Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help The plant asset and accumulated depreciation accounts of Pell Corporation had the Transactions during 2024 were as follows: a. On January 2, 2024,

please help

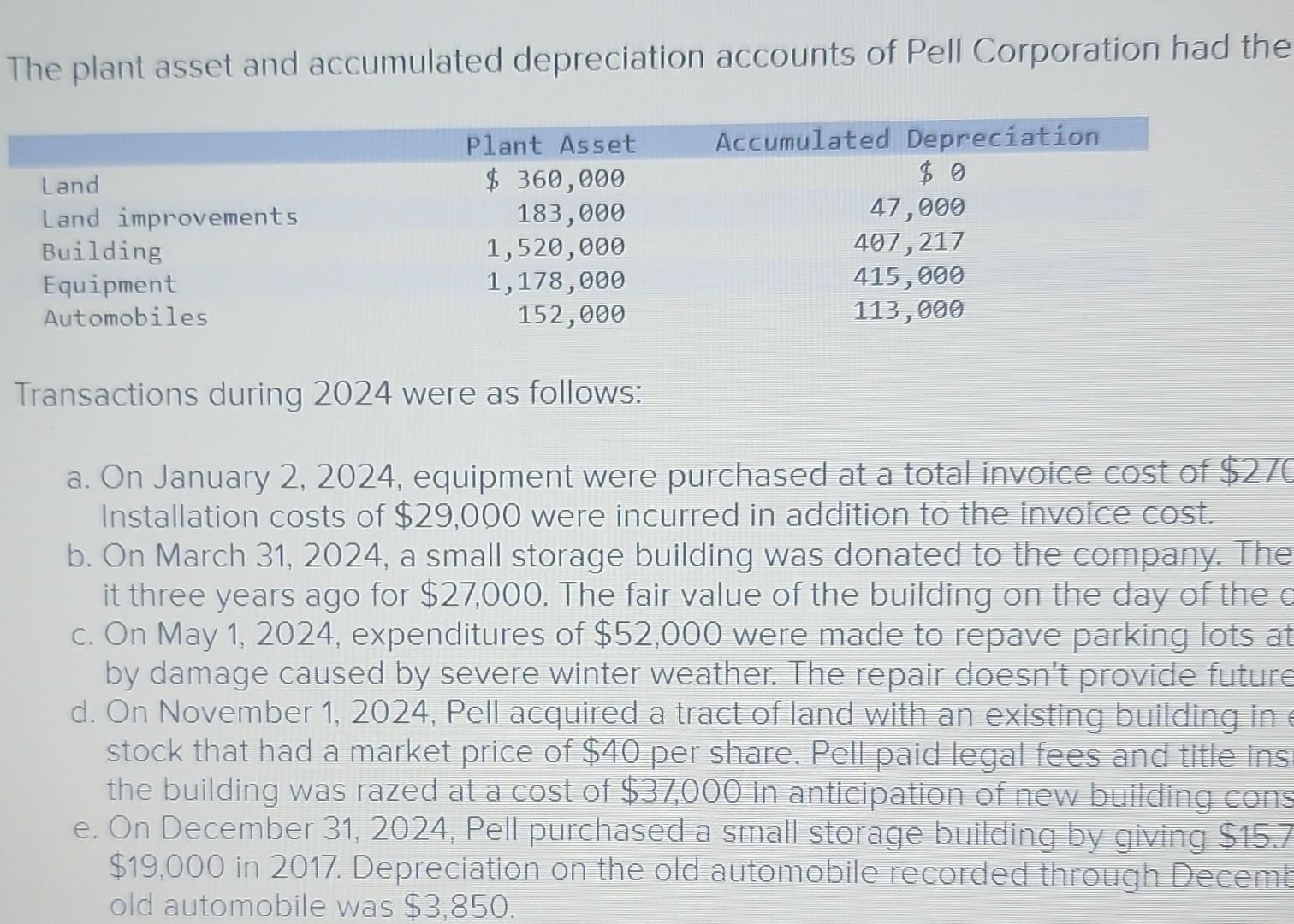

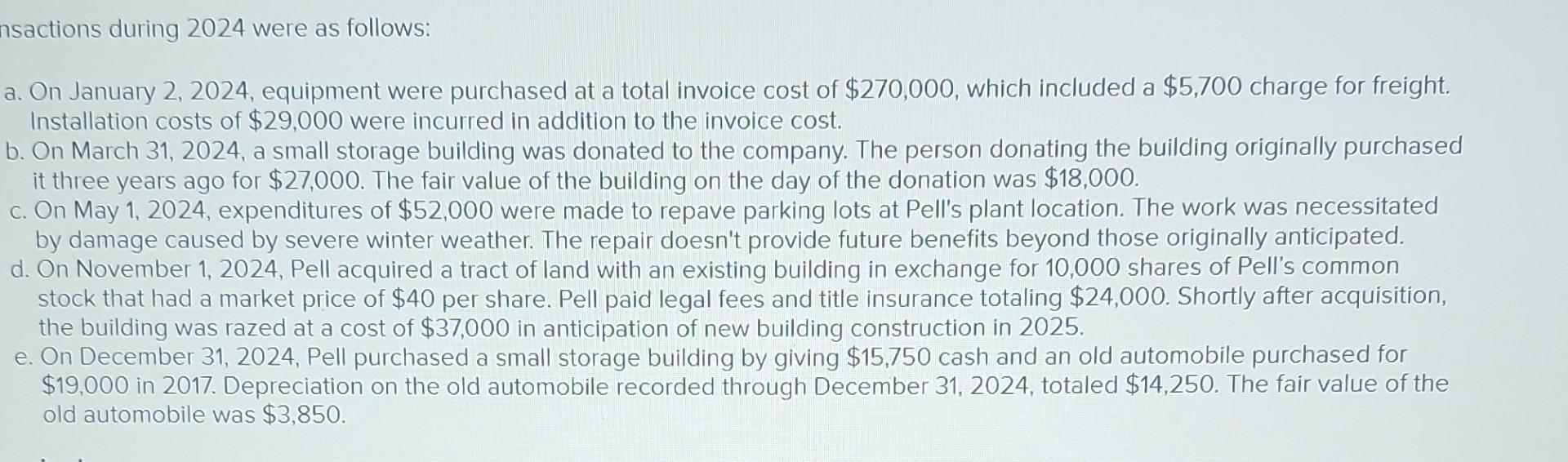

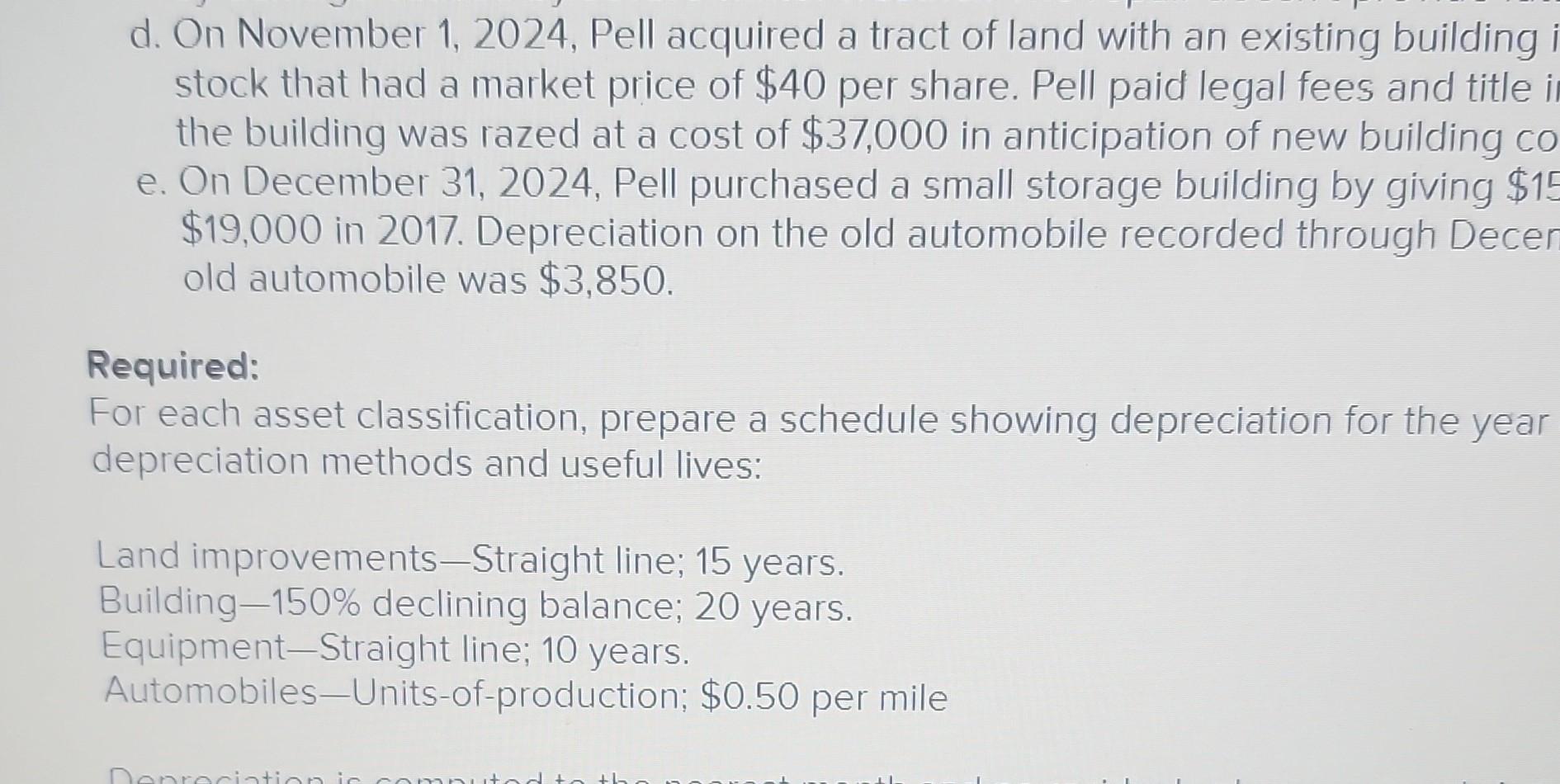

The plant asset and accumulated depreciation accounts of Pell Corporation had the Transactions during 2024 were as follows: a. On January 2, 2024, equipment were purchased at a total invoice cost of $270 Installation costs of $29,000 were incurred in addition to the invoice cost. b. On March 31, 2024, a small storage building was donated to the company. The it three years ago for $27,000. The fair value of the building on the day of the c. On May 1, 2024, expenditures of $52,000 were made to repave parking lots at by damage caused by severe winter weather. The repair doesn't provide future d. On November 1, 2024, Pell acquired a tract of land with an existing building in stock that had a market price of $40 per share. Pell paid legal fees and title ins the building was razed at a cost of $37,000 in anticipation of new building cons e. On December 31, 2024, Pell purchased a small storage building by giving $15.7 $19,000 in 2017. Depreciation on the old automobile recorded through Decemb old automobile was $3,850. nsactions during 2024 were as follows: a. On January 2, 2024, equipment were purchased at a total invoice cost of $270,000, which included a $5,700 charge for freight. Installation costs of $29,000 were incurred in addition to the invoice cost. b. On March 31, 2024, a small storage building was donated to the company. The person donating the building originally purchased it three years ago for $27,000. The fair value of the building on the day of the donation was $18,000. c. On May 1, 2024, expenditures of $52,000 were made to repave parking lots at Pell's plant location. The work was necessitated by damage caused by severe winter weather. The repair doesn't provide future benefits beyond those originally anticipated. d. On November 1, 2024, Pell acquired a tract of land with an existing building in exchange for 10,000 shares of Pell's common stock that had a market price of $40 per share. Pell paid legal fees and title insurance totaling $24,000. Shortly after acquisition, the building was razed at a cost of \$37,000 in anticipation of new building construction in 2025. e. On December 31, 2024, Pell purchased a small storage building by giving $15,750 cash and an old automobile purchased for $19,000 in 2017. Depreciation on the old automobile recorded through December 31,2024 , totaled $14,250. The fair value of the old automobile was $3,850. d. On November 1, 2024, Pell acquired a tract of land with an existing building stock that had a market price of $40 per share. Pell paid legal fees and title it the building was razed at a cost of $37,000 in anticipation of new building c0 e. On December 31, 2024, Pell purchased a small storage building by giving $15 $19,000 in 2017. Depreciation on the old automobile recorded through Decer old automobile was $3,850. Required: For each asset classification, prepare a schedule showing depreciation for the year depreciation methods and useful lives: Land improvements-Straight line; 15 years. Building 150% declining balance; 20 years. Equipment-Straight line; 10 years. Automobiles-Units-of-production; \$0.50 per mile

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started