Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help thank you! Concord Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of

please help thank you!

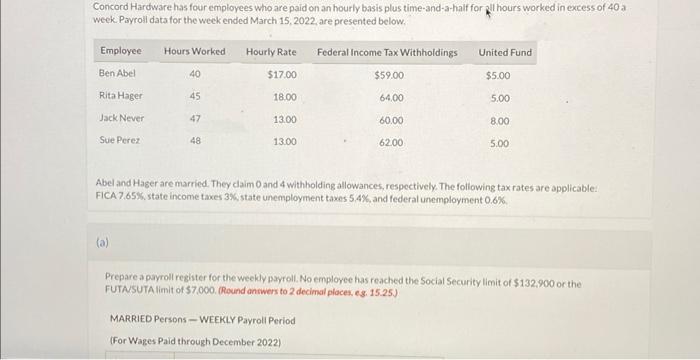

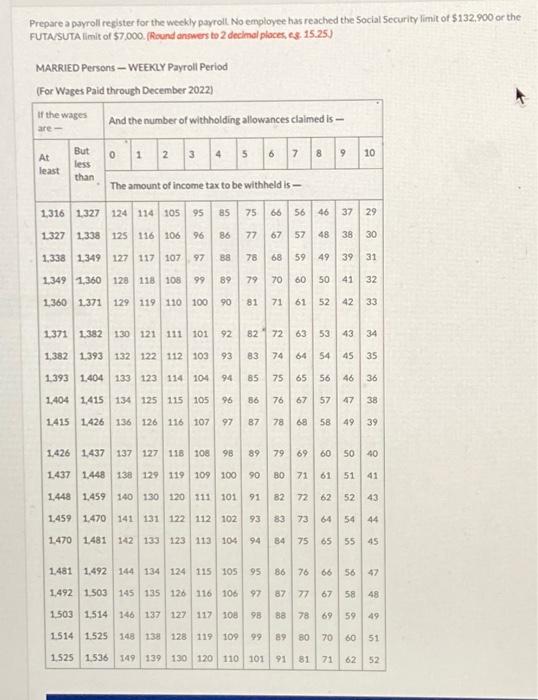

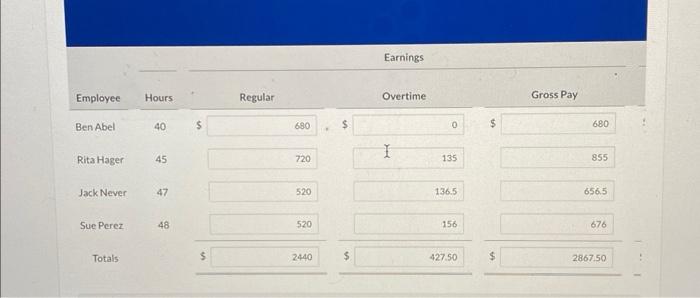

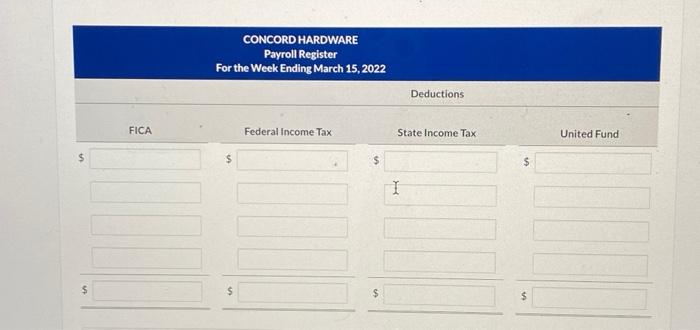

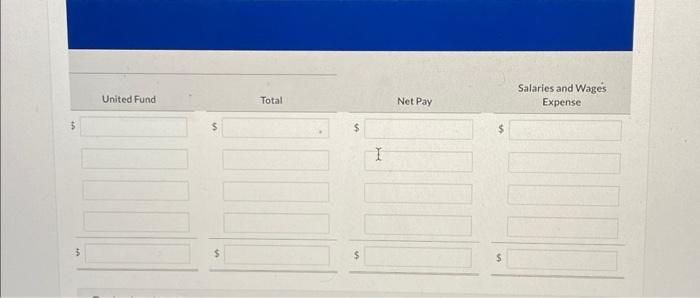

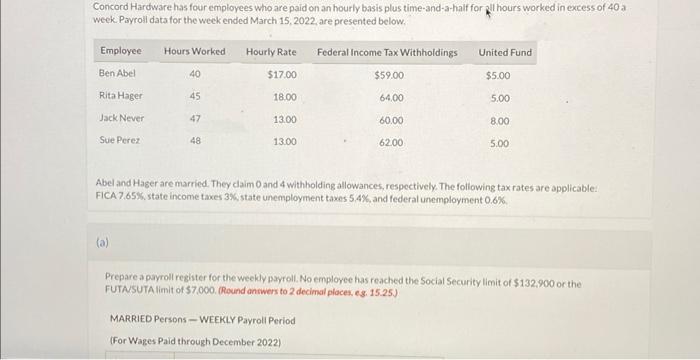

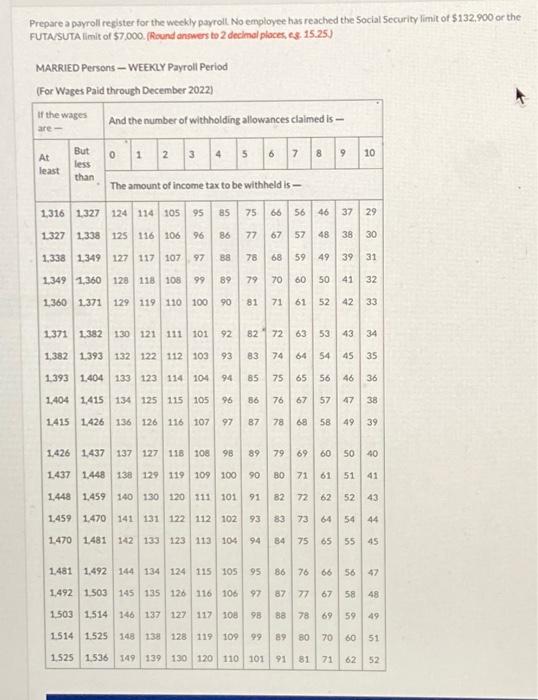

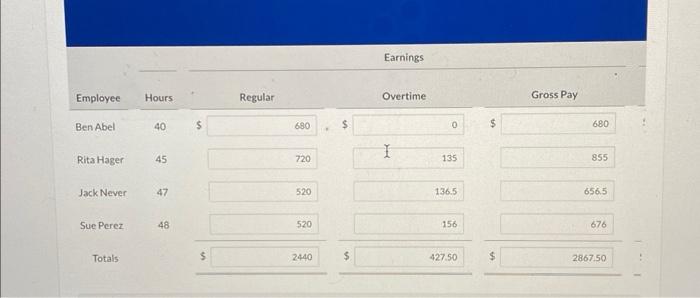

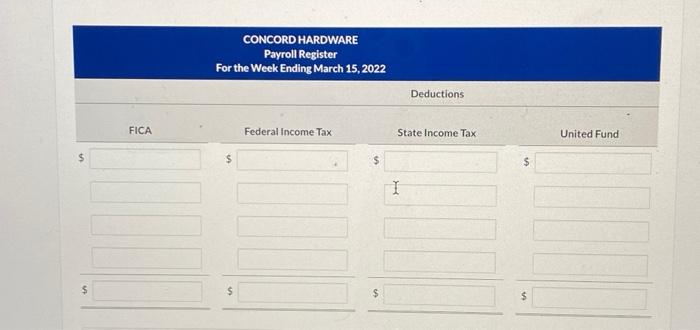

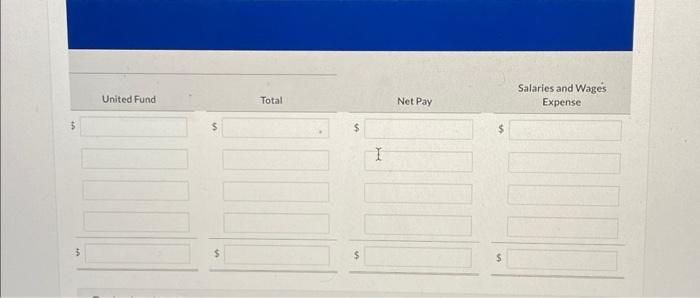

Concord Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2022, are presented below, Abel and Hager are married. They claim 0 and 4 withbolding allowances, respectively. The following tax rates are applicable: FICA 7.65\%. state income taxes 3%6 state unemployment taxes 5.4% and federal unemployment 0.6% (a) Prepare a payroll reghter for the weekly payroll. No employee has reached the Social Security limit of $132.900 or the FUTASUTA limit of 57,000 . (Round anwers to 2 decimal places, es. 15.25.) MARRIED Persons - WEEKLY Payroll Period (For Wages Paid through December 2022) Prepare a payroll register for the weekly payrolt No employee has reached the Social 5 ecurity limit of 5132.900 or the cI ITA isi ir A limir at t7 nn. Birund antwers to 2 declmal ploces es. 15.25. Earnings \begin{tabular}{llll|} Employee & Hours & \multicolumn{1}{c}{ Regular } \\ \hline BenAbel & 40 & 5 & 690 \\ RitaHager & 45 & 720 \\ \hline JackNever & 47 & 520 \\ Sue Perez & 48 & 520 \\ \hline Totals & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started