Answered step by step

Verified Expert Solution

Question

1 Approved Answer

**PLEASE HELP. THANK YOU SO MUCH.** Income Statement, Capital Statement, Balance Sheet, Cash Flow Statement **PLEASE HELP. THANK YOU SO MUCH.** Please prepare: Income Statement,

**PLEASE HELP. THANK YOU SO MUCH.**

Income Statement, Capital Statement, Balance Sheet, Cash Flow Statement

**PLEASE HELP. THANK YOU SO MUCH.**

Please prepare: Income Statement, Capital Statement, Balance Sheet, Cash Flow Statement

After, please answer the 3 questions below:

1. How would you describe the capital invested by Mr. Joe Brown after a months operation?

2. Is the company capable of paying its current liabilities? Why?

3. How was the companys financial performance for its first month of operation?

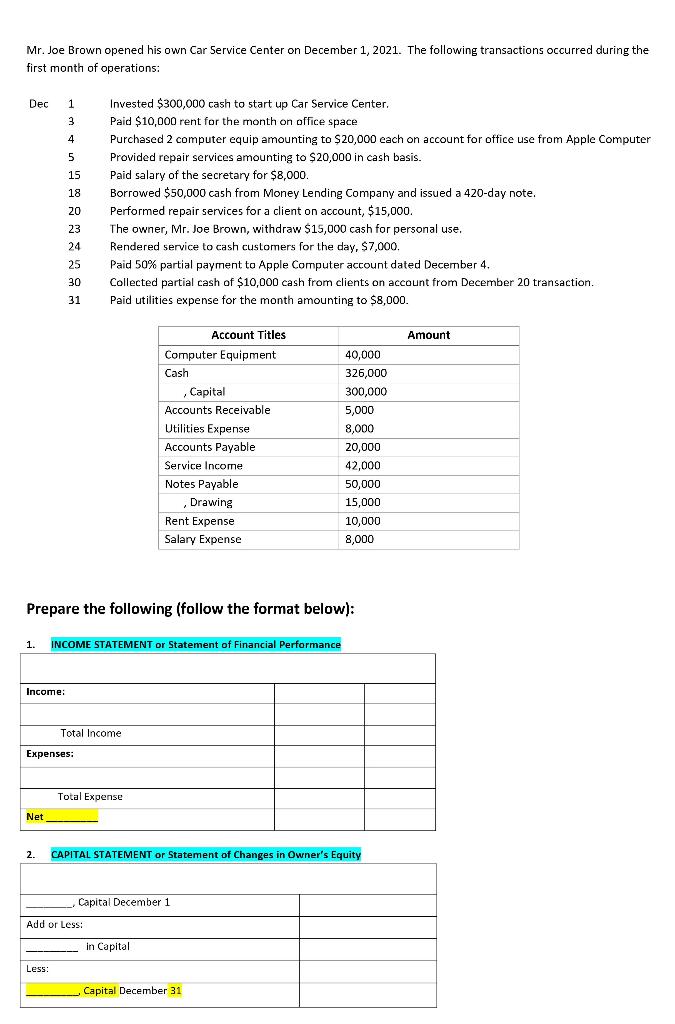

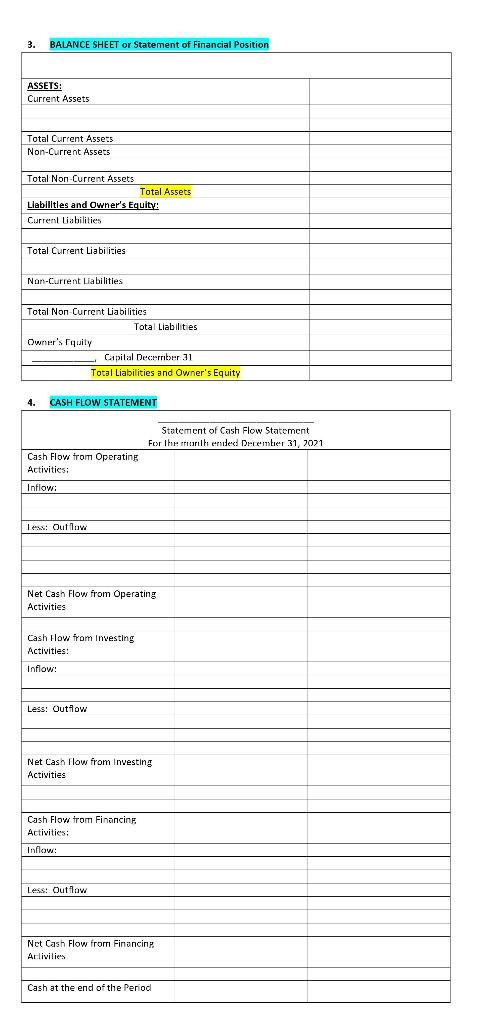

Mr. Joe Brown opened his own Car Service Center on December 1, 2021. The following transactions occurred during the first month of operations: Dec 1 3 4 5 15 18 Invested $300,000 cash to start up Car Service Center, Paid $10,000 rent for the month on office space Purchased 2 computer equip amounting to $20,000 each on account for office use from Apple Computer Provided repair services amounting to $20,000 in cash basis. Paid salary of the secretary for $8,000. Borrowed $50,000 cash from Money Lending Company and issued a 420-day note. Performed repair services for a client on account, $15,000. The owner, Mr. Joe Brown, withdraw $15,000 cash for personal use. Rendered service to cash customers for the day, $7,000. Paid 50% partial payment to Apple Computer account dated December 4. Collected partial cash of $10,000 cash from clients on account from December 20 transaction. Paid utilities expense for the month amounting to $8,000. 20 23 24 25 30 31 Amount Account Titles Computer Equipment Cash Capital Accounts Receivable Utilities Expense Accounts Payable Service Income Notes Payable , Drawing Rent Expense Salary Expense 40,000 326,000 300,000 5,000 8,000 20,000 42,000 50,000 15,000 10,000 8,000 Prepare the following (follow the format below): 1. INCOME STATEMENT or Statement of Financial Performance Income: Total Income Expenses: Total Expense Net 2. CAPITAL STATEMENT or Statement of Changes in Owner's Equity Capital December 1 Add or Less: in Capital Less: Capital December 31 3. BALANCE SHEET or Statement of Financial Position ASSETS: Current Assets Total Current Assets Non-Current Assets Total Non Current Assets Total Assets Llabilities and Owner's Equity: Current Liabilities Total Current Liabilities Non-Current Liabilities Total Non Current Liabilities Total Liabilities Owner's Equity Capital December 31 Total Liabilities and Owner's Equity 4. CASH FLOW STATEMENT Statement of Cash Flow Statement For the railh ended December 31, 2021 Cash Flow from Operating Activities: Inflow: Less: Outlow Net Cash Flow from Operating Activities Cash flow from investing Activities: Inflow: Less: Outflow Net Cash Flow from investing Activities Cash Flow from Financing Activities: Inflow: Less: Outlow Nct Cash Flow from Financing Allivilis Cash at the end of the PeriodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started