please help

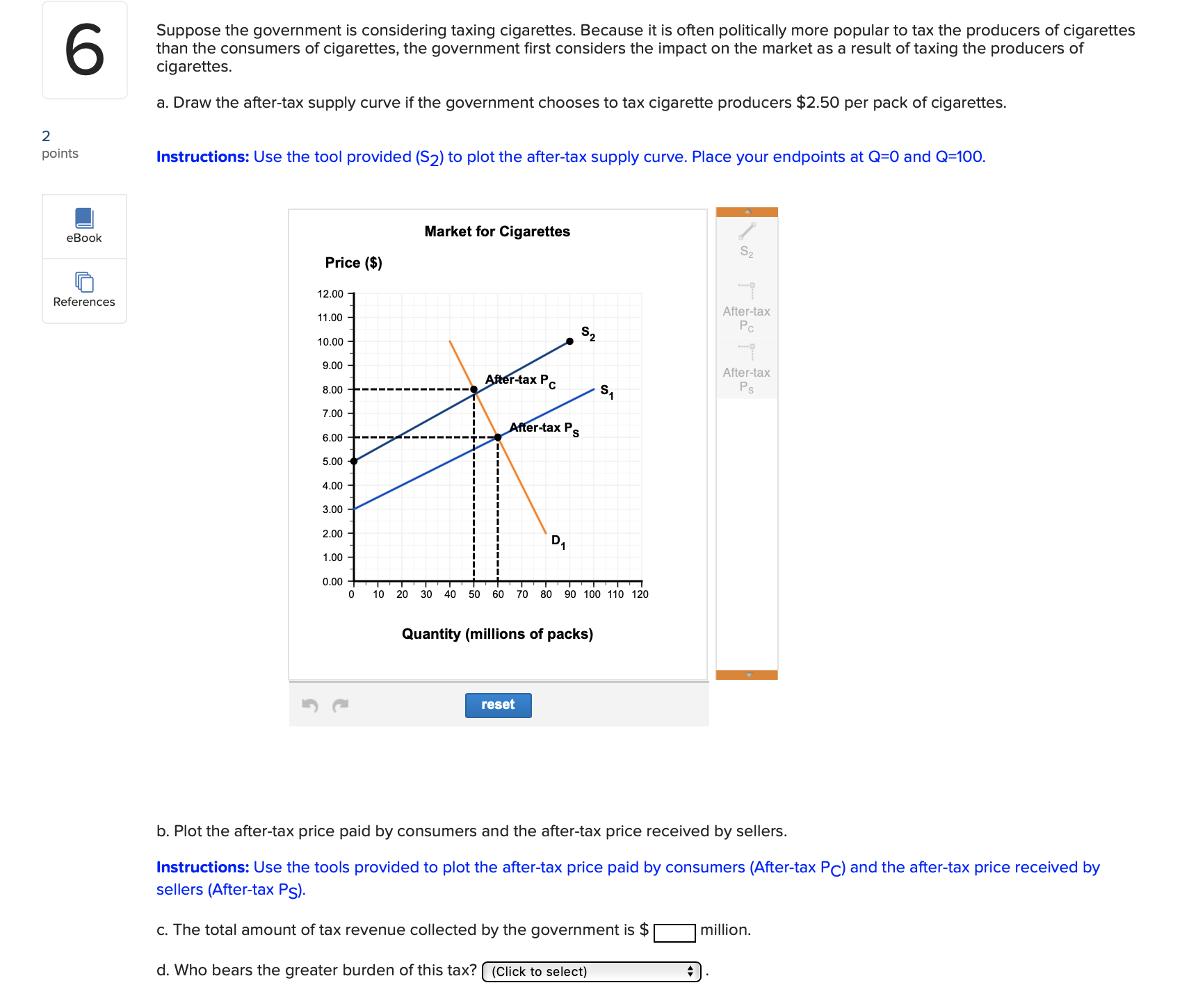

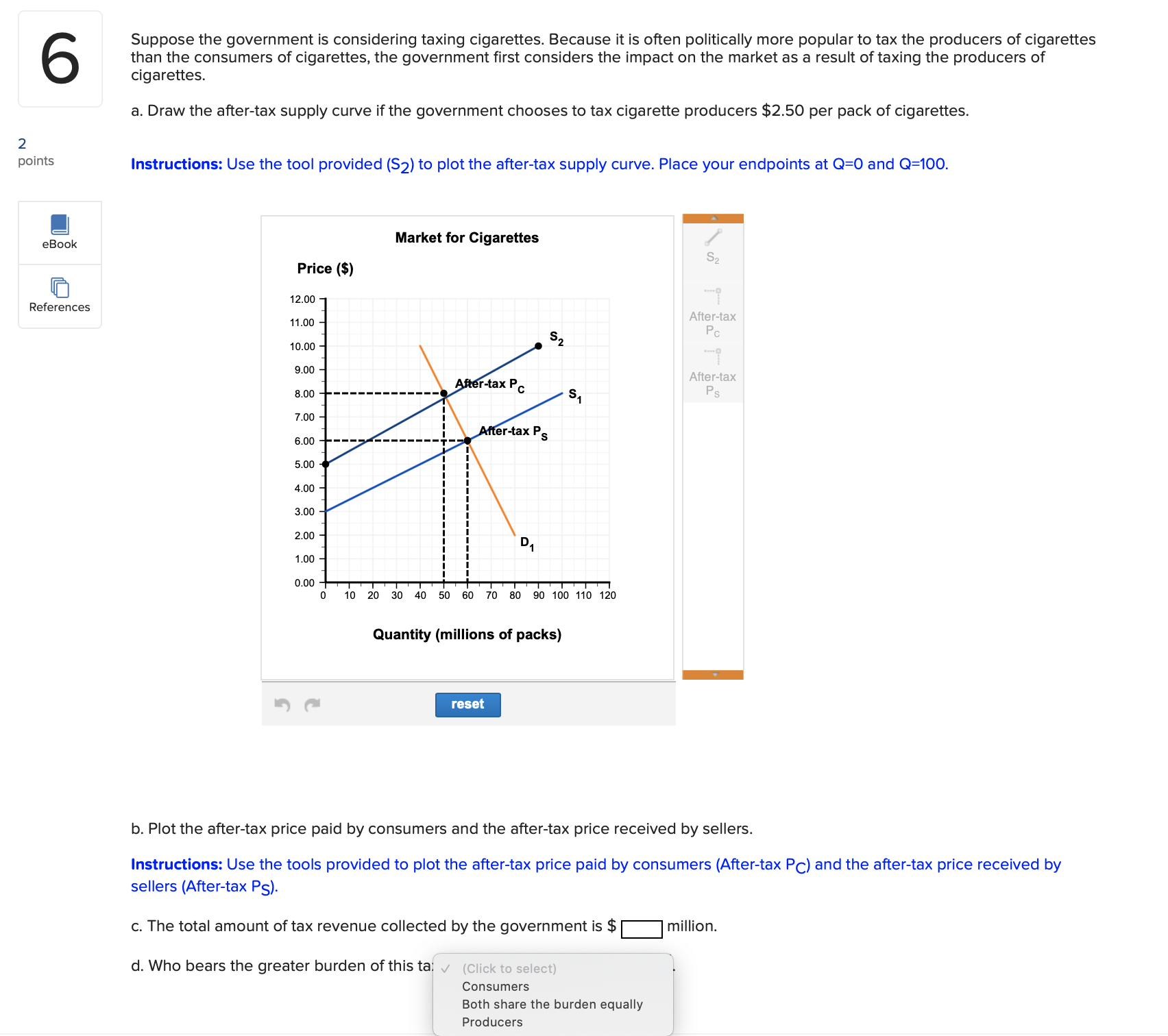

than the consumers of cigarettes, the government rst considers the impact on the market as a result of taxing the producers of Suppose the government is considering taxing cigarettes. Because it is often politically more popular to tax the producers of cigarettes cigarettes. a. Draw the after-tax supply curve if the government chooses to tax cigarette producers $2.50 per pack of cigarettes. 2 PC\"ms Instructions: Use the tool provided (52) to plot the after-tax supply curve. Place your endpoints at O=0 and 0:100. El ejok Market for cigarettes / S, Price (9 ' i F. 12.00 References 11.00 Alter-tax PC 10.00 9'00 Alter-tax 0.00 F's 7.00 0.00 5.00 4.00 3.00 2.00 1.00 0.00 0 10 20 30 40 50 so 70 00 90 100 110 120 Quantity (millions of packs) 'W' m b. Plot the after-tax price paid by consumers and the after-tax price received by sellers. Instructions: Use the tools provided to plot the after-tax price paid by consumers (After-tax PC) and the after-tax price received by sellers (After-tax P5). c. The total amount of tax revenue collected by the government is $ million. d. Who bears the greater burden of this tax? (Click to select) 1) than the consumers of cigarettes. the government rst considers the impact on the market as a result of taxing the producers of Suppose the government is considering taxing cigarettes. Because it is often politically more popular to tax the producers of cigarettes cigarettes. a. Draw the after-tax supply curve if the government chooses to tax cigarette producers $2.50 per pack of cigarettes. 2 POMS Instructions: Use the tool provided (52) to plot the aftertax supply curve. Place your endpoints at Q=O and Q=100. El ea?\" Market for Cigarettes / s Price (3) 2 References 12' 00 11.00 Alter-tax PC 10.00 mm Alter-tax am P5 7.0!) 6.00 5.00 4.00 am 2.00 1.00 cm a 1o 20 an 40 so so 70 no so 100 no 120 Quantity (millions of packs) '50 m b. Plot the after-tax price paid by consumers and the after-tax price received by sellers. Instructions: Use the tools provided to plot the after-tax price paid by consumers (Aftertax Fe) and the aftertax price received by sellers (Aftertax P5). c. The total amount of tax revenue collected by the government is $ |:| million. d. Who bears the greater burden ofthis ta ./ (cnck to select) Consumers Both share the burden equally Producers