Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help. Thank you. This chapter is kicking my butt. Required information [The following information applies to the questions displayed below] On January 1. Mitzu

Please help. Thank you. This chapter is kicking my

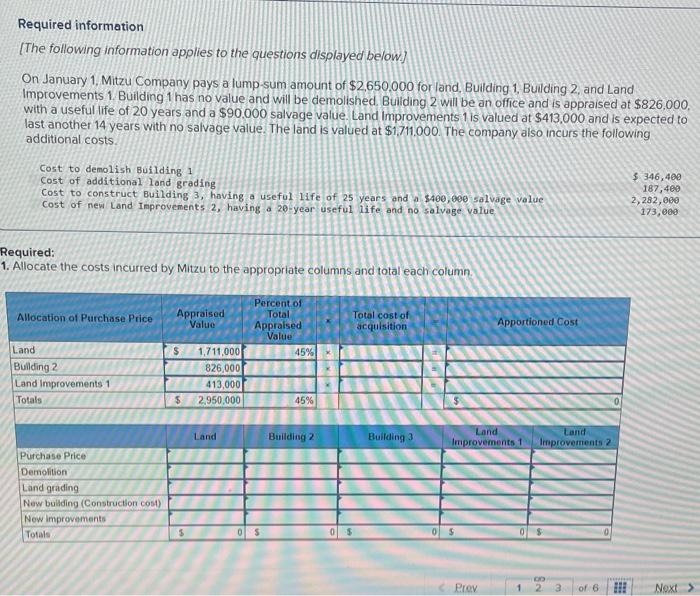

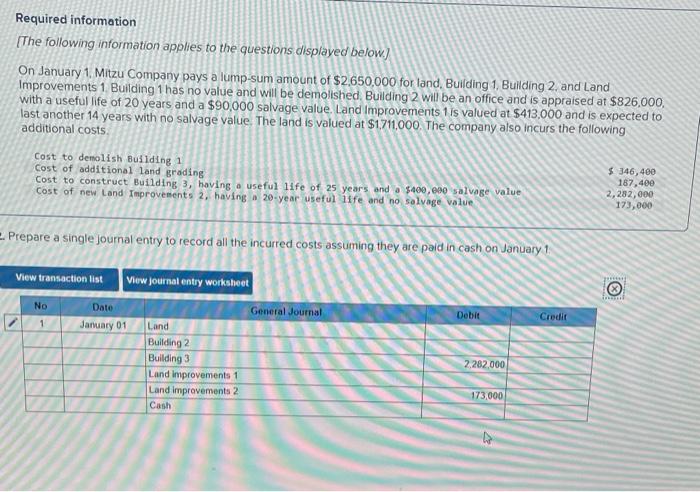

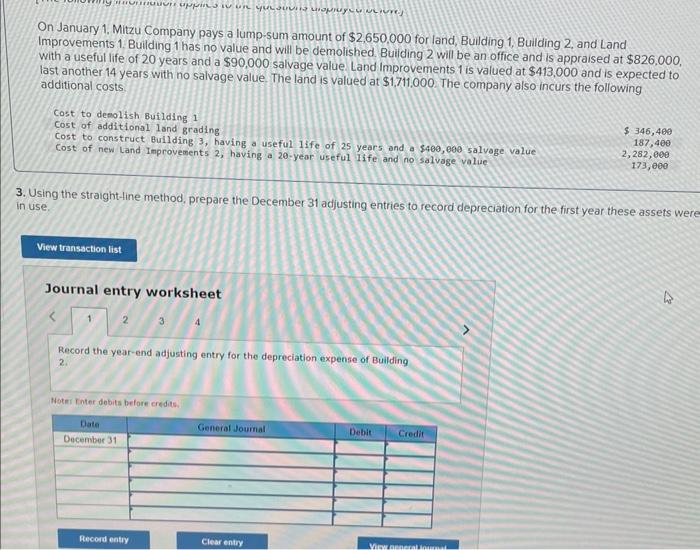

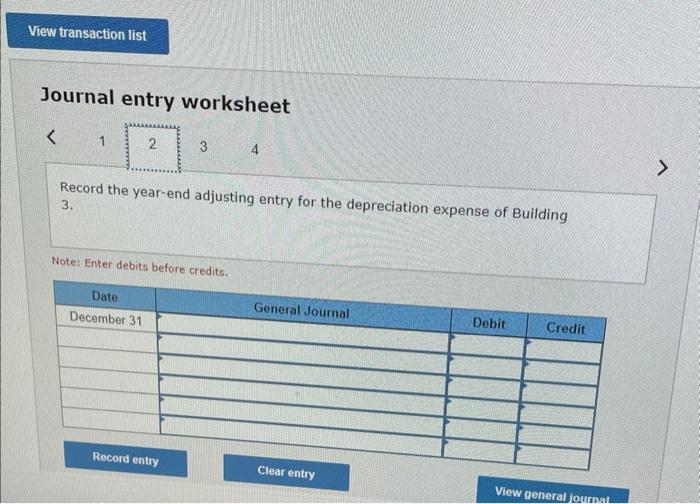

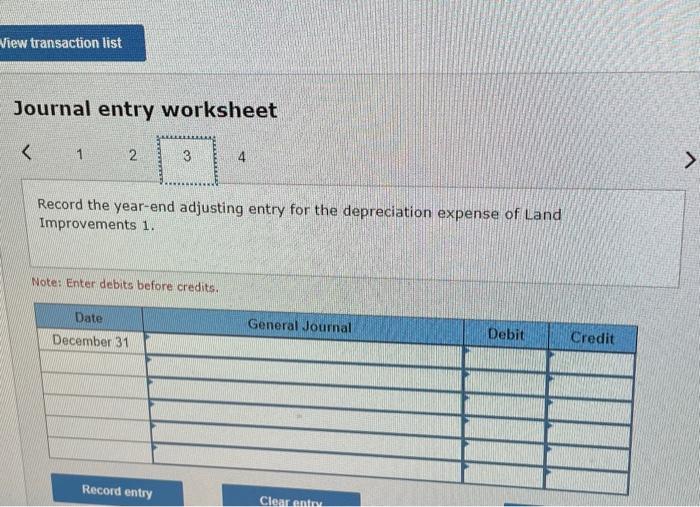

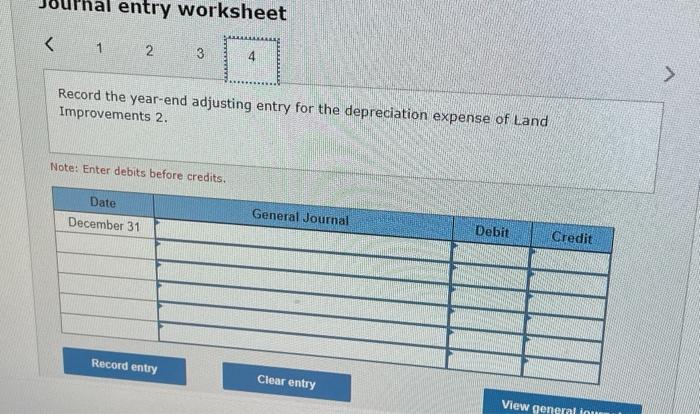

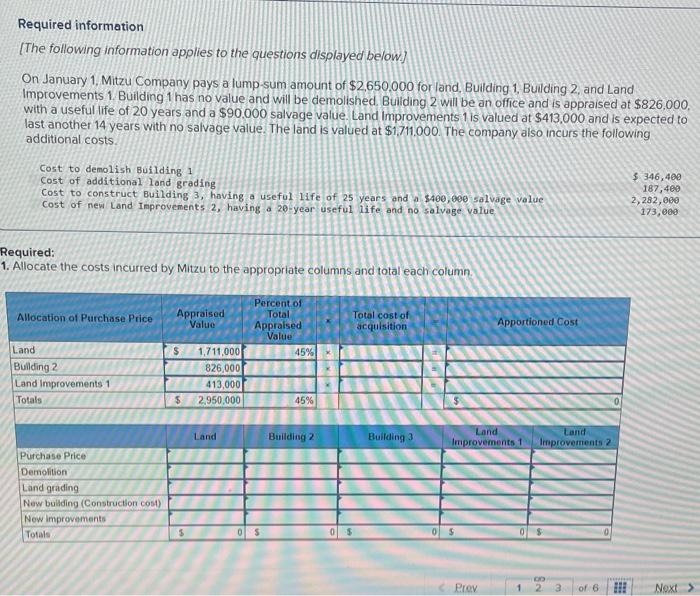

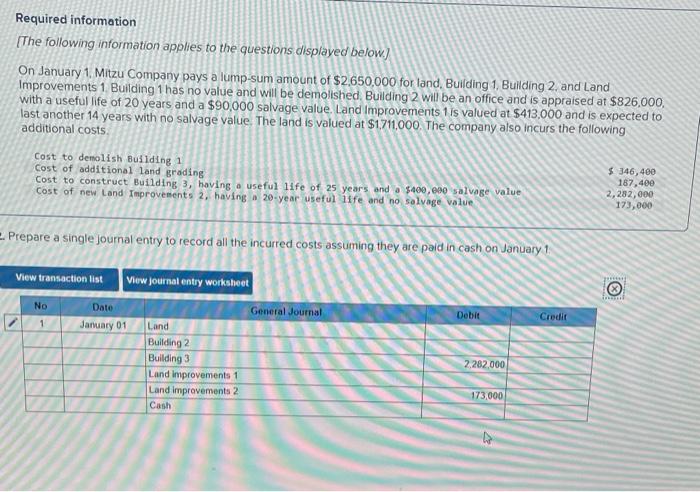

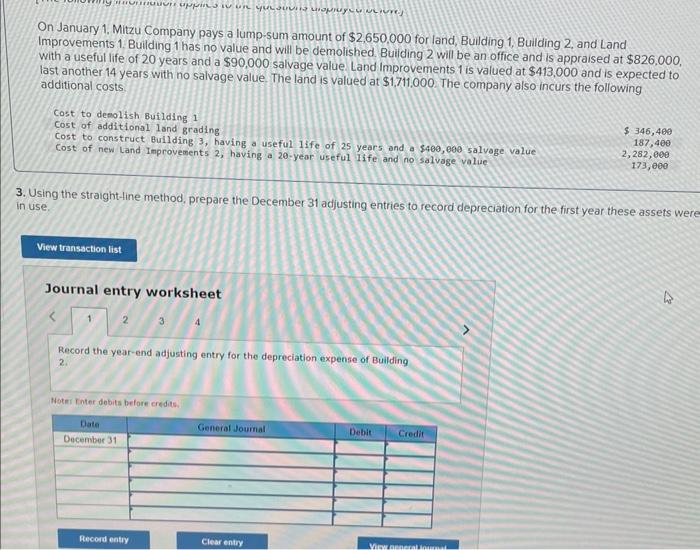

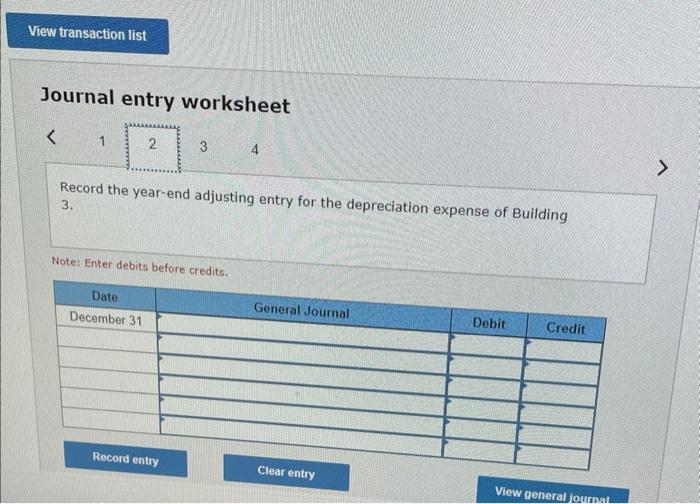

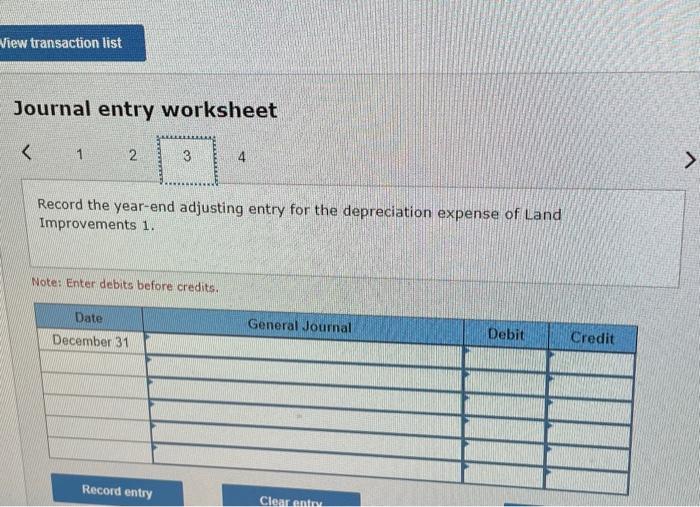

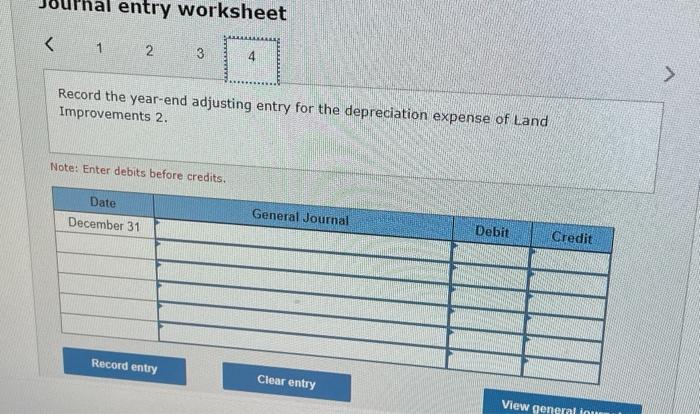

Required information [The following information applies to the questions displayed below] On January 1. Mitzu Company pays a lump-sum amount of \$2,650,000 for land, Building 1. Building 2. and Land Improvements 1. Building 1 has no value and will be demolished. Buiding 2 will be an office and is appraised at $826,000. with a useful life of 20 years and a $90.000 salvage value. Land Improvements 1 is valued at $413,000 and is expected to last another 14 years with no salvage value. The land is valued at $1,711.000. The company also incurs the following additional costs. Cost to demolish Building 1 cost of additional land grading Cost to construct Building 3, having a useful life of 25 years and a $400,000 salvage value 346,400 187,409 Cost of new Land Improvements 2, having a 20-year useful life and no salvage value Required: 1. Allocate the costs incurred by Mitzu to the appropriate columns and total each column. Required information [The following information applies to the questions displayed below.] On January 1, Mitzu Company pays a lump-sum amount of \$2,650,000 for land. Building 1, Building 2 , and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $826,000. with a useful life of 20 years and a $90,000 salvage value. Land Improvements 1 is valued at $413,000 and is expected to last another 14 years with no salvage value. The land is valued at $1,711,000. The company also incurs the following additional costs. Cost to denolish Buslding 1 5. 346,400 Cost of additional land grading Cost to construct Building 3, having a useful 11 fe of 25 years and a $400, eag salvage value Cost of new Land Improvenents 2, having a 20 -year useful life and no solvage value 2,282,000 173,000 Prepare a single journal entry to record all the incurred costs assuming they are paid in cash on January 1 On January 1. Mitzu Company pays a lump-sum amount of $2,650,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $826,000, with a useful life of 20 years and a $90,000 salvage value. Land improvements 1 is valued at $413,000 and is expected to last another 14 years with no salvage value. The land is valued at $1,711,000. The company also incurs the following additional costs. Cost to denolish Building 1 Cost of additional land grading Cost to construct Bullding 3, having a useful life of 25 years and a $400,000 salvoge value Cost of new Land improvements 2, having a 20 -year useful life and no salvage value $346,469 187,400 2,282,000 173,060 Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets wer huse. Journal entry worksheet Record the year-end adjusting entry for the depreciation expense of Building 2. Noter Finter dobits before eredite. Journal entry worksheet Record the year-end adjusting entry for the depreciation expense of Building 3. Note: Enter debits before credits. Journal entry worksheet Record the year-end adjusting entry for the depreciation expense of Land Improvements 1 . Note: Enter debits before credits. Journal entry worksheet butt.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started