Question

PLEASE HELP! There is a vigorous global debate about the existence and/or extent of global warming. At the same time investor demand for alternative energy

PLEASE HELP!

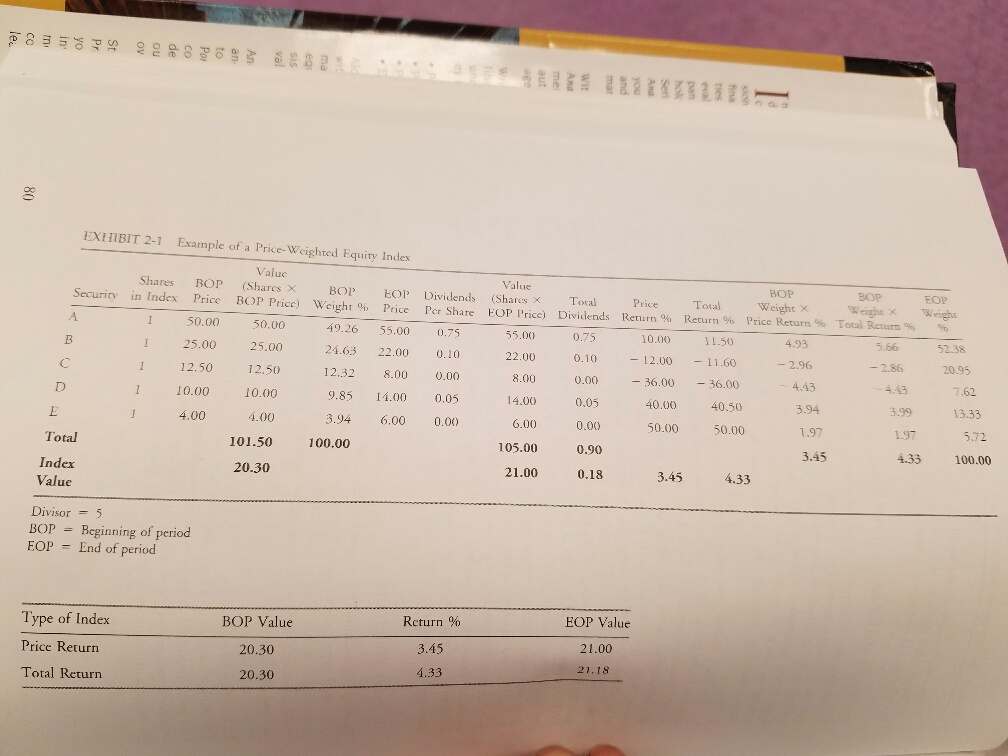

There is a vigorous global debate about the existence and/or extent of global warming. At the same time investor demand for alternative energy stocks, ETFs and indexes is rising. One of the investors you advise in your financial planning practice asks you to invest in a custom basket of alternative energy stocks. This Quiz will see you create a custom basket of alternative energy stocks, a price weighted alternative energy index for those stocks, and then calculate the performance of the custom index. (Hint: The information and examples you need to create a price weighted index are given in chapter 2 of the text.)

Define alternative energy. Use your definition as the basis to create a clear description for your custom alternative energy index.

2. By researching the internet and financial websites (Yahoo! Finance, Bloomberg, Google, etc.) choose five stocks that fit your definition of alternative energy companies, and provide a brief description of what each company does.

Calculate and show the weekly return of your index during Q4 2015.

4. Find a currently trading alternative energy ETF and calculate its price performance over the same period you calculated your custom index performance in requirement 3. 1

I'm confused on what information from Chapter 2 I would use. I have taken pictures of all the tables in chapter two in hopes that someone may be able to assist me.

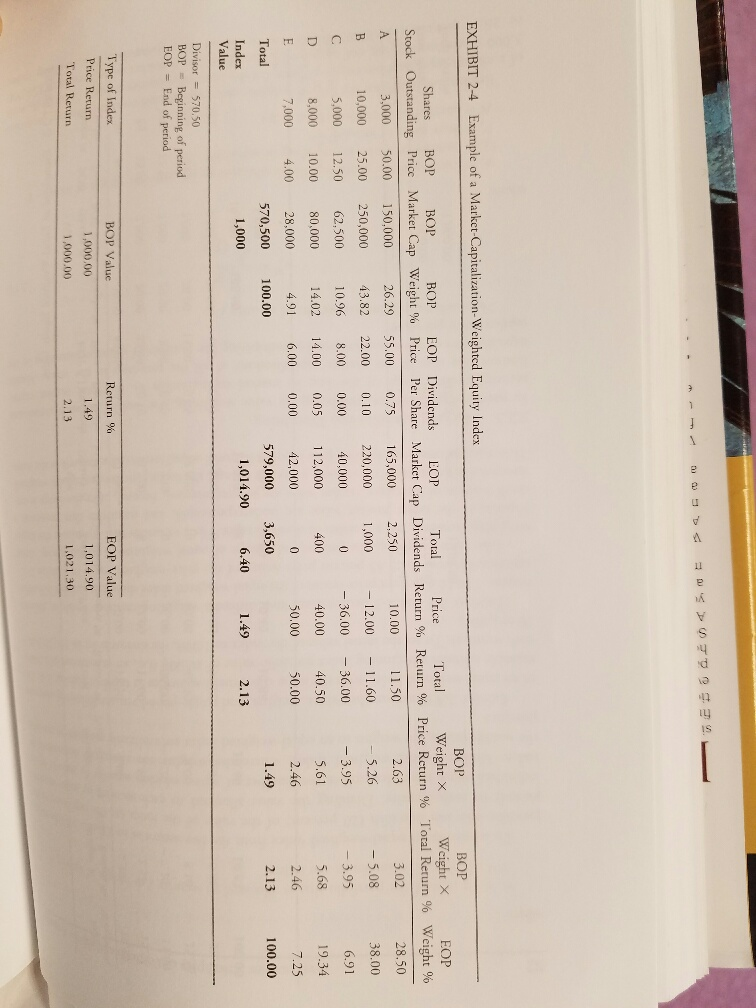

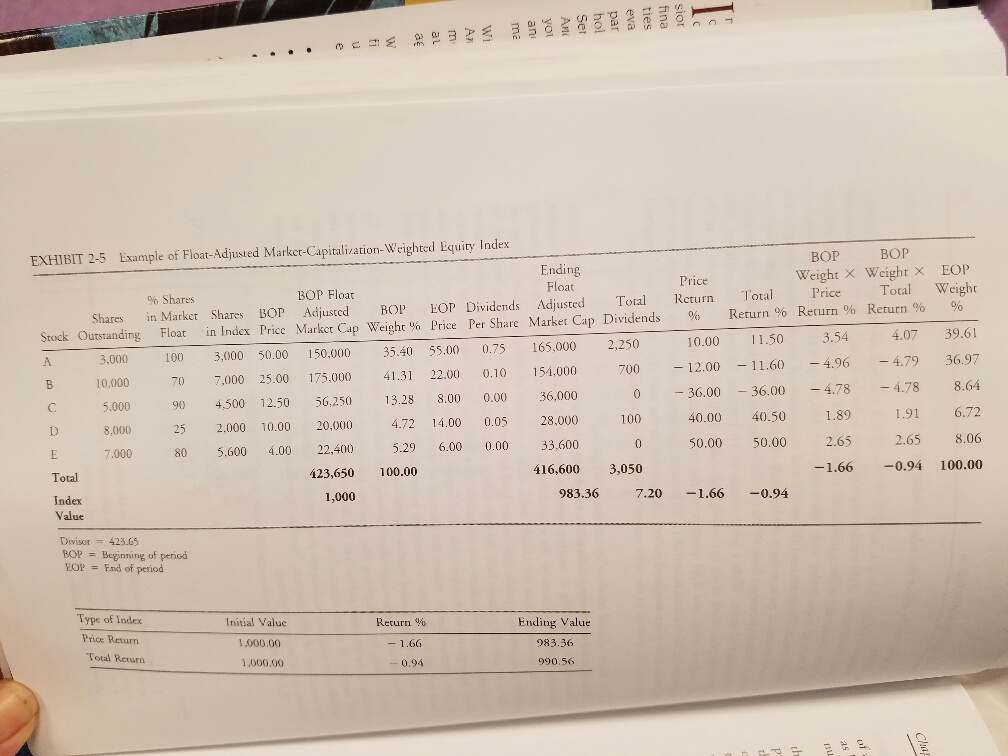

EXHIBIT 2-1 Example of a Price-Weighted Equity Index Value Securiry Shares BCP (Shares x BOP EOP Dividend, Shares x Total Price Total Weight X weight X weight in Index Price BOP Price) Weight Price Por Share EOP Price) Dividends Return Return Price Return Total Retarm 50.00 50.00 49.26 55.00 0.75 55.0 10.00 1.50 4.93 25.00 25.00 24.63 22.00 0.10 22.00 2.00 1 12.50 12.50 2095 12.32 8.00 0.00 8.00 0.00 36.00 36.00 4.43 1 10.00 10.00 9.85 14.00 0,05 4.00 0,05 40.00 40.50 3.94 13.33 4.00 4.00 3.94 6.00 0.0 6.00 0.00 50.00 50.00 1.97 Total 572 101.50 100.00 105.00 0.90 3.45 4.33 100.00 Index 20.30 21.00 0.18 3.45 4.33 Value Divisor BOP ng of period EOP End of period Type of Index BOP Value Return EOP Value Price Return 3.45 20.30 21.00 Total Return 33 20.30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started