Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help. the three attached pictures are financials Analyzing common-size financial statements) Use the common se financial statements found here to respond to your bosses

please help. the three attached pictures are financials

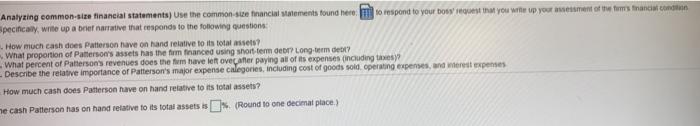

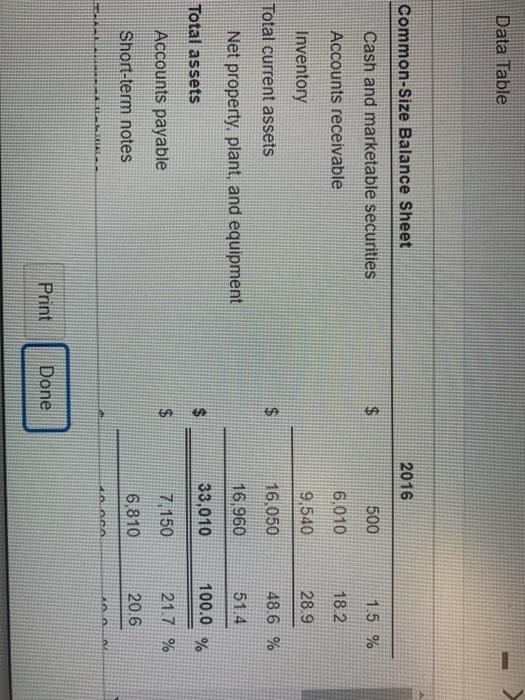

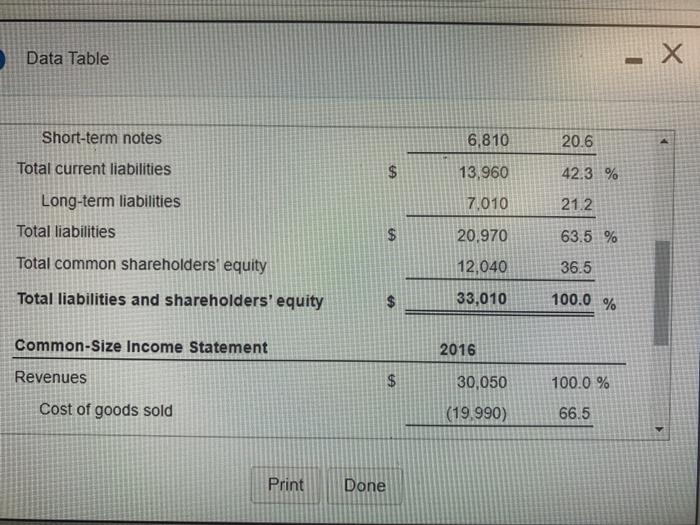

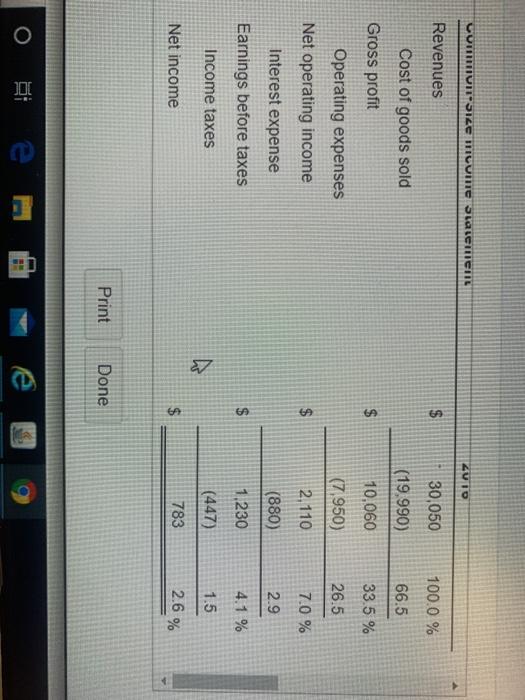

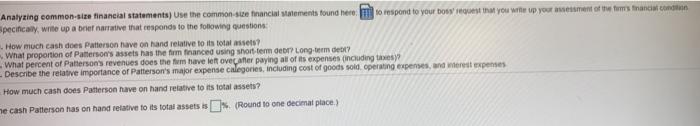

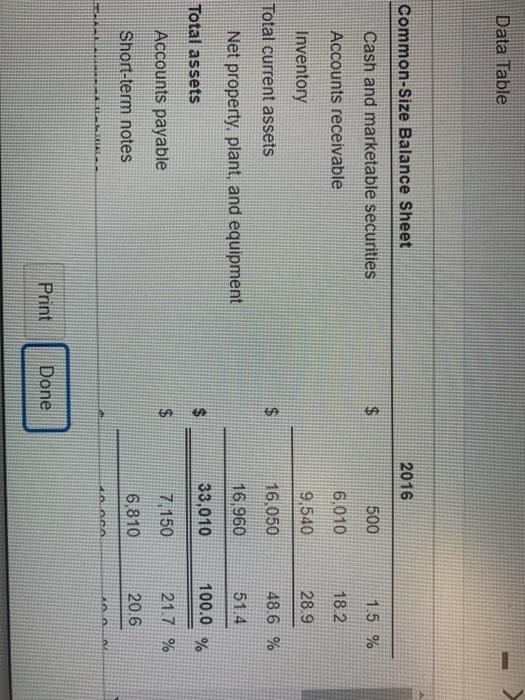

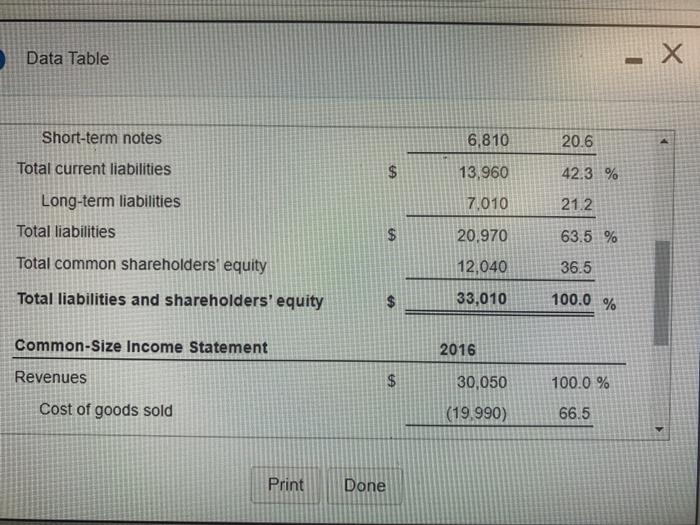

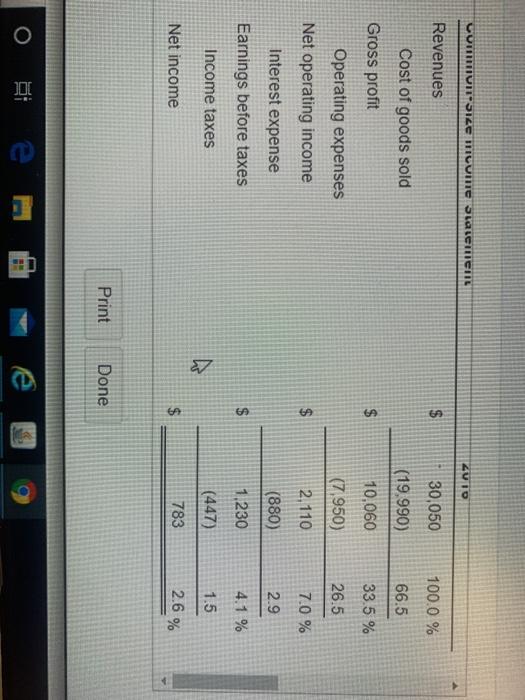

Analyzing common-size financial statements) Use the common se financial statements found here to respond to your bosses that you write up your assessment of forms financi Specifically, write up a brief narrative that responds to the following questions How much cash does Patterson save on hand relative to its total assets? What proportion of Patterson's assets has the firm financed using short term der Long term det What percent of Patterson's revenues does the fum have left over after paying all of its expenses (including the Describe the relative importance of Patterson's major expense calegories, including cost of goods sold operating expenses, and were expenses How much cash does Patterson have on hand relative to its total assets? me cash Patterson has on hand relative to its total assets is (Round to one decimat place) Data Table Common-Size Balance Sheet 2016 Cash and marketable securities $ 500 1.5 % Accounts receivable 6.010 18.2 Inventory 9,540 28.9 Total current assets $ 16.050 48.6 % Net property, plant, and equipment 16,960 51.4 $ Total assets 33,010 100.0 % $ 7,150 21.7 % Accounts payable Short-term notes 6,810 20.6 CA RA BREAL Print Done Data Table - X Short-term notes 6,810 20.6 Total current liabilities A 13,960 42.3 % Long-term liabilities 7,010 212 Total liabilities $ 20.970 63.5 % 12,040 36.5 Total common shareholders' equity Total liabilities and shareholders' equity 33,010 100.0 % Common-Size Income Statement 2016 Revenues $ 100.0 % Cost of goods sold 30,050 (19.990) 66.5 Print Done CUTIIVIISILE MUUme later IL ZUID Revenues $ 30,050 100.0 % (19.990) 66.5 10,060 33.5 % Cost of goods sold Gross profit Operating expenses Net operating income (7,950) 26.5 $ 2.110 7.0 % Interest expense (880) 2.9 Earnings before taxes $ 1,230 4.1 % Income taxes w (447) 1.5 Net income $ 783 2.6 % Print Done O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started