Please help, thank you!!

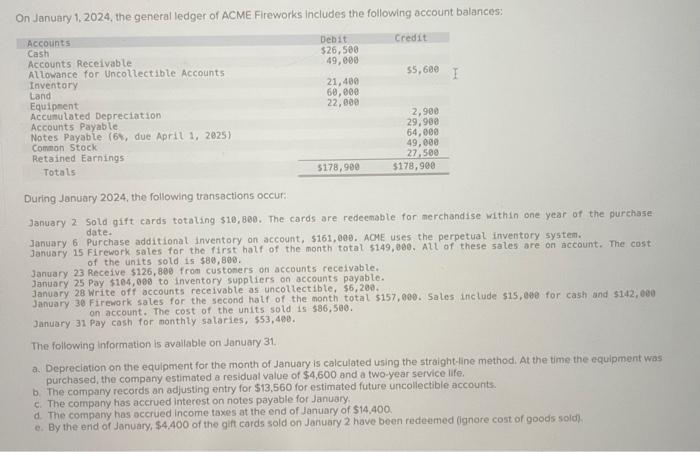

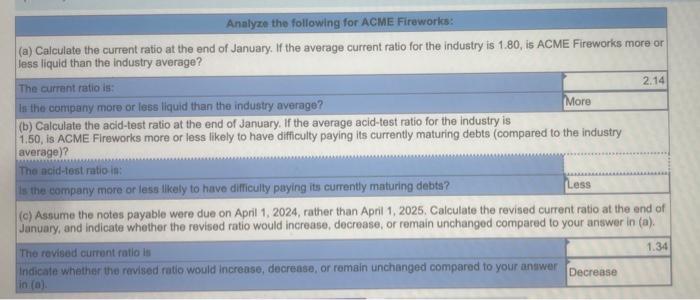

I only need help on this one question, specifically where it asks for the acid-test ratio.

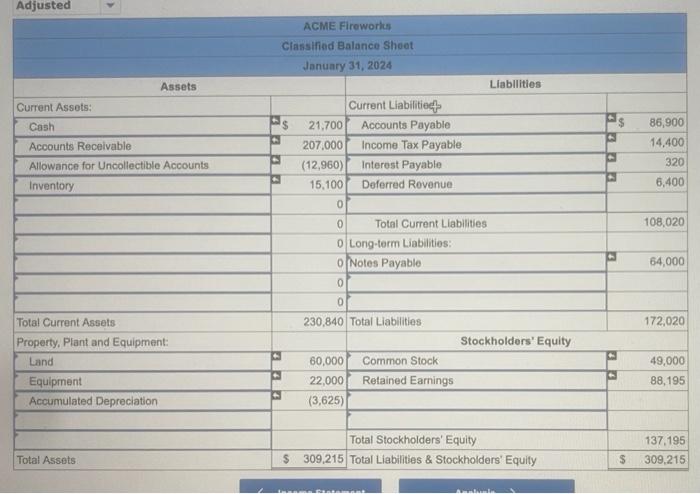

Heres my balance sheet with correct values if that helps.

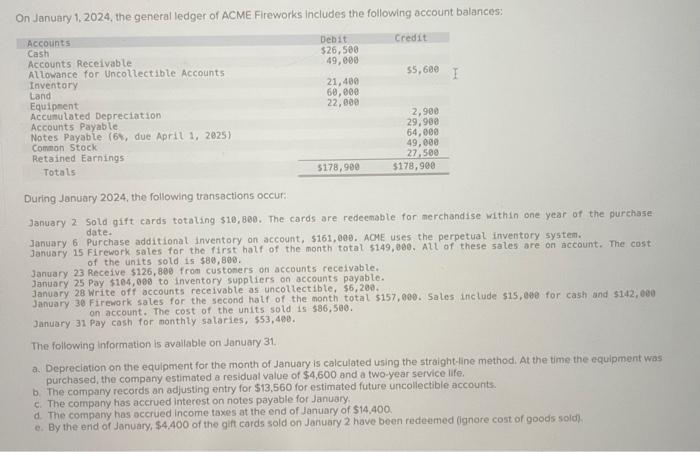

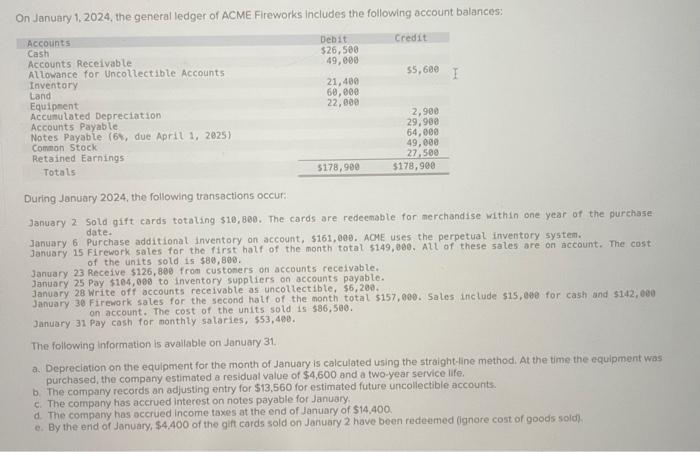

On January 1, 2024, the general ledger of ACME Fireworks includes the following account balances: During January 2024 ; the following transactions occur: January 2 Sold gift cards totaling $10,800. The cards are redecmable for merchandise within one year of the purchase January 6 date. January 6 Purchase additional inventory on account, 5161,000 . ACME uses the perpetual inventory 5y5tem. January 15 Firework sales for the first half of the month total 5149,200 . All of these 5ales are on account. The cost of the units sold is $80,800. January 23 Receive $126,800 from custoners on accounts recelvable. January 25 Pay $104,008 to inventory suppliers on accounts payable. January 28 Write off accounts receivable as uncollectible, $6,209. January 30 Firenork sales for the second hatf of the month total $157,000. Sales include 515 , eve for cash and 1142 , e60 on account. The cost of the units sold is 586,500 . January 31 pay cash for monthly salaries, $53,490. The following information is avaliable on January 31. a. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a residual value of $4,600 and a two-year service life. b. The company records an adjusting entry for $13,560 for estimated future uncollectible accounts. c. The company has acerued interest on notes payable for January. d. The company has accrued income taxes at the end of January of $14.400 e. By the end of January, $4,400 of the gift cards sold on January 2 have been redeemed (ignore cost of goods sold) Annlyze the following for ACME Fireworks: (a) Calculate the current ratio at the end of January. If the average current ratio for the industry is 1.80 , is ACME Fireworks more or less liquid than the industry average? The currant ratio is: In the company more or lass liquid than the industry average? (b) Calculate the acid-test ratio at the end of January. If the average acid-test ratio for the industry is 1,50 , is ACME Fireworks more or less likely to have difficulty paying its currently maturing debts (compared to the industry average)? The acid-test ratio ia: Is the company more or less llkely to have difficulty paying its currently maturing debts? (c) Assume the notes payable were due on April 1, 2024, rather than April 1, 2025. Calculate the revised current ratio at the end of January, and indicate whether the revised ratio would increase, decrease, or remain unchanged compared to your answer in (a). The rovised current ratio is Indicale whether the revised ratio would increase, decrease, or remain unchanged compared to your answer in (a). ACME Firoworks Classified Balance Sheot January 31, 2024