Answered step by step

Verified Expert Solution

Question

1 Approved Answer

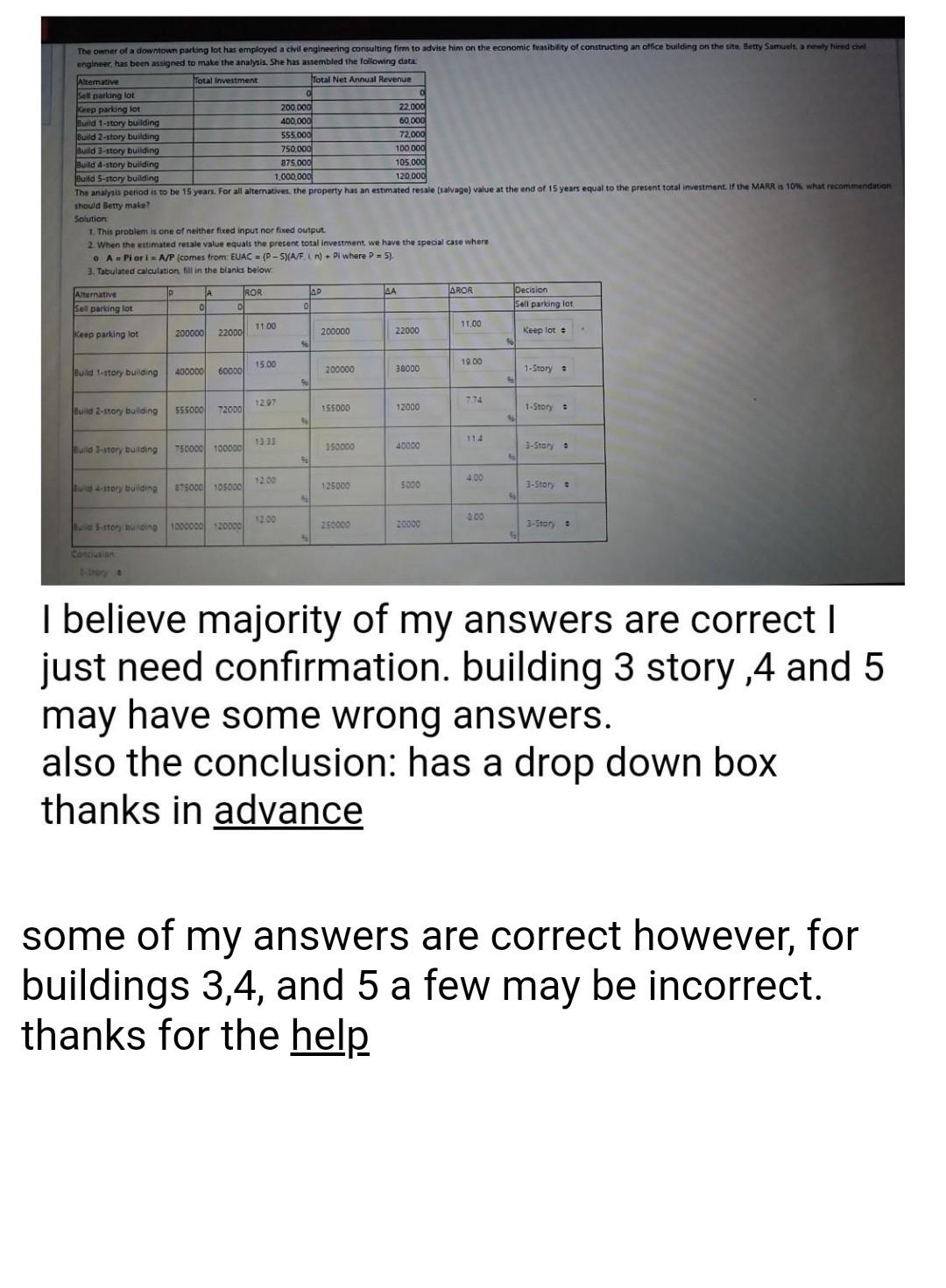

please help there is also a drop down box at the bottom please help me thanks Keep paring for The owner of a downtown parking

please help

there is also a drop down box at the bottom

please help me thanks

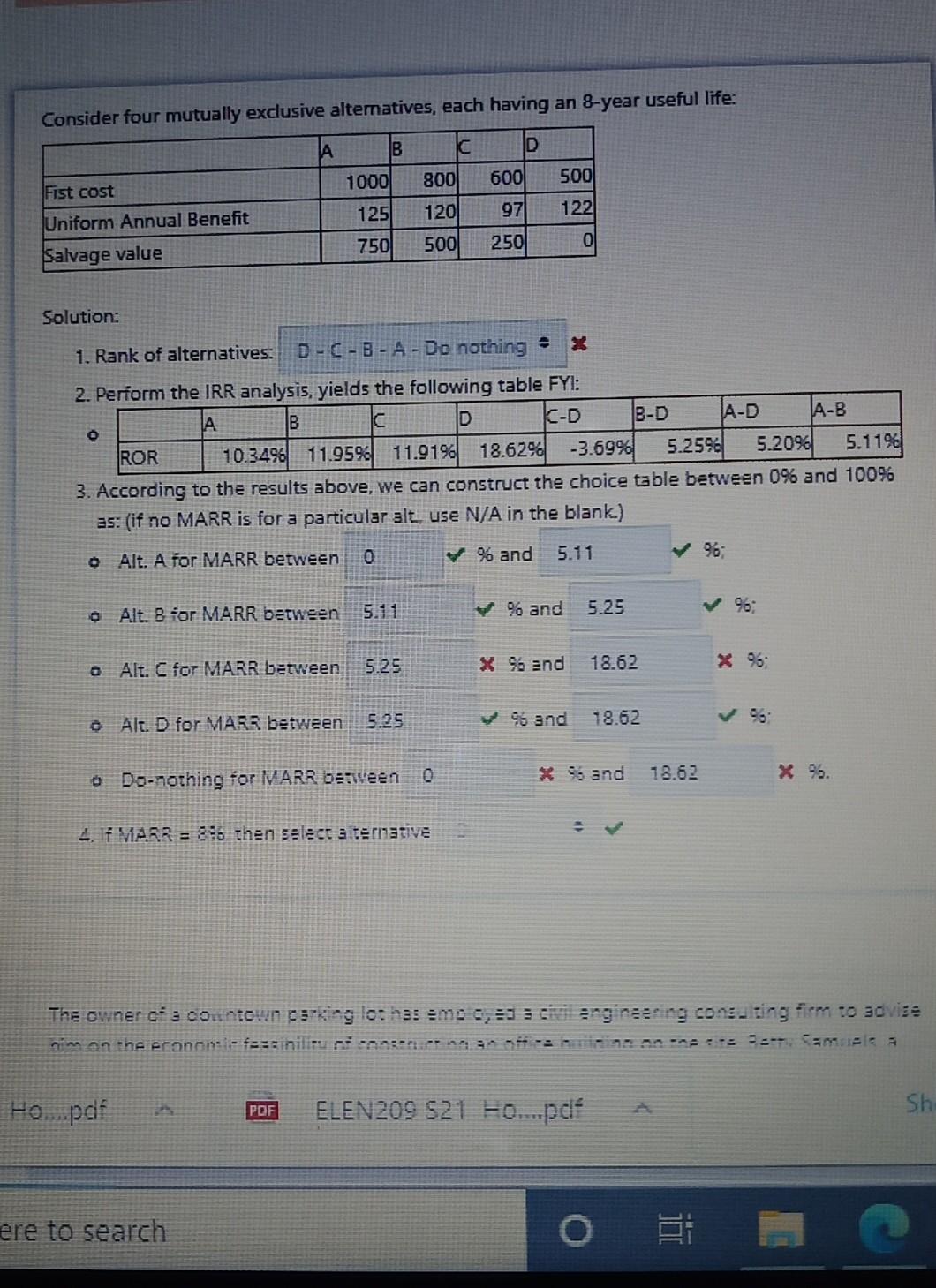

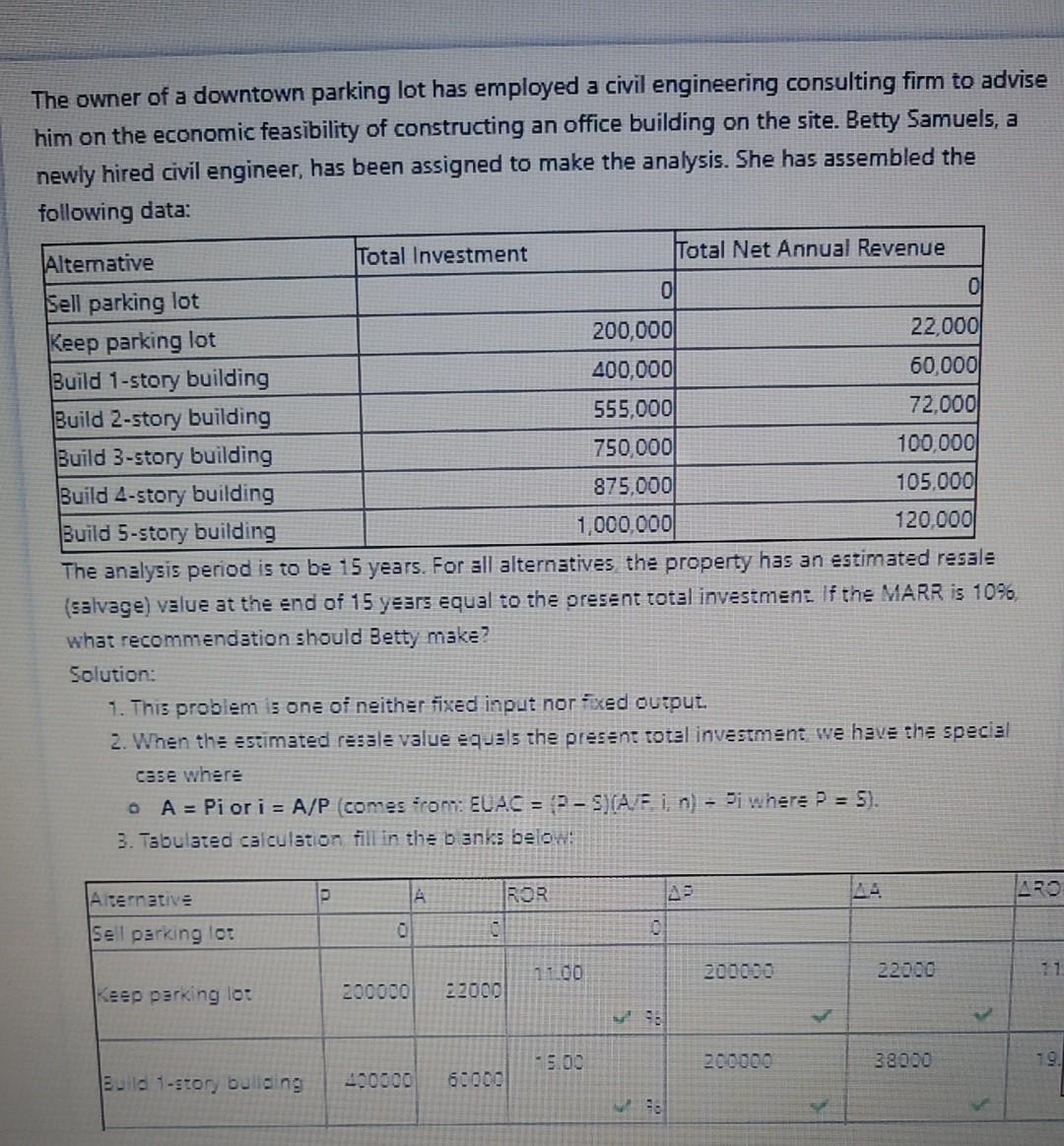

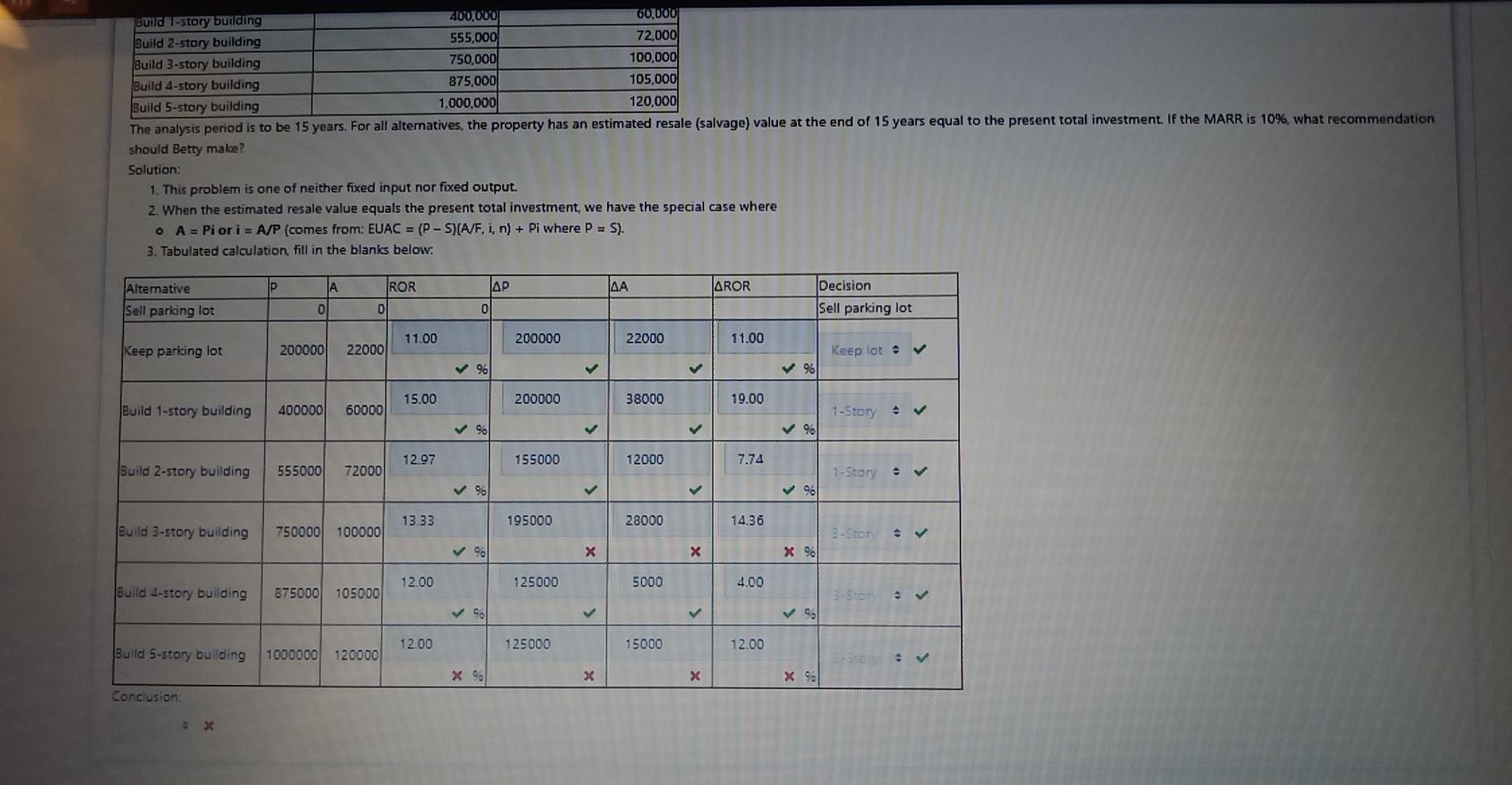

Keep paring for The owner of a downtown parking lot has employed a civil engineering consulting firm to advise him on the economic feasibility of constructing an office building on the site Betty Samuelt, nemy heed col engineer has been assigned to make the analysis. She has assembled the following data Alternative Total Investment Total Net Annual Revenue Sel parlang lot 200 000 22.000 Butid 1-story building 400.000 60,000 Build 2-story building 555.000 72.000 Jaud 3-story building Build 4-story building Build 5-story building 1.000.000 120.000 The analyze period is to be 15 year. For all alternatives the property has an estimated resale (salvage) value at the end of 15 years equal to the present total investment. If the MARR is 10% what recommendation should Betty make7 750.000 100 Dod 105.000 a75.000 Solutions 1. This problem is one of neither fixed input nor faed output 2. When the estimated resale value equals the present total investment we have the special case where O A Piori A/P (comes from EUAC = (P-SYAF LN) Pi where P = 5) 3. Tabulated calculation fill in the blanks below: ROR JAD AROR Alternative Sell parking lot Decision Sell parking lot 11.00 11.00 200000 22000 200000 Keep parking lot 22000 Keep lot 15.00 19.00 Build 1-story building 400000 60000 200000 38000 1-Story 1297 774 Build 2-story building 555000 72000 155000 12000 1-Story: 13.33 Bund -story budding 750000 100000 350000 40000 3-Story. 12.00 400 Bus story building 275000 105000 125000 5000 3-Story 1200 000 5.tohto 1000000 20000 250000 20000 3-Story : I believe majority of my answers are correct | just need confirmation. building 3 story , 4 and 5 may have some wrong answers. also the conclusion: has a drop down box thanks in advance some of my answers are correct however, for buildings 3,4, and 5 a few may be incorrect. thanks for the help Consider four mutually exclusive alternatives, each having an 8-year useful life: A | C ID 1000 800 600 500 125 120 97 122 Fist cost Uniform Annual Benefit Salvage value 750 500 250 0 Solution: 1. Rank of alternatives: D-C-B-A - Do nothing - 2. Perform the IRR analysis, yields the following table FYI: A B D K-D B-D A-D A-B ROR 10.349 11.95% 11.91% 18.6296 -3.69% 5.2596 5.2096 5.1190 3. According to the results above, we can construct the choice table between 0% and 100% as: (if no MARR is for a particular alt, use N/A in the blank) Alt. A for MARR between 0 % and 5.11 % Alt B For MARR between 5.11 % and 5.25 Alt. C for MARR between 5.25 X9 and 18.62 * % Alt. D for MARR between o 5.25 95 and 18.62 o Do-nothing for IVARR benveen 0 96 and 18.62 X 96 4. F MARR = 896 then select alternative The owner of a counteunking lot has emo ,ngineering consulting firm to advise mon the eranon:- forsiniliures. En annen Same Ho....pdf POF Sh ELEN209 S21 Fo....pdf ere to search o The owner of a downtown parking lot has employed a civil engineering consulting firm to advise him on the economic feasibility of constructing an office building on the site. Betty Samuels, a newly hired civil engineer, has been assigned to make the analysis. She has assembled the following data: Altemative Total Investment Total Net Annual Revenue O 0 Sell parking lot Keep parking lot 200,000 22 000 Build 1-story building 400,000 60,000 Build 2-story building 555,000 72.000 Build 3-story building 750,000 100,000 Build 4-story building 875,000 105,000 Build 5-story building 1,000,000 120.000 The analysis period is to be 15 years. For all alternatives the property has an estimated resale (salvage) value at the end of 15 years equal to the present total investment If the MARR is 10% what recommendation should Betty make? Solution: 1. This problem is one of neither fixed input nor fixed output 2. When the estimated resale value equals the present total investment we have the special case where A = Pior i = A/P (comes from: EUAC = 2-SJAJE n - Si where P = 5). 3. Tabulated calculation fill in the banks below: Alternative 14 ROR FO AB Sel parking lot 0 200000 22000 Keep parking lot 200000 22000 - 5.00 200000 38000 19. Build 1-story bulding 400000 2400.000 Build 1-story building 60.000 Build 2-story building 555,000 72,000 Build 3-story building 750,000 100,000 Build 4-story building 875,000 105,000 Build 5-story building 1,000,000 120,000 The analysis period is to be 15 years. For all alternatives, the property has an estimated resale (salvage) value at the end of 15 years equal to the present total investment. If the MARR is 10%, what recommendation should Betty make? Solution: 1. This problem is one of neither fixed input nor fixed output. 2. When the estimated resale value equals the present total investment, we have the special case where O A = Pior i = A/P (comes from: EUAC = (P-S)[A/F, i, n) + Pi where P = S). 3. Tabulated calculation, fill in the blanks below: IP | ROR AROR Alternative Sell parking lot Decision Sell parking lot 0 0 0 11.00 200000 22000 11.00 Keep parking lot 200000 22000 Keep lot 96 > 9 15.00 200000 38000 19.00 Build 1-story building 400000 60000 1-Story % 12.97 155000 12000 7.74 Suild 2-story building 555000 72000 1-Story 96 > 13.33 195000 28000 14.36 Build 3-story building 750000 100000 96 X X% 12.00 125000 5000 4.00 Build 4-story building 875000 105000| > 90 > > 90 12.00 125000 15000 12.00 Build 5-story building 1000000 120000 X 96 X x X 901 Conclusion Keep paring for The owner of a downtown parking lot has employed a civil engineering consulting firm to advise him on the economic feasibility of constructing an office building on the site Betty Samuelt, nemy heed col engineer has been assigned to make the analysis. She has assembled the following data Alternative Total Investment Total Net Annual Revenue Sel parlang lot 200 000 22.000 Butid 1-story building 400.000 60,000 Build 2-story building 555.000 72.000 Jaud 3-story building Build 4-story building Build 5-story building 1.000.000 120.000 The analyze period is to be 15 year. For all alternatives the property has an estimated resale (salvage) value at the end of 15 years equal to the present total investment. If the MARR is 10% what recommendation should Betty make7 750.000 100 Dod 105.000 a75.000 Solutions 1. This problem is one of neither fixed input nor faed output 2. When the estimated resale value equals the present total investment we have the special case where O A Piori A/P (comes from EUAC = (P-SYAF LN) Pi where P = 5) 3. Tabulated calculation fill in the blanks below: ROR JAD AROR Alternative Sell parking lot Decision Sell parking lot 11.00 11.00 200000 22000 200000 Keep parking lot 22000 Keep lot 15.00 19.00 Build 1-story building 400000 60000 200000 38000 1-Story 1297 774 Build 2-story building 555000 72000 155000 12000 1-Story: 13.33 Bund -story budding 750000 100000 350000 40000 3-Story. 12.00 400 Bus story building 275000 105000 125000 5000 3-Story 1200 000 5.tohto 1000000 20000 250000 20000 3-Story : I believe majority of my answers are correct | just need confirmation. building 3 story , 4 and 5 may have some wrong answers. also the conclusion: has a drop down box thanks in advance some of my answers are correct however, for buildings 3,4, and 5 a few may be incorrect. thanks for the help Consider four mutually exclusive alternatives, each having an 8-year useful life: A | C ID 1000 800 600 500 125 120 97 122 Fist cost Uniform Annual Benefit Salvage value 750 500 250 0 Solution: 1. Rank of alternatives: D-C-B-A - Do nothing - 2. Perform the IRR analysis, yields the following table FYI: A B D K-D B-D A-D A-B ROR 10.349 11.95% 11.91% 18.6296 -3.69% 5.2596 5.2096 5.1190 3. According to the results above, we can construct the choice table between 0% and 100% as: (if no MARR is for a particular alt, use N/A in the blank) Alt. A for MARR between 0 % and 5.11 % Alt B For MARR between 5.11 % and 5.25 Alt. C for MARR between 5.25 X9 and 18.62 * % Alt. D for MARR between o 5.25 95 and 18.62 o Do-nothing for IVARR benveen 0 96 and 18.62 X 96 4. F MARR = 896 then select alternative The owner of a counteunking lot has emo ,ngineering consulting firm to advise mon the eranon:- forsiniliures. En annen Same Ho....pdf POF Sh ELEN209 S21 Fo....pdf ere to search o The owner of a downtown parking lot has employed a civil engineering consulting firm to advise him on the economic feasibility of constructing an office building on the site. Betty Samuels, a newly hired civil engineer, has been assigned to make the analysis. She has assembled the following data: Altemative Total Investment Total Net Annual Revenue O 0 Sell parking lot Keep parking lot 200,000 22 000 Build 1-story building 400,000 60,000 Build 2-story building 555,000 72.000 Build 3-story building 750,000 100,000 Build 4-story building 875,000 105,000 Build 5-story building 1,000,000 120.000 The analysis period is to be 15 years. For all alternatives the property has an estimated resale (salvage) value at the end of 15 years equal to the present total investment If the MARR is 10% what recommendation should Betty make? Solution: 1. This problem is one of neither fixed input nor fixed output 2. When the estimated resale value equals the present total investment we have the special case where A = Pior i = A/P (comes from: EUAC = 2-SJAJE n - Si where P = 5). 3. Tabulated calculation fill in the banks below: Alternative 14 ROR FO AB Sel parking lot 0 200000 22000 Keep parking lot 200000 22000 - 5.00 200000 38000 19. Build 1-story bulding 400000 2400.000 Build 1-story building 60.000 Build 2-story building 555,000 72,000 Build 3-story building 750,000 100,000 Build 4-story building 875,000 105,000 Build 5-story building 1,000,000 120,000 The analysis period is to be 15 years. For all alternatives, the property has an estimated resale (salvage) value at the end of 15 years equal to the present total investment. If the MARR is 10%, what recommendation should Betty make? Solution: 1. This problem is one of neither fixed input nor fixed output. 2. When the estimated resale value equals the present total investment, we have the special case where O A = Pior i = A/P (comes from: EUAC = (P-S)[A/F, i, n) + Pi where P = S). 3. Tabulated calculation, fill in the blanks below: IP | ROR AROR Alternative Sell parking lot Decision Sell parking lot 0 0 0 11.00 200000 22000 11.00 Keep parking lot 200000 22000 Keep lot 96 > 9 15.00 200000 38000 19.00 Build 1-story building 400000 60000 1-Story % 12.97 155000 12000 7.74 Suild 2-story building 555000 72000 1-Story 96 > 13.33 195000 28000 14.36 Build 3-story building 750000 100000 96 X X% 12.00 125000 5000 4.00 Build 4-story building 875000 105000| > 90 > > 90 12.00 125000 15000 12.00 Build 5-story building 1000000 120000 X 96 X x X 901 ConclusionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started