please help the only one i figured out was required 1E i need help on the rest please

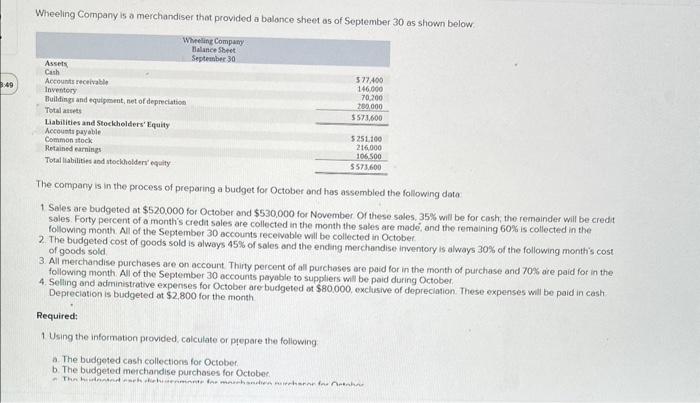

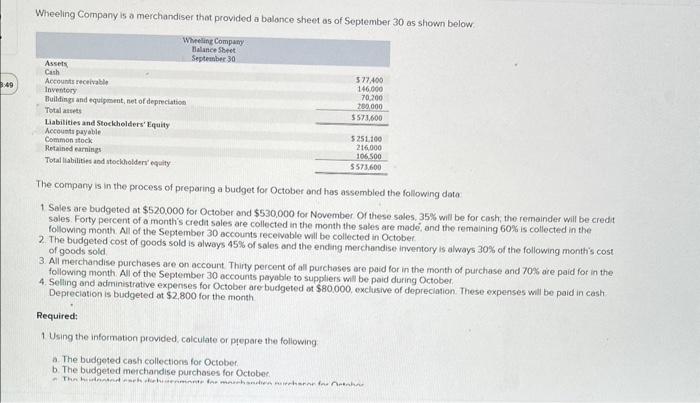

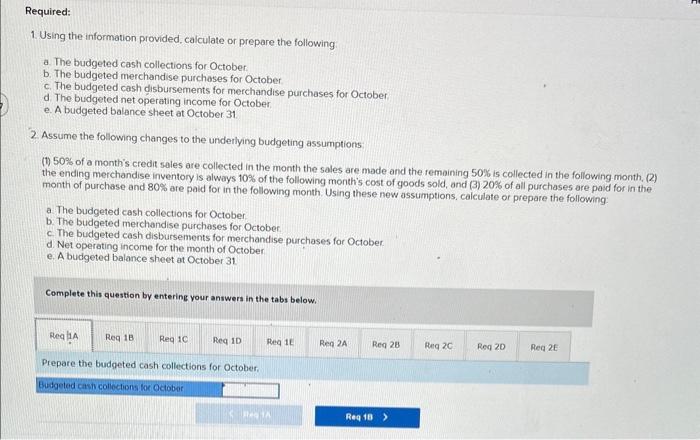

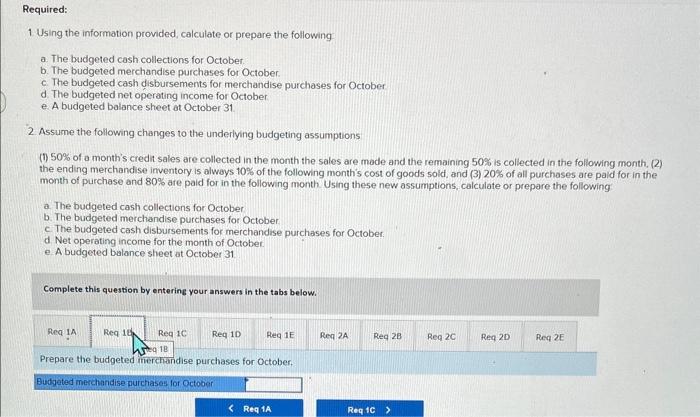

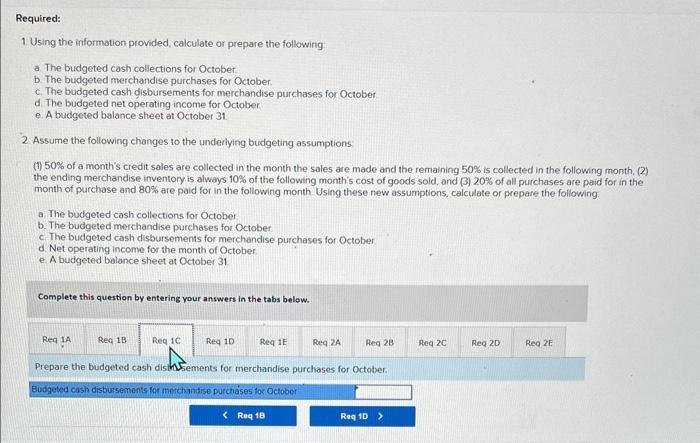

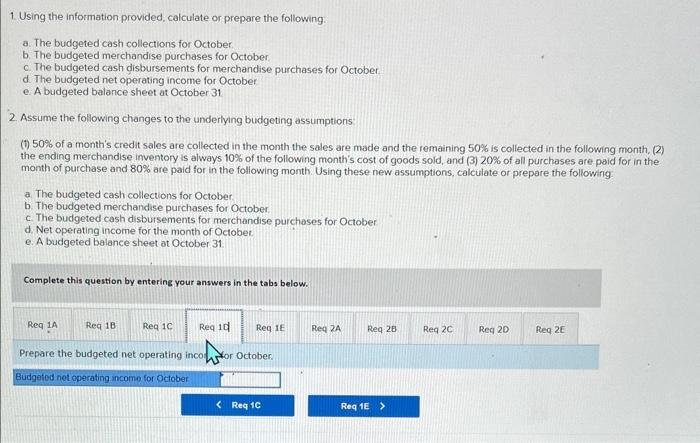

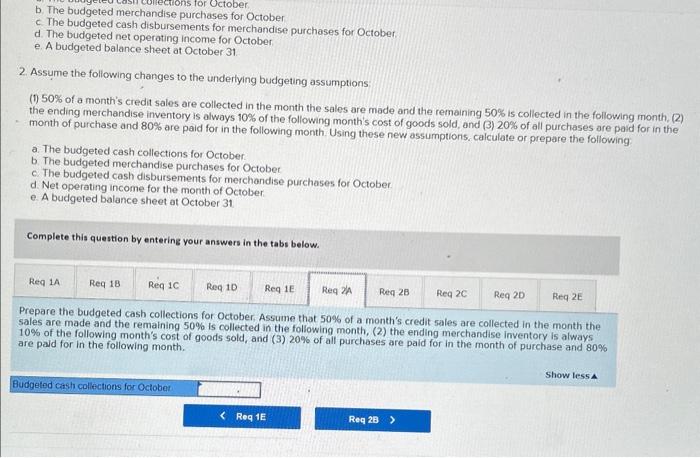

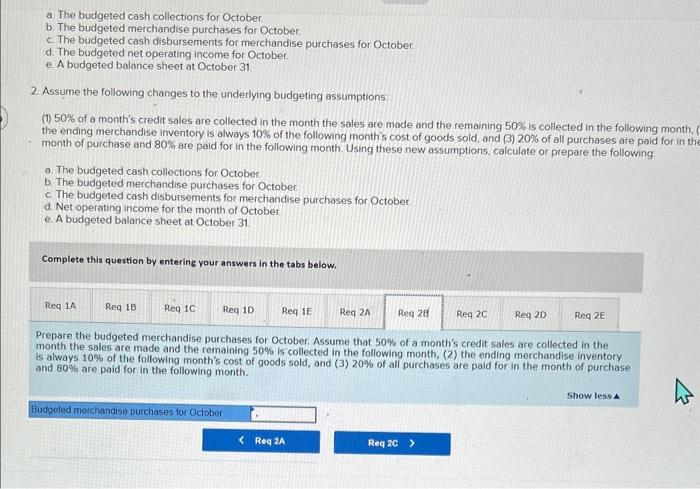

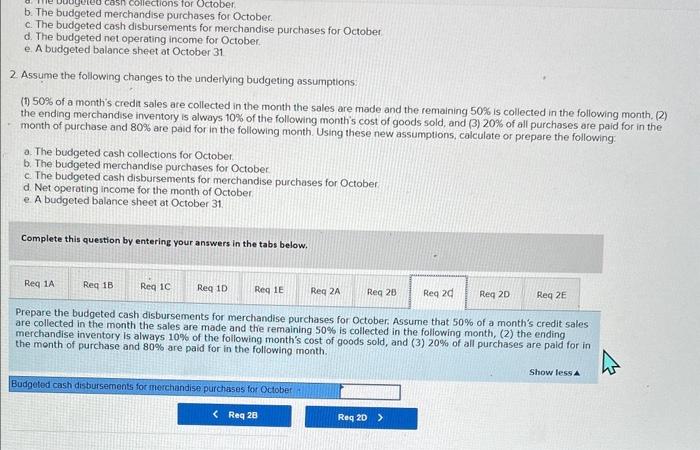

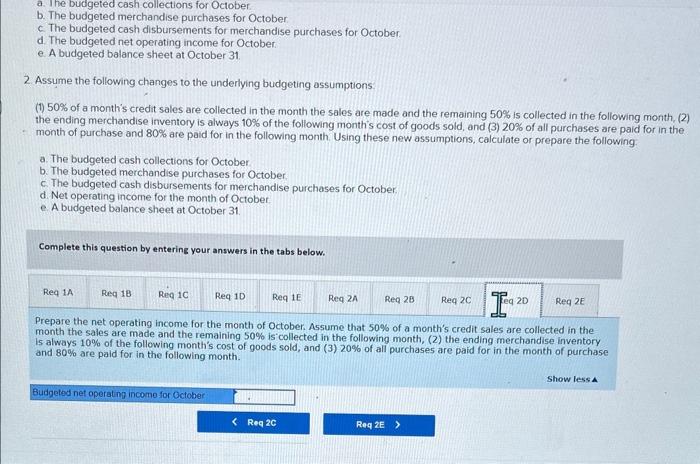

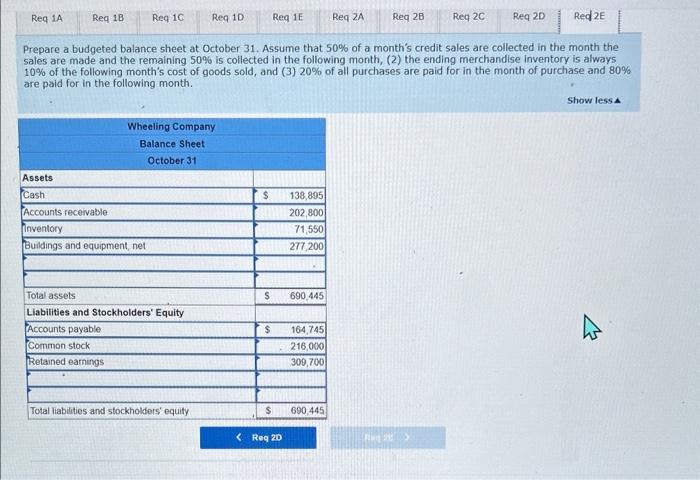

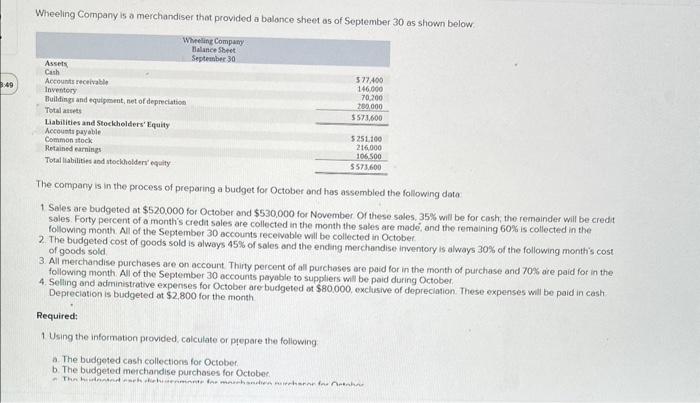

Wheeling Company is a merchandiser that provided a balance sheet as of September 30 as shown below. The company is in the process of preparing a budget for October and has assembled the following dato 1 Sales are budgeted at $520,000 for October and $530,000 for November Of these sales. 35% will be for cash, the remainder will be credit sales. Forty percent of a month's creda sales are collected in the month the sales are made, and the remaining 60% is collected in the following month. All of the September 30 accounts recesvable will be collected in October. 2. The budgeted cost of goods sold is alwoys 45% of sales and the ending merchandise inventory is always 30% of the following month's cost of goods sold. 3. All merchandise purchases are on account. Thirty percent of all purchases are paid for in the month of purchase and 70% are paid for in the following month. All of the September 30 accounts payable to suppliers will be paid during October. 4. Selling and administrative expenses for October are budgeted at $80.000, exclusive of depreciation. These expenses will be poid in cash Depreciation is budgeted at $2,800 for the month Required: 1 Using the information provided, calculate or prepare the following: a. The buigeted cash collections for October. b. The budgeted merchandise purchases for October. 1. Using the information provided, calculate or prepare the following a. The budgeted cash collections for October. b. The budgeted merchandise purchases for October c. The budgeted cash disbursements for merchandise purchases for October. d. The budgeted net operating income for October. e. A budgeted balance sheet at October 31 . 2. Assume the following changes to the underlying budgeting assumptions: (7) 50% of a month's credit sales are collected in the month the sales are made and the remaining 50% is collected in the following month, (2) the ending merchandise inventory is always 10% of the following month's cost of goods sold, and (3) 208 of all purchases are paid for in the month of purchase and 80% are paid for in the following month. Using these new assumptions, calculate or prepare the following: a. The budgeted cash collections for October b. The budgeted merchandise purchases for October. c. The budgeted cash disbursements for merchandise purchases for October. d. Net operating income for the month of October e. A budgeted balance sheet at October 31 Complete this question by entering your answers in the tabs below. Prepare the budgeted cash collections for October. 1. Using the information provided, calculate or prepare the following a. The budgeted cash collections for October. b. The budgeted merchandise purchases for October. c. The budgeted cash disbursements for merchandise purchases for October d. The budgeted net operating income for October e. A budgeted balance sheet at October 31 2. Assume the following changes to the underlying budgeting assumptions (1) 50% of a month's credit sales are collected in the month the sales are made and the remaining 50% is collected in the following month, (2) the ending merchandise inventory is alwoys 10% of the following month's cost of goods sold, and (3) 20% of all purchases are pald for in the month of purchase and 80% are paid for in the following month Using these new assumptions, calculate or prepare the following a. The budgeted cash collections for October. b. The budgeted merchandise purchases for October. c. The budgeted cash distursements for merchandise purchases for October. d. Net operating income for the month of October. e A budgeted balance sheet at October 31 Complete this question by entering your answers in the tabs below. Prepare the budgeted inerchandise purchases for October. 1. Using the information provided, calculate or prepare the following: a. The budgeted cash collections for October. b. The budgeted merchandise purchases for October. c. The budgeted cash disbursements for merchandise purchases for October d The budgeted net operating income for October. e. A budgeted balance sheet at October 31 . 2. Assume the following changes to the underlying budgeting assumptions: (1) 50% of a month's credit sales are collected in the month the sales are made and the remaining 50% is collected in the following month, (2) the ending merchandise inventory is always 10% of the following month's cost of goods sold, and (3) 20% of all purchases are paid for in the month of purchase and 80% are poid for in the following month. Using these new assumptions, calculate or prepare the following: a. The budgeted cash collections for October. b. The budgeted merchandise purchases for October. c. The budgeted cash disbursements for merchandise purchases for October. d. Net operating income for the month of October. e. A budgeted balance sheet at October 31 . Complete this question by entering your answers in the tabs below. Prepare the budgeted cash disintements for merchandise purchases for October. Budgeted cash disbussements for inerthanitise purchses foc October - 1. Using the information provided, calculate or prepare the following: a. The budgeted cash collections for October. b. The budgeted merchandise purchases for October. c. The budgeted cash disbursements for merchandise purchases for October. d. The budgeted net operating income for October e. A budgeted balance sheet at October 31 2. Assume the following changes to the underlying budgeting assumptions: (1) 50% of a month's credit sales are collected in the month the sales are made and the remaining 50% is collected in the following month, (2) the ending merchandise inventory is always 10% of the following month's cost of goods sold, and (3) 20% of all purchases are paid for in the month of purchase and 80% are paid for in the following month. Using these new assumptions, calculate or prepare the following: a. The budgeted cash collections for October. b. The budgeted merchandise purchases for October. c. The budgeted cash disbursements for merchandise purchases for October d. Net operating income for the month of Octobet. e. A budgeted balance sheet at October 31 . Complete this question by entering your answers in the tabs below. Prepare the budgeted net operating inco y or October. b. The budgeted merchandise purchases for October c. The budgeted cash disbursements for merchandise purchases for October d. The budgeted net operating income for October. e. A budgeted balance sheet at October 31 . 2. Assume the following changes to the underlying budgeting assumptions: (1) 50% of a month's credit sales are collected in the month the sales are made and the remaining 50% is collected in the following month, (2) the ending merchandise inventory is always 10% of the following month's cost of goods sold, and (3) 20% of all purchases are paid for in the month of purchase and 80% are paid for in the following month. Using these new assumptions. calculate or prepare the following a. The budgeted cash collections for October. b. The budgeted merchandise purchases for October. c. The budgeted cash disbursements for merchandise purchases for October. d. Net operating income for the month of October. e. A budgeted balance sheet at October 31 Complete this question by entering your answers in the tabs below. Prepare the budgeted cash collections for October. Assume that 50% of a month's credit sales are collected in the month the sales are made and the remaining 50% is collected in the following month, (2) the ending merchandise inventory is always 10% of the following month's cost of goods sold, and (3) 20% of all purchases are paid for in the month of purchase and 80% are pald for in the following month. a. The budgeted cash collections for October. b. The budgeted merchandise purchases for October. c. The budgeted cash disbursements for merchandise purchases for October. d. The budgeted net operating income for October. e. A budgeted balance sheet at October 31 2. Assume the following changes to the underlying budgeting assumptions: (1) 50% of a month's credit sales are collected in the month the sales are made and the remaining 50% is collected in the following month. the ending merchandise inventory is always 10% of the following month's cost of goods sold. and (3) 20% of all purchases are paid for in t month of purchase and 80% are paid for in the following month. Using these new assumptions, calculate or prepare the following: a. The budgeted cash collections for October. b. The budgeted merchandise purchases for October c. The budgeted cash disbursements for merchandise purchases for October d. Net operating income for the month of October. e. A budgeted balance sheet at October 31 . Complete this question by entering your answers in the tabs below. Prepare the budgeted merchandise purchases for October. Assume that 50% of a month's credit sales are collected in the month the sales are made and the remaining 50% is collected in the following month,(2) the ending merchandise inventory is always 10% of the following month's cost of goods sold, and (3) 20% of all purchases are paid for in the month of purchase and 80% are paid for in the following month. b. The budgeted merchandise purchases for October. c. The budgeted cash disbursements for merchandise purchases for October d. The budgeted net operating income for October. e. A budgeted balance sheet at October 31 . 2. Assume the following changes to the underlying budgeting assumptions: (1) 50% of a month's credit sales are collected in the month the sales are made and the remaining 50% is collected in the following month. (2) the ending merchandise inventory is always 10% of the following month's cost of goods sold, and (3) 20% of all purchases are paid for in the month of purchase and 80% are paid for in the following month. Using these new assumptions, calculate or prepare the following: a. The budgeted cash collections for October. b. The budgeted merchandise purchases for October c. The budgeted cash disbursements for merchandise purchases for October d Net operating income for the month of October. e. A budgeted balance sheet at October 31 . Complete this question by entering your answers in the tabs below. Prepare the budgeted cash disbursements for merchandise purchases for October. Assume that 50% of a month's credit sales are collected in the month the sales are made and the remaining 50% is collected in the following month, (2) the ending merchandise inventory Is always 10% of the following month's cost of goods sold, and (3) 20% of all purchases are paid for in the menth of purchase and 80% are paid for in the following month. Show lessa Budgoted cash disbursements for merchandise purchases for October a. The budgeted cash collections for October. b. The budgeted merchandise purchases for October. c. The budgeted cash disbursements for merchandise purchases for October. d. The budgeted net operating income for October. e. A budgeted balance sheet at October 31 2. Assume the following changes to the underlying budgeting assumptions: (7) 50% of a month's credit sales are collected in the month the sales are made and the remaining 50% is collected in the following month, (2) the ending merchandise inventory is always 10% of the following month's cost of goods sold, and (3) 20% of all purchases are paid for in the month of purchase and 80% are paid for in the following month. Using these new assumptions, calculate or prepare the following: a. The budgeted cash collections for October. b. The budgeted merchandise purchases for October. c. The budgeted cash disbursements for merchandise purchases for October. d. Net operating income for the month of Octobet. e. A budgeted balance sheet at October 31 . Complete this question by entering your answers in the tabs below. Prepare the net operating income for the month of October. Assume that 50% of a month's credit sales are collected in the month the sales are made and the remaining 50% is collected in the following month, (2) the ending merchandise inventory Is always 10% of the following month's cost of goods sold, and (3) 20% of all purchases are paid for in the month of purchase and 80% are paid for in the following month. Prepare a budgeted balance sheet at October 31. Assume that 50% of a month's credit sales are collected in the month the sales are made and the remaining 50% is collected in the following month, (2) the ending merchandise inventory is always 10% of the following month's cost of goods sold, and (3) 20% of all purchases are paid for in the month of purchase and 80% are paid for in the following month