Answered step by step

Verified Expert Solution

Question

1 Approved Answer

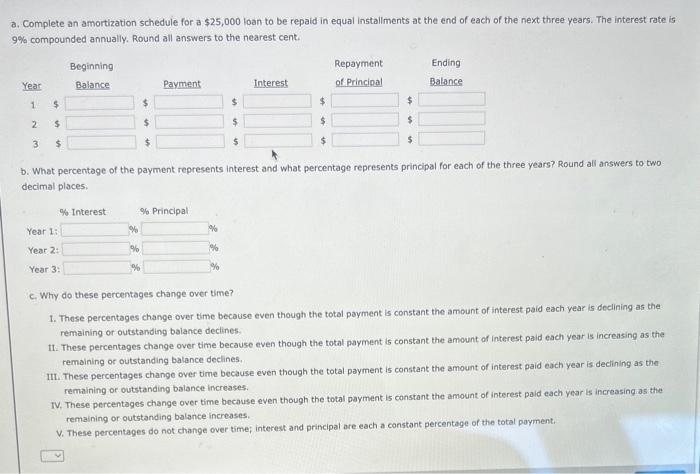

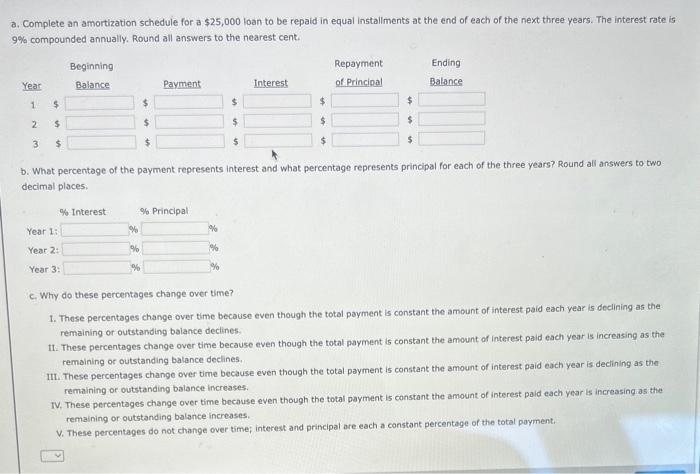

please help! thanks a. Complete an amortization schedule for a $25,000 loan to be repaid in equal instaliments at the end of each of the

please help! thanks

a. Complete an amortization schedule for a $25,000 loan to be repaid in equal instaliments at the end of each of the next three years. The interest rate is 9% compounded annually. Round all answers to the nearest cent. b. What percentage of the payment represents interest and what percentage represents principal for each of the three years? Round all answers to two decimal places, c. Why do these percentages change over time? 1. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the remaining or outstanding balance declines. 11. These percenteges change over time because even though the total payment is constant the amount of interest paid each year is increasing as the remaining or outstanding balance declines. III. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the remaining or outstanding balance increases. IV. These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the remaining or outstanding balance increases. v. These percentages do not change over time; interest and principal are each a constant percentage of the total payment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started