Answered step by step

Verified Expert Solution

Question

1 Approved Answer

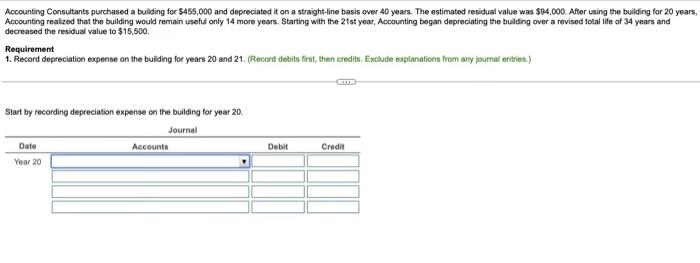

Please help! Thanks! Accounting Consultants purchased a building for $455,000 and depreciated it on a straighstline basis over 40 years. The estimated residual value was

Please help! Thanks!

Accounting Consultants purchased a building for $455,000 and depreciated it on a straighstline basis over 40 years. The estimated residual value was $94,000. After using the building for 20 years Accounting realzed that the building would remain useful only 14 more years. Starting with the 21 st year, Accounting began depreciating the bulling over a revised total life of 34 years and decreased the residual value to $15,500. Requirement 1. Record depreciation expense on the buiding for years 20 and 21 . (Record debits first, then credits. Exclude explarations from any joumal entries.) Start by recording depreciation expense on the builfing for year 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started