Answered step by step

Verified Expert Solution

Question

1 Approved Answer

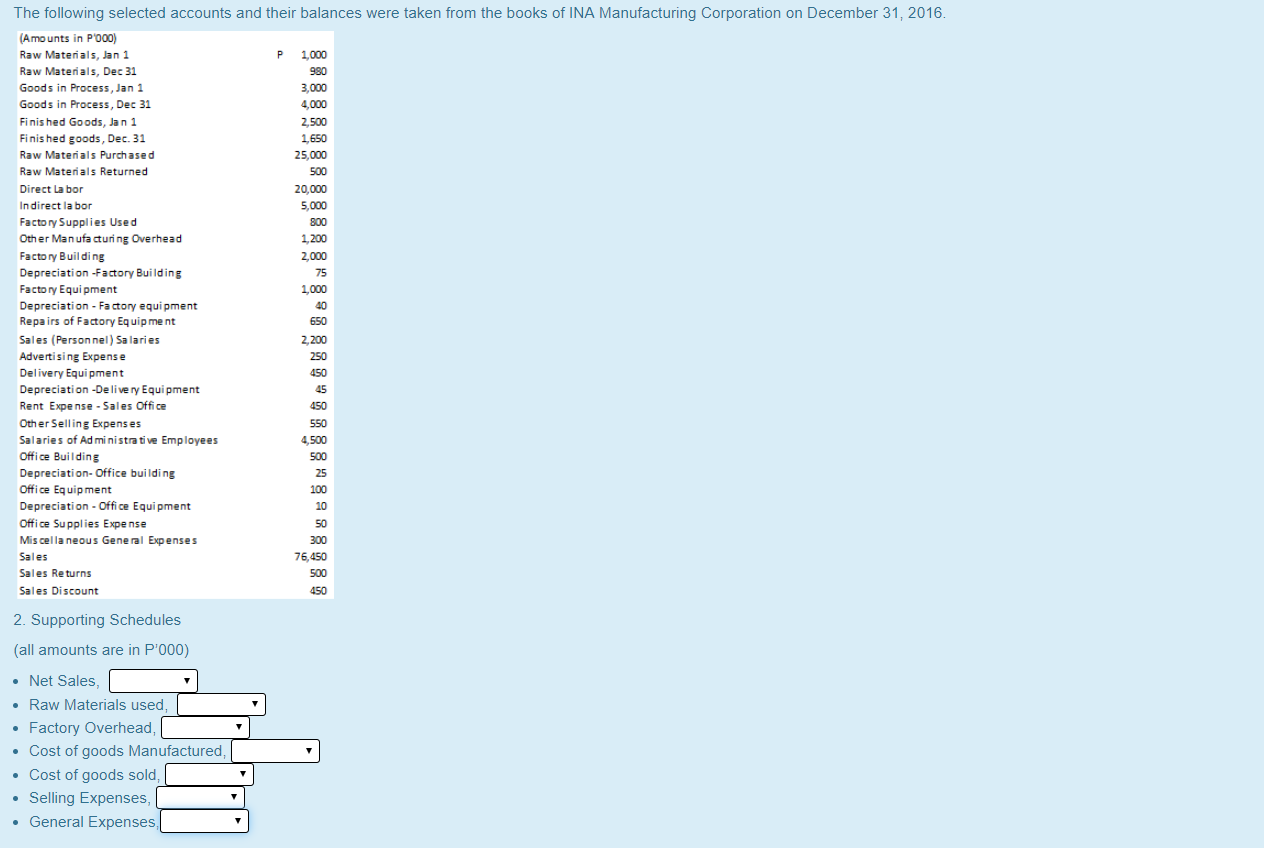

Please Help. Thank You. The following selected accounts and their balances were taken from the books of INA Manufacturing Corporation on December 31, 2016. (Amounts

Please Help. Thank You.

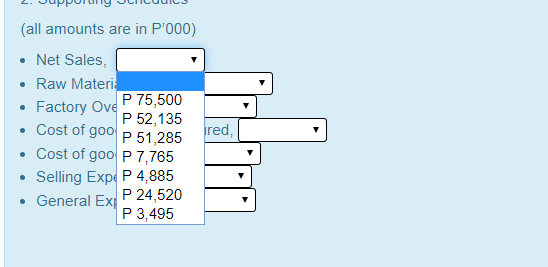

The following selected accounts and their balances were taken from the books of INA Manufacturing Corporation on December 31, 2016. (Amounts in P'000) P 1,000 Raw Materials, Jan 1 Raw Materials, Dec 31 980 Goods in Process, Jan 1 3,000 Goods in Process, Dec 31 4,000 Finis hed Goods, Jan 1 2,500 Finis hed goods, Dec. 31 1650 25,000 Raw Materials Purchased Raw Materials Returned 500 20,000 Direct La bor Indirect la bor 5,000 Factory Supplies Used 800 Other Man ufa cturing Overhead 1,200 Factory Building Depreciation -Factory Build ing Factory Equipment 2,000 75 1,000 Depreciation-Fa ctory equi pment Repairs of Factory Equip me nt 40 650 Sales (Person nel ) Sa lari es 2,200 Advertising Expens e 250 Delivery Equi pment 450 Depreciation -Deli ve ry Equi pment 45 Rent Expense- Sales Office 450 Other Selling Expens es 550 Salaries of Admi ni stra ti ve Emplloye es Office Building Depreciation- Office bui ldi ng Office Equipment Depreciation Office Equi pment 4,500 500 25 100 10 Office Supplies Expense 50 Mis cella neous General Expenses Sales 300 76,450 Sales Returns 500 Sales Discount 450 2. Supporting Schedules (all amounts are in P'000) Net Sales , Raw Materials used, Factory Overhead Cost of goods Manufactured Cost of goods sold, Selling Expenses, . General Expenses, (all amounts are in P'000) Net Sales, Raw Materia Factory Ove P 75,500 P 52,135 Cost of goo p 51,285 red Cost of goo P 7,765 Selling Expe P 4,885 General ExP 24,520 P 3,495Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started