Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help thanks! During 2021, Ming's Book Store paid $485,000 for land and built a store in Georgetown, Washington D.C. Prior to construction, the city

Please help thanks!

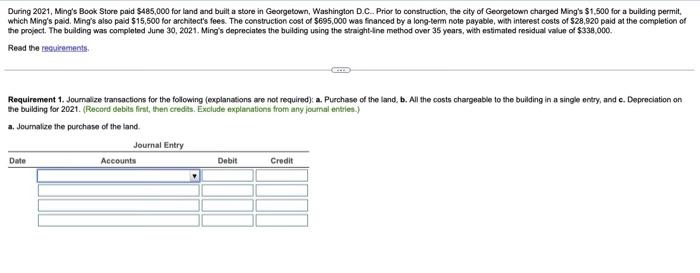

During 2021, Ming's Book Store paid \$485,000 for land and built a store in Georgetown, Washington D.C. Prior to construction, the city of Georgetown charged Ming's \$1,500 for a building permit, which Ming's paid. Ming's also paid $15,500 for archiect's fees. The construction cost of $695,000 was tinanced by a long-term note payable, with interest costs of $28,920 paid at the completion of the project. The building was completed June 30, 2021. Ming's depreciates the building using the straight-Ine method over 35 years, with estimated residuall value of $338,000. Read the recuirements. Requirement 1. Joumalize transactions for the folowing (explanations are not required): a. Purchase of the land, b. All the costs chargeable to the building in a single entry, and c. Depreciation on the building for 2021. (Record debits first, then credits. Exclude explanations from any journal entries.) a. Joumalize the purchase of the land

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started