Answered step by step

Verified Expert Solution

Question

1 Approved Answer

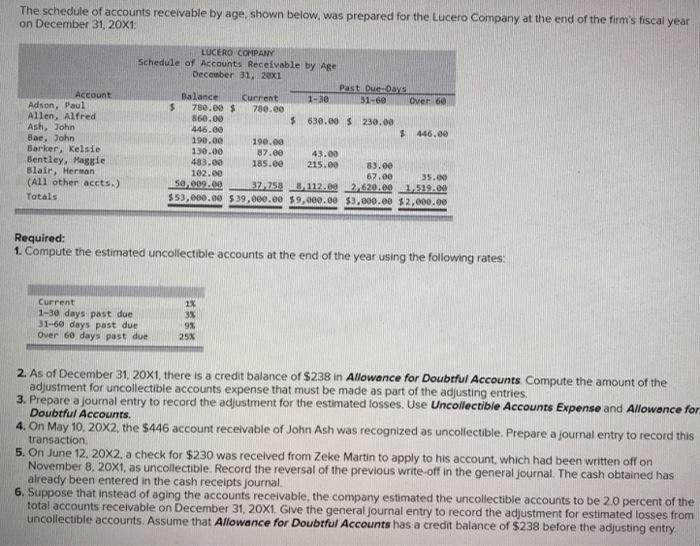

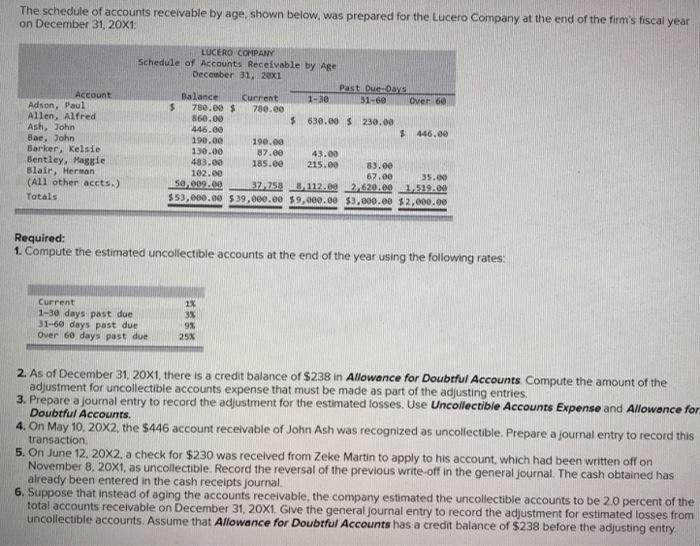

Please help The schedule of accounts receivable by age, shown below. was prepared for the Lucero Company at the end of the firm's fiscal year

Please help

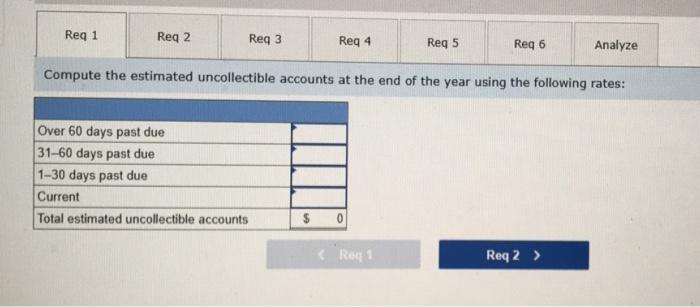

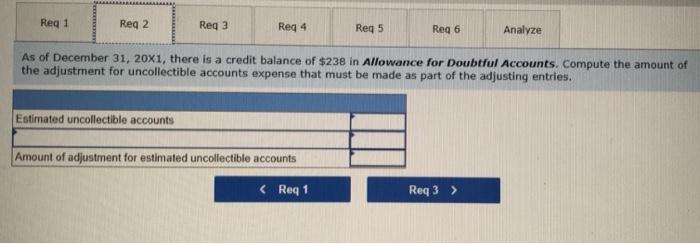

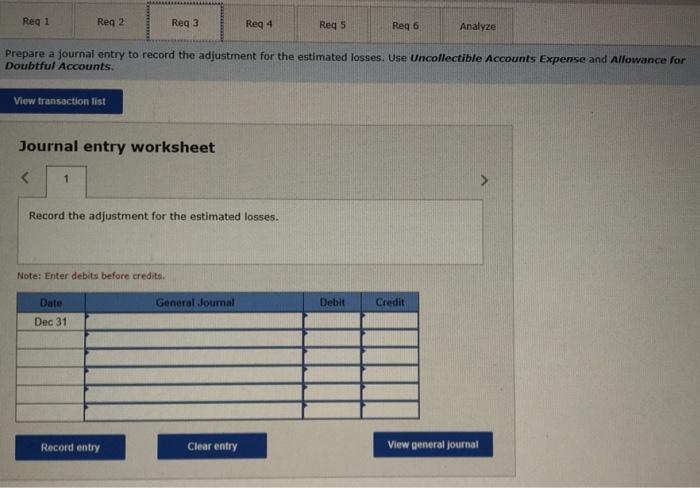

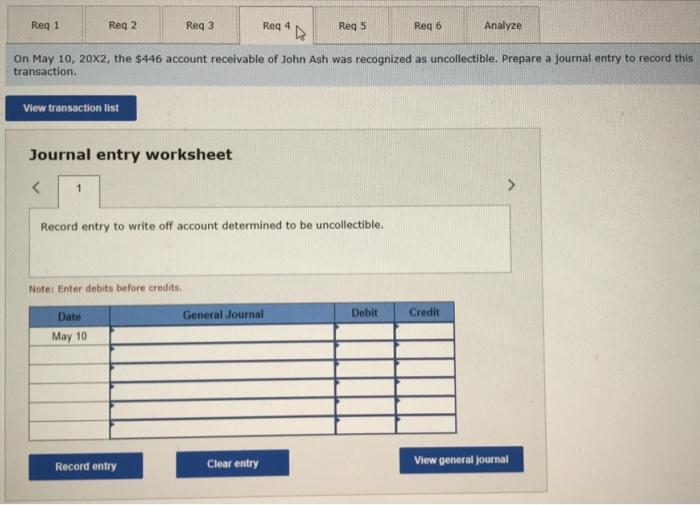

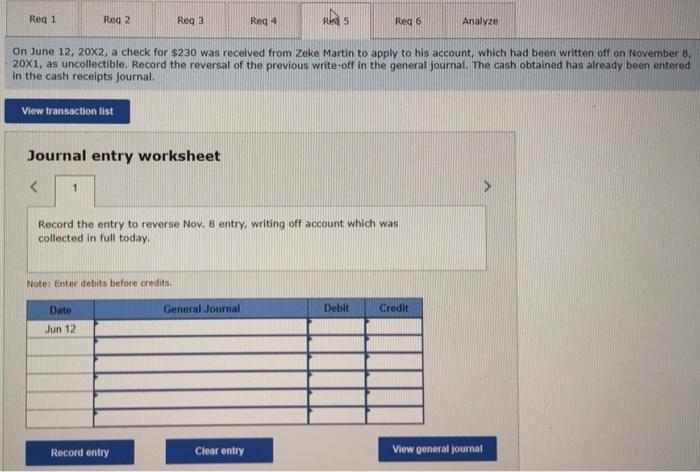

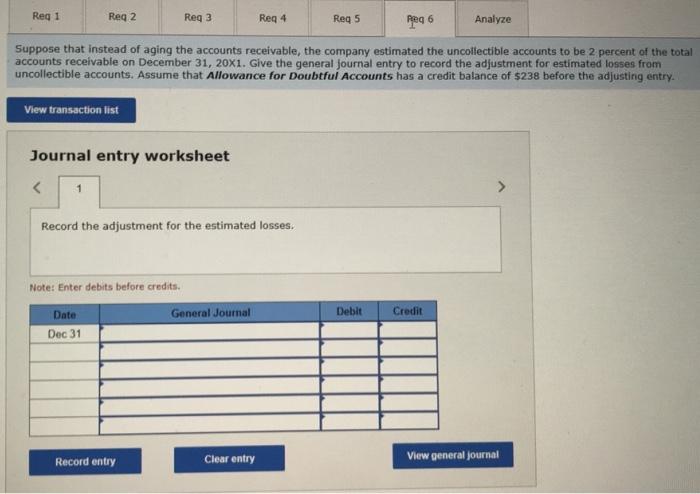

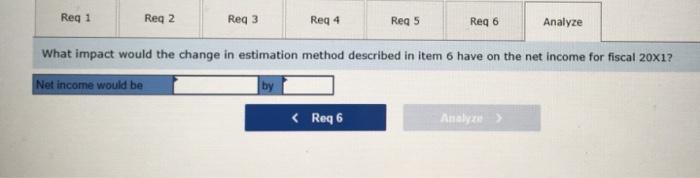

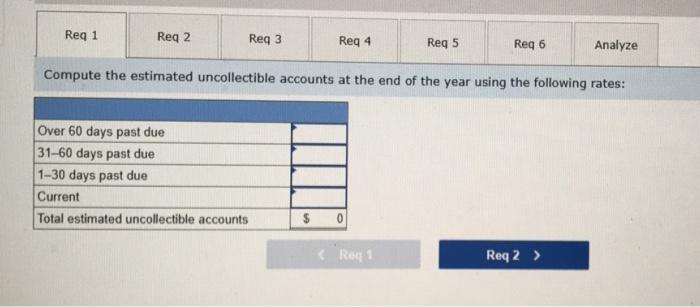

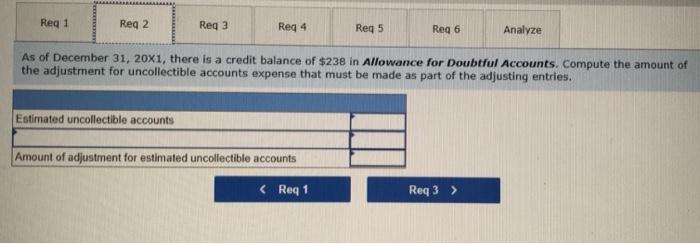

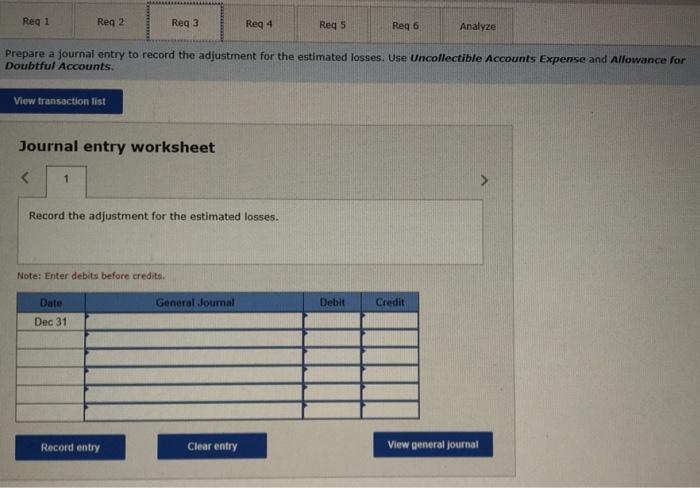

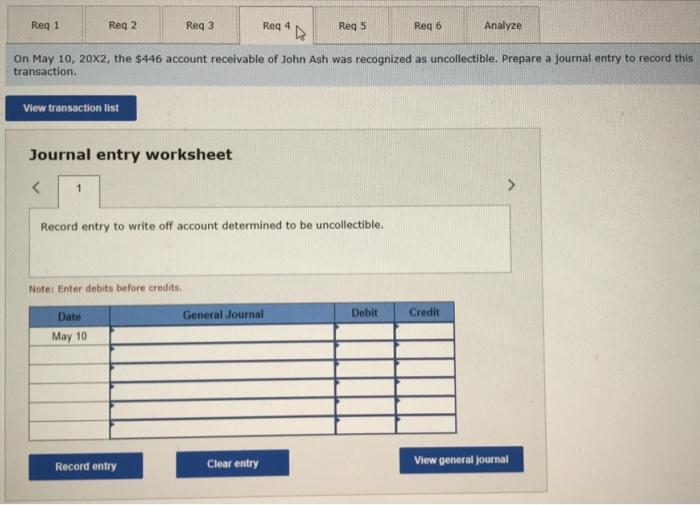

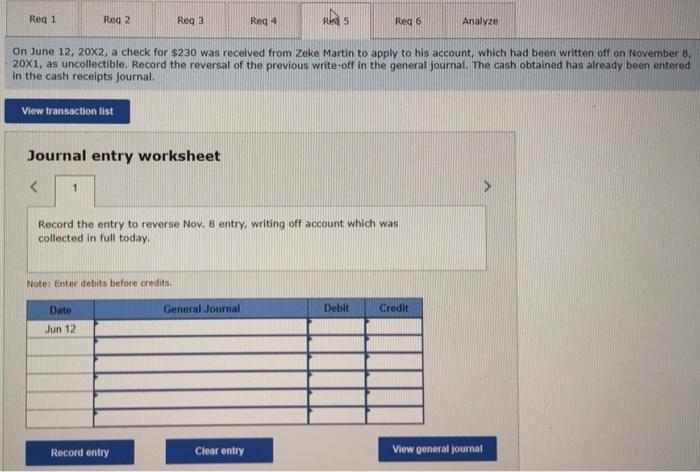

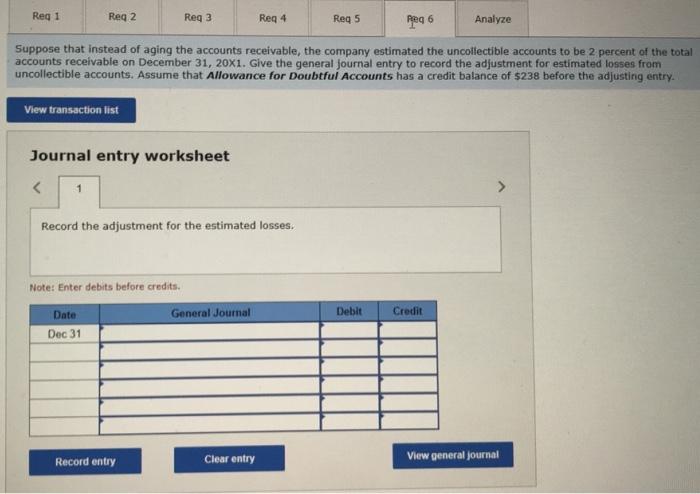

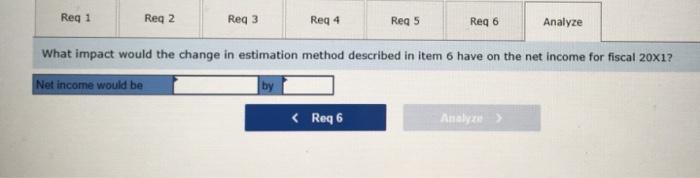

The schedule of accounts receivable by age, shown below. was prepared for the Lucero Company at the end of the firm's fiscal year on December 31, 20x1: Required: 1. Compute the estimated uncollectible accounts at the end of the year using the following rates: 2. As of December 31, 20X1, there is a credit balance of $238 in Allowance for Doubtful Accounts. Compute the amount of the adjustment for uncollectible accounts expense that must be made as part of the adjusting entries. 3. Prepare a journal entry to record the adjustment for the estimated losses. Use Uncollectible Accounts Expense and Allowance for Doubtful Accounts. 4. On May 10, 20X2, the $446 account receivable of John Ash was recognized as uncollectible. Prepare a journal entry to record this transaction. 5. On June 12, 20X2, a check for $230 was recelved from Zeke Martin to apply to his account, which had been written off on November 8,201, as uncollectible. Record the reversal of the previous write-off in the general journal. The cash obtained has already been entered in the cash receipts journal. 6. Suppose that instead of aging the accounts receivable, the company estimated the uncollectible accounts to be 2.0 percent of the total accounts receivable on December 31,201. Glve the general journal entry to record the adjustment for estimated losses from uncollectible accounts. Assume that Allowance for Doubtful Accounts has a credit balance of \$238 before the adjusting entry. Compute the estimated uncollectible accounts at the end of the year using the following rates: As of December 31, 20x1, there is a credit balance of $238 in Allowance for Doubtful Accounts. Compute the amount of the adjustment for uncollectible accounts expense that must be made as part of the adjusting entries. Prepare a journal entry to record the adjustment for the estimated losses. Use Uncollectible Accounts Expense and Allowance for Doubtful Accounts. Journal entry worksheet Record the adjustment for the estimated losses. fotef Enter debits before credits. On May 10, 20x2, the $446 account receivable of John Ash was recognized as uncollectible. Prepare a journal entry to record this transaction. Journal entry worksheet Record entry to write off account determined to be uncollectible. Note; Enter debits before credits. On June 12,202, a check for $230 was received from Zeke Martin to apply to his account, which had been written off on November 8 , 20X1, as uncollectible. Record the reversal of the previous write-off in the general journal. The cash obtained has already been entered in the cash receipts journal. Journal entry worksheet Record the entry to reverse Nov. 8 entry, writing off account which was collected in full today. Notes Enter debits before oredits. Suppose that instead of aging the accounts receivable, the company estimated the uncollectible accounts to be 2 percent of the total accounts receivable on December 31,201. Give the general journal entry to record the adjustment for estimated losses from uncollectible accounts. Assume that Allowance for Doubtful Accounts has a credit balance of $238 before the adjusting entry. Journal entry worksheet Record the adjustment for the estimated losses. Note: Enter debits before credits. What impact would the change in estimation method described in item 6 have on the net income for fiscal 201

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started