Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help :) The common stock of Triangular File Company is selling at $90. A 26-week call option written on Triangular File's stock is selling

Please help :)

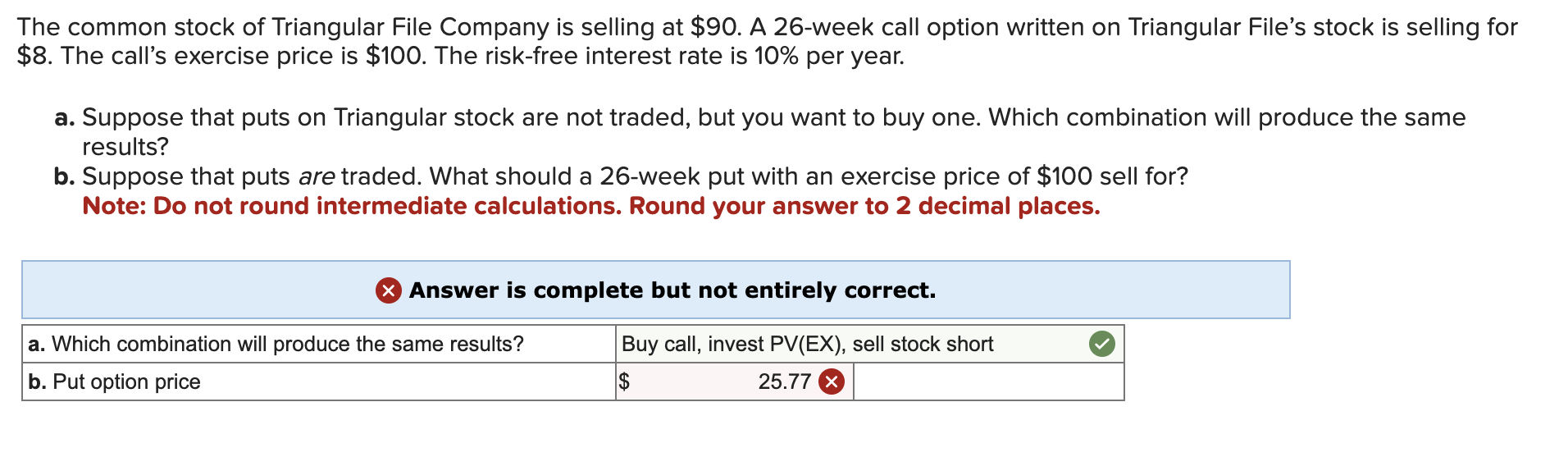

The common stock of Triangular File Company is selling at $90. A 26-week call option written on Triangular File's stock is selling for $8. The call's exercise price is $100. The risk-free interest rate is 10% per year. a. Suppose that puts on Triangular stock are not traded, but you want to buy one. Which combination will produce the same results? b. Suppose that puts are traded. What should a 26 -week put with an exercise price of $100 sell for? Note: Do not round intermediate calculations. Round your answer to 2 decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started