please help! there not long !

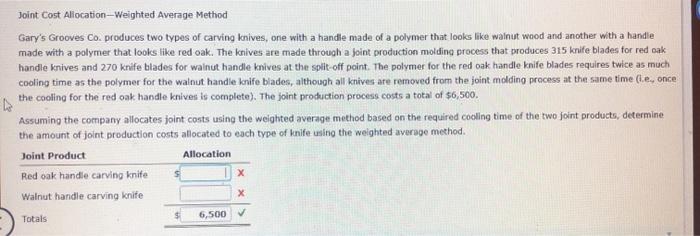

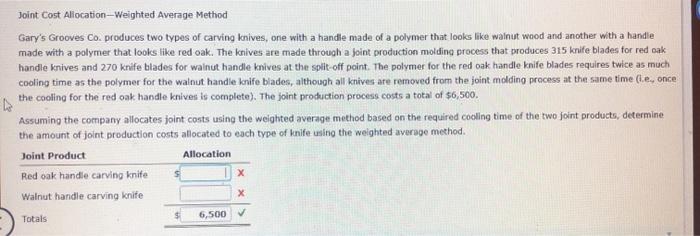

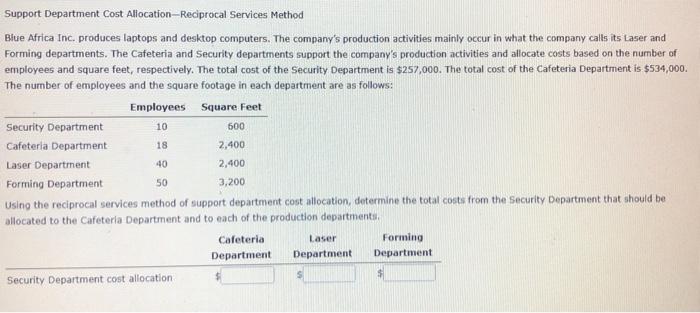

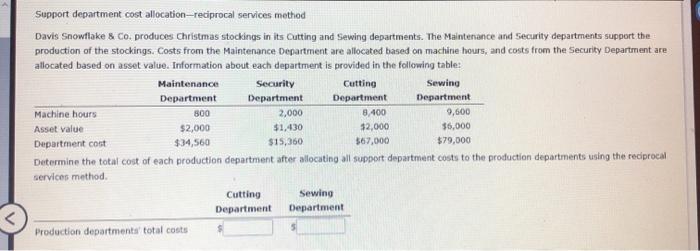

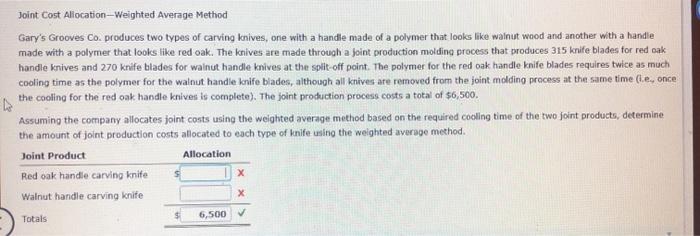

Joint Cost Allocation-Weighted Average Method Gary's Grooves Co. produces two types of carving knives, one with a handle made of a polymer that looks like walnut wood and another with a handie made with a polymer that looks like red oak. The knives are made through a joint production molding process that produces 315 knife blades for red oak handle knives and 270 knife blades for walnut handle knives at the split off point. The polymer for the red oak handle knife blades requires twice as much cooling time as the polymer for the walnut handle knife blades, although all knives are removed from the joint molding process at the same time (le, once the cooling for the red oak handle knives is complete). The joint production process costs a total of $6,500. Assuming the company allocates joint costs using the weighted average method based on the required cooling time of the two joint products, determine the amount of joint production costs allocated to each type of knife using the weighted average method. Joint Product Allocation Red oak handle carving knife X Walnut handle carving knife Totals 6,500 600 Support Department Cost AllocationReciprocal Services Method Blue Africa Inc. produces laptops and desktop computers. The company's production activities mainly occur in what the company calls its Laser and Forming departments. The Cafeteria and Security departments support the company's production activities and allocate costs based on the number of employees and square feet, respectively. The total cost of the Security Department is $257,000. The total cost of the cafeteria Department is $534,000. The number of employees and the square footage in each department are as follows: Employees Square Feet Security Department 10 Cafeteria Department 2,400 Laser Department 40 2,400 Forming Department 50 3,200 Using the reciprocal services method of support department cost allocation, determine the total costs from the security Department that should be allocated to the Cafeteria Department and to each of the production departments, Cafeteria Laser Forming Department Department Department Security Department cost allocation 18 Support department cost allocation-reciprocal services method Davis Snowflake & Co. produces Christmas stockings in its Outting and Sewing departments. The Maintenance and Security departments support the production of the stockings. Costs from the Maintenance Department are allocated based on machine hours, and costs from the Security Department are allocated based on asset value. Information about each department is provided in the following table: Maintenance Security Cutting Sewing Department Department Department Department Machine hours 800 2,000 8.400 9,600 Asset value $2,000 $1,430 $2,000 $6,000 Department cost $34,560 $15,360 567,000 $79,000 Determine the total cost of each production department after allocating all support department costs to the production departments using the reciprocal services method Cutting Sewing Department Department Production departments total costs