Please help this makes no sense to me

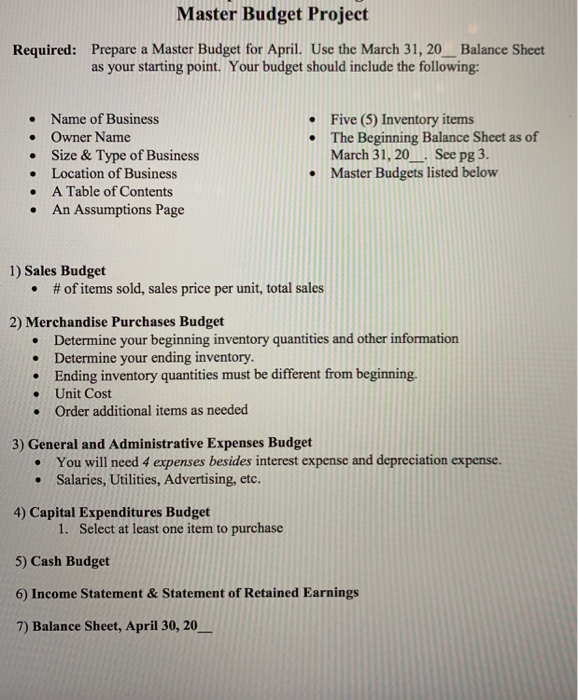

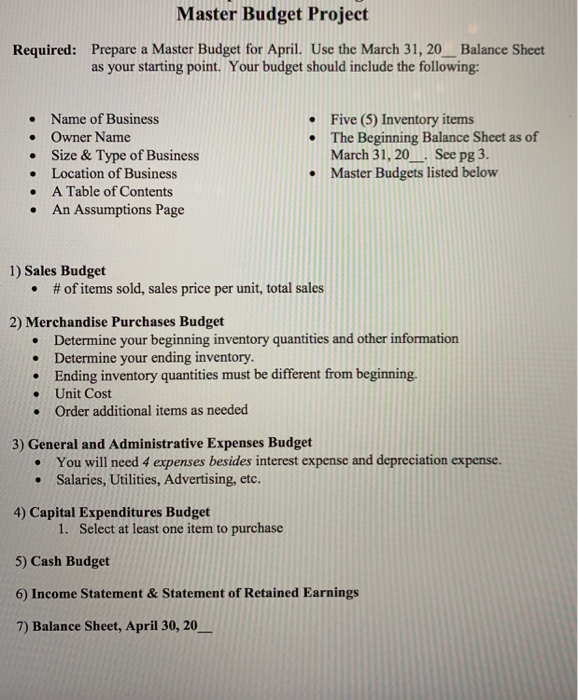

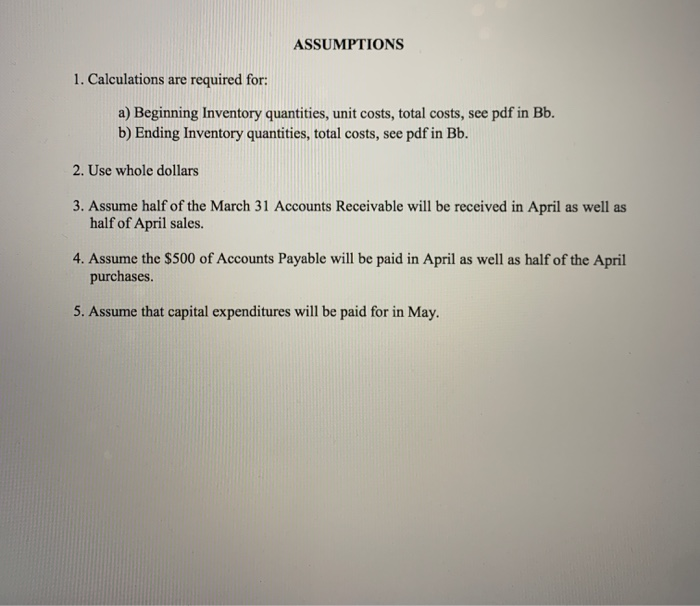

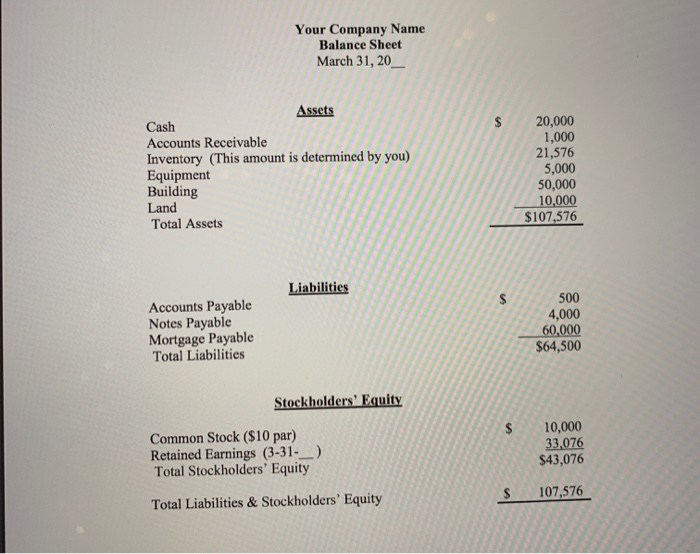

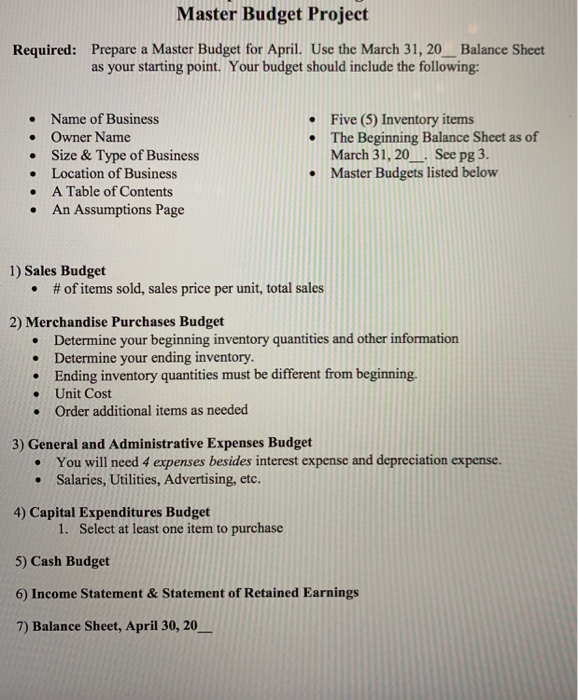

Master Budget Project Required: Prepare a Master Budget for April. Use the March 31, 20_Balance Sheet as your starting point. Your budget should include the following: Name of Business Owner Name Size & Type of Business Location of Business A Table of Contents An Assumptions Page Five (5) Inventory items The Beginning Balance Sheet as of March 31, 20_. See pg 3. Master Budgets listed below 1) Sales Budget # of items sold, sales price per unit, total sales 2) Merchandise Purchases Budget Determine your beginning inventory quantities and other information Determine your ending inventory. Ending inventory quantities must be different from beginning. Unit Cost Order additional items as needed 3) General and Administrative Expenses Budget You will need 4 expenses besides interest expense and depreciation expense. Salaries, Utilities, Advertising, etc. 4) Capital Expenditures Budget 1. Select at least one item to purchase 5) Cash Budget 6) Income Statement & Statement of Retained Earnings 7) Balance Sheet, April 30, 20_ ASSUMPTIONS 1. Calculations are required for: a) Beginning Inventory quantities, unit costs, total costs, see pdf in Bb. b) Ending Inventory quantities, total costs, see pdf in Bb. 2. Use whole dollars 3. Assume half of the March 31 Accounts Receivable will be received in April as well as half of April sales. 4. Assume the $500 of Accounts Payable will be paid in April as well as half of the April purchases. 5. Assume that capital expenditures will be paid for in May. Your Company Name Balance Sheet March 31, 20___ Assets Cash Accounts Receivable Inventory (This amount is determined by you) Equipment Building Land Total Assets 20,000 1,000 21,576 5,000 50,000 10,000 $107,576 Liabilities Accounts Payable Notes Payable Mortgage Payable Total Liabilities 500 4.000 60,000 $64,500 Stockholders' Equity Common Stock ($10 par) Retained Earnings (3-31- Total Stockholders' Equity 10,000 33,076 $43,076 ) $ 107,576 Total Liabilities & Stockholders' Equity Master Budget Project Required: Prepare a Master Budget for April. Use the March 31, 20_Balance Sheet as your starting point. Your budget should include the following: Name of Business Owner Name Size & Type of Business Location of Business A Table of Contents An Assumptions Page Five (5) Inventory items The Beginning Balance Sheet as of March 31, 20_. See pg 3. Master Budgets listed below 1) Sales Budget # of items sold, sales price per unit, total sales 2) Merchandise Purchases Budget Determine your beginning inventory quantities and other information Determine your ending inventory. Ending inventory quantities must be different from beginning. Unit Cost Order additional items as needed 3) General and Administrative Expenses Budget You will need 4 expenses besides interest expense and depreciation expense. Salaries, Utilities, Advertising, etc. 4) Capital Expenditures Budget 1. Select at least one item to purchase 5) Cash Budget 6) Income Statement & Statement of Retained Earnings 7) Balance Sheet, April 30, 20_ ASSUMPTIONS 1. Calculations are required for: a) Beginning Inventory quantities, unit costs, total costs, see pdf in Bb. b) Ending Inventory quantities, total costs, see pdf in Bb. 2. Use whole dollars 3. Assume half of the March 31 Accounts Receivable will be received in April as well as half of April sales. 4. Assume the $500 of Accounts Payable will be paid in April as well as half of the April purchases. 5. Assume that capital expenditures will be paid for in May. Your Company Name Balance Sheet March 31, 20___ Assets Cash Accounts Receivable Inventory (This amount is determined by you) Equipment Building Land Total Assets 20,000 1,000 21,576 5,000 50,000 10,000 $107,576 Liabilities Accounts Payable Notes Payable Mortgage Payable Total Liabilities 500 4.000 60,000 $64,500 Stockholders' Equity Common Stock ($10 par) Retained Earnings (3-31- Total Stockholders' Equity 10,000 33,076 $43,076 ) $ 107,576 Total Liabilities & Stockholders' Equity