Please help!! Thank you!!

-

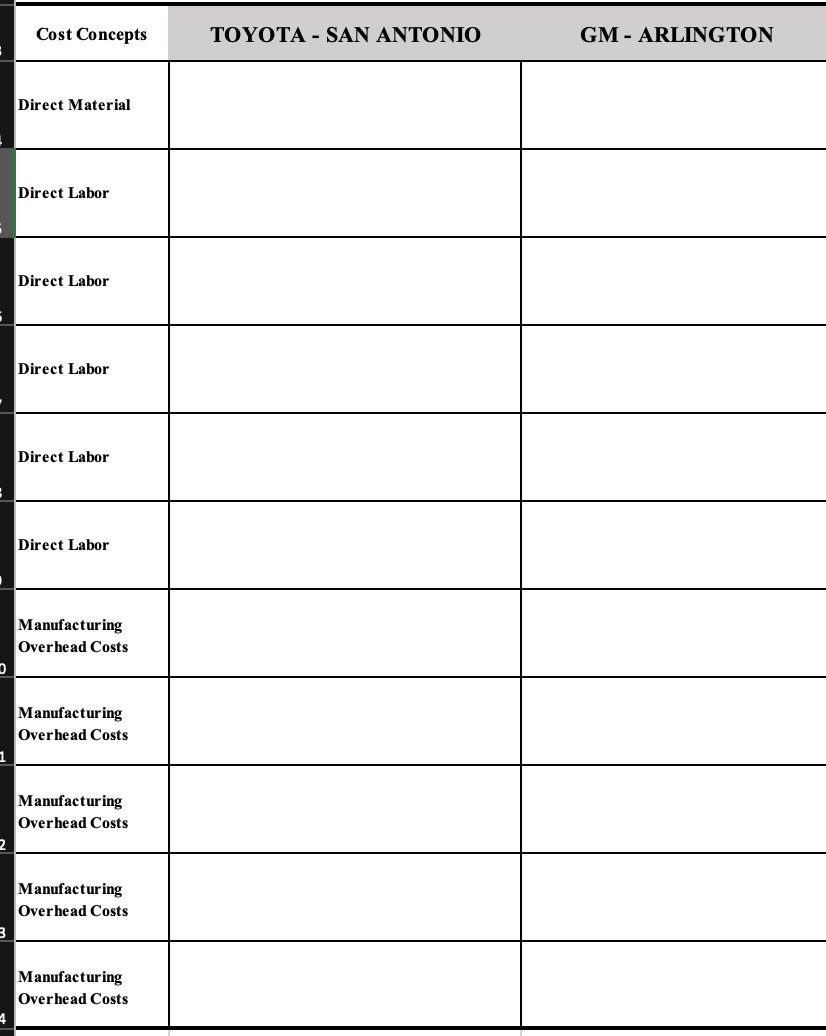

Please read the Wall Street Journal article A Tale of Two Auto Plants and identify at least 16 pieces of information related to the cost concepts discussed in class from the article.

-

Fill in the information you find in the excel spreadsheet provided. You can copy and paste the original sentence from the article to the table. The information you fill in could include numbers, or could be without numbers.

-

There is a total of 22 spaces on the spreadsheet. If you fill in 16 spaces, you get 60% of the points regardless the accuracy of the answers. (Note: you should be able to fill most spaces for Toyota, there are four spaces to be left blank for GM, so at most you should fill in 18 spaces). The remaining 40% points are based on accuracy. If you fill more than 16 spaces, you may get extra points based on the accuracy of the additional information filled.

-

You should match the information on Toyota San Antonio and GM Arlington side by side on the table (Note: if there is no corresponding information for GM, you can just leave the space blank).

-

-

-

-

-

-

-

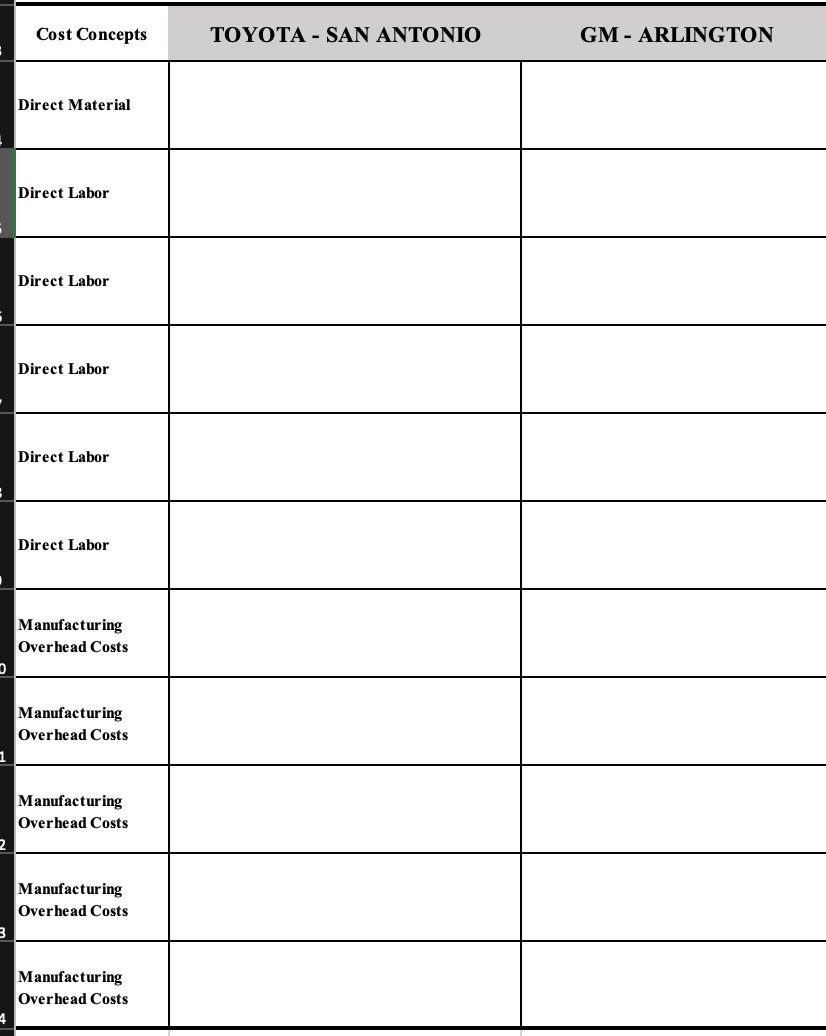

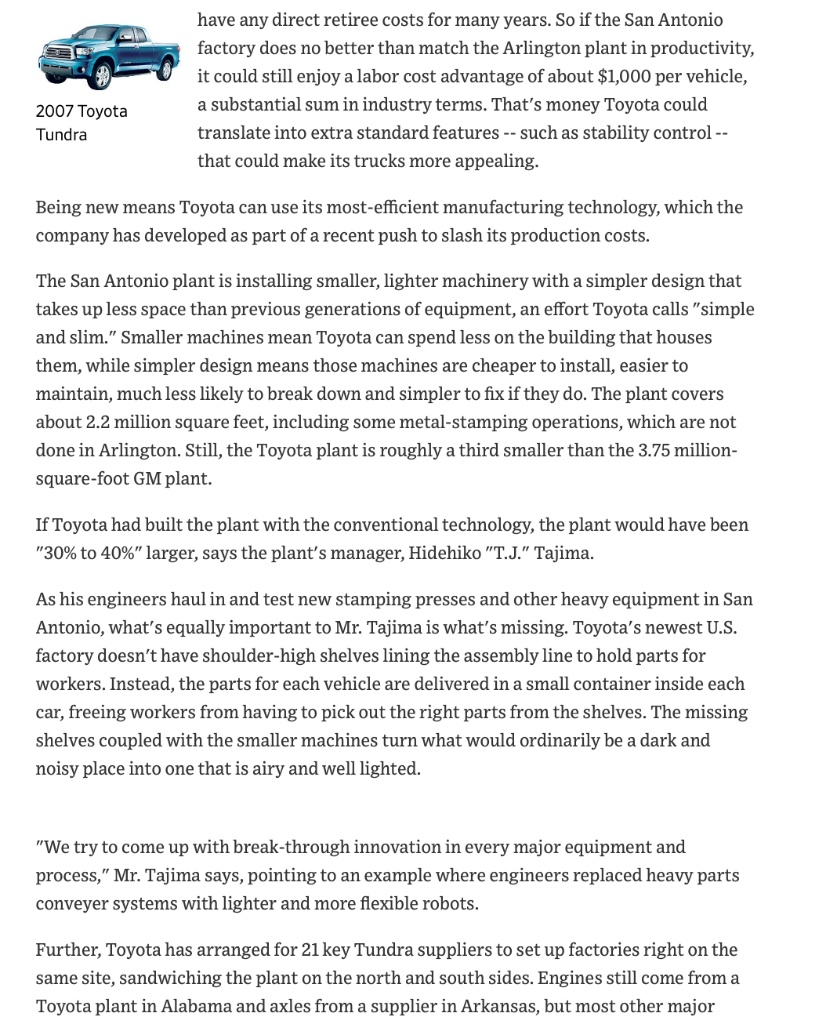

Cost Concepts TOYOTA - SAN ANTONIO GM - ARLINGTON Direct Material Direct Labor Direct Labor Direct Labor Direct Labor Direct Labor Manufacturing Overhead Costs O Manufacturing Overhead Costs Manufacturing Overhead Costs Manufacturing Overhead Costs Manufacturing Overhead Costs A Tale of Two Auto Plants Pair of Texas Factories Shows How Starting Fresh Gives Toyota an Edge Over GM By Lee Hawkins Jr. and Norihiko Shirouzu May 24, 2006 12:01 am ET ARLINGTON, Texas -- For more than 50 years, General Motors Corp. has built cars and trucks here at Texas' only auto assembly plant, pumping billions of dollars a year into the state economy through taxes, purchases and paychecks. The sprawling factory, one of GM's best, employs 3,000 people and buys myriad parts and services from local suppliers to build the big sport utility vehicles that have been among the company's most profitable -- including "the national car of Texas," the Chevrolet Suburban. SEE AN INTERACTIVE MAP Now, though, a rival has come deep into the heart of Texas to battle GM. At a 2,000-acre site in San Antonio, Toyota Motor Corp. is getting ready to start production later this year of the newest generation of Tundra pickup trucks in a plant that will use the Japanese car maker's most advanced machinery and methods. Passing Lane: New Asian auto manufacturing plants are gaining ground against older U.S. ones. Take a look at the auto makers' North American assembly operations. Separated by 280 miles, these two factories bring into stark relief the competitive problems plaguing GM at home at a time when car- building in the U.S. is thriving, even though American car companies are faltering. In no small part, the world's largest auto maker's difficulties stem from the fact that its challengers can start fresh, unencumbered by old plants and old obligations that limit innovation and add hundreds of dollars to the cost of each vehicle. "GM has to stay within the box," says Michael Robinet, a vice president of Michigan-based research firm CSM Worldwide, which specializes in the auto industry. "Toyota was able to think outside the box." In Texas, Toyota appears to be working aggressively to make the most of its advantages. The company has been able to deploy the latest know-how to fit various manufacturing processes -- from stamping to welding to painting to final assembly -- into a relatively compact space and make the plant more efficient. On the other hand, even though Arlington is the country's most efficient large-SUV plant, GM can't maximize its success by adopting its newest, best methods there. "Arlington is doing a great job for GM, but they can't have an optimal layout, and their footprint is landlocked because a world with subdivisions and expressways has grown up around it, whereas Toyota was able to take out a clean sheet of paper," Mr. Robinet says. For example, GM's body shop is housed in a separate building, which was built in 2000 to introduce new technology. The bodies are transported on an elaborate, enclosed conveyor to the final assembly 2007 Chevrolet area, where they are painted and stored before being bolted onto Suburban frames. GM managers say they would use a more modern layout that would help boost the plant's productivity even more, but GM can't afford to shut down operations and completely rebuild the plant. Even so, Arlington ranked No. 1 among North American large-SUV factories last year, at 22.39 assembly labor hours per vehicle, according to Harbour Consulting, which functions as the North American auto industry's de facto productivity scorekeeper. Toyota's Princeton, Ind., SUV and pickup plant was well behind. Two decades ago, GM factories suffered from a sizable gap compared with similar Toyota factories, as measured in the number of hours it takes workers to build a vehicle. Recent Harbour surveys show that this gap has narrowed substantially. But GM's productivity gains are offset by higher hourly labor costs and the burden it carries for benefits owed to retirees. In Arlington, GM pays union-scale wages of $26.50 to $30.50 an hour to its 2,800 hourly workers there. On average, GM pays $81.18 an hour in wages and benefits to U.S. hourly workers, including pension and retiree medical costs. At that rate, labor costs per vehicle at Arlington are about $1,800, based on the Harbour Consulting estimate of labor hours per vehicle. In San Antonio, Toyota will use non-union labor and will start its 1,600 hourly workers at $15.50 to $20.33 per hour, which will grow after three years to $21 to $25. Harbour Consulting President Ron Harbour estimates Toyota's total hourly U.S. labor costs, with benefits, at about $35 an hour -- less than half of GM's rates. The brand-new plant won't have any direct retiree costs for many years. So if the San Antonio factory does no better than match the Arlington plant in productivity, it could still enjoy a labor cost advantage of about $1,000 per vehicle, a substantial sum in industry terms. That's money Toyota could translate into extra standard features -- such as stability control -- that could make its trucks more appealing. 2007 Toyota Tundra Being new means Toyota can use its most-efficient manufacturing technology, which the company has developed as part of a recent push to slash its production costs. The San Antonio plant is installing smaller, lighter machinery with a simpler design that takes up less space than previous generations of equipment, an effort Toyota calls "simple and slim." Smaller machines mean Toyota can spend less on the building that houses them, while simpler design means those machines are cheaper to install, easier to maintain, much less likely to break down and simpler to fix if they do. The plant covers about 2.2 million square feet, including some metal-stamping operations, which are not done in Arlington. Still, the Toyota plant is roughly a third smaller than the 3.75 million- square-foot GM plant. If Toyota had built the plant with the conventional technology, the plant would have been "30% to 40%" larger, says the plant's manager, Hidehiko "T.J." Tajima. As his engineers haul in and test new stamping presses and other heavy equipment in San Antonio, what's equally important to Mr. Tajima is what's missing. Toyota's newest U.S. factory doesn't have shoulder-high shelves lining the assembly line to hold parts for workers. Instead, the parts for each vehicle are delivered in a small container inside each car, freeing workers from having to pick out the right parts from the shelves. The missing shelves coupled with the smaller machines turn what would ordinarily be a dark and noisy place into one that is airy and well lighted. "We try to come up with break-through innovation in every major equipment and process," Mr. Tajima says, pointing to an example where engineers replaced heavy parts conveyer systems with lighter and more flexible robots. Further, Toyota has arranged for 21 key Tundra suppliers to set up factories right on the same site, sandwiching the plant on the north and south sides. Engines still come from a Toyota plant in Alabama and axles from a supplier in Arkansas, but most other major parts, from instrument panels to seats to exhaust systems, are assembled at those on-site suppliers. That cuts the cost of transporting parts and storing large inventories on site as insurance against missed shipments. It also eliminates risks of having too many components en route to San Antonio -- a potential logistical nightmare that could cost Toyota dearly if a defect suddenly appears. Robots on the assembly line at GM's Arlington facility. There are risks for the on-site suppliers, though. They cannot spread their costs over different products from multiple auto makers, which makes them vulnerable to a downshift in demand for Toyota's big trucks. GM, in contrast, is restricted by space, existing deals with suppliers who are located elsewhere and its agreements with the United Auto Workers that prohibit it from using lower-wage, non-union workers on the same site. Of the total 3,330 different kinds of parts that are supplied to the Arlington facility, about 1,075 come from Michigan suppliers, while 739 come from Texas and the rest from Canada and Mexico. Having suppliers located far away has a price tag. Shipping costs have increased in the wake of rising gas prices, GM says, but it is difficult to estimate how much compared with previous years, when Arlington A rendering of was building older generations of SUVs that required fewer parts Toyota's cutting- because they were available with fewer options. edge pickup factory in San Antonio Moreover, because the Tundra plant brings new jobs to San Antonio, Toyota, which chose the city over a rival site in Arkansas, has been able to bargain for a generous package of subsidies from various levels of government. The state gave a total of $133.25 million in direct incentives, including a reprieve from utility bills and a discount on property taxes, along with road improvements worth $57 million. The city, along with other agencies, spent $18 million screening 100,000 job applicants for the plant. The direct incentives alone, averaged over roughly one year's production, amount to more than $600 per vehicle in savings for Toyota. Even though it has made significant investments in Arlington in recent years, GM no longer gets the same pampering. Since 1996, GM has spent about $910 million on the plant and converted it from building cars to making SUVs. In 2000, GM installed more than 600 robots in an overhaul of the plant's body shop, where the frames and underbodies of trucks are fabricated. Much of this new investment, however, is deemed by the state and other government agencies as job-retention rather than job-creation, meaning GM doesn't qualify for incentives similar to those offered Toyota. "We spend $280 million in payroll in a year, $1.6 billion every year to suppliers in this state. I can give you data from here to the moon and back," said Mike Glinski, manager of the GM Arlington plant. "The An aerial photo of appropriate word for how I feel," he added, "is 'disappointed.'" GM's highly productive SUV Arlington's SUVs and San Antonio's Tundras won't directly compete, plant although both are designed to appeal to American consumers who like quintessentially American vehicles: big, V-8-powered, body-on- frame trucks. But Toyota is clearly sensitive about appeals to economic patriotism by GM, which calls itself the "global car company that's proud to be American." The Japanese auto maker has mounted an aggressive campaign to win over public opinion in Texas and elsewhere, by highlighting its U.S. investments. About a third of all cars built in the U.S. last year were assembled in the 14 plants owned by foreign-based auto makers, according to CSM. Japanese car companies are the biggest investors, having spent $28 billion to build North American factories and as much as $45 billion a year on parts here. Japanese auto makers say two-thirds of the cars they sell in North America are made here. Toyota executives routinely downplay the threat the company's growth poses to traditional American auto companies. But there's little doubt that Toyota has big plans for using the new San Antonio factory to grab a chunk of market share in the large pickup market, one of Detroit's last bastions of profit. The current Toyota Tundra has a 5.5% share of the full-size pickup market so far this year, compared with 35.9% for the Ford F- series, and 27.6% for the Chevy Silverado -- the two best selling big pickups in the U.S. When San Antonio hits its full capacity of 200,000 vehicles a year, Toyota will be able to produce more than 300,000 Tundras a year in the U.S., counting capacity at an existing factory producing Tundras in Princeton, Ind. But the company is unlikely to stop there. To explain the layout of the San Antonio plant, Mr. Tajima asks an assistant to bring him a blueprint of the complex. The blueprint shows a second plant next to the new Tundra factory. Mr. Tajima jokes that the space is just a golf driving range. But in the end he says it is "a possible future expansion area" for a second assembly line. A Toyota spokesman says no decisions have been made on the second plant. Cost Concepts TOYOTA - SAN ANTONIO GM - ARLINGTON Direct Material Direct Labor Direct Labor Direct Labor Direct Labor Direct Labor Manufacturing Overhead Costs O Manufacturing Overhead Costs Manufacturing Overhead Costs Manufacturing Overhead Costs Manufacturing Overhead Costs A Tale of Two Auto Plants Pair of Texas Factories Shows How Starting Fresh Gives Toyota an Edge Over GM By Lee Hawkins Jr. and Norihiko Shirouzu May 24, 2006 12:01 am ET ARLINGTON, Texas -- For more than 50 years, General Motors Corp. has built cars and trucks here at Texas' only auto assembly plant, pumping billions of dollars a year into the state economy through taxes, purchases and paychecks. The sprawling factory, one of GM's best, employs 3,000 people and buys myriad parts and services from local suppliers to build the big sport utility vehicles that have been among the company's most profitable -- including "the national car of Texas," the Chevrolet Suburban. SEE AN INTERACTIVE MAP Now, though, a rival has come deep into the heart of Texas to battle GM. At a 2,000-acre site in San Antonio, Toyota Motor Corp. is getting ready to start production later this year of the newest generation of Tundra pickup trucks in a plant that will use the Japanese car maker's most advanced machinery and methods. Passing Lane: New Asian auto manufacturing plants are gaining ground against older U.S. ones. Take a look at the auto makers' North American assembly operations. Separated by 280 miles, these two factories bring into stark relief the competitive problems plaguing GM at home at a time when car- building in the U.S. is thriving, even though American car companies are faltering. In no small part, the world's largest auto maker's difficulties stem from the fact that its challengers can start fresh, unencumbered by old plants and old obligations that limit innovation and add hundreds of dollars to the cost of each vehicle. "GM has to stay within the box," says Michael Robinet, a vice president of Michigan-based research firm CSM Worldwide, which specializes in the auto industry. "Toyota was able to think outside the box." In Texas, Toyota appears to be working aggressively to make the most of its advantages. The company has been able to deploy the latest know-how to fit various manufacturing processes -- from stamping to welding to painting to final assembly -- into a relatively compact space and make the plant more efficient. On the other hand, even though Arlington is the country's most efficient large-SUV plant, GM can't maximize its success by adopting its newest, best methods there. "Arlington is doing a great job for GM, but they can't have an optimal layout, and their footprint is landlocked because a world with subdivisions and expressways has grown up around it, whereas Toyota was able to take out a clean sheet of paper," Mr. Robinet says. For example, GM's body shop is housed in a separate building, which was built in 2000 to introduce new technology. The bodies are transported on an elaborate, enclosed conveyor to the final assembly 2007 Chevrolet area, where they are painted and stored before being bolted onto Suburban frames. GM managers say they would use a more modern layout that would help boost the plant's productivity even more, but GM can't afford to shut down operations and completely rebuild the plant. Even so, Arlington ranked No. 1 among North American large-SUV factories last year, at 22.39 assembly labor hours per vehicle, according to Harbour Consulting, which functions as the North American auto industry's de facto productivity scorekeeper. Toyota's Princeton, Ind., SUV and pickup plant was well behind. Two decades ago, GM factories suffered from a sizable gap compared with similar Toyota factories, as measured in the number of hours it takes workers to build a vehicle. Recent Harbour surveys show that this gap has narrowed substantially. But GM's productivity gains are offset by higher hourly labor costs and the burden it carries for benefits owed to retirees. In Arlington, GM pays union-scale wages of $26.50 to $30.50 an hour to its 2,800 hourly workers there. On average, GM pays $81.18 an hour in wages and benefits to U.S. hourly workers, including pension and retiree medical costs. At that rate, labor costs per vehicle at Arlington are about $1,800, based on the Harbour Consulting estimate of labor hours per vehicle. In San Antonio, Toyota will use non-union labor and will start its 1,600 hourly workers at $15.50 to $20.33 per hour, which will grow after three years to $21 to $25. Harbour Consulting President Ron Harbour estimates Toyota's total hourly U.S. labor costs, with benefits, at about $35 an hour -- less than half of GM's rates. The brand-new plant won't have any direct retiree costs for many years. So if the San Antonio factory does no better than match the Arlington plant in productivity, it could still enjoy a labor cost advantage of about $1,000 per vehicle, a substantial sum in industry terms. That's money Toyota could translate into extra standard features -- such as stability control -- that could make its trucks more appealing. 2007 Toyota Tundra Being new means Toyota can use its most-efficient manufacturing technology, which the company has developed as part of a recent push to slash its production costs. The San Antonio plant is installing smaller, lighter machinery with a simpler design that takes up less space than previous generations of equipment, an effort Toyota calls "simple and slim." Smaller machines mean Toyota can spend less on the building that houses them, while simpler design means those machines are cheaper to install, easier to maintain, much less likely to break down and simpler to fix if they do. The plant covers about 2.2 million square feet, including some metal-stamping operations, which are not done in Arlington. Still, the Toyota plant is roughly a third smaller than the 3.75 million- square-foot GM plant. If Toyota had built the plant with the conventional technology, the plant would have been "30% to 40%" larger, says the plant's manager, Hidehiko "T.J." Tajima. As his engineers haul in and test new stamping presses and other heavy equipment in San Antonio, what's equally important to Mr. Tajima is what's missing. Toyota's newest U.S. factory doesn't have shoulder-high shelves lining the assembly line to hold parts for workers. Instead, the parts for each vehicle are delivered in a small container inside each car, freeing workers from having to pick out the right parts from the shelves. The missing shelves coupled with the smaller machines turn what would ordinarily be a dark and noisy place into one that is airy and well lighted. "We try to come up with break-through innovation in every major equipment and process," Mr. Tajima says, pointing to an example where engineers replaced heavy parts conveyer systems with lighter and more flexible robots. Further, Toyota has arranged for 21 key Tundra suppliers to set up factories right on the same site, sandwiching the plant on the north and south sides. Engines still come from a Toyota plant in Alabama and axles from a supplier in Arkansas, but most other major parts, from instrument panels to seats to exhaust systems, are assembled at those on-site suppliers. That cuts the cost of transporting parts and storing large inventories on site as insurance against missed shipments. It also eliminates risks of having too many components en route to San Antonio -- a potential logistical nightmare that could cost Toyota dearly if a defect suddenly appears. Robots on the assembly line at GM's Arlington facility. There are risks for the on-site suppliers, though. They cannot spread their costs over different products from multiple auto makers, which makes them vulnerable to a downshift in demand for Toyota's big trucks. GM, in contrast, is restricted by space, existing deals with suppliers who are located elsewhere and its agreements with the United Auto Workers that prohibit it from using lower-wage, non-union workers on the same site. Of the total 3,330 different kinds of parts that are supplied to the Arlington facility, about 1,075 come from Michigan suppliers, while 739 come from Texas and the rest from Canada and Mexico. Having suppliers located far away has a price tag. Shipping costs have increased in the wake of rising gas prices, GM says, but it is difficult to estimate how much compared with previous years, when Arlington A rendering of was building older generations of SUVs that required fewer parts Toyota's cutting- because they were available with fewer options. edge pickup factory in San Antonio Moreover, because the Tundra plant brings new jobs to San Antonio, Toyota, which chose the city over a rival site in Arkansas, has been able to bargain for a generous package of subsidies from various levels of government. The state gave a total of $133.25 million in direct incentives, including a reprieve from utility bills and a discount on property taxes, along with road improvements worth $57 million. The city, along with other agencies, spent $18 million screening 100,000 job applicants for the plant. The direct incentives alone, averaged over roughly one year's production, amount to more than $600 per vehicle in savings for Toyota. Even though it has made significant investments in Arlington in recent years, GM no longer gets the same pampering. Since 1996, GM has spent about $910 million on the plant and converted it from building cars to making SUVs. In 2000, GM installed more than 600 robots in an overhaul of the plant's body shop, where the frames and underbodies of trucks are fabricated. Much of this new investment, however, is deemed by the state and other government agencies as job-retention rather than job-creation, meaning GM doesn't qualify for incentives similar to those offered Toyota. "We spend $280 million in payroll in a year, $1.6 billion every year to suppliers in this state. I can give you data from here to the moon and back," said Mike Glinski, manager of the GM Arlington plant. "The An aerial photo of appropriate word for how I feel," he added, "is 'disappointed.'" GM's highly productive SUV Arlington's SUVs and San Antonio's Tundras won't directly compete, plant although both are designed to appeal to American consumers who like quintessentially American vehicles: big, V-8-powered, body-on- frame trucks. But Toyota is clearly sensitive about appeals to economic patriotism by GM, which calls itself the "global car company that's proud to be American." The Japanese auto maker has mounted an aggressive campaign to win over public opinion in Texas and elsewhere, by highlighting its U.S. investments. About a third of all cars built in the U.S. last year were assembled in the 14 plants owned by foreign-based auto makers, according to CSM. Japanese car companies are the biggest investors, having spent $28 billion to build North American factories and as much as $45 billion a year on parts here. Japanese auto makers say two-thirds of the cars they sell in North America are made here. Toyota executives routinely downplay the threat the company's growth poses to traditional American auto companies. But there's little doubt that Toyota has big plans for using the new San Antonio factory to grab a chunk of market share in the large pickup market, one of Detroit's last bastions of profit. The current Toyota Tundra has a 5.5% share of the full-size pickup market so far this year, compared with 35.9% for the Ford F- series, and 27.6% for the Chevy Silverado -- the two best selling big pickups in the U.S. When San Antonio hits its full capacity of 200,000 vehicles a year, Toyota will be able to produce more than 300,000 Tundras a year in the U.S., counting capacity at an existing factory producing Tundras in Princeton, Ind. But the company is unlikely to stop there. To explain the layout of the San Antonio plant, Mr. Tajima asks an assistant to bring him a blueprint of the complex. The blueprint shows a second plant next to the new Tundra factory. Mr. Tajima jokes that the space is just a golf driving range. But in the end he says it is "a possible future expansion area" for a second assembly line. A Toyota spokesman says no decisions have been made on the second plant