Question

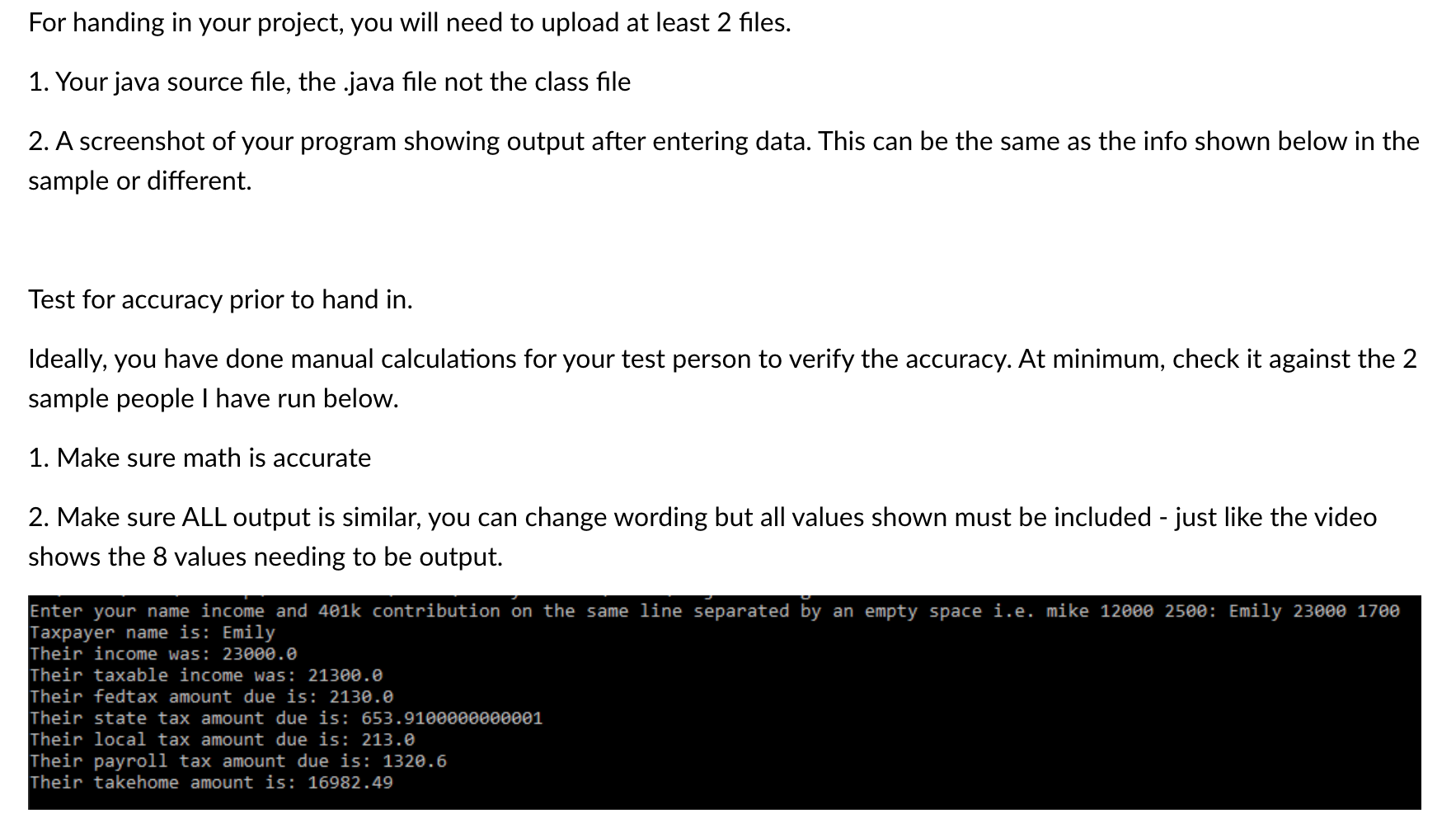

please help, the first is our teacher given to us, and it should become the last part in the picture. THANK YOU!! import java.util.Scanner; //

please help, the first is our teacher given to us, and it should become the last part in the picture. THANK YOU!!

import java.util.Scanner; // import the Scanner class to gain access to make our Scanner object

public class Assignment1 { public static void main(String[] args) { Scanner keyboard = new Scanner(System.in); // keyboard is now how we will prompt for input String userName; double income,taxable,retire,ftax,stax,ltax,ptax,takehome; // these are the variables you will need to set or calculate // name income 401k //calc taxable (income -retire) //calc 10% fedtax, 3.07% statetax, 1%localtax, 6.2% payroll tax //calc takehome (taxable - all the taxes) // Enter username and press Enter System.out.print("Enter your name income and 401k contribution on the same line separated by an empty space i.e. mike 12000 2500: "); } }

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started