Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help!! Thank you!! 6) Suppose that you are the CFO of an American car manufacturer. You face significant pressure from foreign imports. For example,

Please help!! Thank you!!

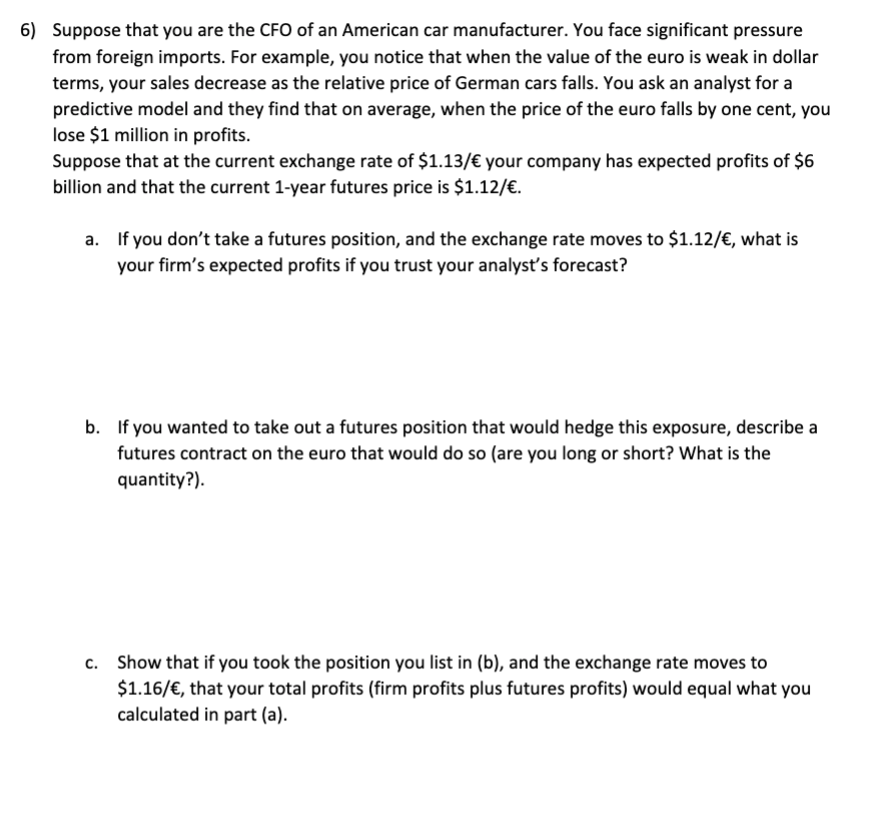

6) Suppose that you are the CFO of an American car manufacturer. You face significant pressure from foreign imports. For example, you notice that when the value of the euro is weak in dollar terms, your sales decrease as the relative price of German cars falls. You ask an analyst for a predictive model and they find that on average, when the price of the euro falls by one cent, you lose $1 million in profits. Suppose that at the current exchange rate of $1.13/ your company has expected profits of $6 billion and that the current 1-year futures price is $1.12/. a. If you don't take a futures position, and the exchange rate moves to $1.12/, what is your firm's expected profits if you trust your analyst's forecast? b. If you wanted to take out a futures position that would hedge this exposure, describe a futures contract on the euro that would do so (are you long or short? What is the quantity?) c. Show that if you took the position you list in (b), and the exchange rate moves to $1.16/, that your total profits (firm profits plus futures profits) would equal what you calculated in part (a)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started