Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP! thanks please help. 1) Introduce balance sheet. Why assets must be equal to liabilities and equity? Discuss. 2) Discuss how a firm can

PLEASE HELP! thanks

please help.

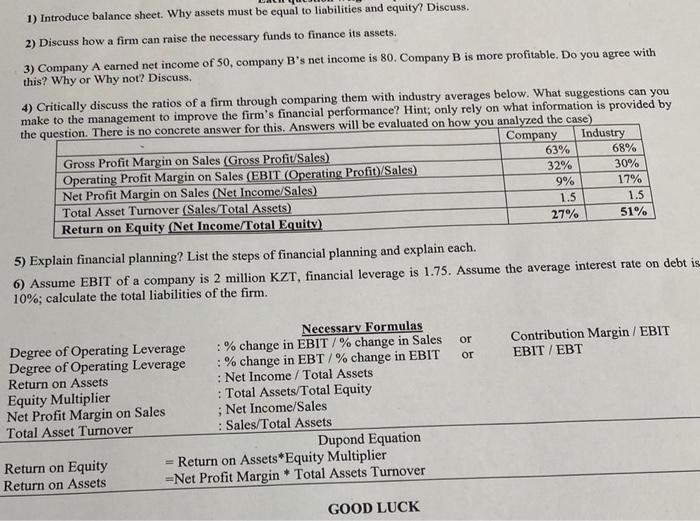

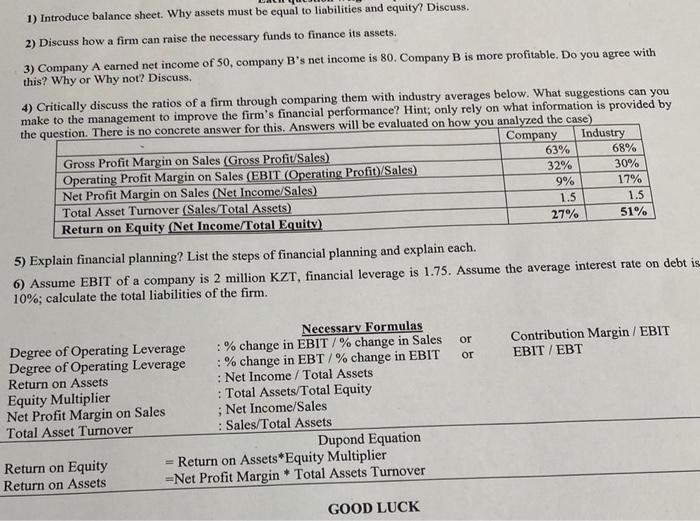

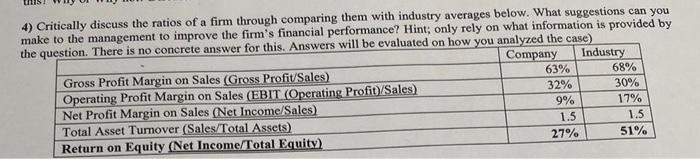

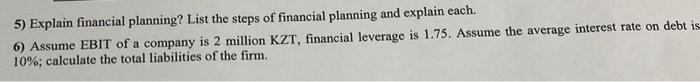

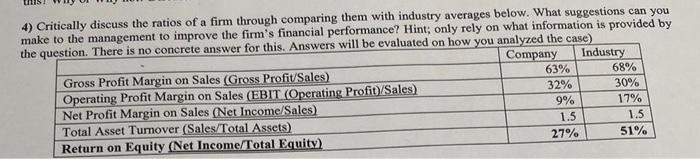

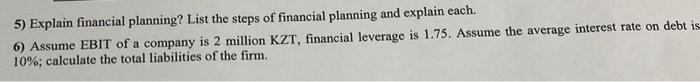

1) Introduce balance sheet. Why assets must be equal to liabilities and equity? Discuss. 2) Discuss how a firm can raise the necessary funds to finance its assets. 3) Company A carned net income of 50, company B's net income is 80. Company B is more profitable. Do you agree with this? Why or Why not? Discuss. 4) Critically discuss the ratios of a firm through comparing them with industry averages below. What suggestions can you make to the management to improve the firm's financial performance? Hint; only rely on what information is provided by the question. There is no concrete answer for this. Answers will be evaluated on how you analyzed the case) Company Industry Gross Profit Margin on Sales (Gross Profit Sales) 63% 68% Operating Profit Margin on Sales (EBIT (Operating Profit/Sales) 32% 30% Net Profit Margin on Sales (Net Income/Sales) 9% 17% Total Asset Turnover (Sales/Total Assets 1.5 1.5 Return on Equity (Net Income/Total Equity) 27% 51% 5) Explain financial planning? List the steps of financial planning and explain each. 6) Assume EBIT of a company is 2 million KZT, financial leverage is 1.75. Assume the average interest rate on debt is 10%; calculate the total liabilities of the firm. or or Contribution Margin/EBIT EBIT/EBT Necessary Formulas Degree of Operating Leverage : % change in EBIT/% change in Sales Degree of Operating Leverage : % change in EBT/% change in EBIT Return on Assets : Net Income / Total Assets Equity Multiplier : Total Assets/Total Equity Net Profit Margin on Sales ; Net Income/Sales Total Asset Turnover : Sales/Total Assets Dupond Equation Return on Equity Return on Assets Equity Multiplier Return on Assets =Net Profit Margin. Total Assets Turnover GOOD LUCK 4) Critically discuss the ratios of a firm through comparing them with industry averages below. What suggestions can you make to the management to improve the firm's financial performance? Hint; only rely on what information is provided by the question. There is no concrete answer for this. Answers will be evaluated on how you analyzed the case) Company Industry Gross Profit Margin on Sales (Gross Profit/Sales) 63% 68% Operating Profit Margin on Sales (EBIT (Operating Profit/Sales) 32% 30% Net Profit Margin on Sales (Net Income/Sales) 9% 17% Total Asset Turnover (Sales/Total Assets) 1.5 27% 51% Return on Equity (Net Income/Total Equity) 1.5 5) Explain financial planning? List the steps of financial planning and explain each. 6) Assume EBIT of a company is 2 million KZT, financial leverage is 1.75. Assume the average interest rate on debt is 10%; calculate the total liabilities of the firm. 1) Introduce balance sheet. Why assets must be equal to liabilities and equity? Discuss. 2) Discuss how a firm can raise the necessary funds to finance its assets. 3) Company A carned net income of 50, company B's net income is 80. Company B is more profitable. Do you agree with this? Why or Why not? Discuss. 4) Critically discuss the ratios of a firm through comparing them with industry averages below. What suggestions can you make to the management to improve the firm's financial performance? Hint; only rely on what information is provided by the question. There is no concrete answer for this. Answers will be evaluated on how you analyzed the case) Company Industry Gross Profit Margin on Sales (Gross Profit Sales) 63% 68% Operating Profit Margin on Sales (EBIT (Operating Profit/Sales) 32% 30% Net Profit Margin on Sales (Net Income/Sales) 9% 17% Total Asset Turnover (Sales/Total Assets 1.5 1.5 Return on Equity (Net Income/Total Equity) 27% 51% 5) Explain financial planning? List the steps of financial planning and explain each. 6) Assume EBIT of a company is 2 million KZT, financial leverage is 1.75. Assume the average interest rate on debt is 10%; calculate the total liabilities of the firm. or or Contribution Margin/EBIT EBIT/EBT Necessary Formulas Degree of Operating Leverage : % change in EBIT/% change in Sales Degree of Operating Leverage : % change in EBT/% change in EBIT Return on Assets : Net Income / Total Assets Equity Multiplier : Total Assets/Total Equity Net Profit Margin on Sales ; Net Income/Sales Total Asset Turnover : Sales/Total Assets Dupond Equation Return on Equity Return on Assets Equity Multiplier Return on Assets =Net Profit Margin. Total Assets Turnover GOOD LUCK 4) Critically discuss the ratios of a firm through comparing them with industry averages below. What suggestions can you make to the management to improve the firm's financial performance? Hint; only rely on what information is provided by the question. There is no concrete answer for this. Answers will be evaluated on how you analyzed the case) Company Industry Gross Profit Margin on Sales (Gross Profit/Sales) 63% 68% Operating Profit Margin on Sales (EBIT (Operating Profit/Sales) 32% 30% Net Profit Margin on Sales (Net Income/Sales) 9% 17% Total Asset Turnover (Sales/Total Assets) 1.5 27% 51% Return on Equity (Net Income/Total Equity) 1.5 5) Explain financial planning? List the steps of financial planning and explain each. 6) Assume EBIT of a company is 2 million KZT, financial leverage is 1.75. Assume the average interest rate on debt is 10%; calculate the total liabilities of the firm

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started