PLEASE HELP! THANK YOU IN ADVANCE!

Bank of America is one of the largest banks in the United States and indeed the world. Operating in many different jurisdictions, it offers a wide array of financial services including traditional banking, insurance, security and investment services.

This project asks you to assess the performance of BOA for two years 2017 and 2018 using financial statement analysis. In addition, you are also asked to evaluate the soundness of the bank within the context of various capital adequacy ratios as defined under international Basel III norms.

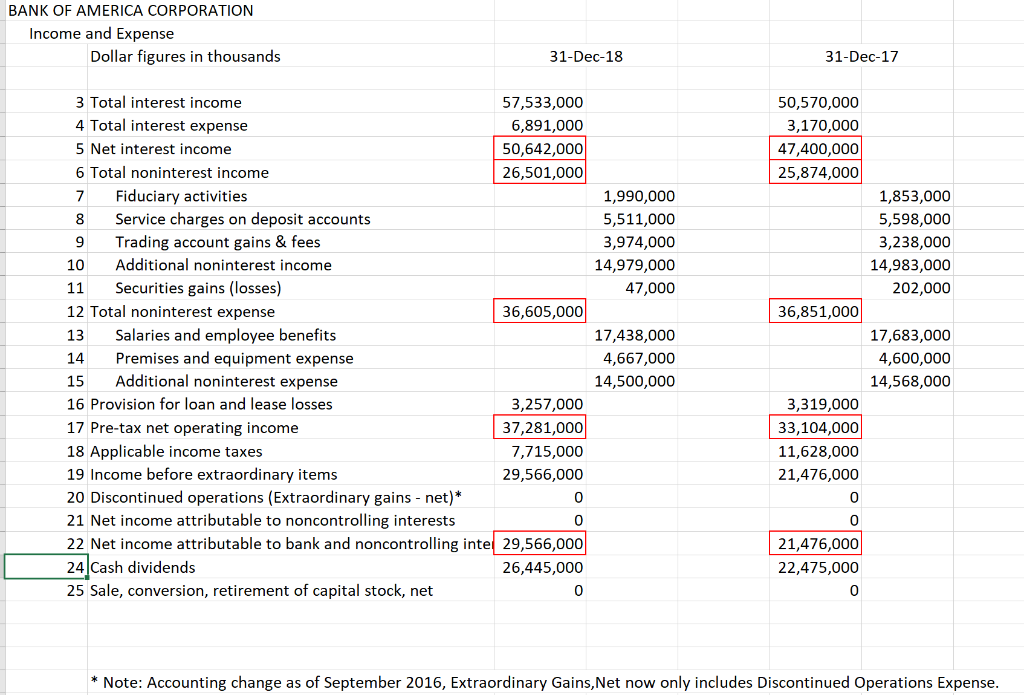

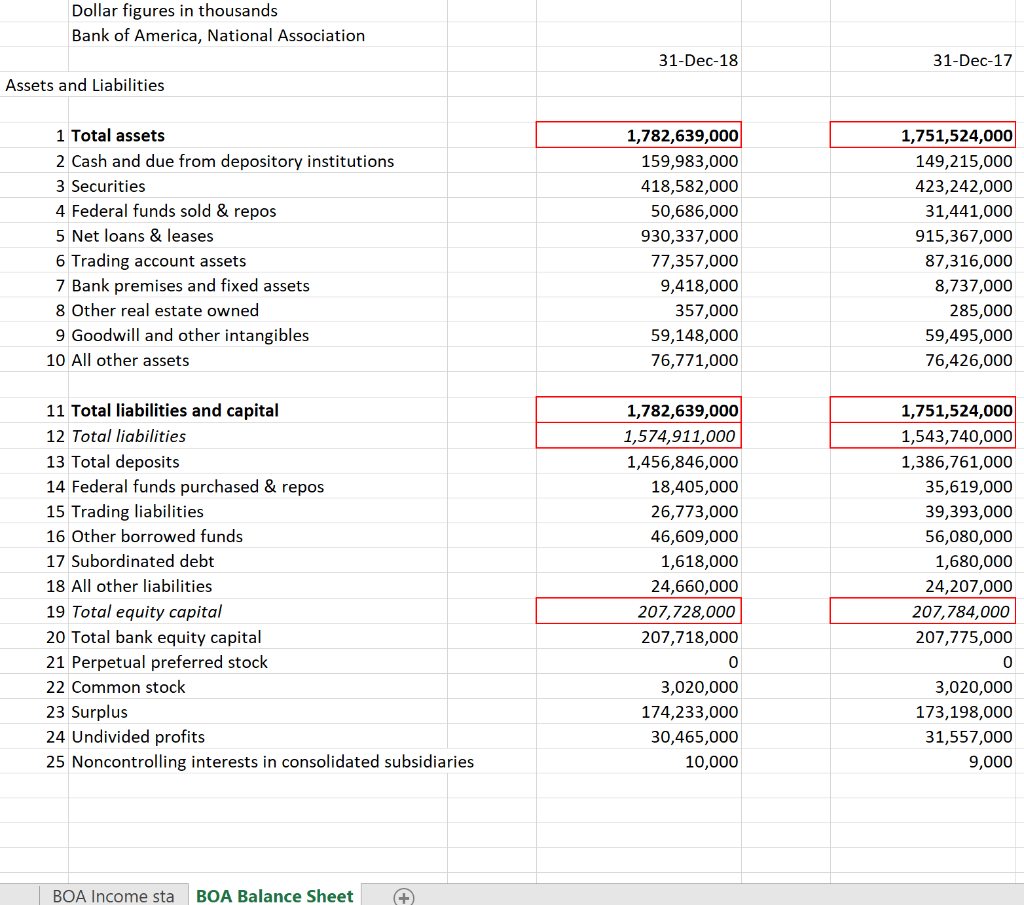

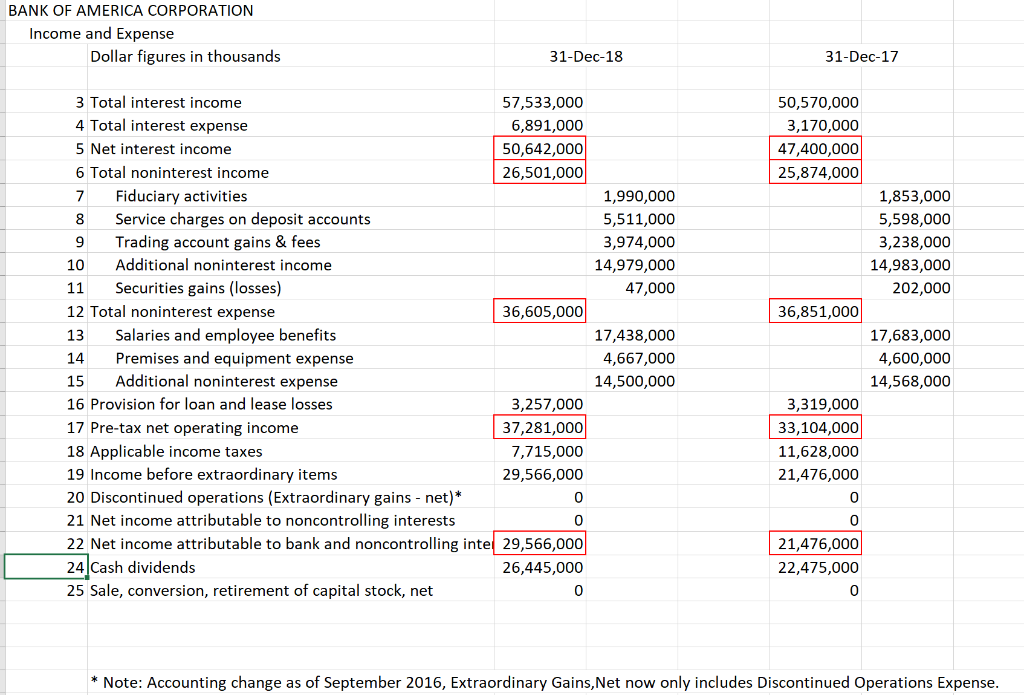

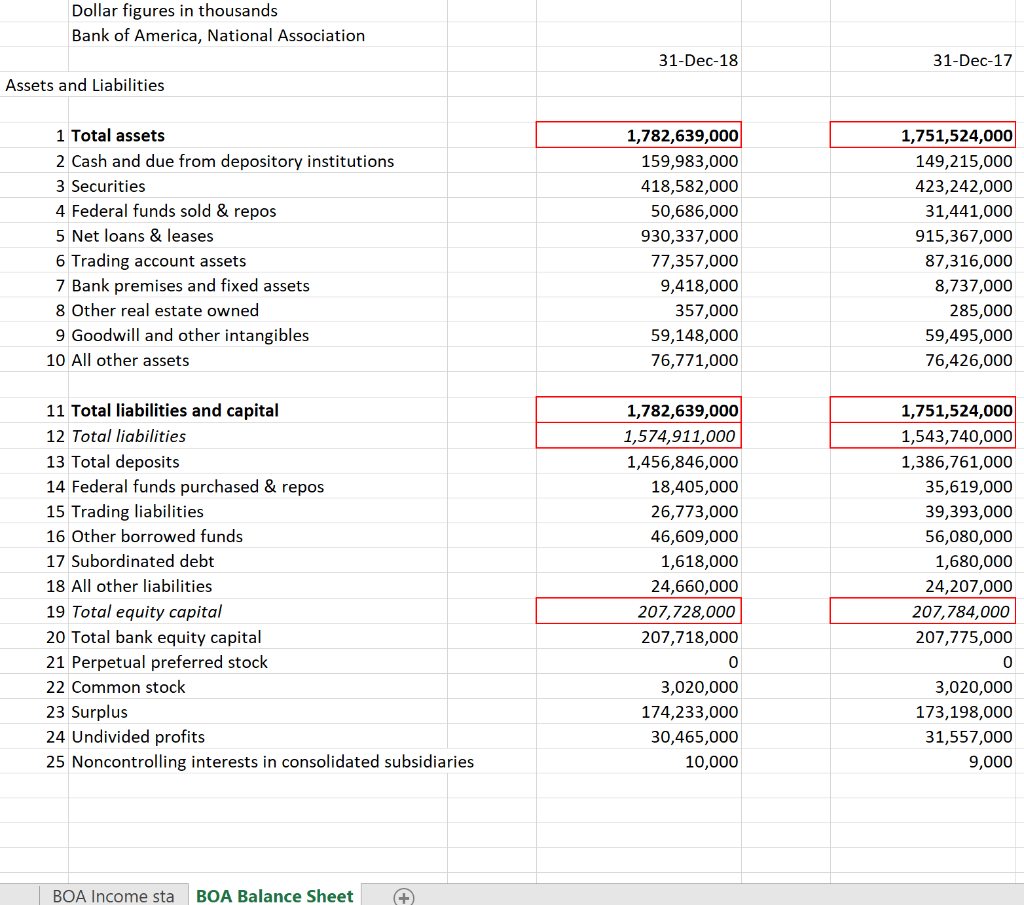

An Excel workbook with two sheets provide data on the Balance Sheet and Income statement for BOA for 2017 and 2018. Footnotes also provide additional information not directly contained in the financial statements. In addition to the material provided in chapters 11, 12, and 13 of the Text Book, you will also need material contained in Appendices 13 a, b, c, d and e. Appendix 13 a and b are in the text, while 13 c, d, and E are posted in Canvas.

Questions

For each calculation provide all details, for example for a ratio give the values of the numerator and denominator. Provide details of how the numerator or denominator was determined, for example as the sum of various figures. Providing more details can lead to partial points even if the answer is wrong.

You may also submit the excel sheet on which you have carried out your computations.

- The primary measure of performance for publicly held corporations is the return to shareholders. What has ROE been for the two years?

- A measure of how well a corporation utilizes its assets is its ROA. Compute this ratio for the two years. Did it improve or deteriorate?

- It appears that the ROE is larger than the ROA by a factor. That is, how many times larger is ROE than ROA? In your own words explain why ROE is so many times greater than ROA. (Use only 2018)

- Compute and compare the PROFIT MARGIN and ASSET UTILIZATION ratios for the two years.

- How do the ratios in Q4 above explain the ROA?

- Compute the INTEREST EXPENSE RATIO, provision for loan losses ratio, non interest expense ratio, and the tax ratio for 2018. Which of these ratios most negatively affected the profit margin in 2018?

- What are the INTEREST INCOME RATIO and the NONINTEREST INCOME RATIO for 2018 compared to 2017?

- Using the data provided in the footnotes of the balance sheet for 2018 compute:

- Common equity Tier I risk based ratio

- Tier I risk based ratio

- Total risk based ratio

- Tier I leverage ratio (for Total Exposure use Total Assets

BANK OF AMERICA CORPORATION Income and Expense Dollar figures in thousands 31-Dec-18 31-Dec-17 3 Total interest income 50,570,000 57,533,000 4 Total interest expense 6,891,000 3,170,000 47,400,000 5 Net interest income 50,642,000 26,501,000 6 Total noninterest income 25,874,000 Fiduciary activities 7 1,990,000 1,853,000 Service charges on deposit accounts 5,598,000 3,238,000 8 5,511,000 Trading account gains & fees 9 3,974,000 Additional noninterest income 10 14,979,000 14,983,000 11 Securities gains (losses) 47,000 202,000 36,605,000 12 Total noninterest expense 36,851,000 Salaries and employee benefits Premises and equipment expense 13 17,438,000 17,683,000 4,600,000 14 4,667,000 Additional noninterest expense 15 14,500,000 14,568,000 16 Provision for loan and lease losses 3,257,000 3,319,000 37,281,000 17 Pre-tax net operating income 33,104,000 18 Applicable income taxes 7,715,000 11,628,000 19 Income before extraordinary items 29,566,000 21,476,000 20 Discontinued operations (Extraordinary gains - net)* 21 Net income attributable to noncontrolling interests 22 Net income attributable to bank and noncontrolling inte 29,566,000 24 Cash dividends C 21,476,000 26,445,000 22,475,000 25 Sale, conversion, retirement of capital stock, net 0 Note: Accounting change as of September 2016, Extraordinary Gains,Net now only includes Discontinued Operations Expense. Dollar figures in thousands Bank of America, National Association 31-Dec-18 31-Dec-17 Assets and Liabilities 1 Total assets 1,782,639,000 1,751,524,000 2 Cash and due from depository institutions 149,215,000 159,983,000 423,242,000 3 Securities 418,582,000 4 Federal funds sold & repos 50,686,000 31,441,000 5 Net loans & leases 915,367,000 930,337,000 6 Trading account assets 77,357,000 9,418,000 87,316,000 7 Bank premises and fixed assets 8,737,000 8 Other real estate owned 357,000 285,000 9 Goodwill and other intangibles 59,148,000 59,495,000 10 All other assets 76,771,000 76,426,000 11 Total liabilities and capital 1,751,524,000 1,782,639,000 1,543,740,000 12 Total liabilities 1,574,911,000 13 Total ,761,000 14 Federal funds purchased & repos 35,619,000 18,405,000 15 Trading liabilities 26,773,000 39,393,000 16 Other borrowed funds 46,609,000 56,080,000 17 Subordinated debt 1,618,000 1,680,000 18 All other liabilities 24,660,000 24,207,000 19 Total equity capital 207,784,000 207,728,000 20 Total bank equity capital 207,775,000 207,718,000 21 Perpetual preferred stock 0 22 Common stock 3,020,000 3,020,000 23 Surplus 24 Undivided profits 173,198,000 174,233,000 30,465,000 31,557,000 25 Noncontrolling interests in consolidated subsidiaries 10,000 9,000 BOA Income sta BOA Balance Sheet BANK OF AMERICA CORPORATION Income and Expense Dollar figures in thousands 31-Dec-18 31-Dec-17 3 Total interest income 50,570,000 57,533,000 4 Total interest expense 6,891,000 3,170,000 47,400,000 5 Net interest income 50,642,000 26,501,000 6 Total noninterest income 25,874,000 Fiduciary activities 7 1,990,000 1,853,000 Service charges on deposit accounts 5,598,000 3,238,000 8 5,511,000 Trading account gains & fees 9 3,974,000 Additional noninterest income 10 14,979,000 14,983,000 11 Securities gains (losses) 47,000 202,000 36,605,000 12 Total noninterest expense 36,851,000 Salaries and employee benefits Premises and equipment expense 13 17,438,000 17,683,000 4,600,000 14 4,667,000 Additional noninterest expense 15 14,500,000 14,568,000 16 Provision for loan and lease losses 3,257,000 3,319,000 37,281,000 17 Pre-tax net operating income 33,104,000 18 Applicable income taxes 7,715,000 11,628,000 19 Income before extraordinary items 29,566,000 21,476,000 20 Discontinued operations (Extraordinary gains - net)* 21 Net income attributable to noncontrolling interests 22 Net income attributable to bank and noncontrolling inte 29,566,000 24 Cash dividends C 21,476,000 26,445,000 22,475,000 25 Sale, conversion, retirement of capital stock, net 0 Note: Accounting change as of September 2016, Extraordinary Gains,Net now only includes Discontinued Operations Expense. Dollar figures in thousands Bank of America, National Association 31-Dec-18 31-Dec-17 Assets and Liabilities 1 Total assets 1,782,639,000 1,751,524,000 2 Cash and due from depository institutions 149,215,000 159,983,000 423,242,000 3 Securities 418,582,000 4 Federal funds sold & repos 50,686,000 31,441,000 5 Net loans & leases 915,367,000 930,337,000 6 Trading account assets 77,357,000 9,418,000 87,316,000 7 Bank premises and fixed assets 8,737,000 8 Other real estate owned 357,000 285,000 9 Goodwill and other intangibles 59,148,000 59,495,000 10 All other assets 76,771,000 76,426,000 11 Total liabilities and capital 1,751,524,000 1,782,639,000 1,543,740,000 12 Total liabilities 1,574,911,000 13 Total ,761,000 14 Federal funds purchased & repos 35,619,000 18,405,000 15 Trading liabilities 26,773,000 39,393,000 16 Other borrowed funds 46,609,000 56,080,000 17 Subordinated debt 1,618,000 1,680,000 18 All other liabilities 24,660,000 24,207,000 19 Total equity capital 207,784,000 207,728,000 20 Total bank equity capital 207,775,000 207,718,000 21 Perpetual preferred stock 0 22 Common stock 3,020,000 3,020,000 23 Surplus 24 Undivided profits 173,198,000 174,233,000 30,465,000 31,557,000 25 Noncontrolling interests in consolidated subsidiaries 10,000 9,000 BOA Income sta BOA Balance Sheet