Please help

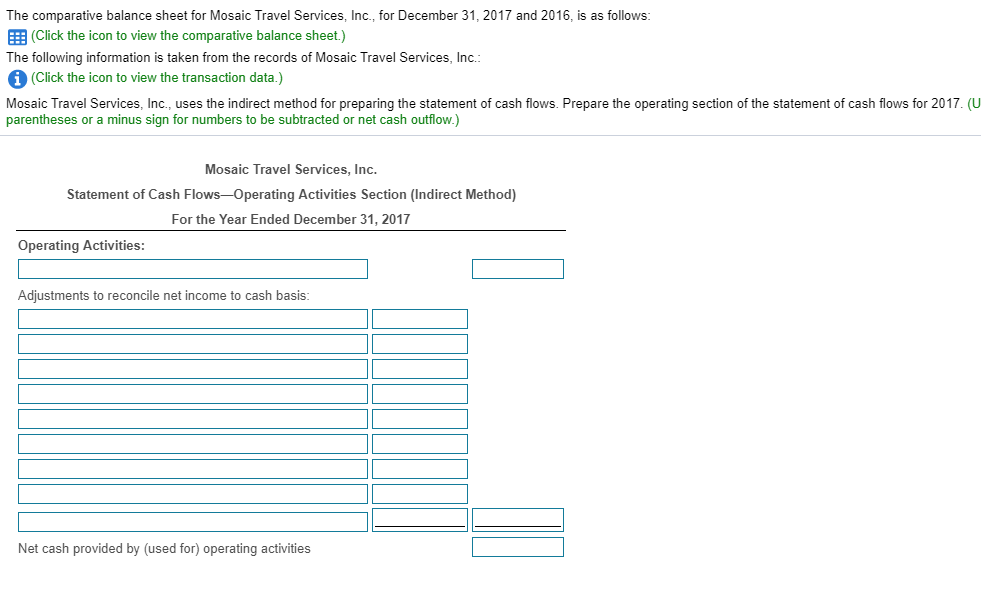

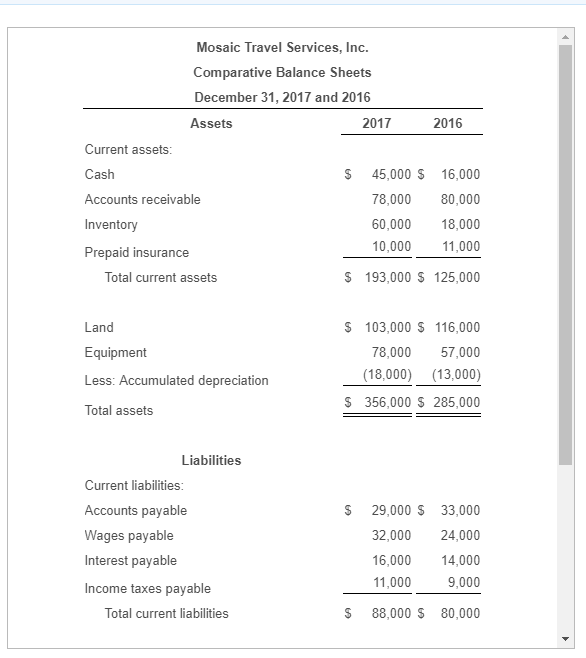

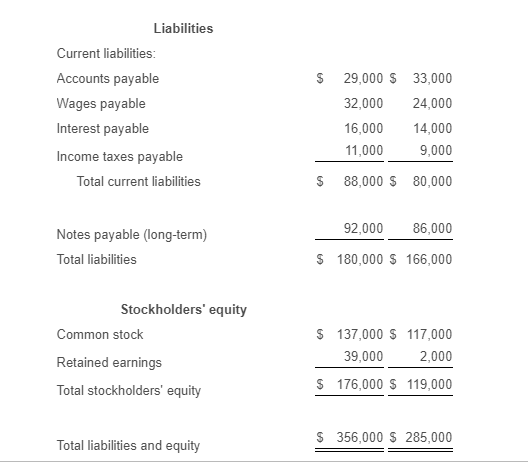

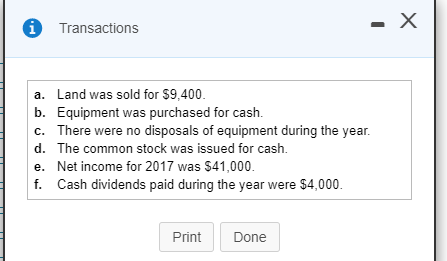

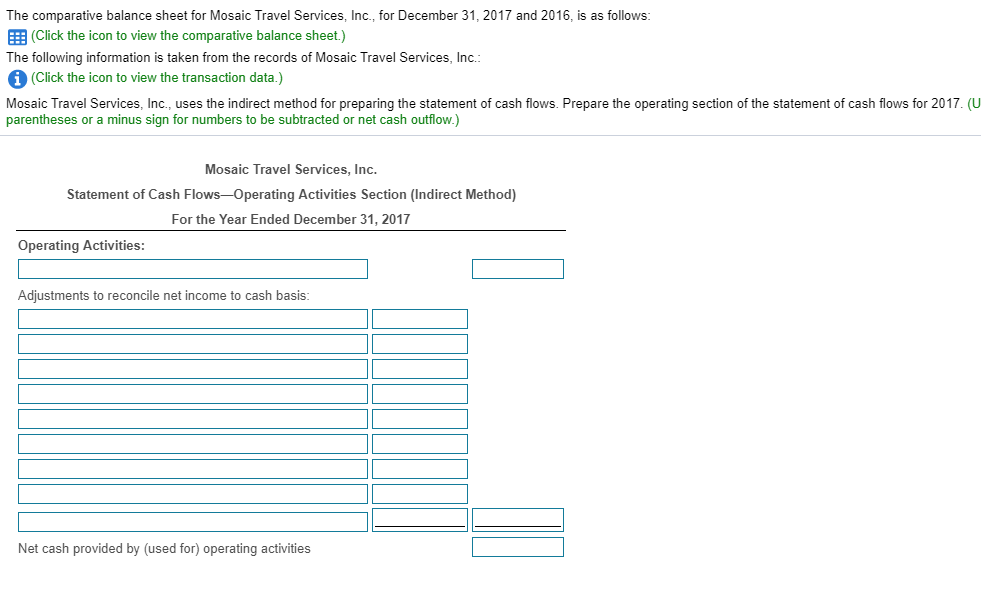

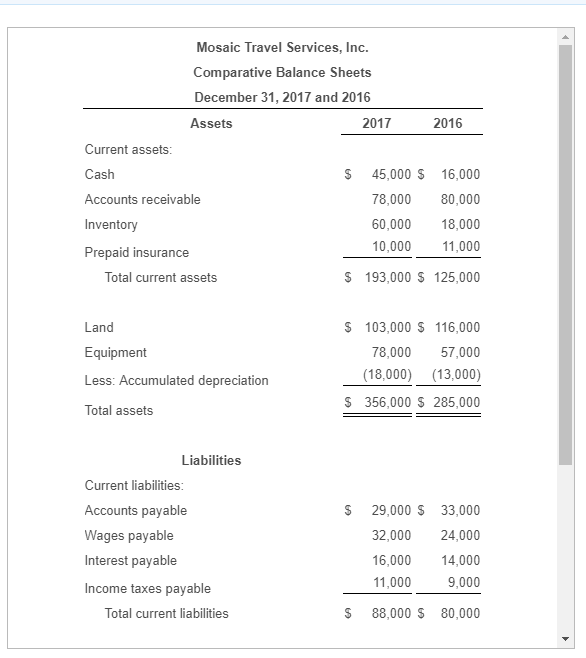

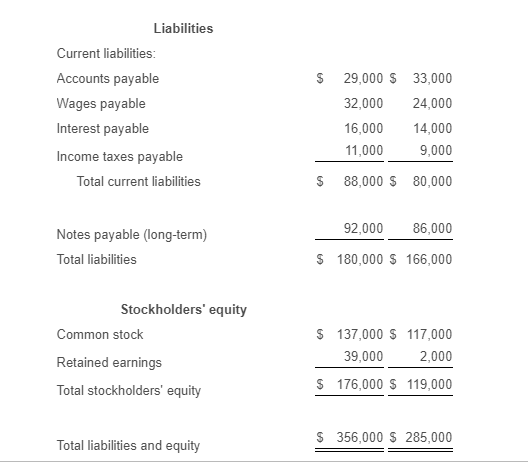

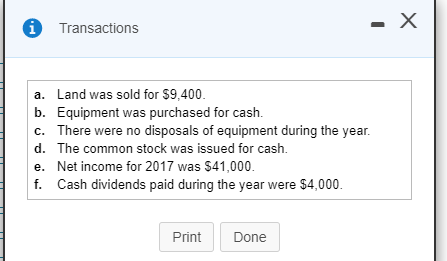

The comparative balance sheet for Mosaic Travel Services, Inc., for December 31, 2017 and 2016, is as follows: (Click the icon to view the comparative balance sheet.) The following information is taken from the records of Mosaic Travel Services, Inc.: (Click the icon to view the transaction data.) Mosaic Travel Services, Inc., uses the indirect method for preparing the statement of cash flows. Prepare the operating section of the statement of cash flows for 2017. (U parentheses or a minus sign for numbers to be subtracted or net cash outflow.) Mosaic Travel Services, Inc. Statement of Cash Flows-Operating Activities Section (Indirect Method) For the Year Ended December 31, 2017 Operating Activities: Adjustments to reconcile net income to cash basis: Net cash provided by (used for) operating activities Mosaic Travel Services, Inc. Comparative Balance Sheets December 31, 2017 and 2016 Assets 2017 2016 Current assets: Cash 45,000 $ 16,000 Accounts receivable 78,000 80,000 Inventory 60,000 18,000 10,000 11,000 Prepaid insurance Total current assets $ 193,000 $ 125,000 Land Equipment $ 103,000 $ 116,000 78,000 57,000 (18,000) (13,000) $ 356,000 $ 285,000 Less: Accumulated depreciation Total assets Liabilities $ Current liabilities: Accounts payable Wages payable Interest payable 29,000 $ 32,000 16,000 11,000 33,000 24,000 14,000 9,000 Income taxes payable Total current liabilities $ 88,000 $ 80,000 Liabilities Current liabilities: Accounts payable Wages payable Interest payable $ 29,000 $ 33,000 32,000 24,000 16,000 14,000 11,000 9,000 Income taxes payable Total current liabilities $ 88,000 $ 80,000 Notes payable (long-term) 92,000 86,000 Total liabilities $ 180,000 $ 166,000 $ Stockholders' equity Common stock Retained earnings Total stockholders' equity 137,000 $ 117,000 39,000 2,000 $ 176,000 $ 119,000 $ 356,000 $ 285,000 Total liabilities and equity Transactions a. Land was sold for $9.400. b. Equipment was purchased for cash. c. There were no disposals of equipment during the year d. The common stock was issued for cash. e. Net income for 2017 was $41,000. f. Cash dividends paid during the year were $4,000. Print Done