Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help The Shlit Works sells a aarge variety of tee shirts and sweatshirts. Steve Hooper, the owner, Is thinking of expanding his sales by

please help

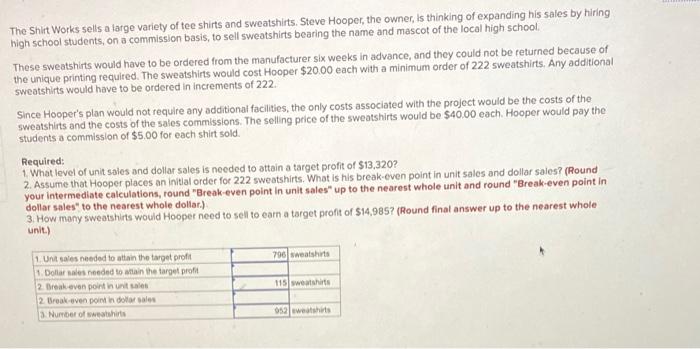

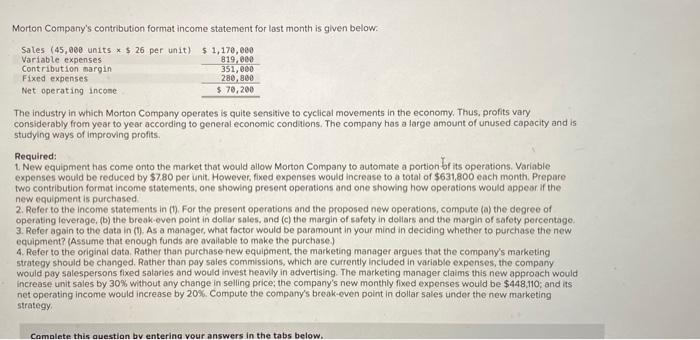

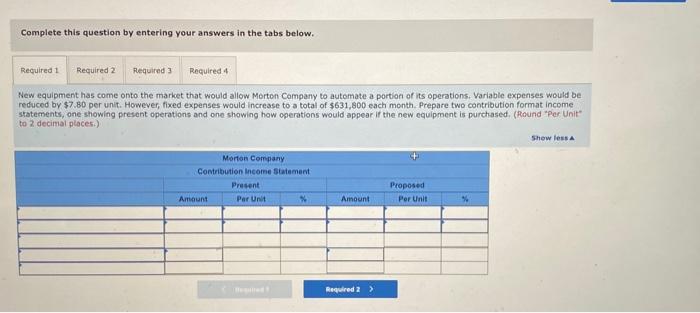

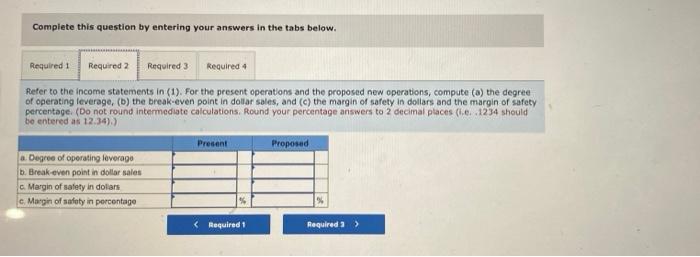

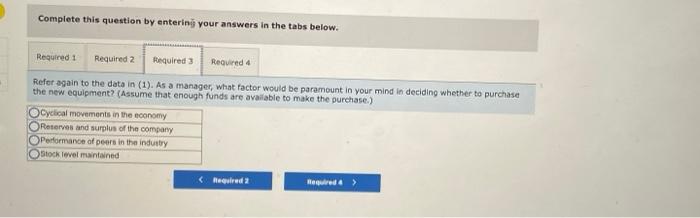

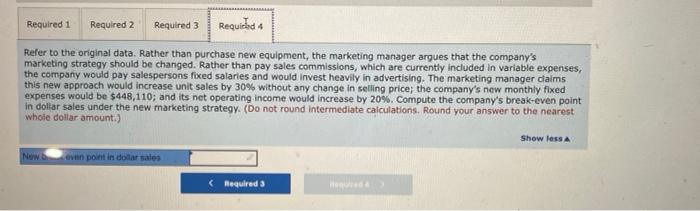

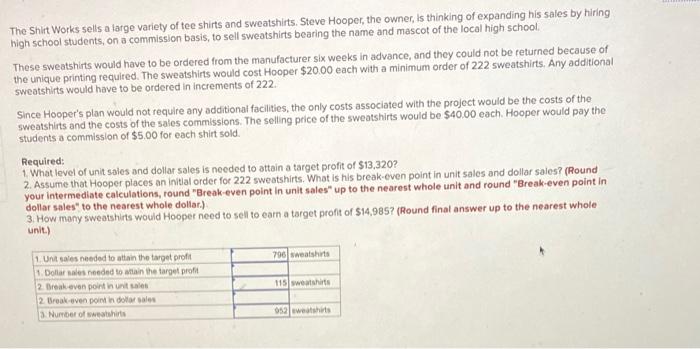

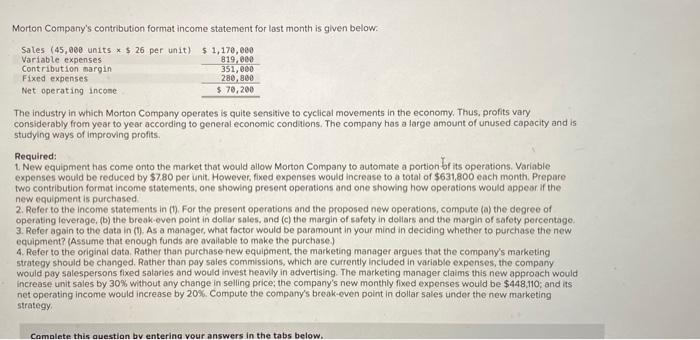

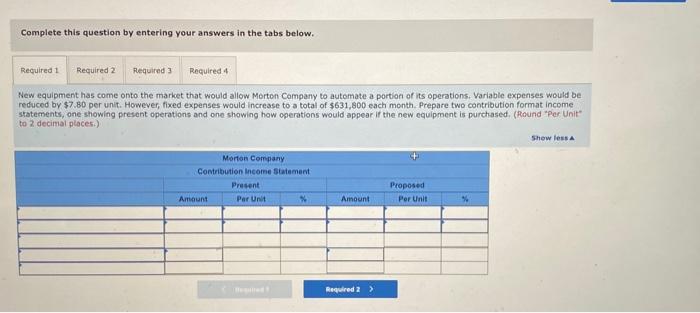

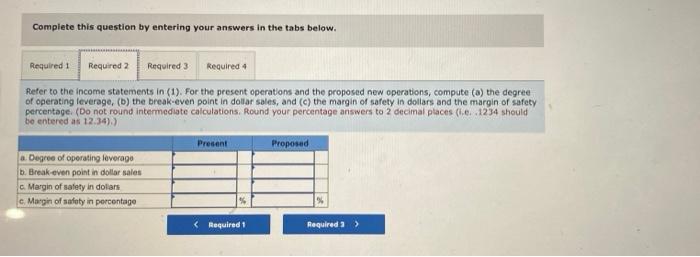

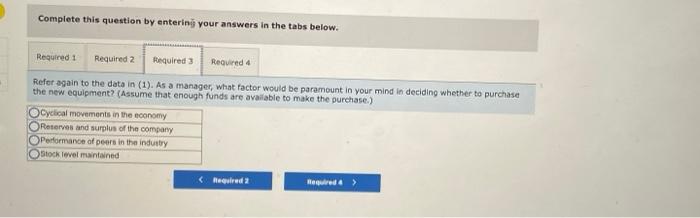

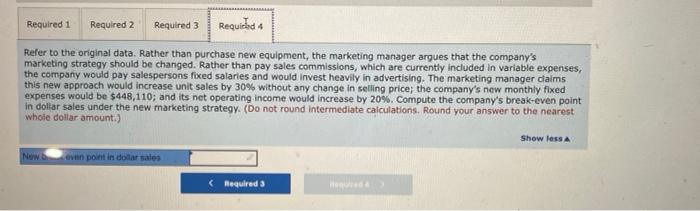

The Shlit Works sells a aarge variety of tee shirts and sweatshirts. Steve Hooper, the owner, Is thinking of expanding his sales by hiring high school students, on a commission basis, to sell sweatshirts bearing the name and mascot of the local high school: These sweatshirts would have to be ordered from the manufacturer six weeks in advance, and they could not be returned because of the unique printing required. The sweatshirts would cost Hooper $20.00 each with a minimum order of 222 sweatshirts. Any additional sweatshirts would have to be ordered in increments of 222. Since Hooper's plan would not require any additional facilities, the only costs associated with the project would be the costs of the sweatshirts and the costs of the sales commissions. The selling price of the sweatshirts would be $40.00 each. Hooper would pay the students a commission of $5.00 for each shirt sold. Required: 1. What level of unit sales and dollar sales is needed to attain a target profit of $13.320 ? 2. Assume that Hooper places an initial order for 222 sweatshirts. What is his break-even point in unit sales and dollar sales? (Round your intermediate calculations, round "Break-even point in unit sales" up to the nearest whole unit and round "Break-even point in dollar sales" to the nearest whole dollar.) 3. How many sweatshirts would Hooper need to sell to earn a target proft of $14,985 ? (Round final answer up to the nearest whole unit) Morton Company's contribution format income statement for last month is given below. The industry in which Morton Company operates is quite sensitive to cyclical movements in the economy. Thus, profits vary considerably from year to year according to general economic conditions. The company has a farge amount of unused capacity and is studying ways of improving profits. Required: 1. New equipment has come onto the market that would allow Morton Company to automate a portion bf its operations. Variable expenses would be reduced by $7.80 per unit. However, fixed expenses would increase to a total of $631,800 each month. Prepare two contribution format income statements, one showing present operations and one showing how operations would appear if the new equipment is purchased. 2. Refer to the income statements in (1). For the present operations and the proposed new operations, compute (a) the degree of operating leverage, (b) the break-even point in dollar sales. and (c) the margin of safety in dollars and the margin of safety percentage. 3. Refer again to the data in (1). As a manager, what factor would be paramount in your mind in deciding whether to purchase the new equipment? (Assume that enough funds are avallable to make the purchase.) 4. Refer to the original data. Rather than purchase new equipment, the marketing manager argues that the company's marketing strategy should be changed. Rather than pay sales commissions, which are currently included in variable expenses, the company would pay salespersons fixed salaries and would invest heavly in advertising. The marketing manager claims this new approach would increase unit sales by 30% without any change in selling price; the company's new monthly fixed expenses would be $448,110; and its net operating income would increase by 20%. Compute the company's breok-even point in dollar sales under the new marketing strategy: Complete this question by entering your answers in the tabs below. New equipment has come onto the maricet that would allow Morton Company to automate a portian of its operations. Variable expenses would be reduced by $7.80 per unit. However, fixed expenses would increase to a total of $631,800 each month. Prepare two contribution format income statements, one showing present operations and one showing how operations would appear if the new equipment is purchased. (Plound "Per. Unit" to 2 decimal places.) Complete this question by entering your answers in the tabs below. Pefer to the income statements in (1). For the present operations and the proposed new operations, compute (o) the degree of ogerating leverage, (b) the break-even point in dollar sales, and (c) the margin of safety in doliars and the margin of safety percentage. (Do not round intermediate calculations. Round your percentage answers to 2 decimal places (i.e. -1234 should bo entered as 12.34). ) Complete this question by enterinij your answers in the tabs below. Refor again to the data in (1). As a manager, what factor would be paramount in your mind in deciding whether to purchase the new equipment? (Assume that enough funds are available to make the purchase.) Refer to the original data. Rather than purchase new equipment, the marketing manager argues that the company's marketing strategy should be changed. Rather than pay sales commissions, which are currently included in variable expenses, the company would pay salespersons fixed salaries and would invest heavily in advertising. The marketing manager claims this new approach would increase unit sales by 30% without any change in selling price; the company's new monthly fixed expenses would be $448,110; and its net operating income would increase by 20%. Compute the company's break-even point in dollar sales under the new marketing strategy. (Do not round intermedlate calculations. Round your answer to the nearest whole dollar amount.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started