Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help thanks, i have 30 mins Plug Products owns 80 percent of the stock of Spark Filter Company, which it acquired at underlying book

please help thanks, i have 30 mins

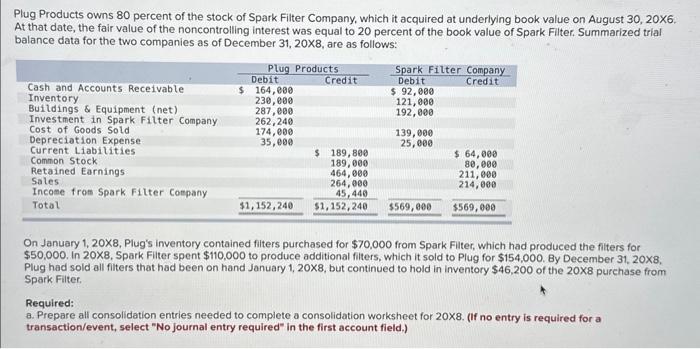

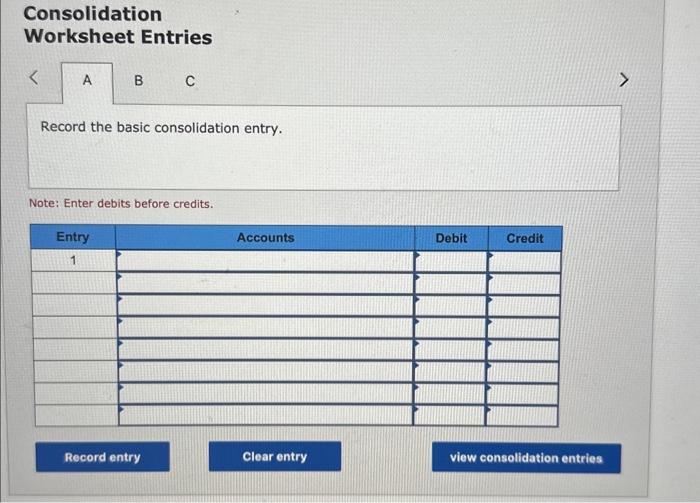

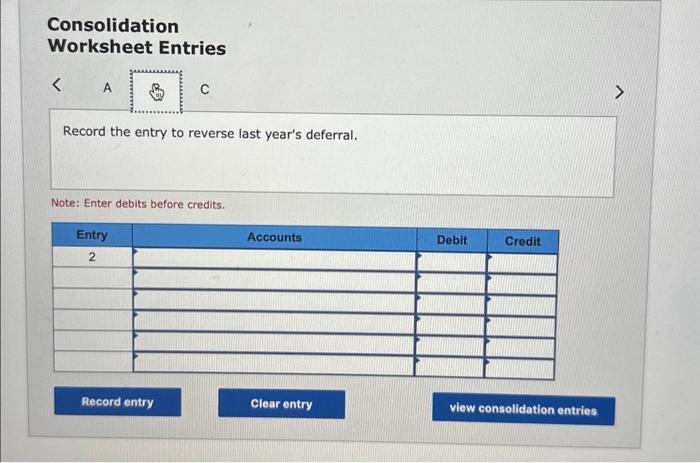

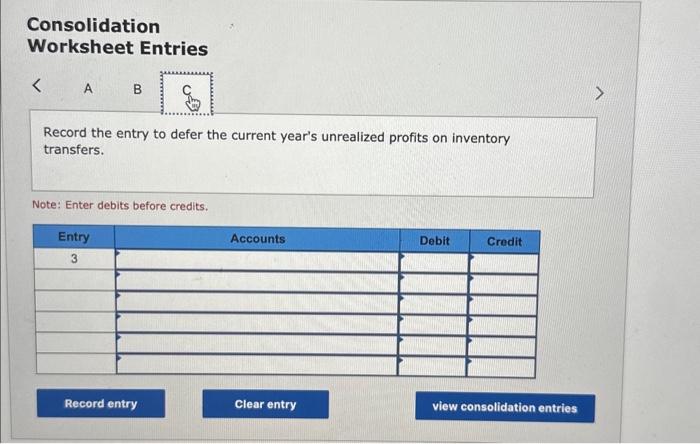

Plug Products owns 80 percent of the stock of Spark Filter Company, which it acquired at underlying book value on August 30,206. At that date, the fair value of the noncontrolling interest was equal to 20 percent of the book value of Spark Filter. Summarized trial balance data for the two companies as of December 31,208, are as follows: On January 1, 20X8, Plug's inventory contained filters purchased for $70,000 from Spark Filter, which had produced the fiters for $50,000. In 208, Spark Filter spent $110,000 to produce additional fiters, which it sold to Plug for $154,000.8y December 31,208, Plug had sold all filters that had been on hand January 1,208, but continued to hold in inventory $46,200 of the 208 purchase from Spark Fiter. Required: a. Prepare all consolidation entries needed to complete a consolidation worksheet for 208. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Consolidation Worksheet Entries Record the basic consolidation entry. Note: Enter debits before credits. Consolidation Worksheet Entries Record the entry to reverse last year's deferral. Note: Enter debits before credits. Consolidation Worksheet Entries Record the entry to defer the current year's unrealized profits on inventory transfers. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started