Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Help Temple Co., Ltd. determines that it should expand its investment portfolio. It determines that the convertible debentures issued by Debt Co., Inc. are

Please Help

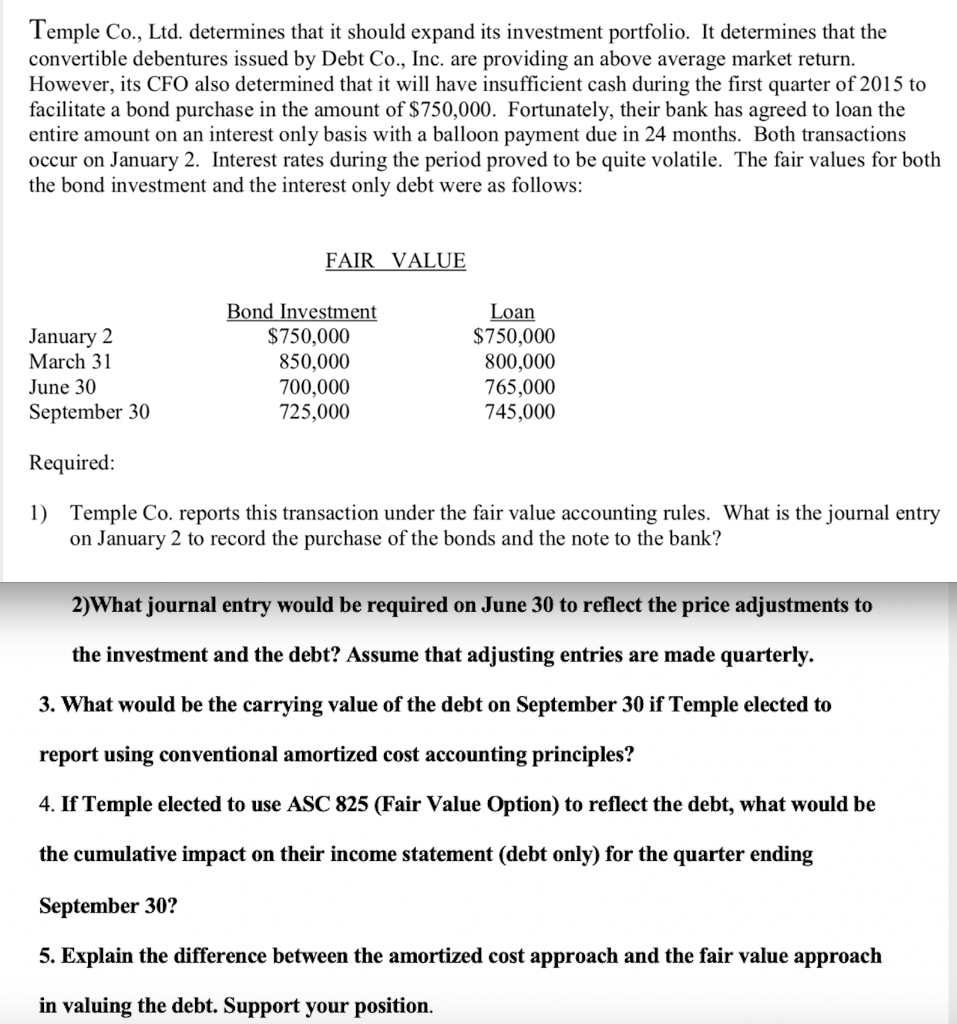

Temple Co., Ltd. determines that it should expand its investment portfolio. It determines that the convertible debentures issued by Debt Co., Inc. are providing an above average market return. However, its CFO also determined that it will have insufficient cash during the first quarter of 2015 to facilitate a bond purchase in the amount of $750,000. Fortunately, their bank has agreed to loan the entire amount on an interest only basis with a balloon payment due in 24 months. Both transactions occur on January 2. Interest rates during the period proved to be quite volatile. The fair values for both the bond investment and the interest only debt were as follows: FAIR VALUE January 2 March 31 June 30 September 30 Bond Investment $750,000 850,000 700,000 725,000 Loan $750,000 800,000 765,000 745,000 Required: 1) Temple Co. reports this transaction under the fair value accounting rules. What is the journal entry on January 2 to record the purchase of the bonds and the note to the bank? 2) What journal entry would be required on June 30 to reflect the price adjustments to the investment and the debt? Assume that adjusting entries are made quarterly. 3. What would be the carrying value of the debt on September 30 if Temple elected to report using conventional amortized cost accounting principles? 4. If Temple elected to use ASC 825 (Fair Value Option) to reflect the debt, what would be the cumulative impact on their income statement (debt only) for the quarter ending September 30? 5. Explain the difference between the amortized cost approach and the fair value approach in valuing the debt. Support your positionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started