Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help! thanks! all the info is here please help thank you! Rex loves to work with his hands and is very good at making

Please help!

thanks!

all the info is here please help thank you!

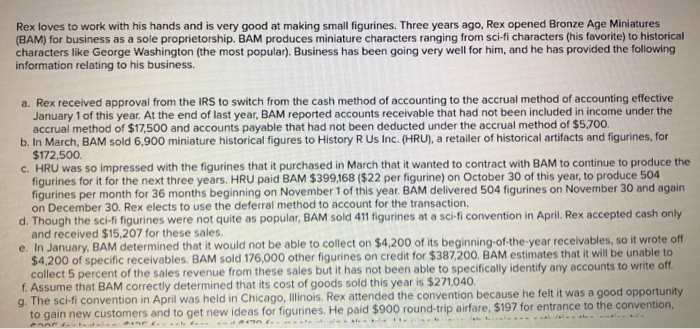

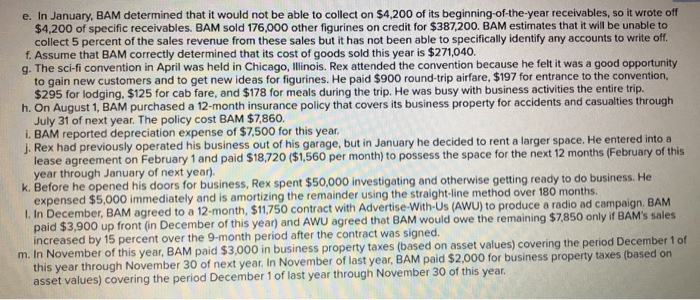

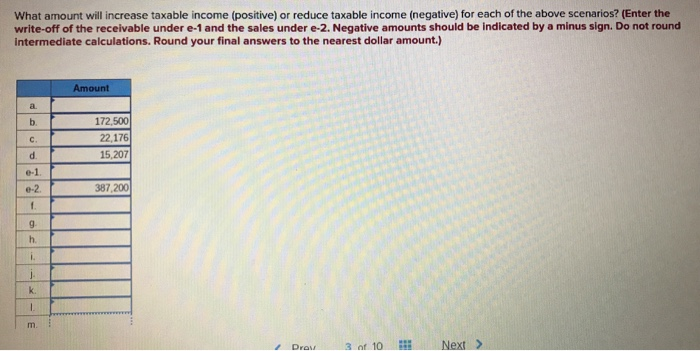

Rex loves to work with his hands and is very good at making small figurines. Three years ago, Rex opened Bronze Age Miniatures (BAM) for business as a sole proprietorship. BAM produces miniature characters ranging from sci-fi characters (his favorite) to historical characters like George Washington (the most popular), Business has been going very well for him, and he has provided the following information relating to his business a. Rex received approval from the IRS to switch from the cash method of accounting to the accrual method of accounting effective January 1 of this year. At the end of last year, BAM reported accounts receivable that had not been included in income under the accrual method of $17,500 and accounts payable that had not been deducted under the accrual method of $5,700. b. In March, BAM sold 6,900 miniature historical figures to History R Us Inc. (HRU), a retailer of historical artifacts and figurines, for $172,500. C. HRU was so impressed with the figurines that it purchased in March that it wanted to contract with BAM to continue to produce the figurines for it for the next three years. HRU paid BAM $399,168 ($22 per figurine) on October 30 of this year, to produce 504 figurines per month for 36 months beginning on November 1 of this year. BAM delivered 504 figurines on November 30 and again on December 30. Rex elects to use the deferral method to account for the transaction d. Though the sci-fi figurines were not quite as popular, BAM sold 411 figurines at a sci-fi convention in April. Rex accepted cash only and received $15,207 for these sales. e. In January, BAM determined that it would not be able to collect on $4,200 of its beginning-of-the-year receivables, so it wrote off $4,200 of specific receivables. BAM sold 176,000 other figurines on credit for $387,200. BAM estimates that it will be unable to collect 5 percent of the sales revenue from these sales but it has not been able to specifically identify any accounts to write off. f. Assume that BAM correctly determined that its cost of goods sold this year is $271,040. g. The sci-fi convention in April was held in Chicago, Illinois. Rex attended the convention because he felt it was a good opportunity to gain new customers and to get new ideas for figurines. He paid $900 round-trip airfare. $197 for entrance to the convention, What amount will increase taxable income (positive) or reduce taxable income (negative) for each of the above scenarios? (Enter the write-off of the receivable under e-1 and the sales under e-2. Negative amounts should be indicated by a minus sign. Do not round Intermediate calculations. Round your final answers to the nearest dollar amount.) Amount 172,500 22,176 15,207 387,200 Prov 30 10 # Next > Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started