Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help! the the questions that are partially cut off i do not need an answer for. only the ones with the question and all

please help!

the the questions that are partially cut off i do not need an answer for. only the ones with the question and all the answer choices visible. thank you!

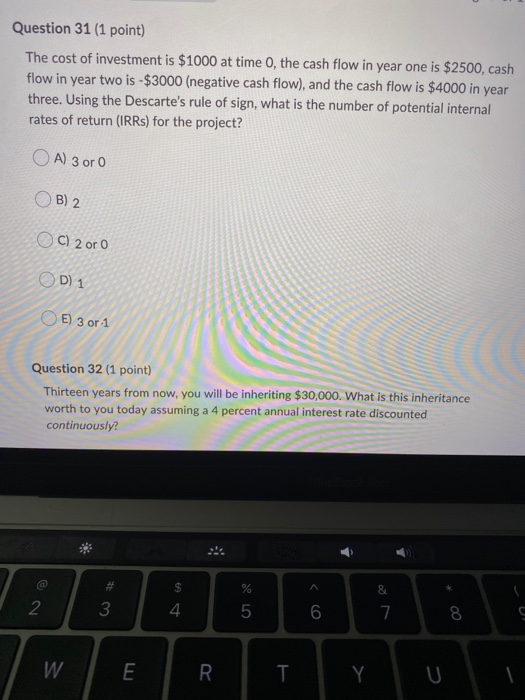

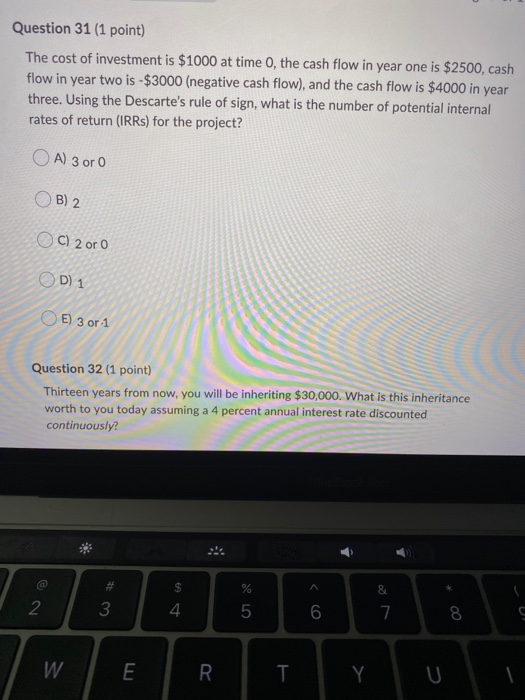

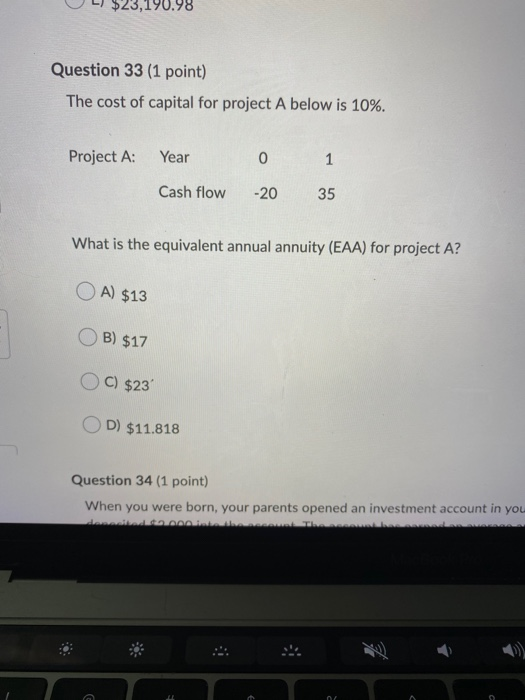

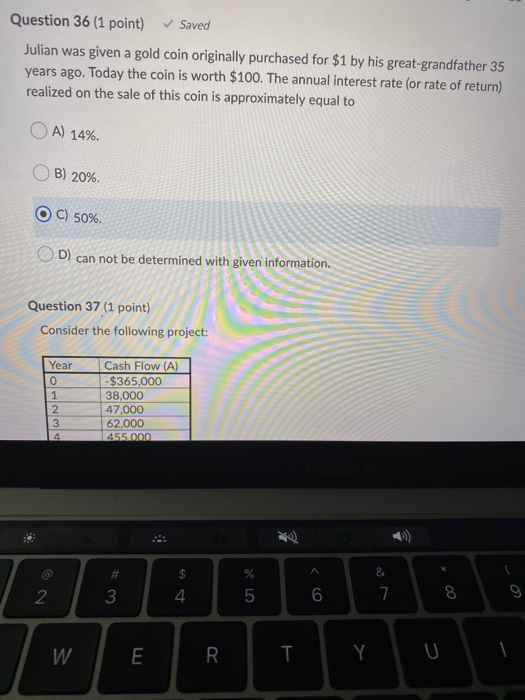

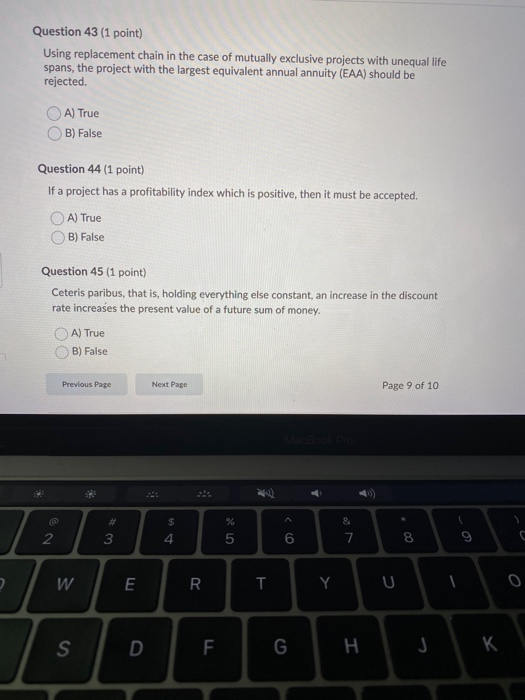

Question 31 (1 point) The cost of investment is $1000 at time 0, the cash flow in year one is $2500, cash flow in year two is - $3000 (negative cash flow), and the cash flow is $4000 in year three. Using the Descarte's rule of sign, what is the number of potential internal rates of return (IRRs) for the project? O A) 3 oro B) 2 C) 2 or 0 D) 1 E) 3 or 1 Question 32 (1 point) Thirteen years from now, you will be inheriting $30,000. What is this inheritance worth to you today assuming a 4 percent annual interest rate discounted continuously? a S & 2 3 4 5 6 7 8 W E R Y $23,190.98 Question 33 (1 point) The cost of capital for project A below is 10%. Project A: Year 0 1 Cash flow -20 35 What is the equivalent annual annuity (EAA) for project A? OA) $13 B) $17 C) $23 OD) $11.818 Question 34 (1 point) When you were born, your parents opened an investment account in you oitaaaaaa Question 36 (1 point) Saved Julian was given a gold coin originally purchased for $1 by his great-grandfather 35 years ago. Today the coin is worth $100. The annual interest rate (or rate of return) realized on the sale of this coin is approximately equal to OA) 14%. B) 20% C) 50% OD can not be determined with given information. Question 37 (1 point) Consider the following project: Year 0 Cash Flow (A) -$365,000 38,000 47,000 62,000 455.000 2 3 4 * # $ & 2 3 4 5 6 7 W E R T Y Question 43 (1 point) Using replacement chain in the case of mutually exclusive projects with unequal life spans, the project with the largest equivalent annual annuity (EAA) should be rejected A) True B) False Question 44 (1 point) If a project has a profitability index which is positive, then it must be accepted. A) True B) False Question 45 (1 point) Ceteris paribus, that is, holding everything else constant, an increase in the discount rate increases the present value of a future sum of money. A) True B) False Previous Page Next Page Page 9 of 10 : # $ 4 0 > & 7 2 3 5 8 9 W E R T Y S D F G H K Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started