Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Help. Thank you!! 4) Suppose that you have a non-dividend-paying stock with a spot price of $100 and a 1-year futures price of $102.

Please Help. Thank you!!

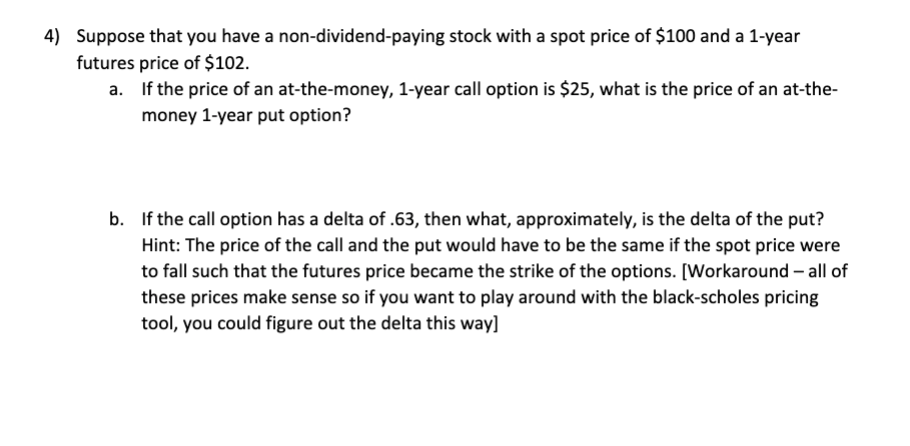

4) Suppose that you have a non-dividend-paying stock with a spot price of $100 and a 1-year futures price of $102. a. If the price of an at-the-money, 1-year call option is $25, what is the price of an at-the- money 1-year put option? b. If the call option has a delta of .63, then what, approximately, is the delta of the put? Hint: The price of the call and the put would have to be the same if the spot price were to fall such that the futures price became the strike of the options. [Workaround all of these prices make sense so if you want to play around with the black-scholes pricing tool, you could figure out the delta this way]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started