Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help.. thanks Background: IRC Section 162(m) which deals with executive compensation deduction limits was first passed in 1994 and then amended by the Tax

please help.. thanks

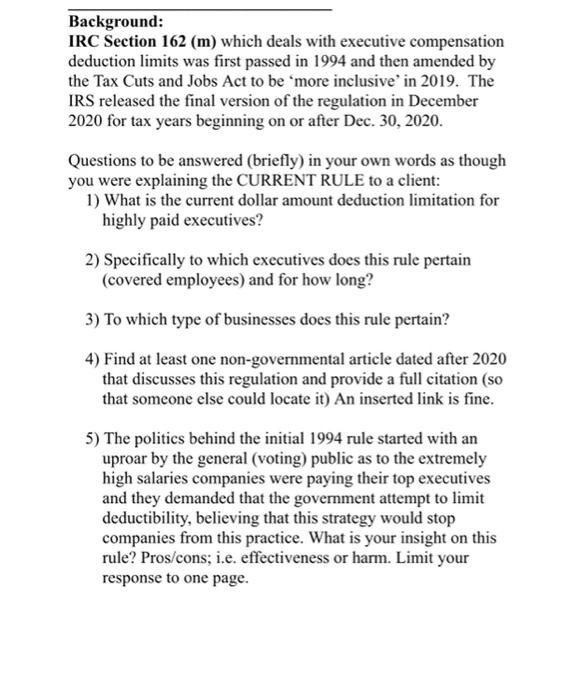

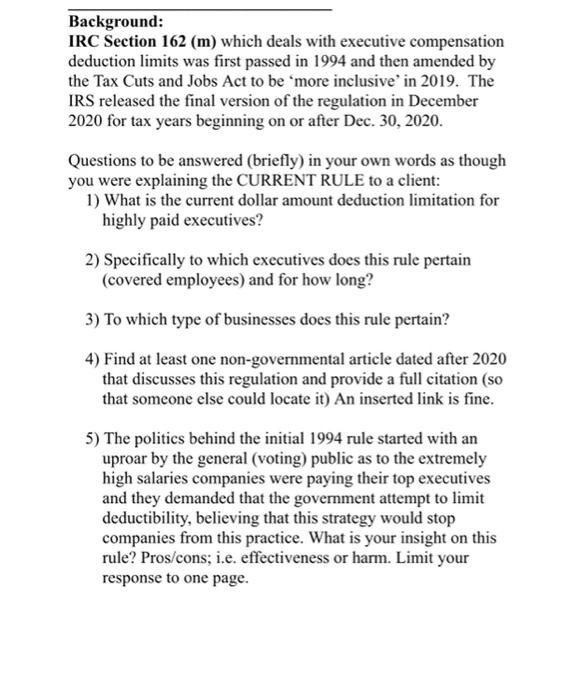

Background: IRC Section 162(m) which deals with executive compensation deduction limits was first passed in 1994 and then amended by the Tax Cuts and Jobs Act to be 'more inclusive' in 2019. The IRS released the final version of the regulation in December 2020 for tax years beginning on or after Dec. 30,2020. Questions to be answered (briefly) in your own words as though you were explaining the CURRENT RULE to a client: 1) What is the current dollar amount deduction limitation for highly paid executives? 2) Specifically to which executives does this rule pertain (covered employees) and for how long? 3) To which type of businesses does this rule pertain? 4) Find at least one non-governmental article dated after 2020 that discusses this regulation and provide a full citation (so that someone else could locate it) An inserted link is fine. 5) The politics behind the initial 1994 rule started with an uproar by the general (voting) public as to the extremely high salaries companies were paying their top executives and they demanded that the government attempt to limit deductibility, believing that this strategy would stop companies from this practice. What is your insight on this rule? Pros/cons; i.e. effectiveness or harm. Limit your response to one page

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started