Answered step by step

Verified Expert Solution

Question

1 Approved Answer

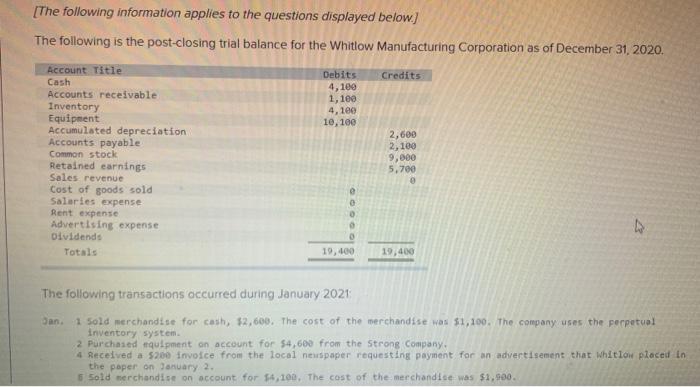

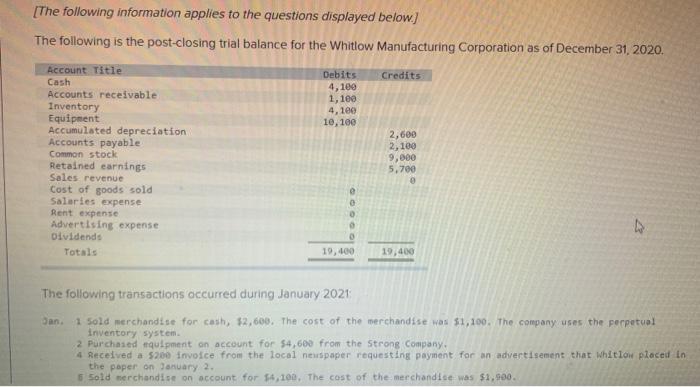

please help [The following information applies to the questions displayed below] The following is the post-closing trial balance for the Whitlow Manufacturing Corporation as of

please help

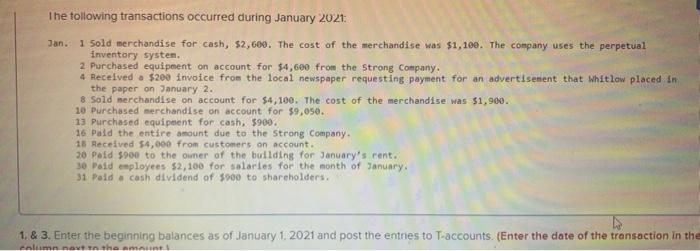

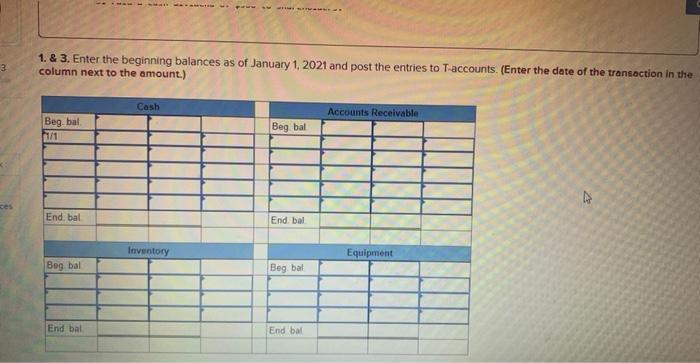

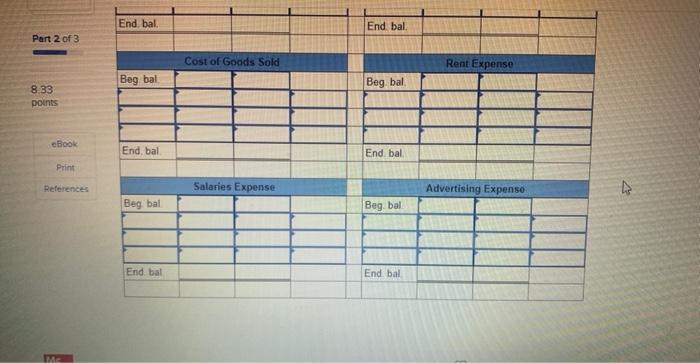

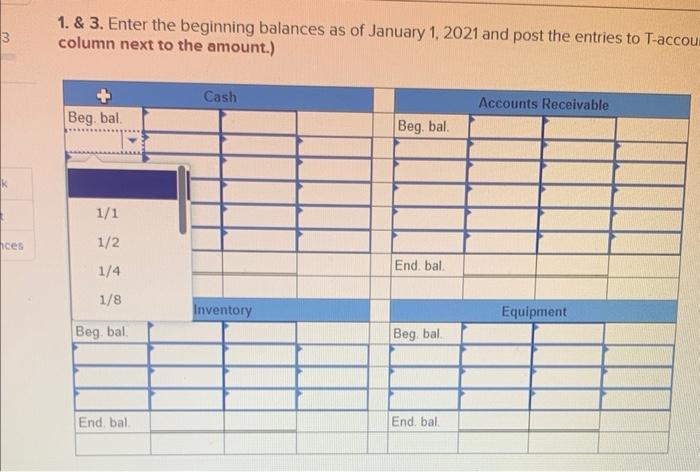

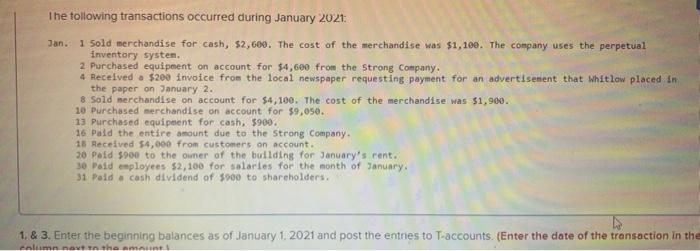

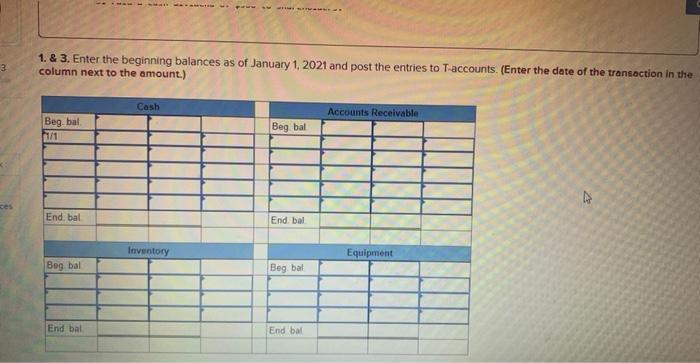

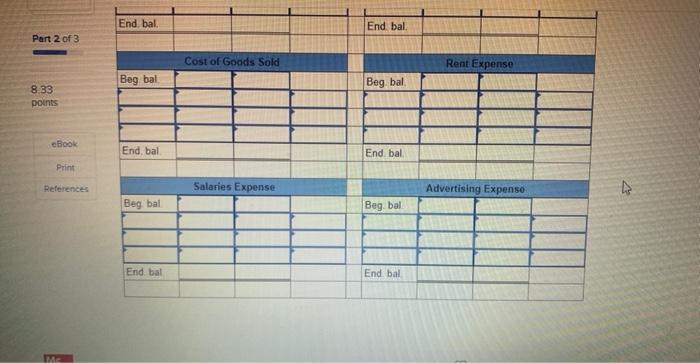

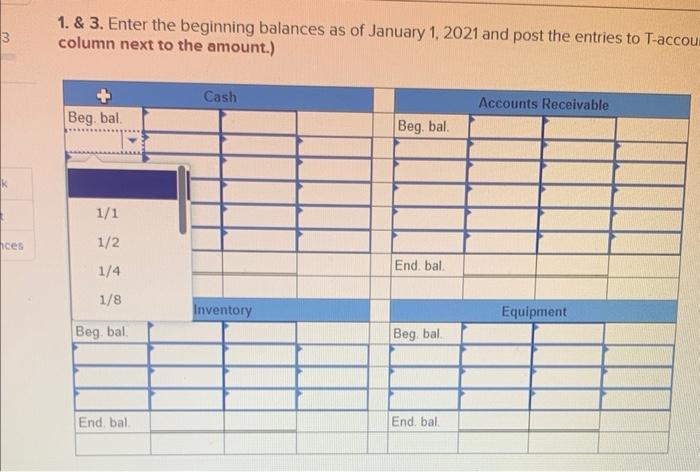

[The following information applies to the questions displayed below] The following is the post-closing trial balance for the Whitlow Manufacturing Corporation as of December 31,2020. The following transactions occurred during January 2021 Jan. 1 Sold merchandise for cash, 32,600. The cost of the merchandise was 81,100 . The company uses the pecpetual inventory system. 2 Purchased fquipment on account for $4,600 from the Strong Company. 4 Recelved a s200 involce from the local newspaper request ing payment for an advertisement that whitlow ploced in the poper on Jenuary 2 . 5. Sold merchendine on account for 94 , 10e, The cost of the merchandlse was $1,900. I he tollowing transactions occurred during January 2021 : Jan. 1 sold nerchandise for cash, $2,600. The cost of the merchandise was $1,100. The conpany uses the perpetual inventory systen. 2 Purchased equipoent on account for $4,600 from the strong Company. 4 Aecelved a $200 invoice froe the 10ca1 newspaper requesting payment for an advertisenent that Whitlow placed in the poper on January 2. 8 Sold nerchandise on account for $4,100. The cost of the merchandise was $1,960. 10 Purchased merchandise on account for 39,050 . 13. Purchased equipant for cash, $900. 16. Pald the entire asount due to the strong Company. 15 Received $4,600 from customers on account. 20 Deld $900 to the ouner of the building for January's rent. 30 . Paid epployees $2,100 for salaries for the month of yanuary. 31 pold a cash dividend of 1500 to shareholders. 1. \& 3. Enter the beginning balances as of January 1, 2021 and post the entries to T-accounts. (Enter the date of the transaction in thi 1. \& 3. Enter the beginning balances as of January 1, 2021 and post the entries to T-accounts. (Enter the date of the transaction in the column next to the amount.) \begin{tabular}{|l|l|l|l|l|l|l|} \hline Beg. bal. & & & & & & Beg. bal. \end{tabular} Part 2 of 3 \begin{tabular}{|l|l|l|l|l|l|l|} \hline End bal. & & & & & & \\ \hline & & & & End bal. & & \\ \hline \end{tabular} 8.33 polnts 1. \& 3. Enter the beginning balances as of January 1, 2021 and post the entries to T-accou column next to the amount.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started