Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP THANKS IN ADVANCE!!! #1. Maria Gonzalez is the chief financial officer of Ganado. She has just concluded negotiations for the sale of a

PLEASE HELP THANKS IN ADVANCE!!!

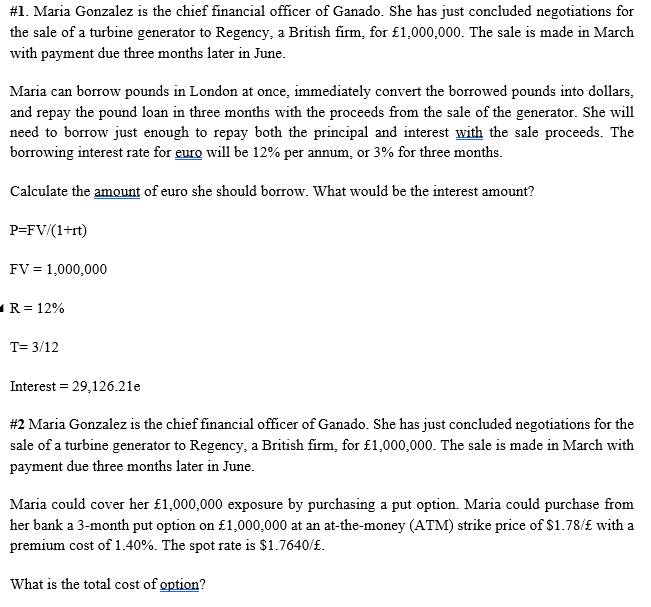

\#1. Maria Gonzalez is the chief financial officer of Ganado. She has just concluded negotiations for the sale of a turbine generator to Regency, a British firm, for 1,000,000. The sale is made in March with payment due three months later in June. Maria can borrow pounds in London at once, immediately convert the borrowed pounds into dollars, and repay the pound loan in three months with the proceeds from the sale of the generator. She will need to borrow just enough to repay both the principal and interest with the sale proceeds. The borrowing interest rate for euro will be 12% per annum, or 3% for three months. Calculate the amount of euro she should borrow. What would be the interest amount? P=FV/(1+rt) FV=1,000,000 R=12% T=3/12 Interest =29,126.21e \#2 Maria Gonzalez is the chief financial officer of Ganado. She has just concluded negotiations for the sale of a turbine generator to Regency, a British firm, for 1,000,000. The sale is made in March with payment due three months later in June. Maria could cover her 1,000,000 exposure by purchasing a put option. Maria could purchase from her bank a 3-month put option on 1,000,000 at an at-the-money (ATM) strike price of $1.78/ with a premium cost of 1.40%. The spot rate is $1.7640/E. What is the total cost of option

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started