Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP THANKS IN ADVANCE !!!! #3 Assume that the export price of a Toyota Corolla from Osaka, Japan is 2,100,000. The exchange rate is

PLEASE HELP THANKS IN ADVANCE !!!!

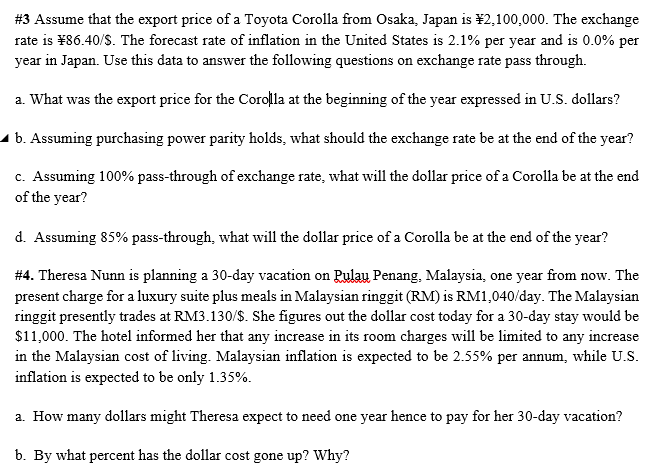

\#3 Assume that the export price of a Toyota Corolla from Osaka, Japan is 2,100,000. The exchange rate is 876.40/S. The forecast rate of inflation in the United States is 2.1% per year and is 0.0% per year in Japan. Use this data to answer the following questions on exchange rate pass through. a. What was the export price for the Corolla at the beginning of the year expressed in U.S. dollars? b. Assuming purchasing power parity holds, what should the exchange rate be at the end of the year? c. Assuming 100% pass-through of exchange rate, what will the dollar price of a Corolla be at the end of the year? d. Assuming 85% pass-through, what will the dollar price of a Corolla be at the end of the year? \#4. Theresa Nunn is planning a 30-day vacation on Pulau Penang, Malaysia, one year from now. The present charge for a luxury suite plus meals in Malaysian ringgit (RM) is RM1,040/day. The Malaysian ringgit presently trades at RM3.130/\$. She figures out the dollar cost today for a 30-day stay would be $11,000. The hotel informed her that any increase in its room charges will be limited to any increase in the Malaysian cost of living. Malaysian inflation is expected to be 2.55% per annum, while U.S. inflation is expected to be only 1.35%. a. How many dollars might Theresa expect to need one year hence to pay for her 30 -day vacation? b. By what percent has the dollar cost gone up? Why

\#3 Assume that the export price of a Toyota Corolla from Osaka, Japan is 2,100,000. The exchange rate is 876.40/S. The forecast rate of inflation in the United States is 2.1% per year and is 0.0% per year in Japan. Use this data to answer the following questions on exchange rate pass through. a. What was the export price for the Corolla at the beginning of the year expressed in U.S. dollars? b. Assuming purchasing power parity holds, what should the exchange rate be at the end of the year? c. Assuming 100% pass-through of exchange rate, what will the dollar price of a Corolla be at the end of the year? d. Assuming 85% pass-through, what will the dollar price of a Corolla be at the end of the year? \#4. Theresa Nunn is planning a 30-day vacation on Pulau Penang, Malaysia, one year from now. The present charge for a luxury suite plus meals in Malaysian ringgit (RM) is RM1,040/day. The Malaysian ringgit presently trades at RM3.130/\$. She figures out the dollar cost today for a 30-day stay would be $11,000. The hotel informed her that any increase in its room charges will be limited to any increase in the Malaysian cost of living. Malaysian inflation is expected to be 2.55% per annum, while U.S. inflation is expected to be only 1.35%. a. How many dollars might Theresa expect to need one year hence to pay for her 30 -day vacation? b. By what percent has the dollar cost gone up? Why Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started