PLEASE HELP!!! THANKS!

1

2

3

4

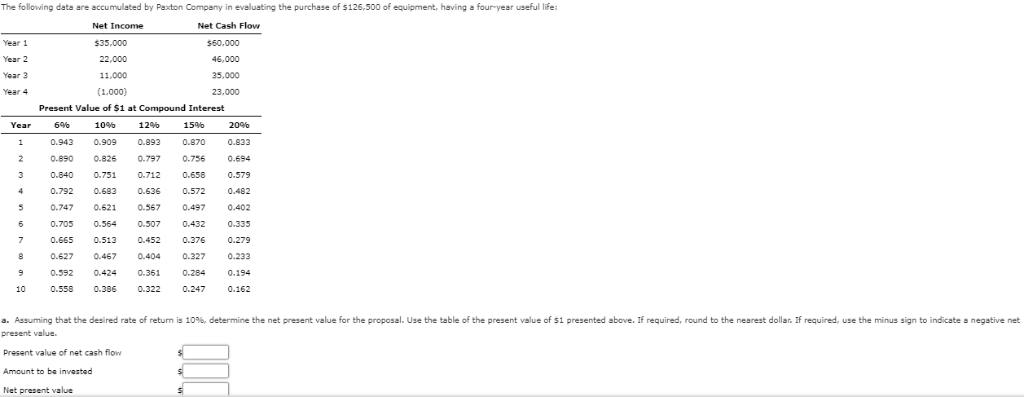

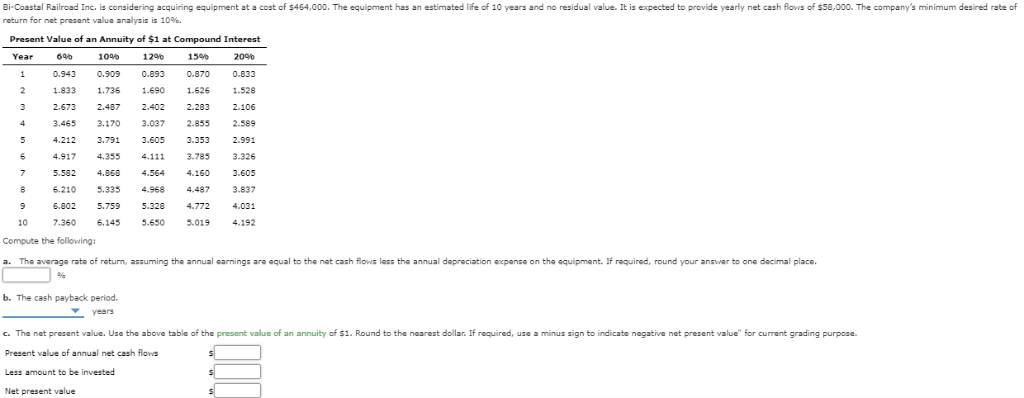

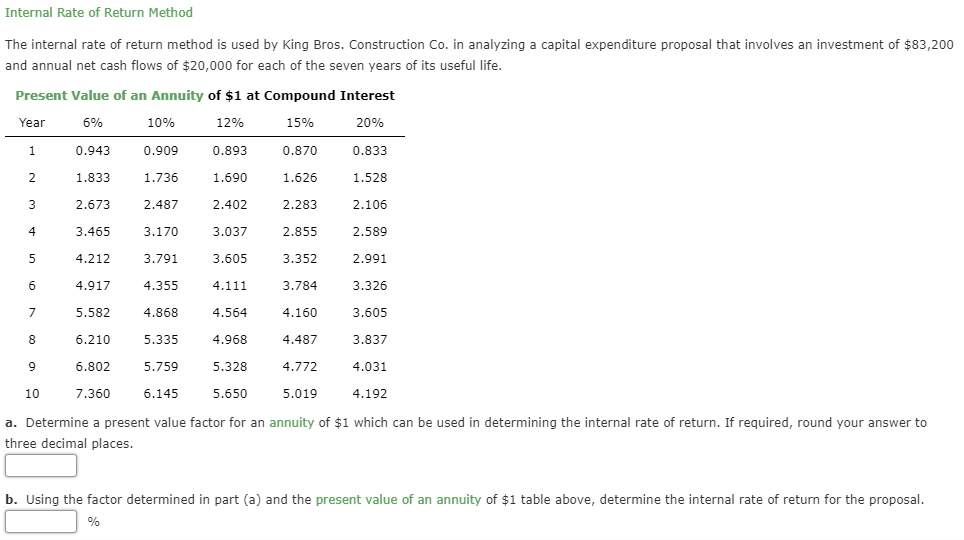

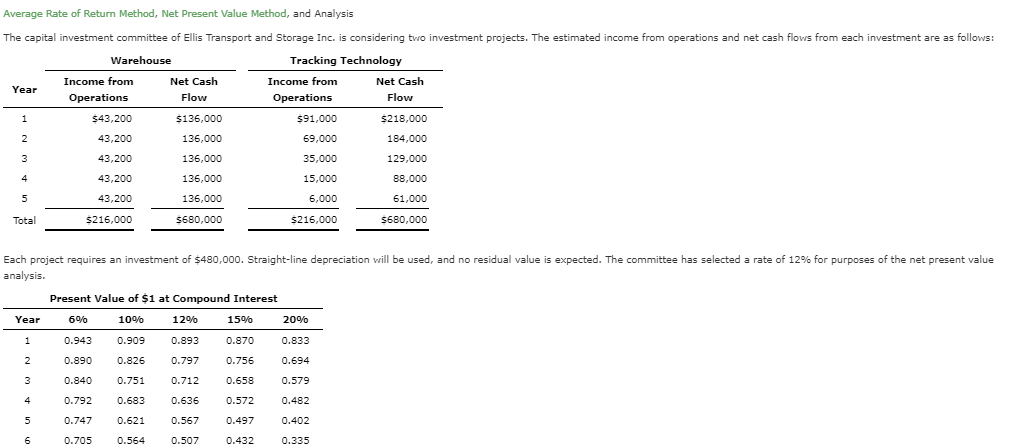

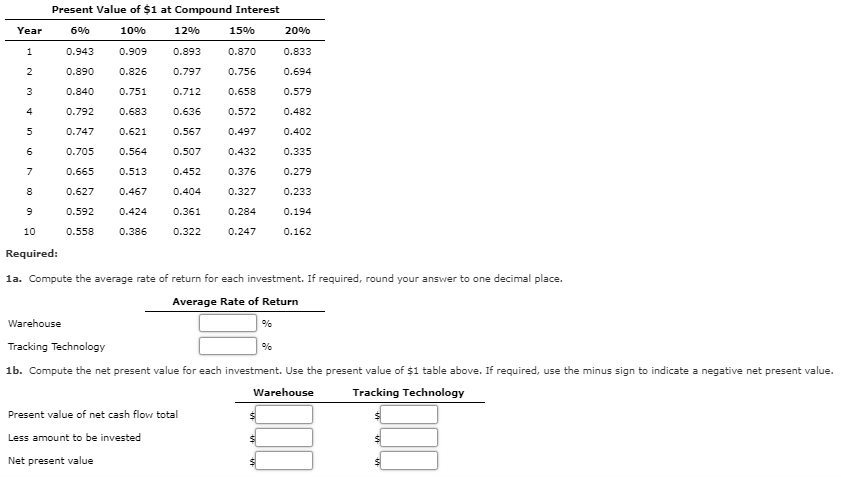

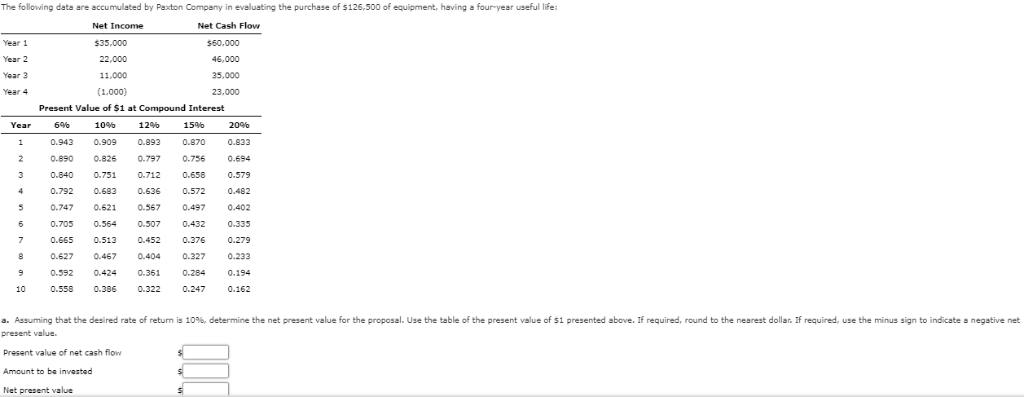

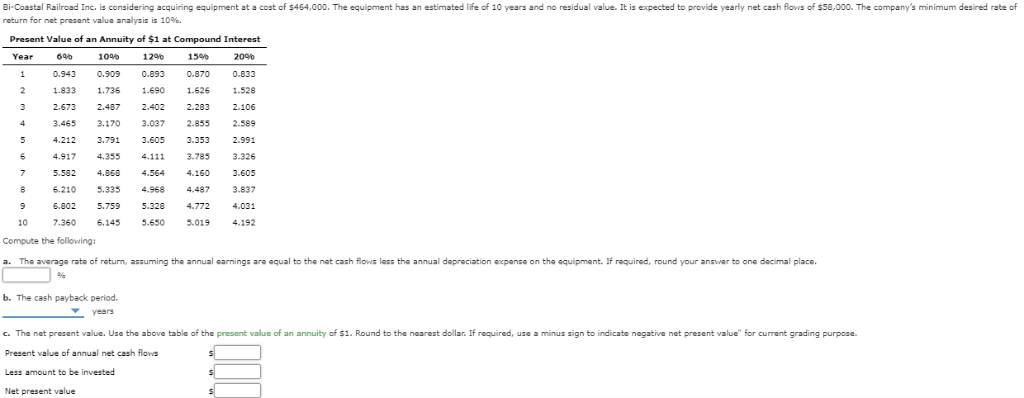

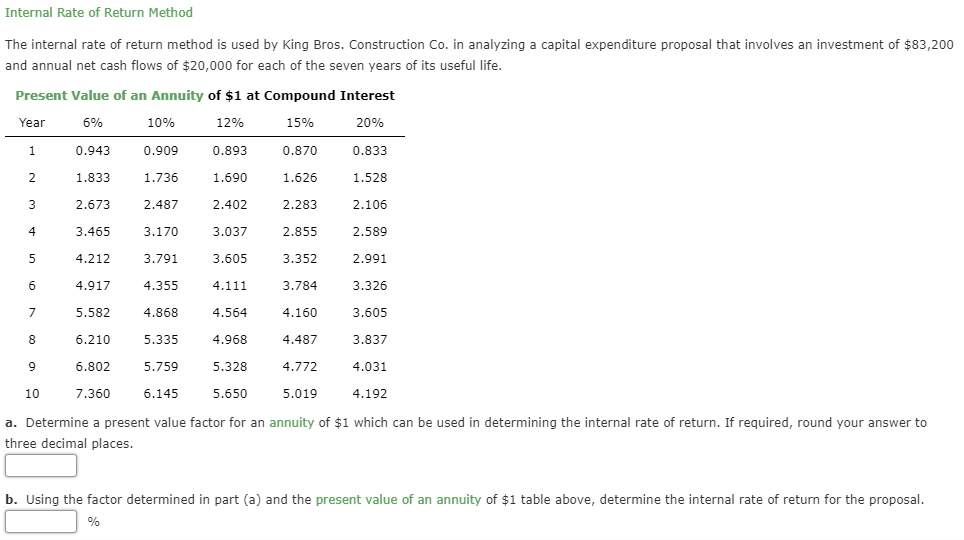

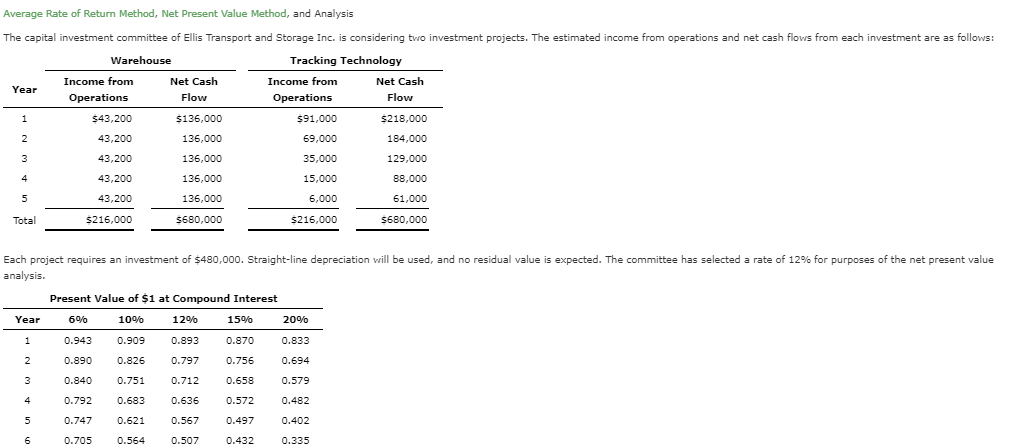

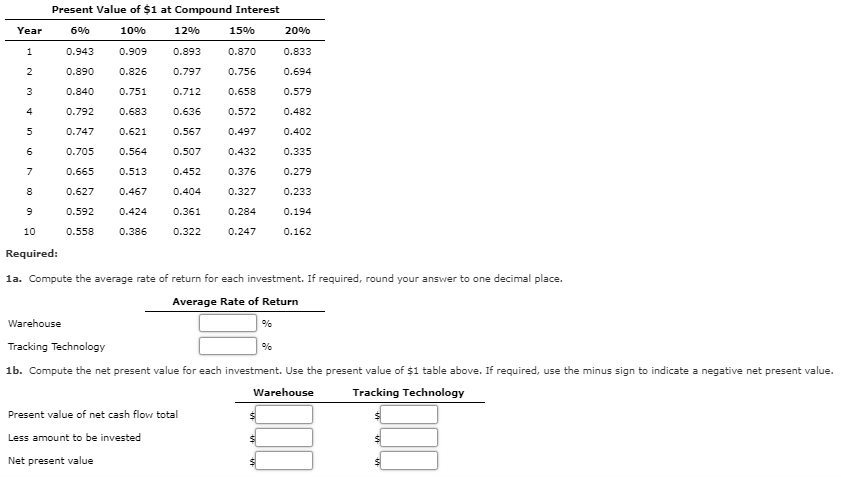

The following date are accumulated by Paxton Company in evaluating the purchase of $126,500 of equipment, having a four year useful life Net Cash Flow Net Income $35.000 Year $60,000 22,00 46,000 .. Year 2 Year 3 11,000 35,000 Year 4 (1.000) 23,000 Present Value $1 at Compound Interest Year 60 10% 12% 15% 20% 0.943 0.909 0.893 0.870 0.833 1 0.826 0.797 0.756 0.890 0.694 0.840 0.751 0.712 0.658 0.579 0.792 0.683 0.636 0.572 0.482 0.747 0.621 0.567 0.497 0.402 0.705 0.564 0.507 0.432 0.335 0.665 0.513 0.452 0.376 0.279 0.627 0.467 0.404 0.327 0.233 0.361 0.592 0.424 28c o 194 0.322 0.162 10 0.558 0.386 0.247 a. Assuming that the desired rate of return is 10 % , determine the net present value for the proposal. Use the table of the present value of $1 presented above. If required, round to t present value. e nearest dollar. If required, use the minuss sign to indicate a negative net Present value of et cash flow Amount to be invastad Net present value Bi-Coastal Railroad Inc. is considering acquiring equipment at a cost of $464,000. The equipment has an estimated life of 10 years and no residual value. It is expected to provide yearly net cash flows of $58,000. The company's minimum desired rate of return for net present value analysis 10% Annuity of $1 at Compound Interest Present Value of 6% 10% 1290 15% 209% Year 0.943 0.905 0.893 0.870 0.833 1.833 1.73e 1.690 1.626 1.528 2.673 2.487 2.402 2.283 2.106 3.465 3.170 3.037 2.855 2.589 4.212 3.791 3.605 3.353 2.991 4.917 4.355 3.785 3.326 4.111 5.582 4,860 4.564 4,160 3.605 6.210 5.335 4.968 4,487 3.837 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Compute the following: a. The average rata off return, assuming the annual earnings are aqual to the nat cash flows less the annual depraciation expanse e the aquipment. If requirad, round your answer to one decimal place. b. The cash payback period. years . The net prerent value. Use the above table of the present value of an annuity f$1. Round to the nearest dollar required, use a minus sign to indicate neqative net present value" for current grading purpose. Present value of annual et cash flowa Less amount to be invested Net present value Internal Rate of Return Method The internal rate of return method is used by King Bros. Construction Co. in analyzing a capital expenditure proposal that involves an investment of $83,200 and annual net cash flows of $20,000 for each of the seven years of its useful life. Present Value of an Annuity of $1 at Compound Interest 10% 12% 15% 20% Year 6% 0.943 0.909 0.893 0.870 0.833 1 1.736 1.626 1.528 2 1.833 1.690 2.673 2.487 2.402 2.283 2.106 3 3.170 4 3.465 3.037 2.855 2.589 3.791 5 4.212 3.605 3.352 2,991 4.917 4.355 3.784 3.326 4.111 4.868 7 5.582 4.564 4.160 3.605 6.210 5.335 4.968 4.487 3.837 6.802 5.759 4.772 5.328 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine a present value factor for an annuity of $1 which can be used in determining the internal rate of return. If required, round your answer to three decimal places. b. Using the factor determined in part (a) and the present value of an annuity of $1 table above, determine the internal rate of return for the proposal. 0/a Average Rate of Return Method, Net Present Value Method, and Analysis The capital investment committee of Ellis Transport and Storage Inc. is considering two investment projects. The estimated income from operations and net cash flows from each investment are as follows: Tracking Technology Warehouse Income from Net Cash Income from Net Cash Year Flow Flow Operations Operations $91,000 1 $43,200 $136,000 $218,000 43.200 136,000 69.000 2 184,000 43.200 35.000 136.000 129,000 43,200 4 136,000 15,000 88,000 43,200 136,000 6,000 61,000 Tatal $216,000 $680,000 $216.000 $680,000 Each project requires an investment of $480,000. Straight-line depreciation will be used, and no residual value is expected. The committee has selected a rate of 12% for purposes of the net present value analysis. Present Value of $1 Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 0.890 0.826 2 0.797 0.756 0.694 0.840 0.712 3 0.751 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 0.747 0.621 0.567 0.497 0.402 0.507 0.335 0.705 0.564 ,432 Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 0.592 0.424 0.361 0.284 0.194 0. 10 0.386 0.322 52 Required: 1a. Compute the average rate of return for each investment. If required, round your answer to one decimal place Average Rate of Return Warehouse Tracking Technology e 1b. Compute the net present value for each investment. Use the present value of $1 table above. If required, use the minus sign to indicate a negative net present value. Tracking Technology Warehouse Present value of net cash flow total be inv Less Net present value