Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP!!! [The following information applies to the questions displayed below.) Raner, Harris and Chan is a consulting firm that specializes in information systems for

PLEASE HELP!!!

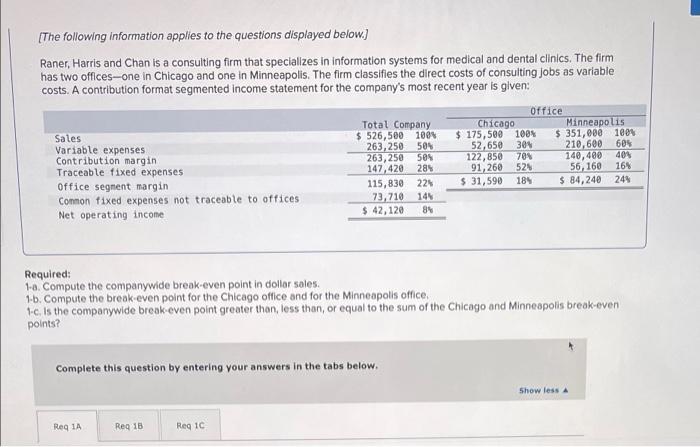

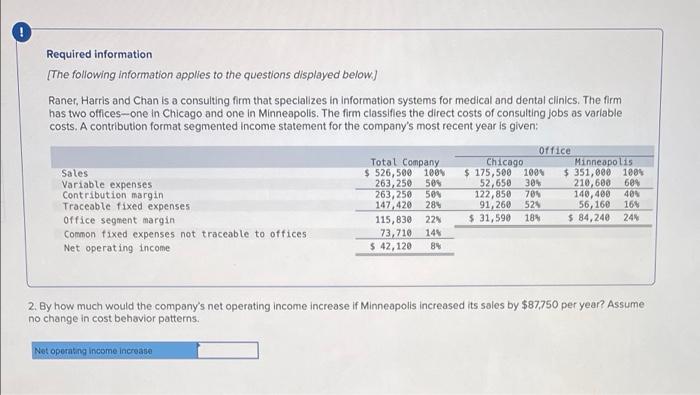

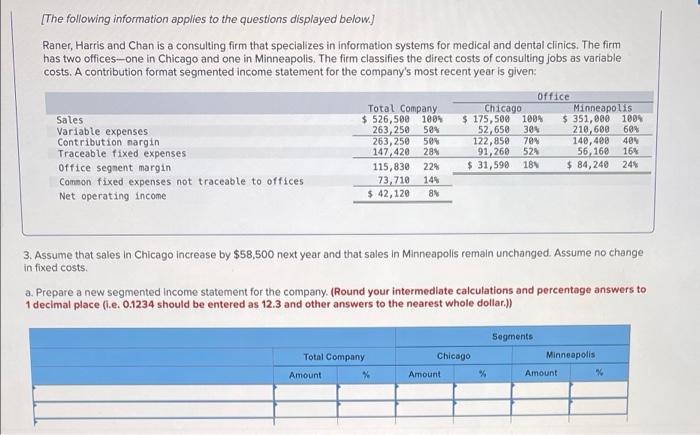

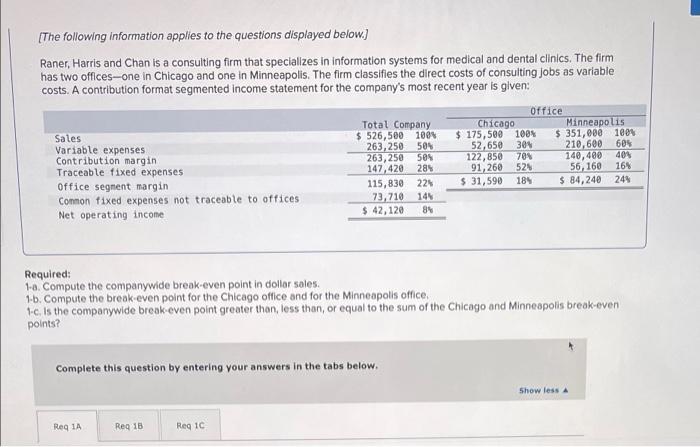

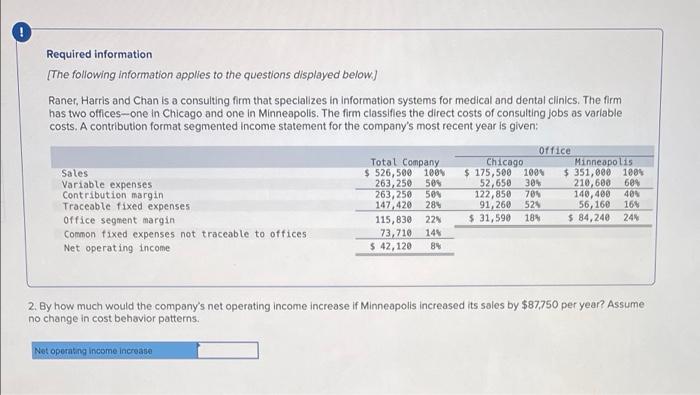

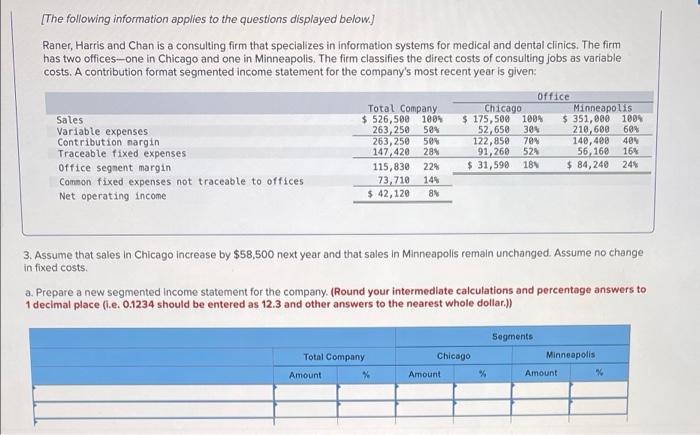

[The following information applies to the questions displayed below.) Raner, Harris and Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices--one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company's most recent year is given: Sales Variable expenses Contribution margin Traceable fixed expenses Office segment margin Common fixed expenses not traceable to offices Net operating income 3es Total Company $ 526,500 100% 263,250 509 263, 250 50% 147,420 289 115,830 228 73, 710 149 $ 42,120 84 Office Chicago Minneapolis $ 175,500 100% $ 351,000 1804 52,650 210,600 60% 122,850 705 140,400 409 91,260 524 56,160 16% $ 31,590 189 $ 84,240 249 Required: 1-a. Compute the companywide break-even point in dollar sales. 1-b. Compute the break even point for the Chicago office and for the Minneapolis office, 1-c. is the companywide break-even point greater than, less than or equal to the sum of the Chicago and Minneapolis break-even points? Complete this question by entering your answers in the tabs below. Show less Reg 1A Reg 16 Reg 10 Required information [The following information applies to the questions displayed below) Raner, Harris and Chan is a consulting firm that specializes in Information systems for medical and dental clinics. The firm has two offices--one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company's most recent year is given: Total Company $ 526,500 100 263, 250 504 263,250 500 147, 420 284 115,830 22 73, 710 149 $ 42,120 84 Sales Variable expenses Contribution margin Traceable fixed expenses office segment margin Common fixed expenses not traceable to offices Net operating income Office Chicago Minneapolis $ 175,500 1004 $ 351,800 1804 52,650 304 210,600 689 122,850 709 140,400 401 91,260 524 56,160 $ 31,590 184 5 84,240 24% 165 2. By how much would the company's net operating Income increase if Minneapolls increased its sales by $87,750 per year? Assume no change in cost behavior patterns. Net operating income increase (The following information applies to the questions displayed below.) Raner, Harris and Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices--one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company's most recent year is given: Office Total Company Chicago Minneapolis Sales $ 526,500 1004 $ 175,500 1999 $ 351,000 1009 Variable expenses 263, 250 589 52,658 304 210,600 Contribution margin 263,250 504 122,850 709 140,400 404 Traceable fixed expenses 147,420 284 91,260 524 56,160 16% Office segnent margin 115,830 $ 31,590 184 $ 84,240 245 Common fixed expenses not traceable to offices 73, 710 144 Net operating income $ 42,120 89 60% 229 3. Assume that sales in Chicago Increase by $58,500 next year and that sales in Minneapolis remain unchanged. Assume no change in fixed costs a. Prepare a new segmented Income statement for the company. (Round your intermediate calculations and percentage answers to 1 decimal place (l.e. 01234 should be entered as 12.3 and other answers to the nearest whole dollar.)) Chicago Total Company Amount % Segments Minneapolis Amount Amount %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started