Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help The following selected transactions apply to Topeca Supply for November and December Year 1. November was the first month of operations, Sales tax

please help

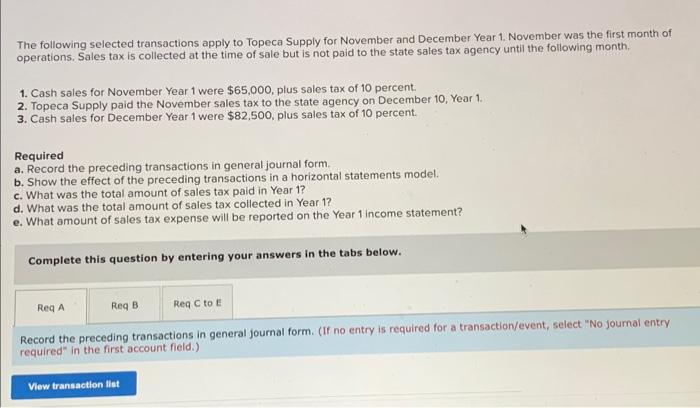

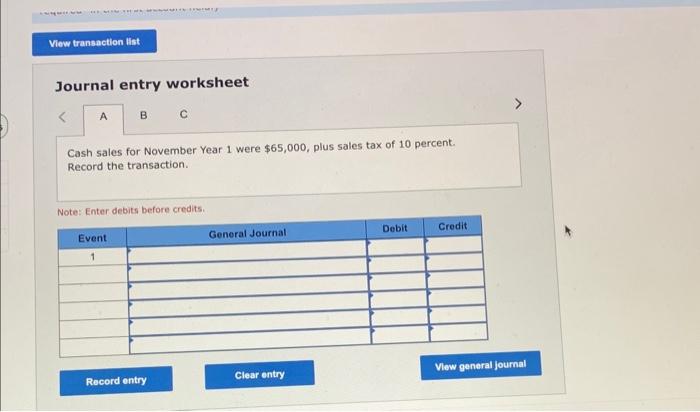

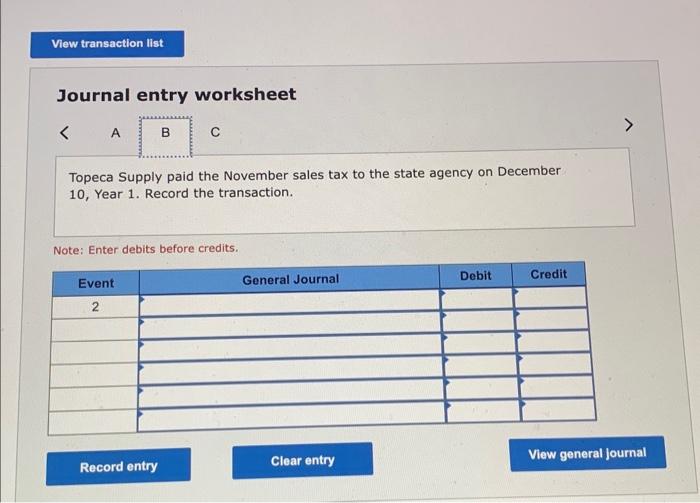

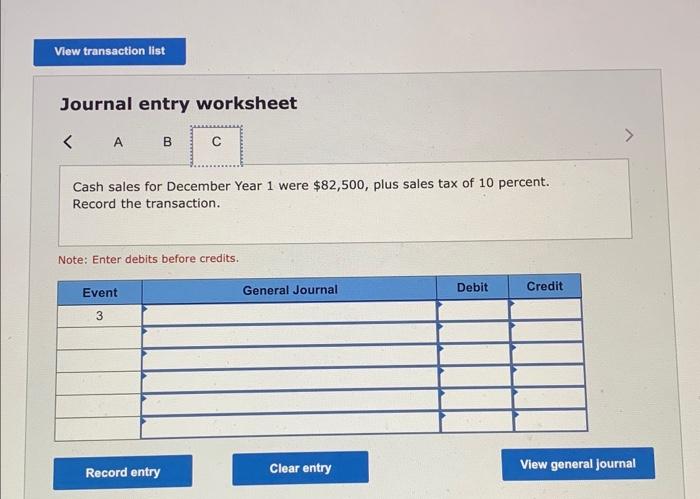

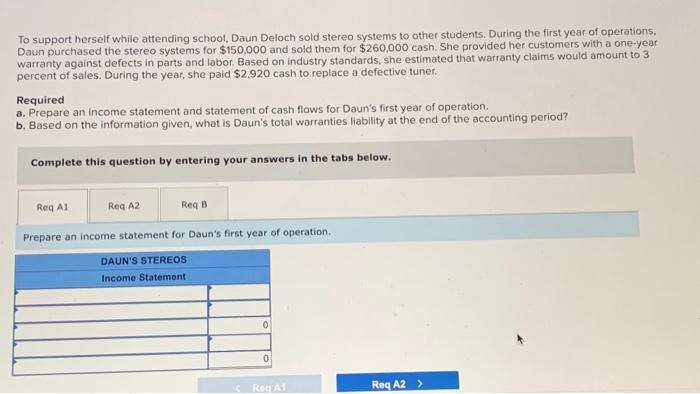

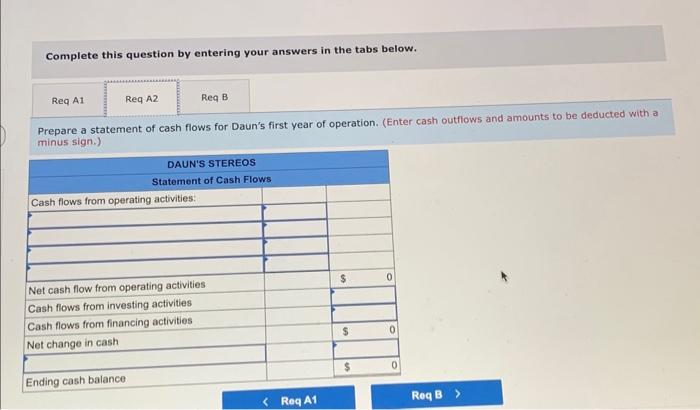

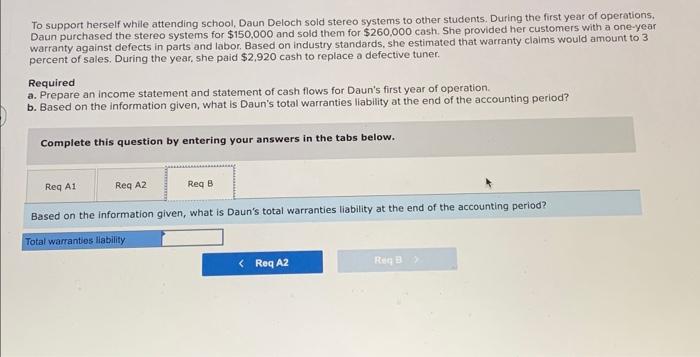

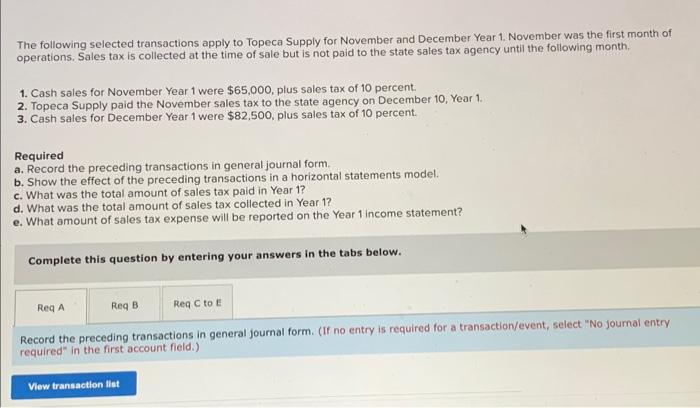

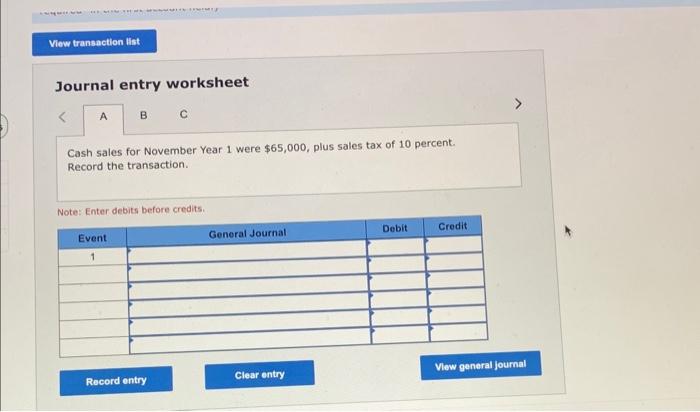

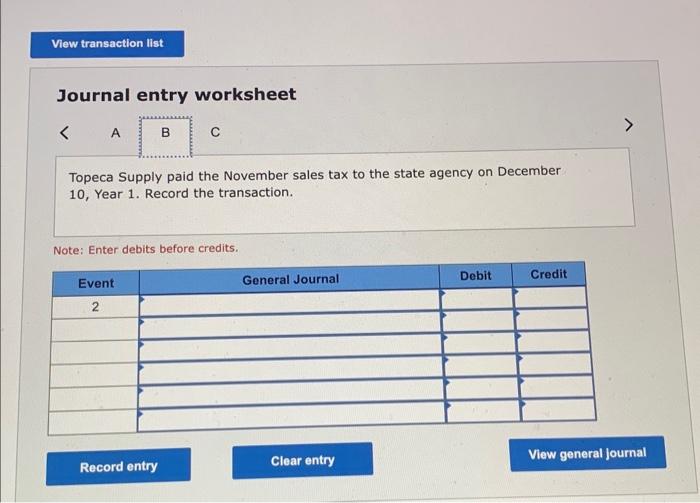

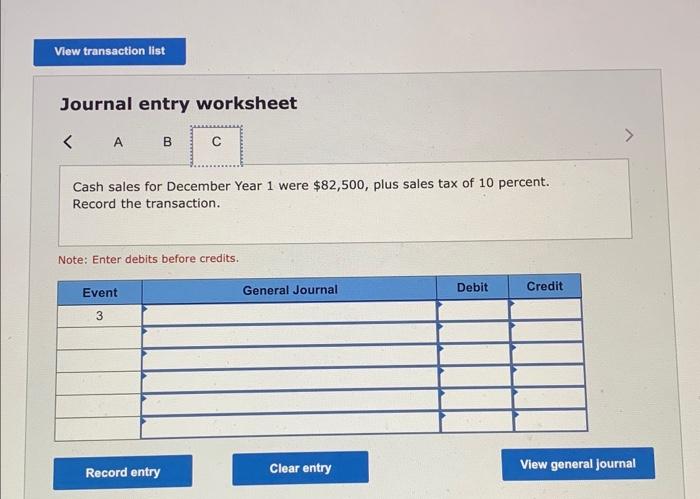

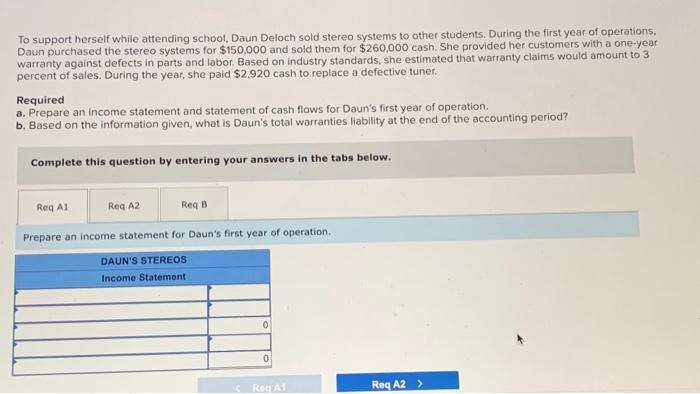

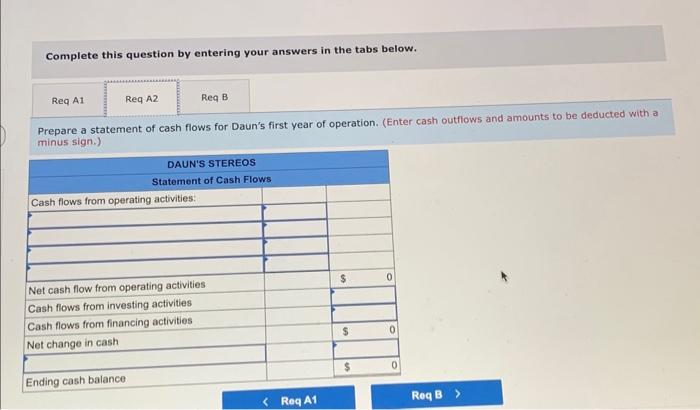

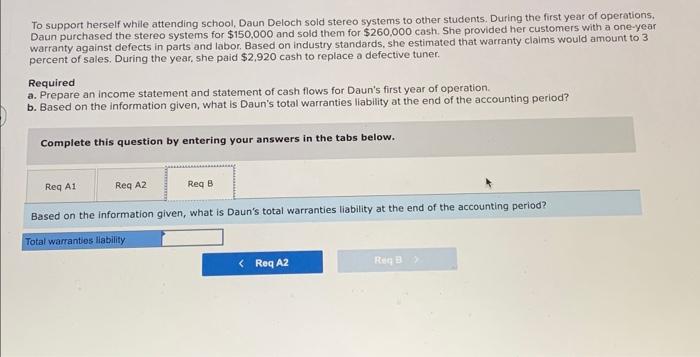

The following selected transactions apply to Topeca Supply for November and December Year 1. November was the first month of operations, Sales tax is collected at the time of sale but is not paid to the state sales tax agency until the following month. 1. Cash sales for November Year 1 were $65,000, plus sales tax of 10 percent. 2. Topeca Supply paid the November sales tax to the state agency on December 10, Year 1. 3. Cash sales for December Year 1 were $82,500, plus sales tax of 10 percent. Required a. Record the preceding transactions in general journal form. b. Show the effect of the preceding transactions in a horizontal statements model. c. What was the total amount of sales tax paid in Year 1 ? d. What was the total amount of sales tax collected in Year 1 ? e. What amount of sales tax expense will be reported on the Year 1 income statement? Complete this question by entering your answers in the tabs below. Record the preceding transactions in general journal form. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Cash sales for November Year 1 were $65,000, plus sales tax of 10 percent. Record the transaction. Note: Enter debits before credits. Journal entry worksheet Topeca Supply paid the November sales tax to the state agency on December 10 , Year 1. Record the transaction. Note: Enter debits before credits. Journal entry worksheet Cash sales for December Year 1 were $82,500, plus sales tax of 10 percent. Record the transaction. Note: Enter debits before credits. To support herself while attending school, Daun Deloch sold stereo systems to other students. During the first year of operations. Daun purchased the stereo systems for $150,000 and sold them for $260.000 cash. She provided her customers with a one-year warranty against defects in parts and labor. Based on industry standards, she estimated that wartanty claims would amount to 3 percent of sales. During the year, she paid $2,920 cash to replace a defective tunet. Required a. Prepare an income statement and statement of cash flows for Daun's first year of operation. b. Based on the information given, what is Daun's total warranties liability at the end of the accounting period? Complete this question by entering your answers in the tabs below. Prepare an income statement for Daun's first year of operation. Complete this question by entering your answers in the tabs below. Prepare a statement of cash flows for Daun's first year of operation. (Enter cash outflows and amounts to be deducted with a minus sign.) To support herself while attending school, Daun Deloch sold stereo systems to other students. During the first year of operations. Daun purchased the stereo systems for $150,000 and sold them for $260,000 cash. She provided her customers with a one-year warranty against defects in parts and labor. Based on industry standards, she estimated that warranty claims would amount to 3 percent of sales. During the year, she paid $2,920 cash to replace a defective tuner. Required a. Prepare an income statement and statement of cash flows for Daun's first year of operation. b. Based on the information given, what is Daun's total warranties liability at the end of the accounting period? Complete this question by entering your answers in the tabs below. Based on the information given, what is Daun's total warranties liability at the end of the accounting period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started