Data Market price per share Annual dividend per share Weighted average number of shares outstanding 8,9008,400 8.900 8.400 Requirement 1. Compute each ratio for both companies for 2025 and 2024 . Assume all sales are credit sales. Round all ratios to two decimal piaces. a. Current ratio Begin by selecting the correct formula. Currentratio = Now, compule the ratio for both companies for both years. (Round your answers to two decimal places, XXX.) b. Cash ratio Begin by selecting the correct formula. Cash tatio = Now, compute the ratio for both compani c. Inventory tumover Begin by selacting the correct formula 1. Using the finarcial stafements ghen, compuab the follow the ratios lar both congatist places a. Cumeril estio b. Cisthratio C. Inventory turnoven d. Aecounts recewible tumbiver e. Ceoss preds percentage 1. Deboritio 9. Dubt to equety ritio B. Profit magin tifo 1. Aeset murnover ratio 1. Rate of retum en tomnos afocitiokers os if Eaeningst ber thay 1 Priceleaming raks me. Dividend yield C. IItveritory turioveI d. Accounts receivable tumover e. Gross profit percentage f. Debt ratio g. Debt to equity ratio h. Profit margin ratio i. Asset turnover ratio j. Rate of return on common stockholders' equity k. Earnings per share I. Pricelearnings ratio m. Dividend yield n. Dividend payout Compare the companies' performance for 2025 and 2024. Make a recommendation to Happy Camper Company about investing in these companies. Which company would be a better investment, The Boat Company or Zone Life Vests? Base your answer on ability to pay current liabilities, ability to sell merchandise and collect receivables, ability to pay long-term debt, profitability, and attractiveness as an investment. Balance Sheet Assets Liabilities Other Data Market price per share Annual dividend per share Weighted average number of shares outstanding 8,9008,400 8.900 8.400 Requirement 1. Compute each ratio for both companies for 2025 and 2024 . Assume all sales are credit sales. Round all ratios to two decimal piaces. a. Current ratio Begin by selecting the correct formula. Currentratio = Now, compule the ratio for both companies for both years. (Round your answers to two decimal places, XXX.) b. Cash ratio Begin by selecting the correct formula. Cash tatio = Now, compute the ratio for both compani c. Inventory tumover Begin by selacting the correct formula

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started