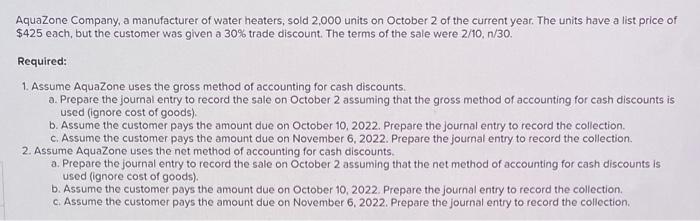

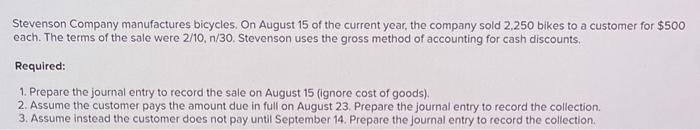

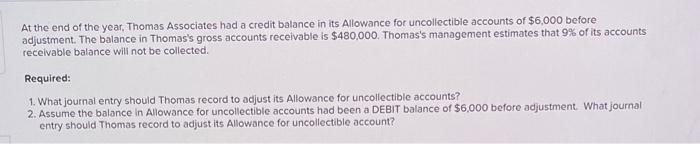

AquaZone Company, a manufacturer of water heaters, sold 2,000 units on October 2 of the current year. The units have a list price of $425 each, but the customer was given a. 30% trade discount. The terms of the sale were 2/10,n/30. Required: 1. Assume AquaZone uses the gross method of accounting for cash discounts. a. Prepare the journal entry to record the sale on October 2 assuming that the gross method of accounting for cash discounts is used (ignore cost of goods). b. Assume the customer pays the amount due on October 10, 2022. Prepare the journal entry to record the collection. c. Assume the customer pays the amount due on November 6, 2022. Prepare the journal entry to record the collection. 2. Assume AquaZone uses the net method of accounting for cash discounts. a. Prepare the journal entry to record the sale on October 2 assuming that the net method of accounting for cash discounts is used (ignore cost of goods). b. Assume the customer pays the amount due on October 10, 2022. Prepare the journal entry to record the collection. c. Assume the customer pays the amount due on November 6, 2022. Prepare the journal entry to record the collection. Stevenson Company manufactures bicycles, On August 15 of the current year, the company sold 2,250 bikes to a customer for $500 each. The terms of the sale were 2/10,n/30. Stevenson uses the gross method of accounting for cash discounts. Required: 1. Prepare the journal entry to record the sale on August 15 (ignore cost of goods). 2. Assume the customer pays the amount due in full on August 23. Prepare the journal entry to record the collection. 3. Assume instead the customer does not pay until September 14. Prepare the journal entry to record the collection. At the end of the year, Thomas Associates had a credit balance in its Allowance for uncollectible accounts of $6,000 before adjustment. The balance in Thomas's gross accounts receivable is $480,000. Thomas's management estimates that 9% of its accounts receivable balance will not be collected. Required: 1. What journal entry should Thomas record to adjust its Allowance for uncollectible accounts? 2. Assume the balance in Allowance for uncollectible accounts had been a DEBIT balance of $6,000 before adjustment. What journal entry should Thomas record to adjust its Allowance for uncollectible account