Please Help! THANK YOU!

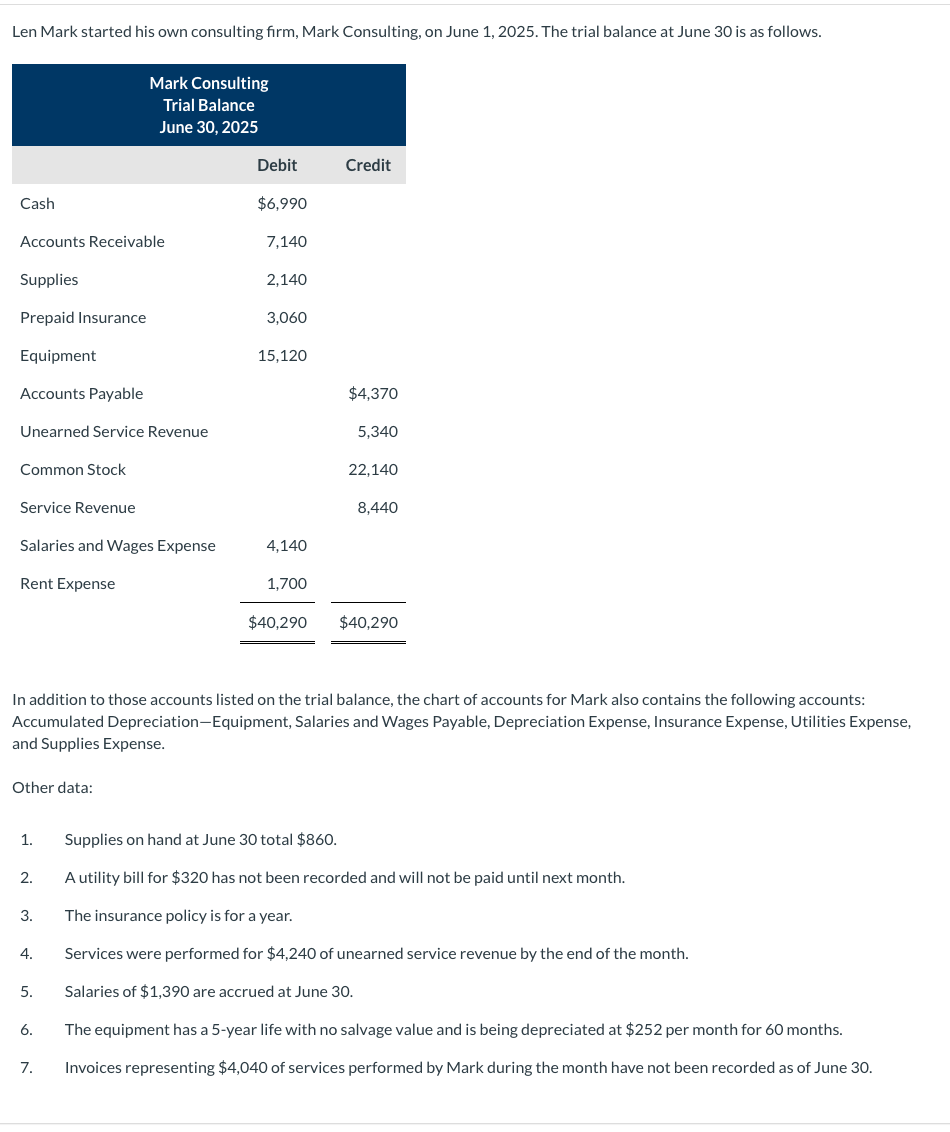

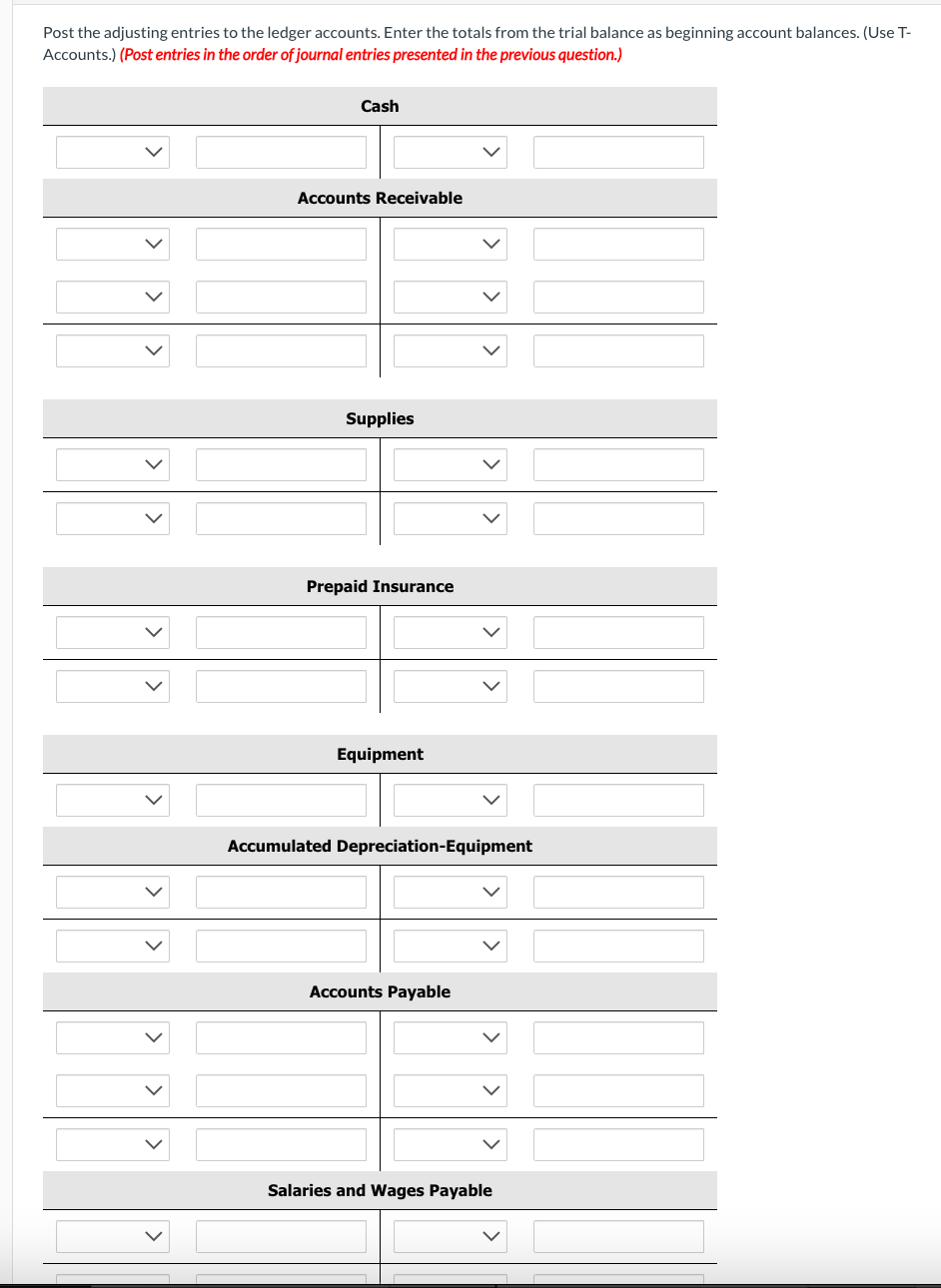

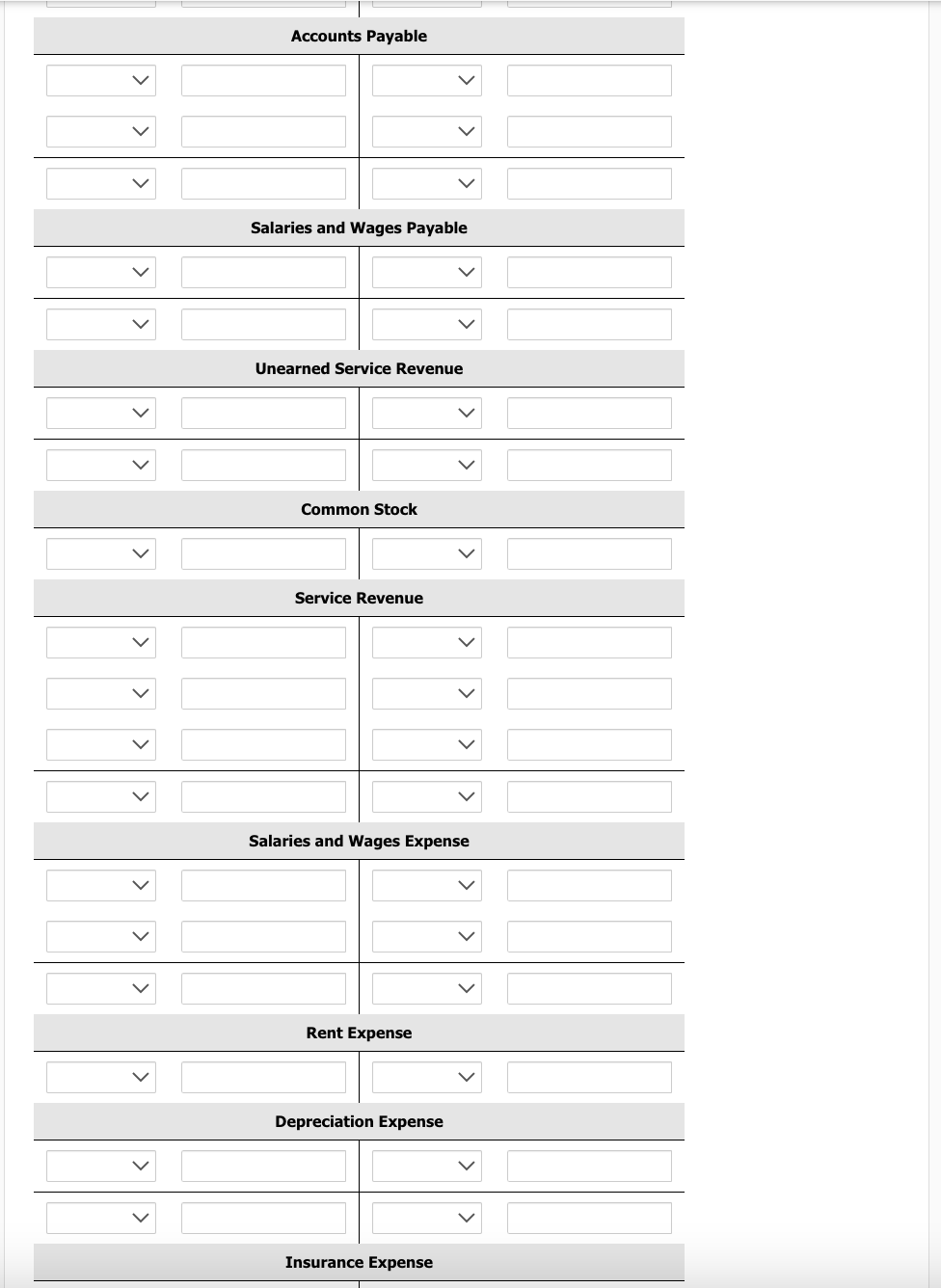

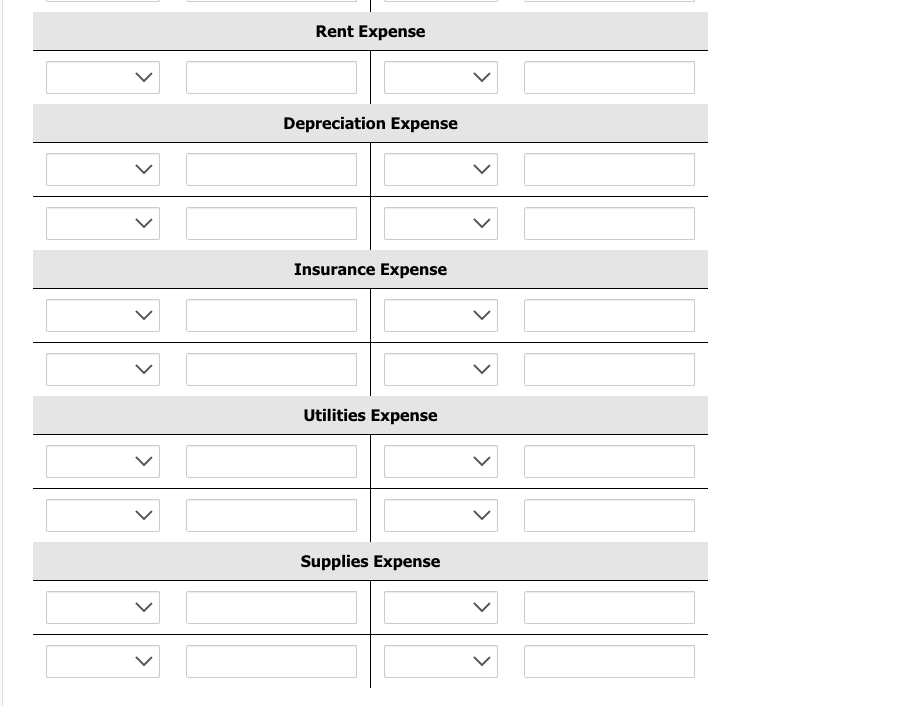

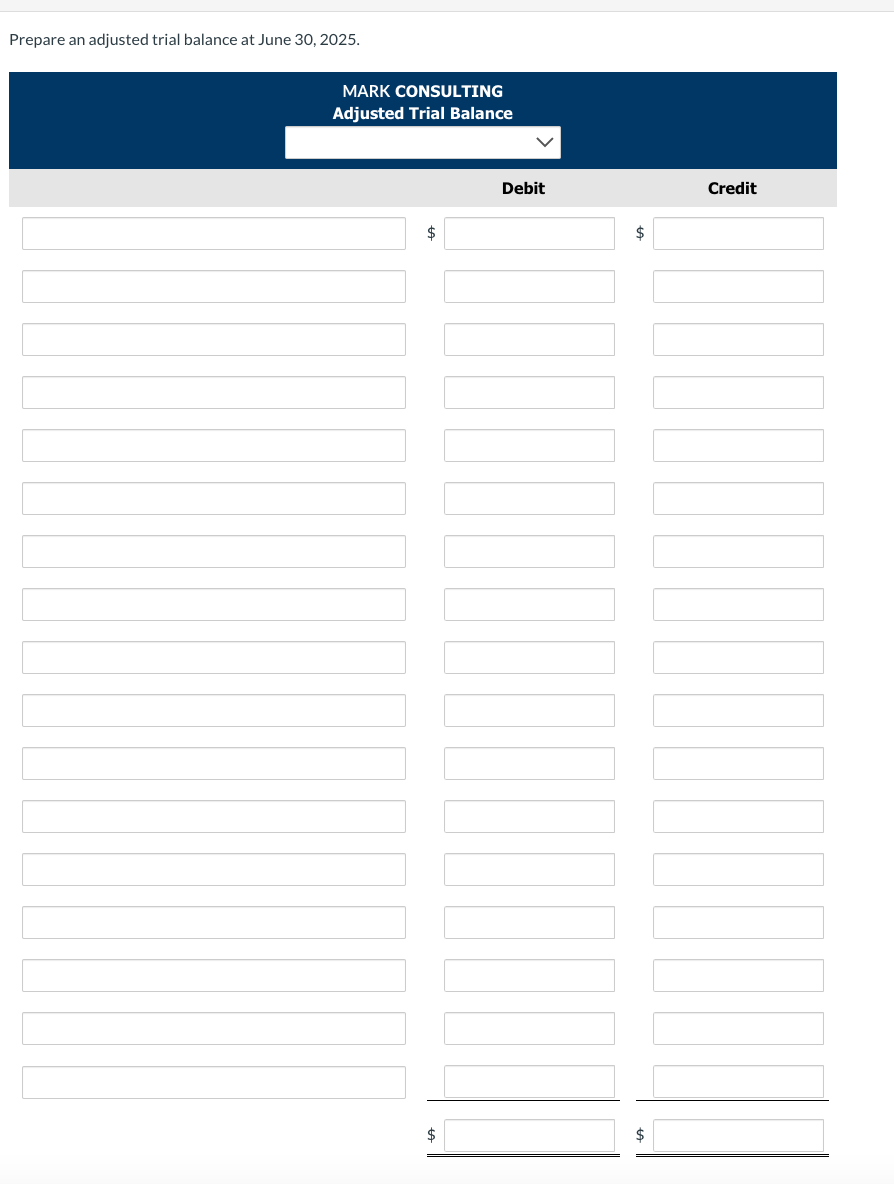

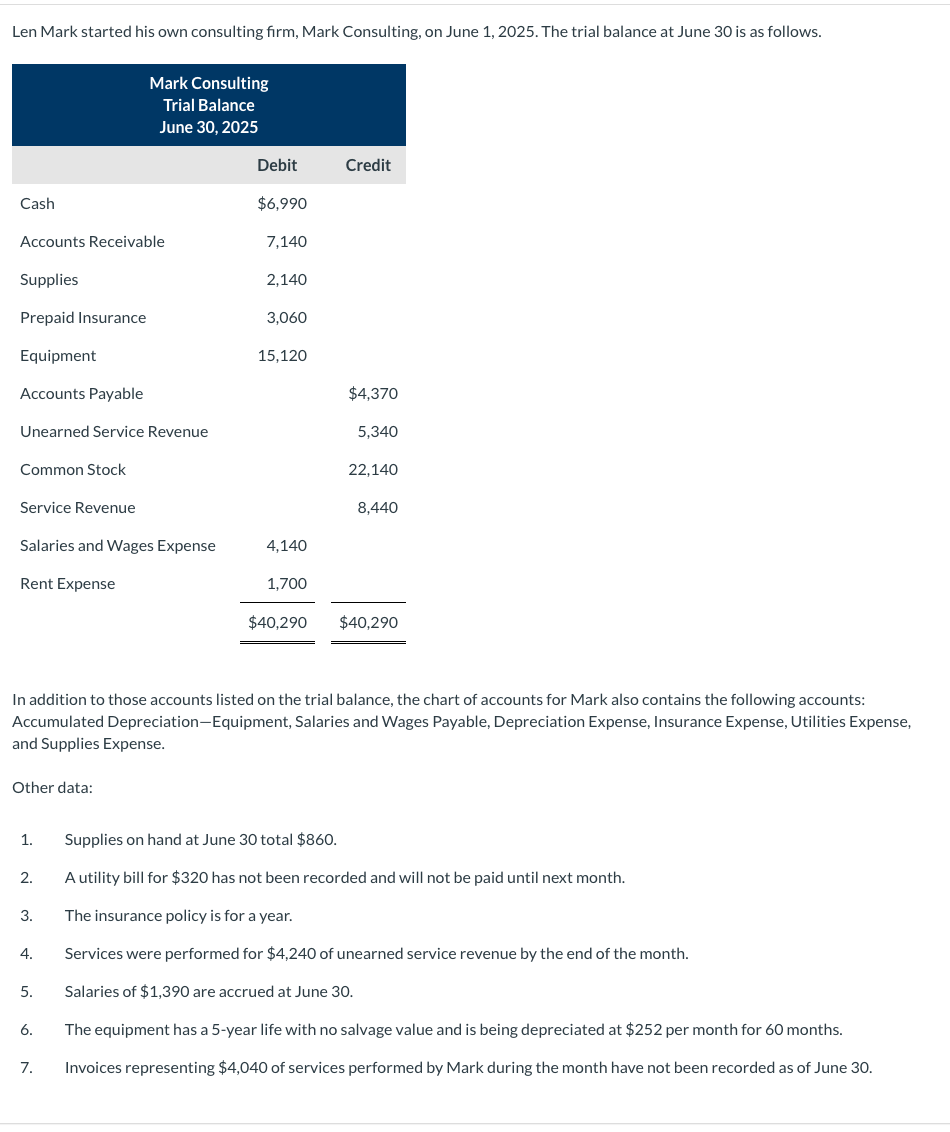

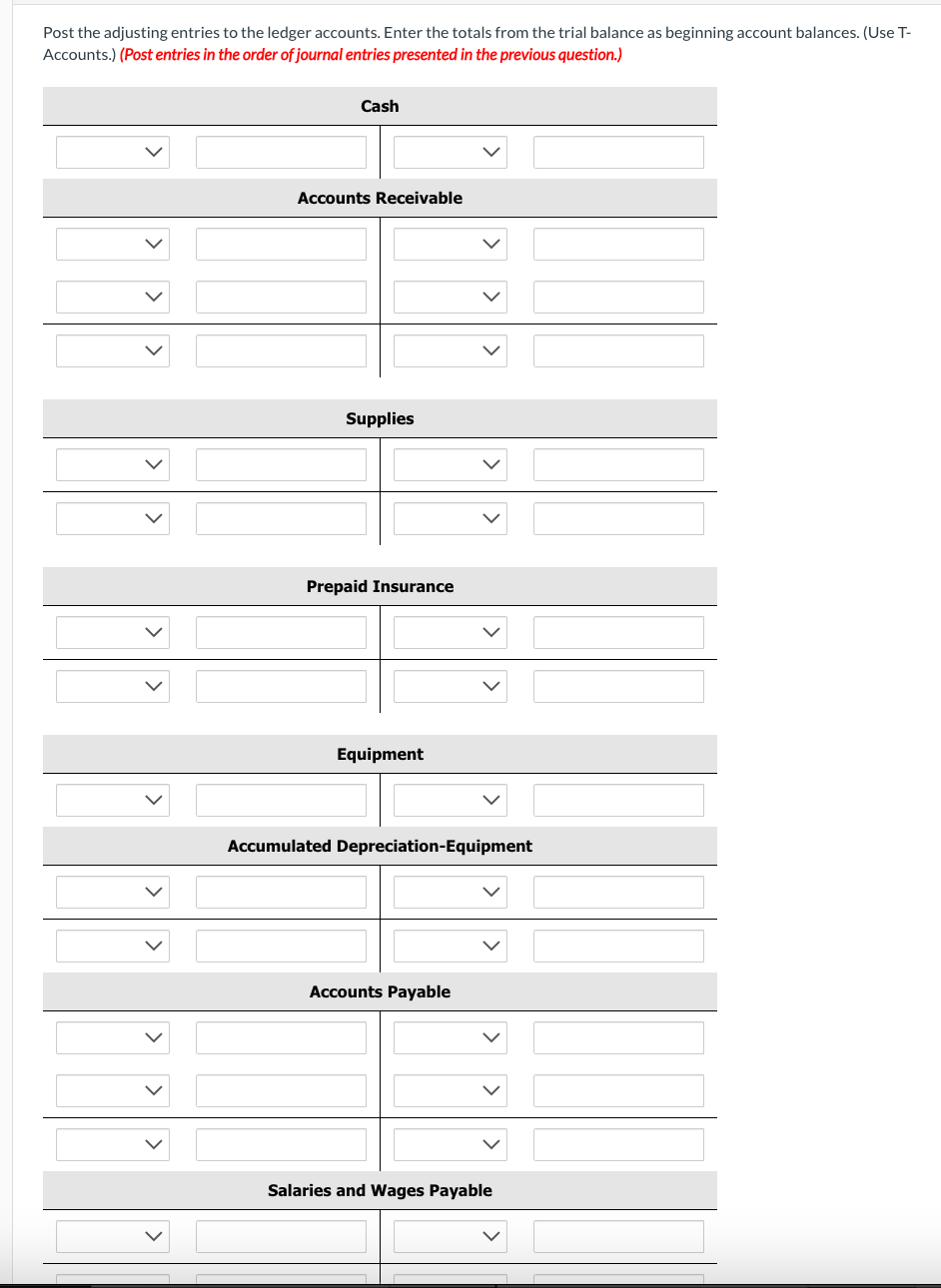

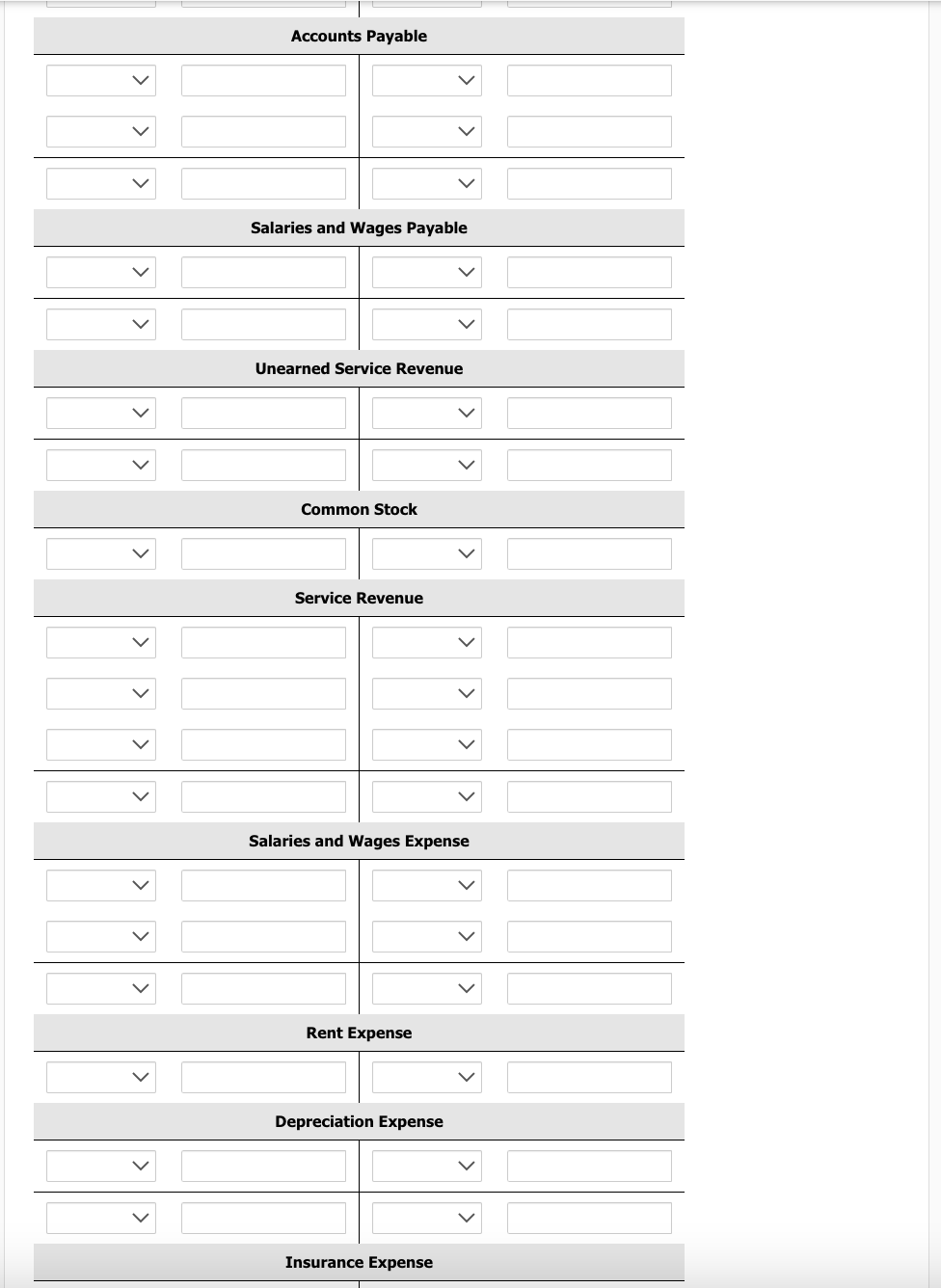

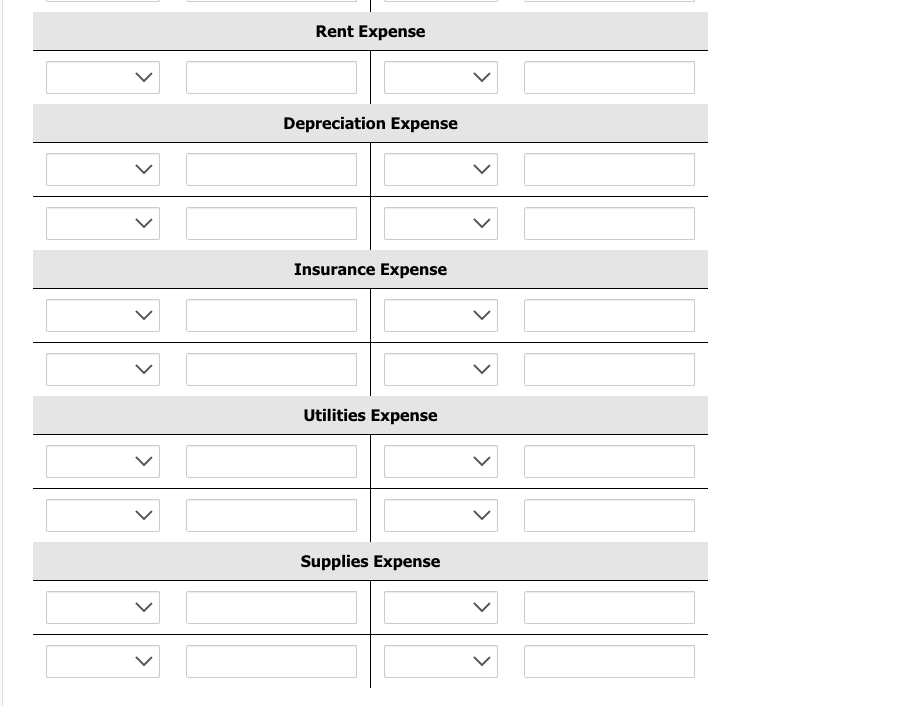

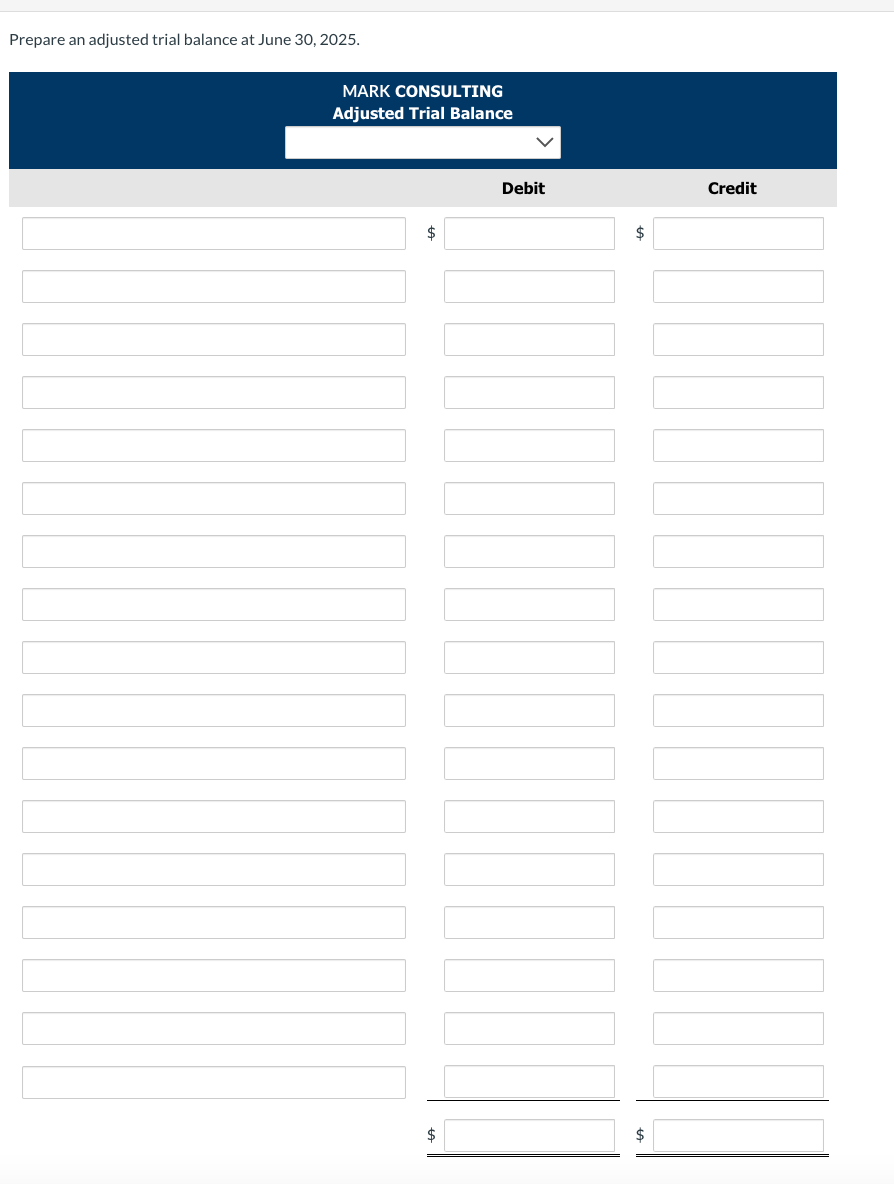

Len Mark started his own consulting firm, Mark Consulting, on June 1, 2025. The trial balance at June 30 is as follows. In addition to those accounts listed on the trial balance, the chart of accounts for Mark also contains the following accounts: Accumulated Depreciation-Equipment, Salaries and Wages Payable, Depreciation Expense, Insurance Expense, Utilities Expense, and Supplies Expense. Other data: 1. Supplies on hand at June 30 total $860. 2. A utility bill for $320 has not been recorded and will not be paid until next month. 3. The insurance policy is for a year. 4. Services were performed for $4,240 of unearned service revenue by the end of the month. 5. Salaries of $1,390 are accrued at June 30 . 6. The equipment has a 5-year life with no salvage value and is being depreciated at $252 per month for 60 months. 7. Invoices representing $4,040 of services performed by Mark during the month have not been recorded as of 30 . Post the adjusting entries to the ledger accounts. Enter the totals from the trial balance as beginning account balances. (Use T- Rent Expense Utilities Expense Supplies Expense Prepare an adjusted trial balance at June 30, 2025. MARK CONSULTING Adjusted Trial Balance Len Mark started his own consulting firm, Mark Consulting, on June 1, 2025. The trial balance at June 30 is as follows. In addition to those accounts listed on the trial balance, the chart of accounts for Mark also contains the following accounts: Accumulated Depreciation-Equipment, Salaries and Wages Payable, Depreciation Expense, Insurance Expense, Utilities Expense, and Supplies Expense. Other data: 1. Supplies on hand at June 30 total $860. 2. A utility bill for $320 has not been recorded and will not be paid until next month. 3. The insurance policy is for a year. 4. Services were performed for $4,240 of unearned service revenue by the end of the month. 5. Salaries of $1,390 are accrued at June 30 . 6. The equipment has a 5-year life with no salvage value and is being depreciated at $252 per month for 60 months. 7. Invoices representing $4,040 of services performed by Mark during the month have not been recorded as of 30 . Post the adjusting entries to the ledger accounts. Enter the totals from the trial balance as beginning account balances. (Use T- Rent Expense Utilities Expense Supplies Expense Prepare an adjusted trial balance at June 30, 2025. MARK CONSULTING Adjusted Trial Balance