Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help, thank you! an excel table would be great The ABC Corporation placed an asset in service three years ago. The company uses the

please help, thank you! an excel table would be great

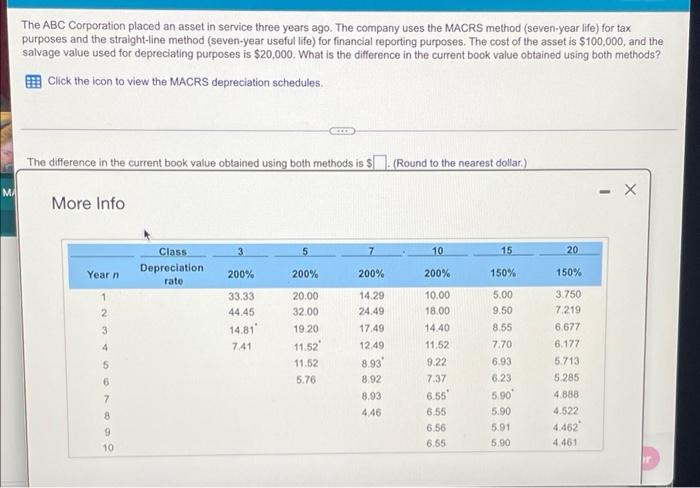

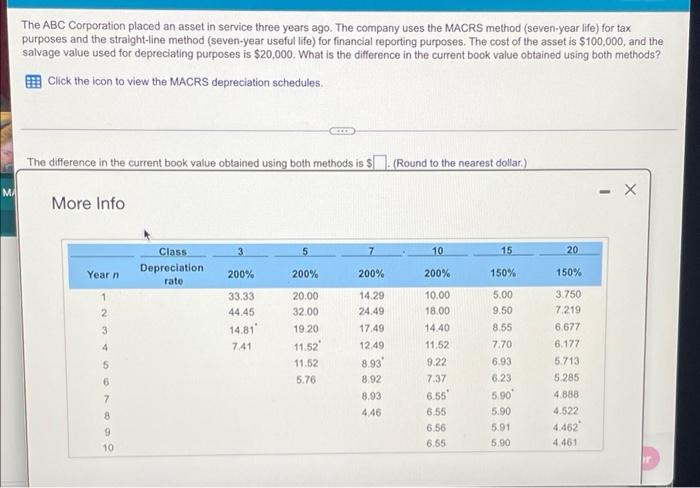

The ABC Corporation placed an asset in service three years ago. The company uses the MACRS method (seven-year life) for tax purposes and the straight-line method (seven-year useful life) for financial reporting purposes. The cost of the asset is $100,000, and the salvage value used for depreciating purposes is $20,000. What is the difference in the current book value obtained using both methods? Click the icon to view the MACRS depreciation schedules The difference in the current book value obtained using both methods is $ (Round to the nearest dollar.) MA - X More Info 3 5 10 15 20 Class Depreciation rato Yearn 200% 200% 200% 200% 150% 1 2 3 33.33 44,45 14.81" 7.41 20.00 32.00 19 20 11.52 11.52 5.76 4 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.46 10.00 18.00 14.40 11,52 9.22 7.37 6.55 6.55 6.56 6.55 5 6 7 150% 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 5.00 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 8 9 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started