Answered step by step

Verified Expert Solution

Question

1 Approved Answer

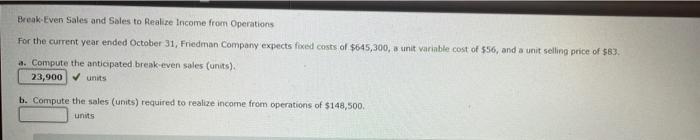

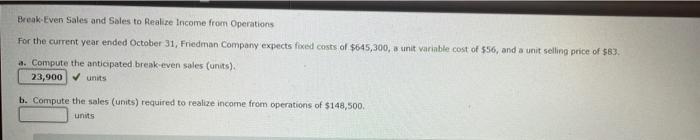

please help thanks Break Even Sales and Sales to Realize Income from Operations For the current year ended October 31, Friedman Company expects foed costs

please help

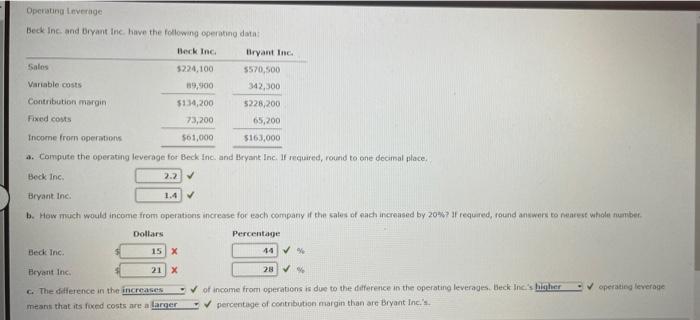

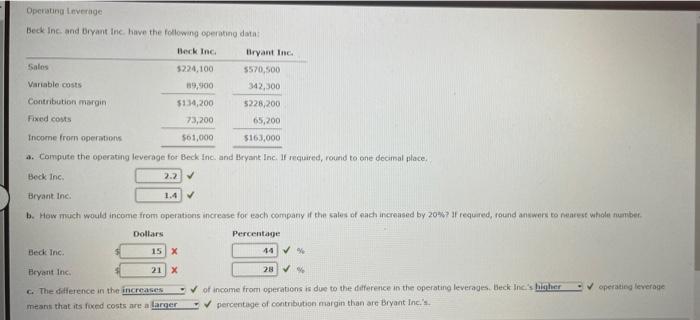

Break Even Sales and Sales to Realize Income from Operations For the current year ended October 31, Friedman Company expects foed costs of $645,300, a unit variable cost of $56, and a unit selling price of 58). a. Compute the anticipated break even sales (units). 23,900 units b. Compute the sales (units) required to realize income from operations of $148,500 units Operating Leverage Beck Inc. and Bryant Inc. have the following operating data Beck Inc Bryant Inc. Sales 5224,100 5570,500 Variable costs 89,900 342,300 Contribution margin $14,200 5228,200 Fixed costs 73,200 65,200 Income from operations 501,000 5163.000 a. Compute the operating leverage for Beck Inc. and Bryant Inc. If required, round to one decimal place Beck Inc. 2.2 Bryant Inc. 1.4 b. How much would income from operations increase for each company of the sales of each increased by 20? required, round answers to nearest whole number Dollars Percentage Beck Inc. 15 X 44 Bryant Inc. 21 X 28 operating leverage The difference in the increases means that its fixed costs are a larger of income from operations is due to the difference in the operating leverages Beck Inc.'s higher percentage of contribution margin than are Bryant Inc.'s thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started