please help thank you so much

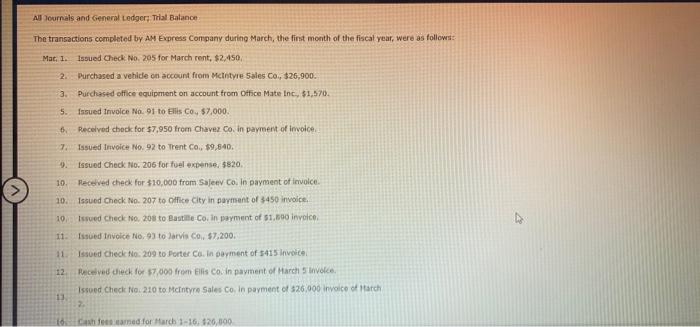

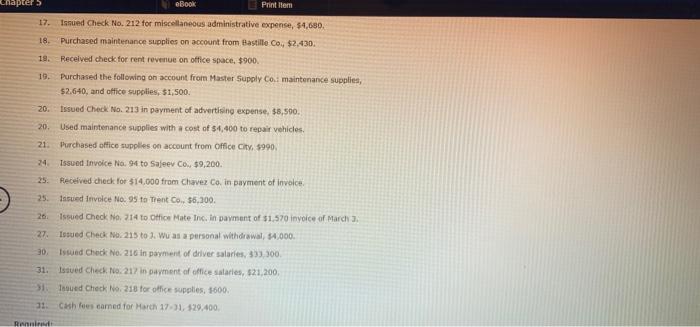

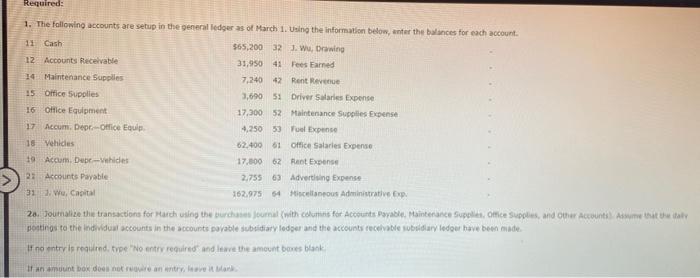

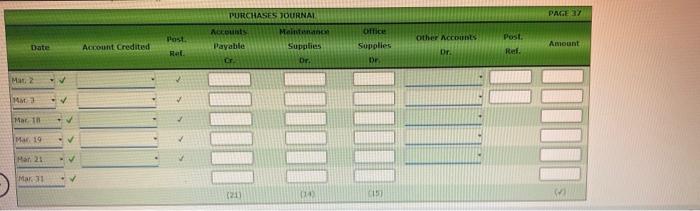

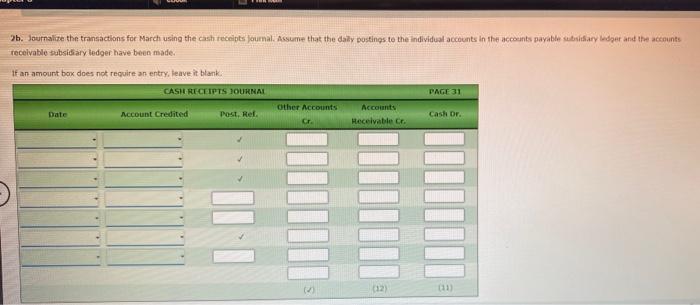

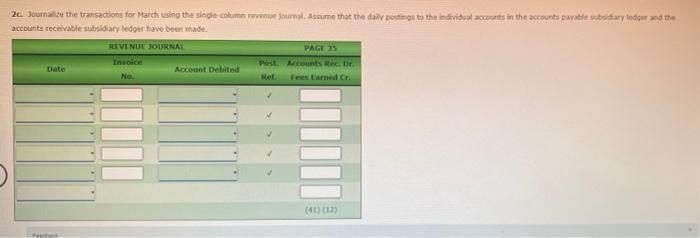

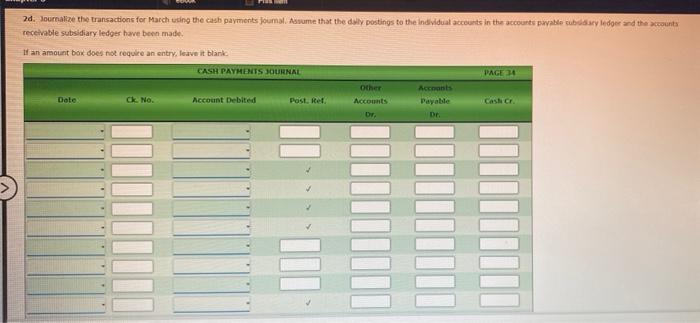

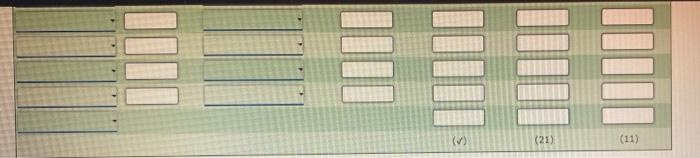

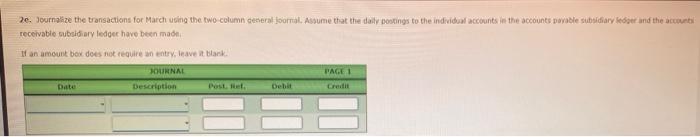

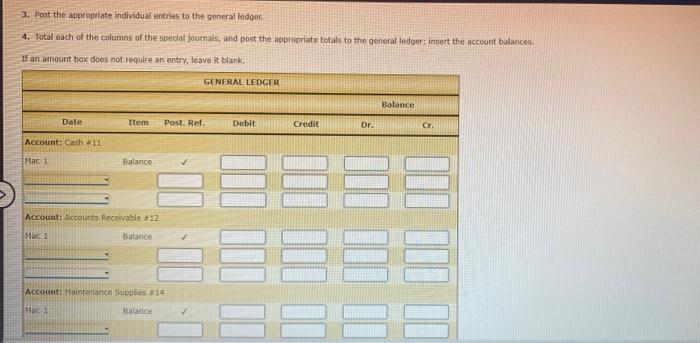

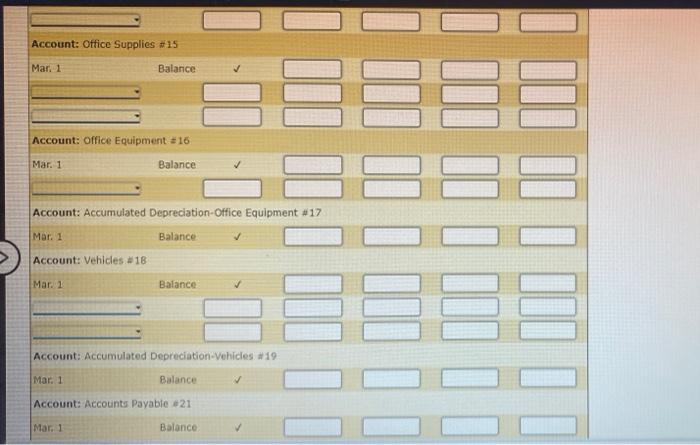

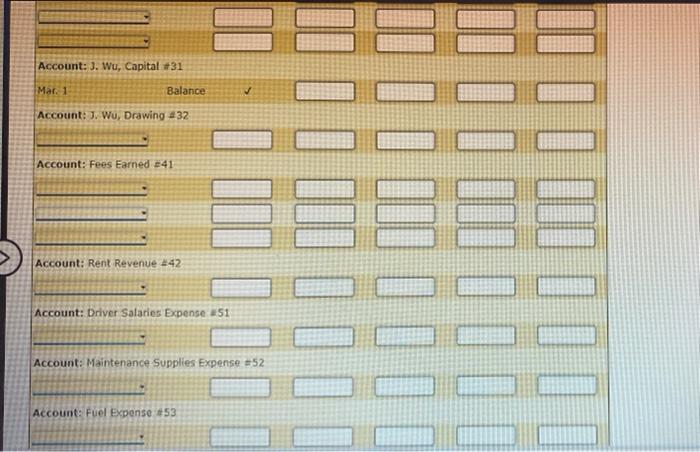

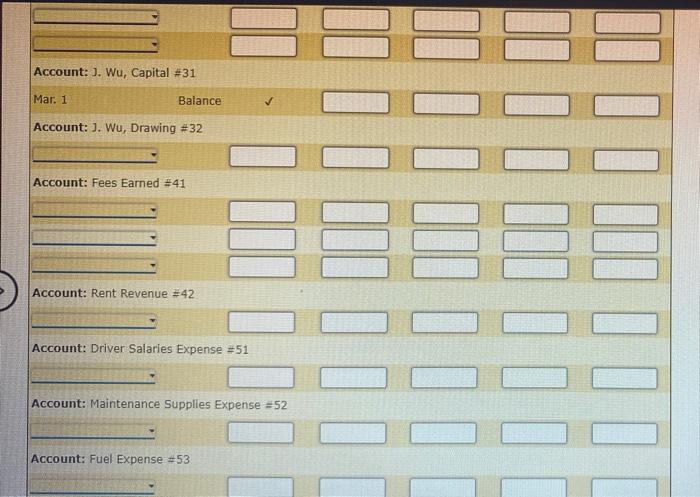

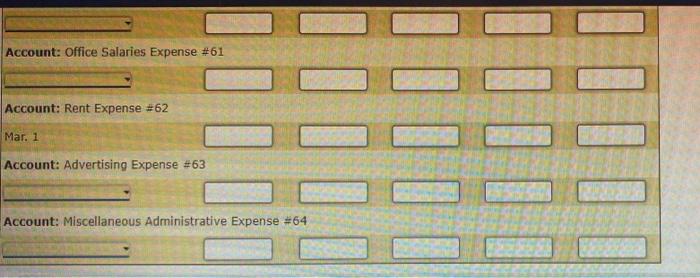

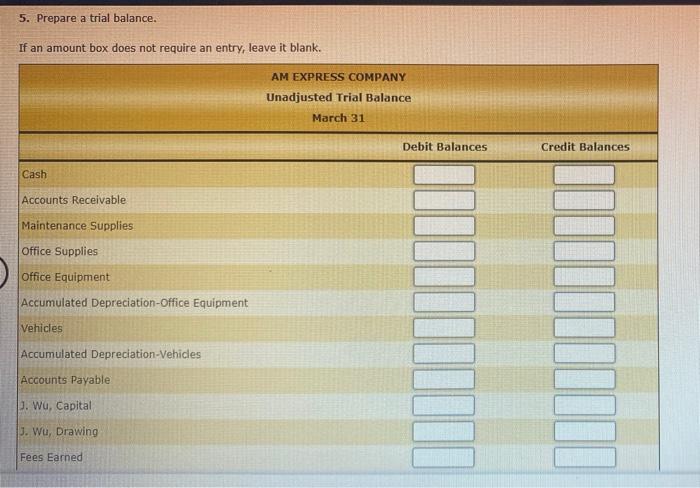

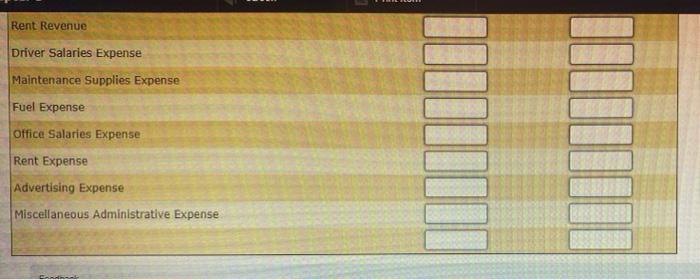

Al Journals and General Ledger; Trial Balance The transactions completed by AM Express Company during March, the first month of the fiscal year, were as follows: Mar. 1. Issued Check No. 205 for March rent, $2,450 2. Purchased a vehicle on account from McIntyre Sales Co, $26,900. 3. Purchased office equipment on account from Office Mate Inc., $1,570. 5. Issued Invoice No. 91 to Elis Co. $7,000. Receyed check for $7.950 from Chavez Co. In payment of invoice 7. Issued Invoice No. 92 to Trent Co. $9,840. 9. Issued Check No. 205 for fuel expense, 5820 10. Received check for $10,000 from Sajeev Co. In payment of invoice 10. Issued Check No. 207 to Office City in payment of $450 invoice 102 Issued Check No. 208 to Bastille Coin payment of $1,000 invoice 11 Issued Invoice No. 93 to Jarvis Co, 57,200. 11 Issued Check No 209 to Porter Co. In payment of 5415 invoice 12 Received check for $7.000 from Ellis Co. In payment of March 5 invoke Issoed Check No 210 to McIntyre Sales Co. In payment of $26.000 invoice of March 13 10 Cathet med for Hardb 1-16.520,000 Chapters eBook Printem 17. Issued Check No. 212 for miscellaneous administrative expense, $4,680. 18. Purchased maintenance supplies on account from Bastille Co. $2.430. 19. Received check for rent revenue on office space $900. 19. Purchased the following on account from Master Supply Co.: maintenance supplies, $2.640, and office supplies, $1,500. 20. Issued Check No. 213 in payment of advertising expense, $8,500. 20. Used maintenance supplies with a cost of $4,400 to repair vehicles. 21. Purchased office supplies on account from Office City, 1990, 24 Issued Invoice No. 94 to Sajeev Co. $9,200. Received check for $14,000 from Chavez co, in payment of invoice 25. Issued Invoice No. 95 to Trent Co., 56,300. 26. Issued Check No. 214 to Office Mate Inc. In payment of $1,570 invoice of March 27. Tosued Check No. 215 to 1. Was a personal withdrawal, 54.000. 30, Issued Check No. 216 in payment of driver salaries, 333,300 31. Isted Check No. 21 in payment of office salaries, 521,200. Inoued Check No. 218 for office supplies, 5600 3. Cith foes camed for Harch 17-3129.400 Rann Required: 1. The following accounts are setup in the general ledger as of March 1. Using the information below, enter the balances for each account 11 Cash $55,200 32. w Drawing 12 Accounts Receivable 31,950 41 Fees Earned 14. Maintenance Supplies 7,240 42 Rent Revenue 15 Office Supplies 3,690 51 Driver Sales Expense 16 Office Equipment 17,300 52 Maintenance Supplies Expense 17 Accum. Depr.-Office Equip 4,250 53 Fuel Expense 18 Vehides 62.400 61 Office Salaries Expense 19 Accum. Debe-Vides 17.000 2 Rent Expense 23 Accounts Payable 2.755 62 Advertising Expense 31Wu, Capital 362.975 54 Miscellaneous Administrative Exp 20. Journalize the transactions for purch using the purchases Journal (with columits tot Accountable, Paintenance Supolis, olce Spousand other countlemme tout utaly posting to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable nobillary ledou have been made. If no entry is required. type "No entry required and love the amount bones blank If an amount box does not an entry, teve in PAGE 1 PURCHASES JOURNAI Access Maintenance Payable Supplies Other Accounts Date Account Credited Post Ral Office Supplies Dr Post Ref. Amount Dr. Dr. Man 2 3 Mart Mar. 19 > Har 25 Mar 21 (21 114 (151 2b. Journalize the transactions for March using the cash receipts journal. Assume that the daily postings to the individual accounts in the accounts payable subsidiary Indger and the accounts receivable subsidiary ledger have been made. If an amount box does not require an entry, leave it blank CASIL RECEIPTS JOURNAL PAGE 31 Other Accounts Date Account Credited Post, Rel Accounts Receivable Cr. Cash Dr. Cr 012 20. Journalize the transactions for March using the single column revenue mal. Assume that the daily posting to the individual accounts in the accounts payable subsidiary lodger and the accounts receivable subsidiary ledger have been made REVENUE JOURNAL PAGE 15 Invoice Posting or Account Debited No Het Date Tees Earned CH 20. Journalize the transactions for March using the cash payments foumal. Assume that the daily postings to the Individual accounts in the accounts payable by deer and the counts receivable subsidiary ledges have been made If an amount box does not require an entry, leave it blank CASH PAYMENTS JOURNAL PAGE 4 Date ck. No. Account Debited Post Rel Other Accounts Dr. Accants Payable Dr. Cast CF (4) (21) (11) Pe. Journalize the transactions for March using the two column general formal Assume that the daily postings to the individual accounts in the accounts payable subsidiary feet and the account receivable subsidiary ledger have been made If an amount box does not require an entry leave it back BOURNAL PAGE 1 Date Description Poste Debit 3. Post the appropriate individual entries to the general ledger 4. Total each of the columns of the spedal Journals, and post the appropriate totals to the general ledger: insert the account balances. If an amount box does not require an entry, leave it blank. GENERAL LEDGER Balance Date Item Post. Ret Debit Credit Dr. Account: Cash 11 Mar. 1 Balance Account Accounts Receivable -12 Mar Balance BEE Account Maintenance Supplies 14 MET Balance Il Account: Office Supplies #15 Mar. 1 Balance 33333 Account: Office Equipment #16 Balance Mar. 1 Account: Accumulated Depreciation Office Equipment #17 Mar. 1 Balance Account: Vehicles #18 Mar. 1 Balance 5359 Account: Accumulated Depreciation Vehicles #19 Mar. 1 Balance Account: Accounts Payable 21 Mar. 1 Balance Account: 3. Wu, Capital #31 Mar. 1 Balance Account: J. Wu, Drawing +32 Account: Fees Earned 241 I Account: Rent Revenue 242 11 11111 Account: Driver Salaries Expense #51 Account: Maintenance Supplies Expense 52 Account: Fuel Expense #53 = Account:). Wu, Capital #31 Mar. 1 Balance Account: J. Wu, Drawing #32 Account: Fees Earned 541 011 Account: Rent Revenue #42 III III Account: Driver Salaries Expense #51 Account: Maintenance Supplies Expense #52 11 Account: Fuel Expense #53 Account: Office Salaries Expense #61 Account: Rent Expense #62 Mar. 1 Account: Advertising Expense #63 Account: Miscellaneous Administrative Expense #64 5. Prepare a trial balance. If an amount box does not require an entry, leave it blank. AM EXPRESS COMPANY Unadjusted Trial Balance March 31 Debit Balances Credit Balances Cash Accounts Receivable Maintenance Supplies Office Supplies Office Equipment Accumulated Depreciation Office Equipment Vehicles Accumulated Depreciation-Vehicles Accounts Payable 3. Wu, Capital J. Wu, Drawing Fees Earned Rent Revenue Driver Salaries Expense Maintenance Supplies Expense Fuel Expense Office Salaries Expense Rent Expense Advertising Expense Miscellaneous Administrative Expense