Please help! This project is due soon and I am struggling.

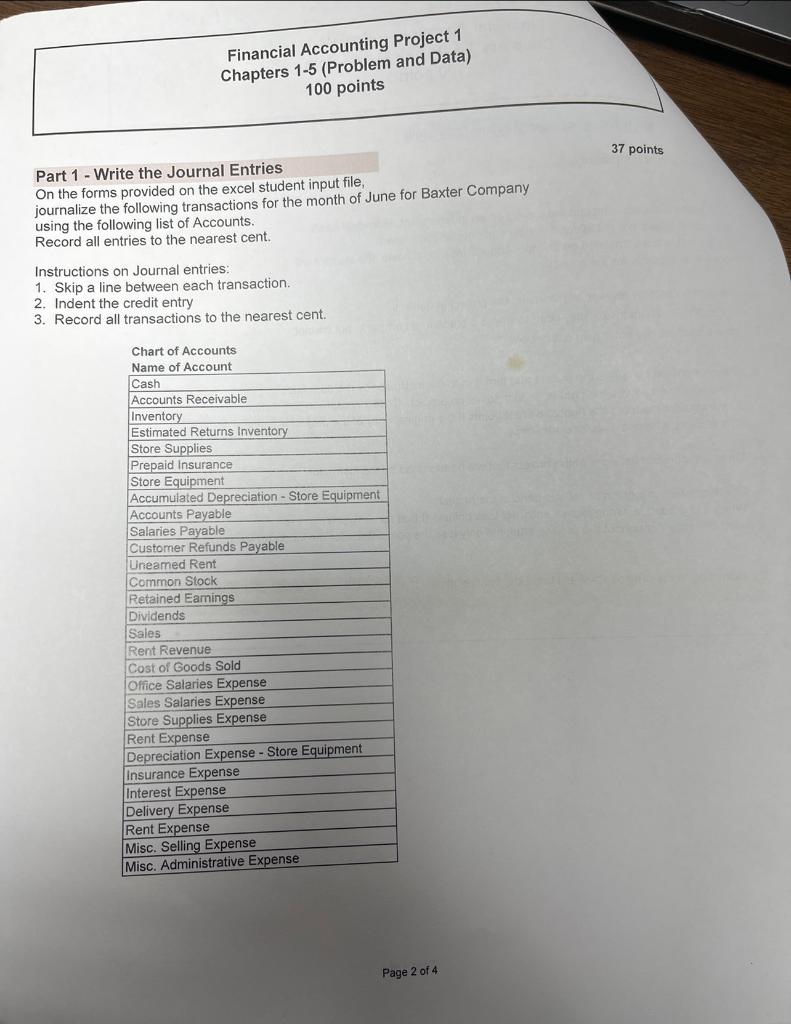

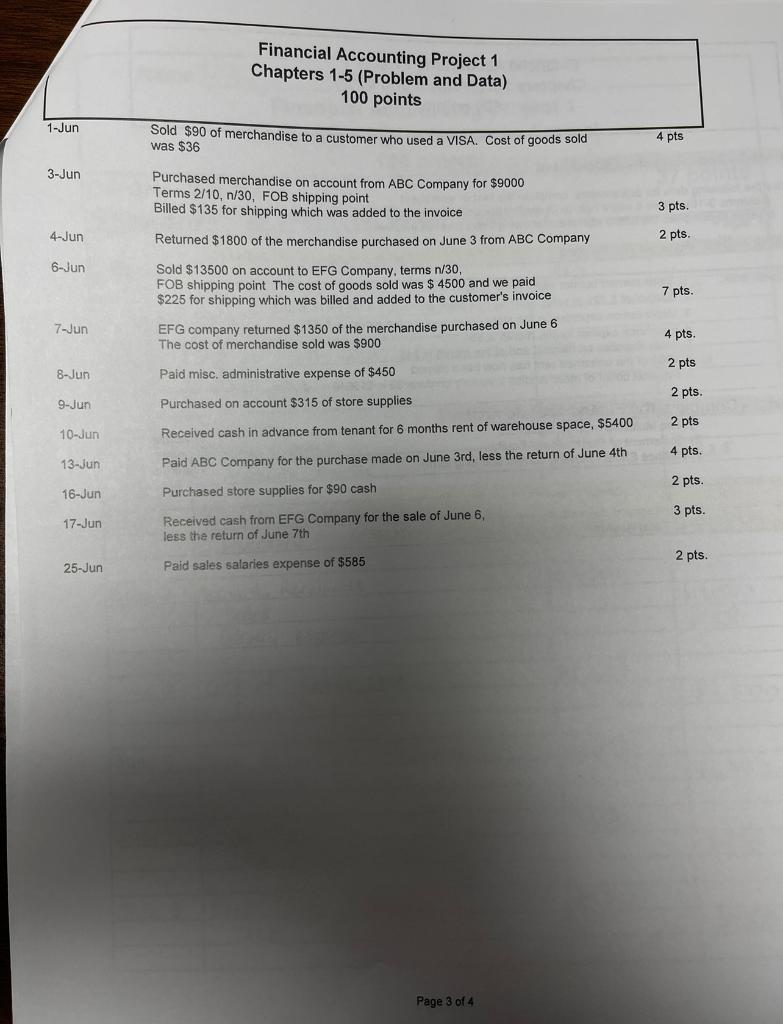

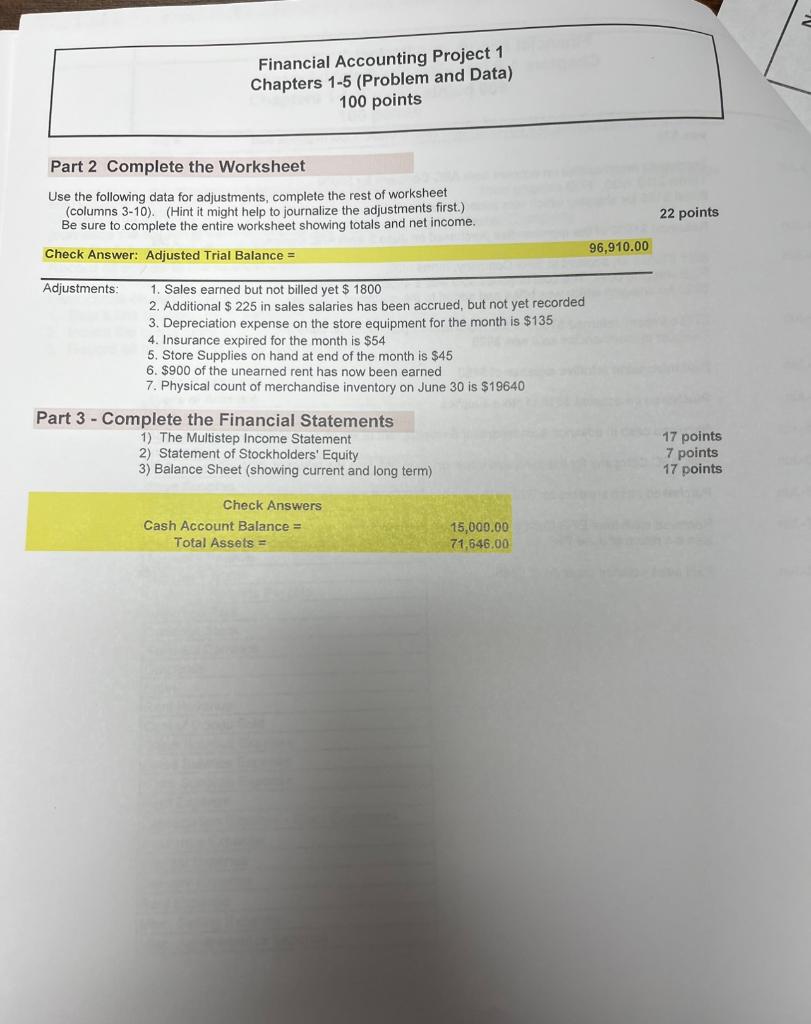

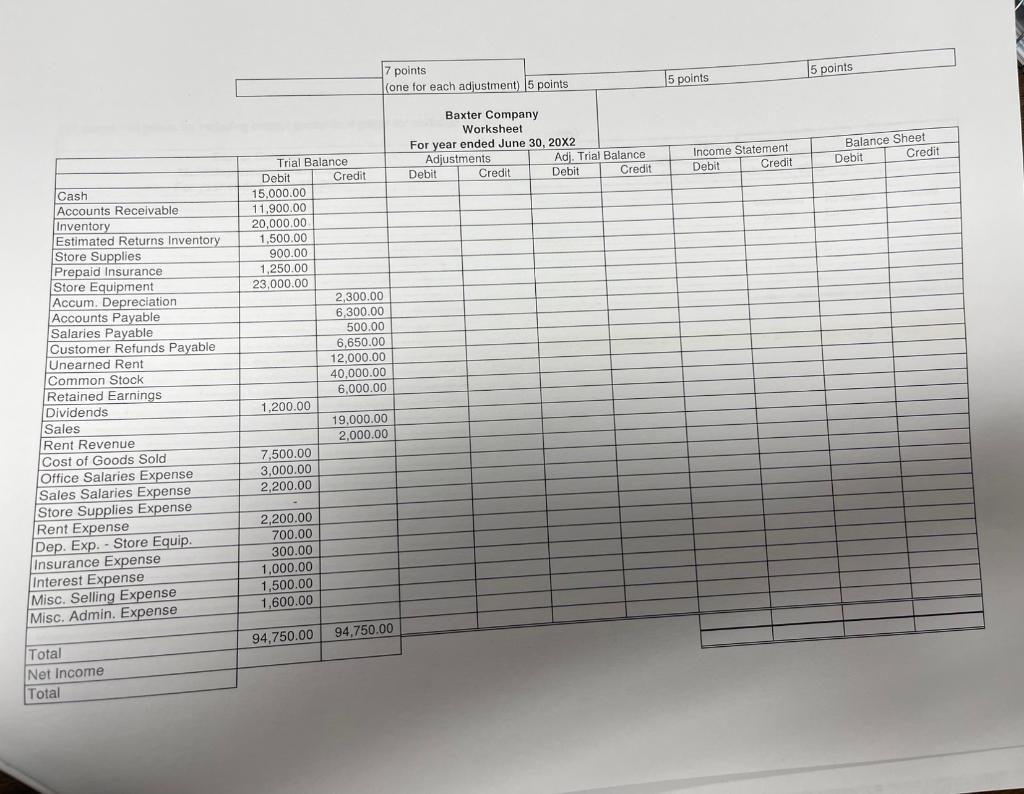

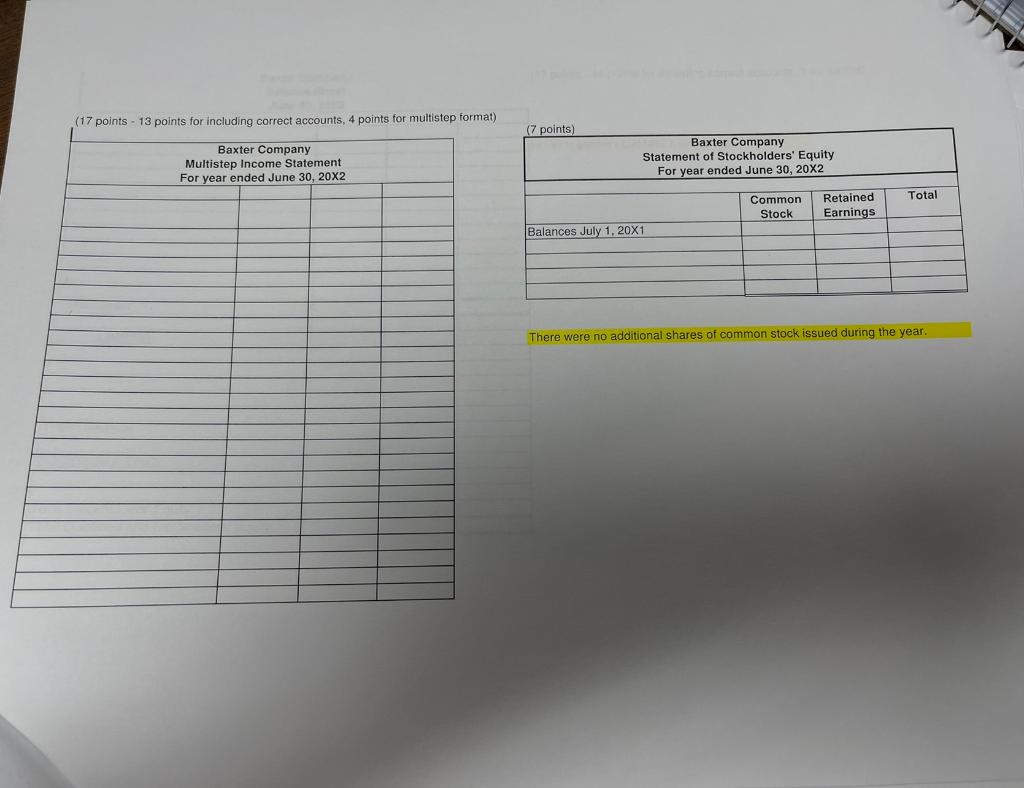

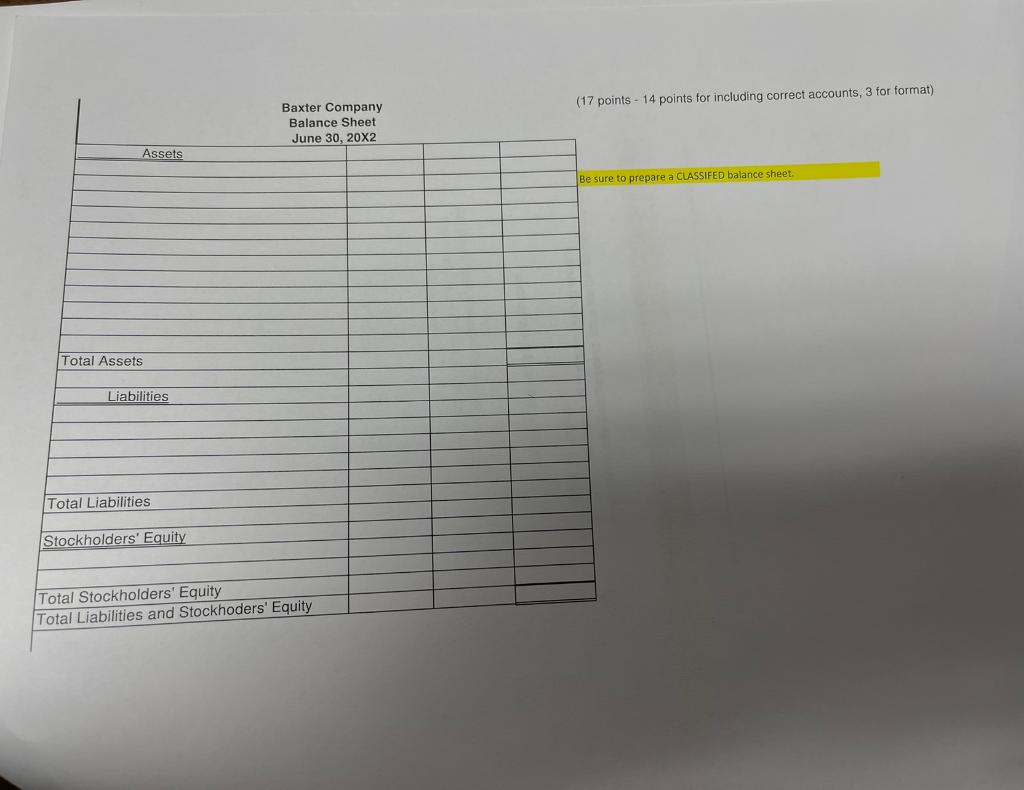

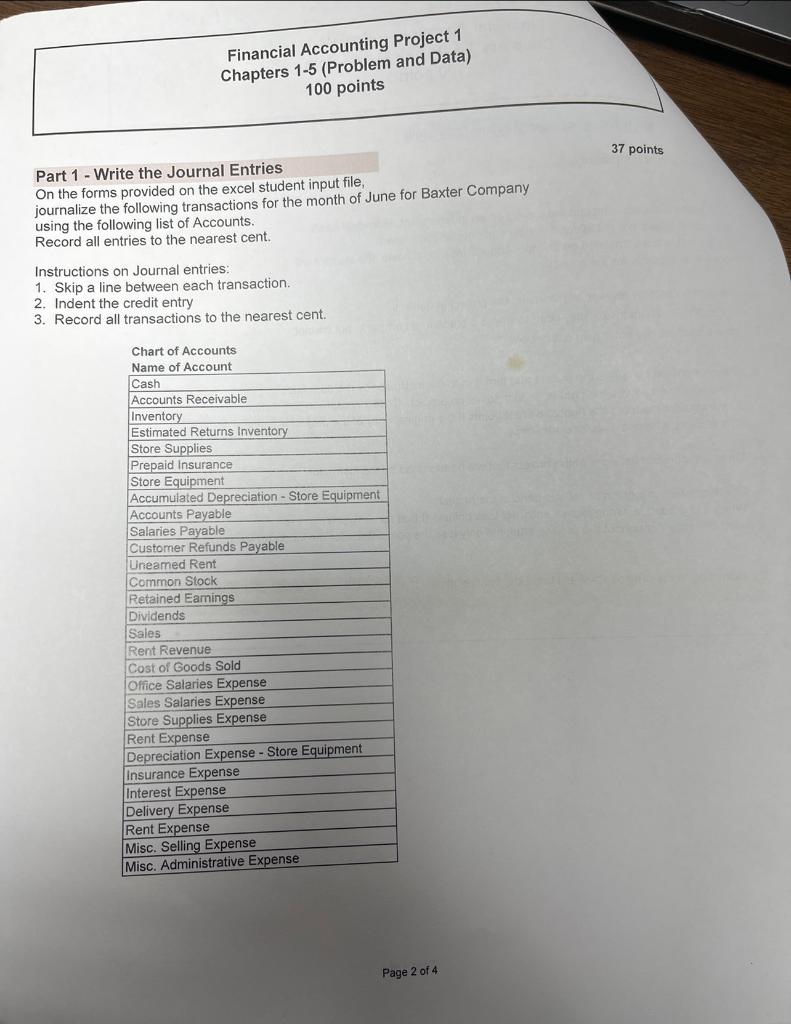

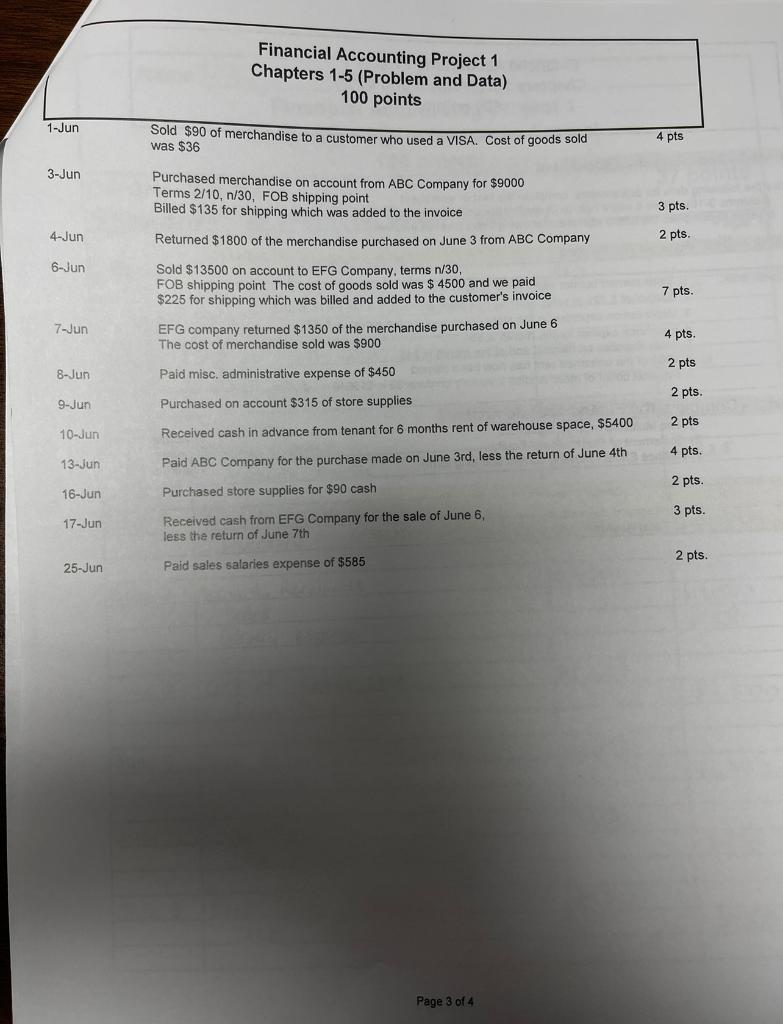

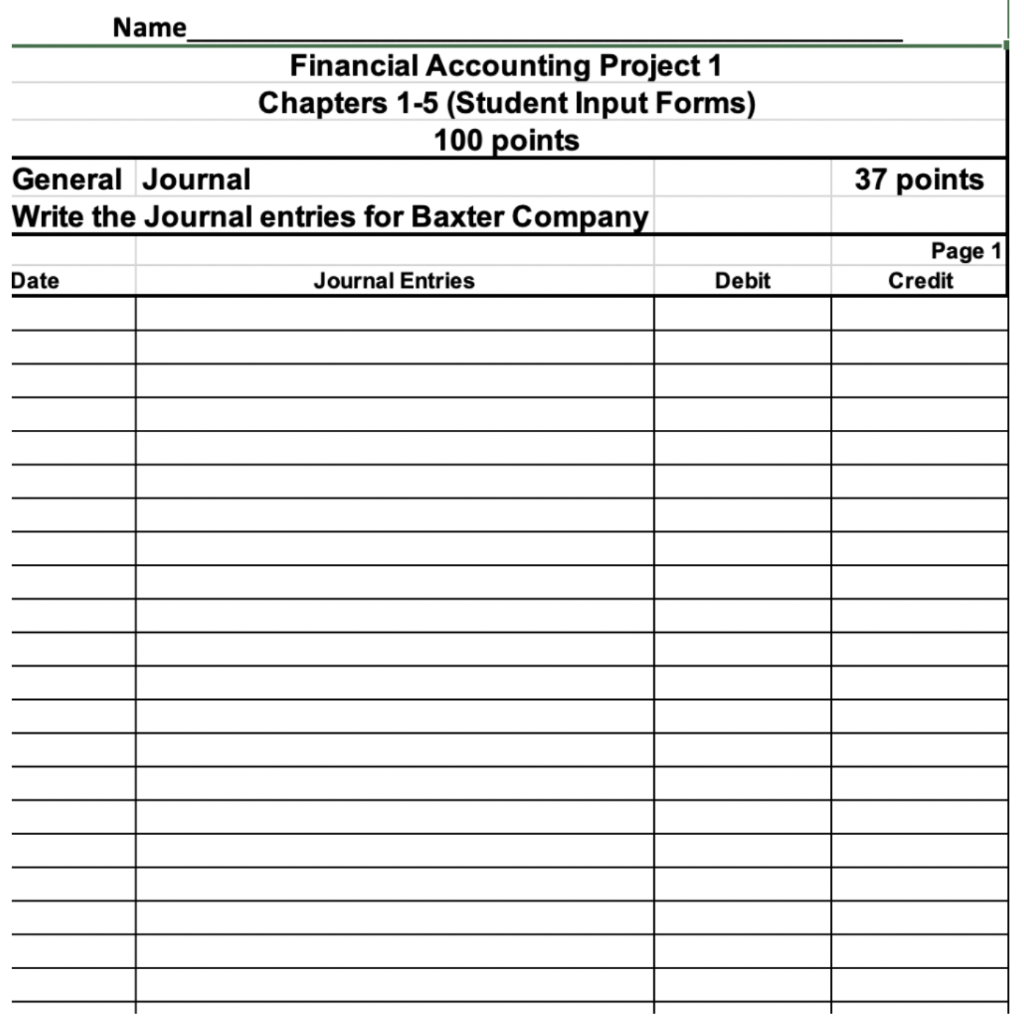

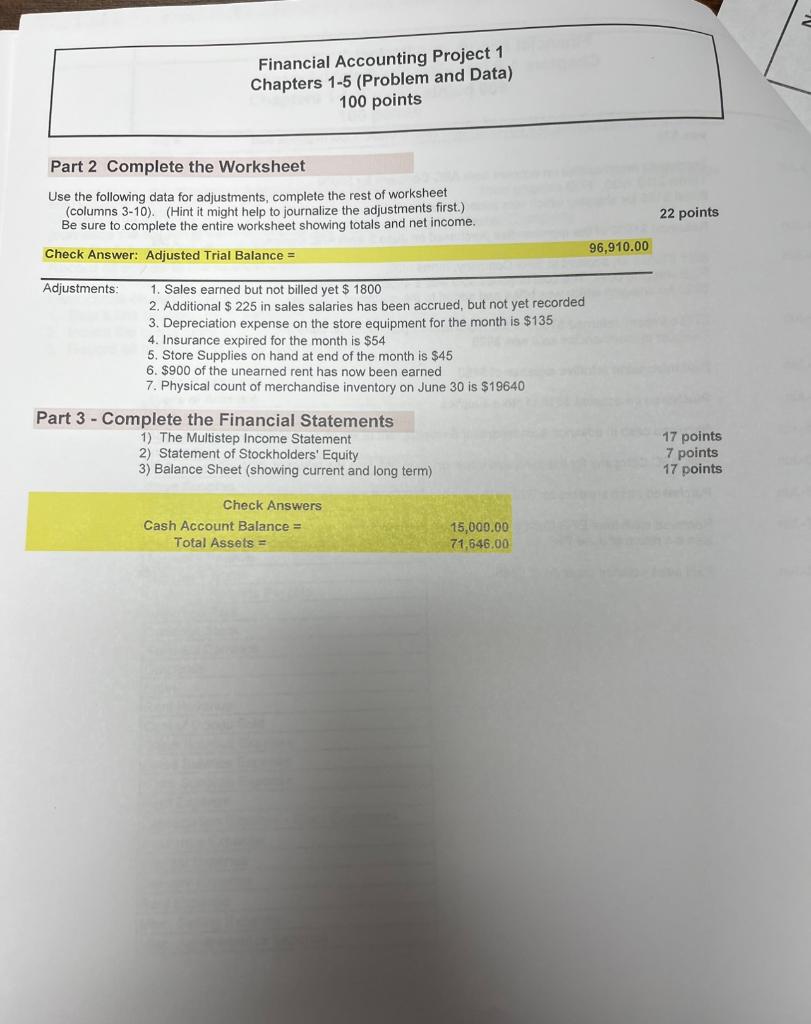

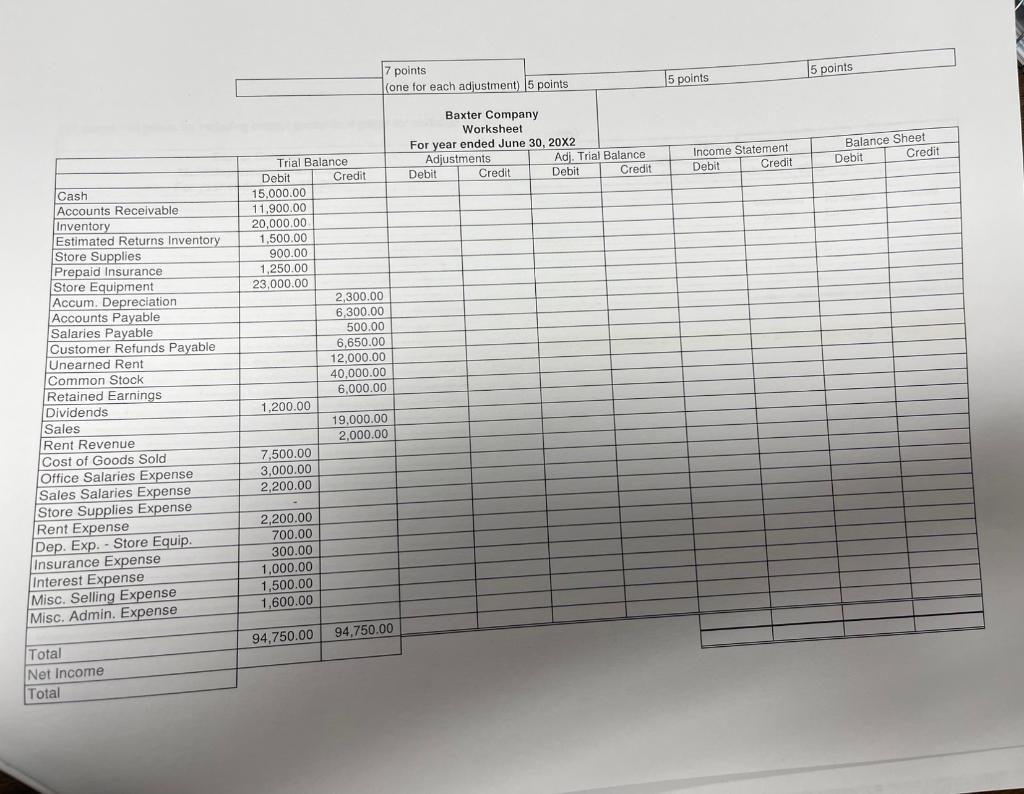

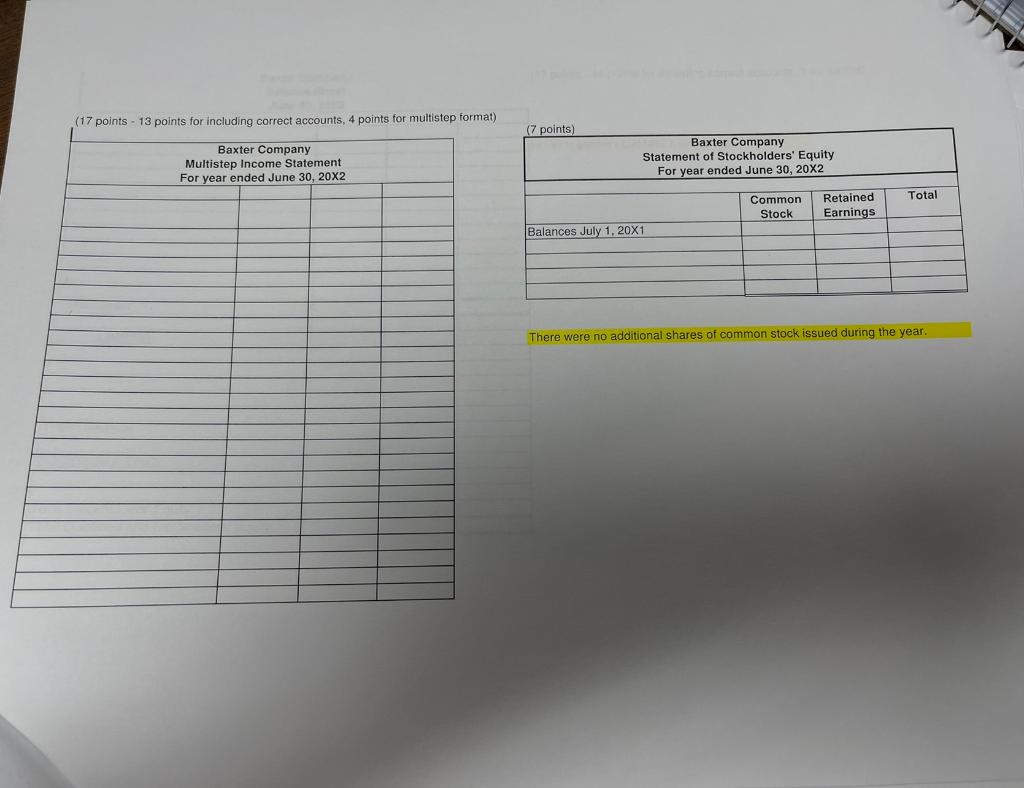

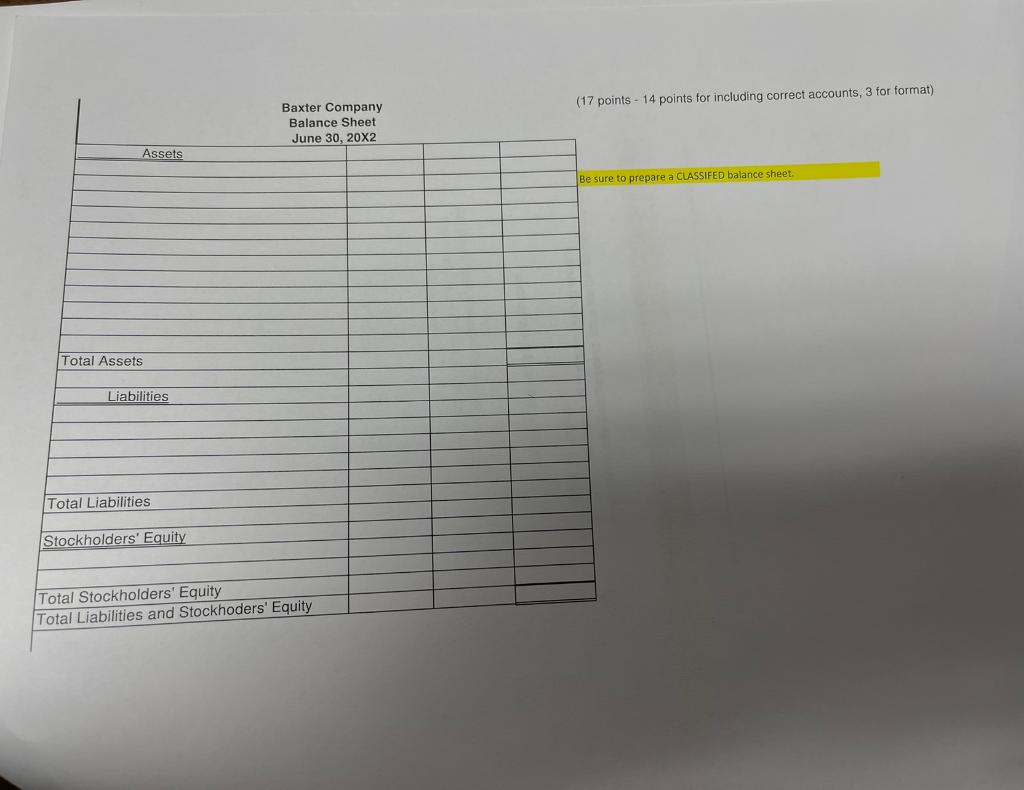

Part 1 - Write the Journal Entries On the forms provided on the excel student input file, journalize the following transactions for the month of June for Baxter Company using the following list of Accounts. Record all entries to the nearest cent. Instructions on Journal entries: 1. Skip a line between each transaction. 2. Indent the credit entry 3. Record all transactions to the nearest cent. Financial Accounting Project 1 Chapters 1-5 (Problem and Data) 100 points 1-Jun Sold $90 of merchandise to a customer who used a VISA. Cost of goods sold 4pts was $36 3-Jun Purchased merchandise on account from ABC Company for $9000 Terms 2/10,n/30, FOB shipping point Billed $135 for shipping which was added to the invoice 3 pts. 4-Jun Returned $1800 of the merchandise purchased on June 3 from ABC Company 2 pts. 6-Jun Sold $13500 on account to EFG Company, terms n/30, FOB shipping point The cost of goods sold was $4500 and we paid $225 for shipping which was billed and added to the customer's invoice 7 pts. 7-Jun EFG company returned $1350 of the merchandise purchased on June 6 4 pts. The cost of merchandise sold was $900 8-Jun Paid misc. administrative expense of $450 2pts 9-Jun Purchased on account $315 of store supplies 2 pts. 10-Jun Received cash in advance from tenant for 6 months rent of warehouse space, $54002 pts 17-Jun Received cash from EFG Company for the sale of June 6 , 3 pts. less the return of June 7 th 25-Jun Paid sales salaries expense of $585 2 pts. Page 3 of 4 Financial Accounting Project 1 Chapters 1-5 (Student Input Forms) 100points General Journal 37 points Write the Journal entries for Baxter Company Name Financial Accounting Project 1 Chapters 1-5 (Student Input Forms) 100points Adjustments: 1. Sales earned but not billed yet $1800 2. Additional $225 in sales salaries has been accrued, but not yet recorded 3. Depreciation expense on the store equipment for the month is $135 4. Insurance expired for the month is $54 5. Store Supplies on hand at end of the month is $45 6. $900 of the unearned rent has now been earned 7. Physical count of merchandise inventory on June 30 is $19640 (17 points - 13 points for including correct accounts, 4 points for multistep format) There were no additional shares of common stock issued during the year. joints - 14 points for including correct accounts, 3 for format) Part 1 - Write the Journal Entries On the forms provided on the excel student input file, journalize the following transactions for the month of June for Baxter Company using the following list of Accounts. Record all entries to the nearest cent. Instructions on Journal entries: 1. Skip a line between each transaction. 2. Indent the credit entry 3. Record all transactions to the nearest cent. Financial Accounting Project 1 Chapters 1-5 (Problem and Data) 100 points 1-Jun Sold $90 of merchandise to a customer who used a VISA. Cost of goods sold 4pts was $36 3-Jun Purchased merchandise on account from ABC Company for $9000 Terms 2/10,n/30, FOB shipping point Billed $135 for shipping which was added to the invoice 3 pts. 4-Jun Returned $1800 of the merchandise purchased on June 3 from ABC Company 2 pts. 6-Jun Sold $13500 on account to EFG Company, terms n/30, FOB shipping point The cost of goods sold was $4500 and we paid $225 for shipping which was billed and added to the customer's invoice 7 pts. 7-Jun EFG company returned $1350 of the merchandise purchased on June 6 4 pts. The cost of merchandise sold was $900 8-Jun Paid misc. administrative expense of $450 2pts 9-Jun Purchased on account $315 of store supplies 2 pts. 10-Jun Received cash in advance from tenant for 6 months rent of warehouse space, $54002 pts 17-Jun Received cash from EFG Company for the sale of June 6 , 3 pts. less the return of June 7 th 25-Jun Paid sales salaries expense of $585 2 pts. Page 3 of 4 Financial Accounting Project 1 Chapters 1-5 (Student Input Forms) 100points General Journal 37 points Write the Journal entries for Baxter Company Name Financial Accounting Project 1 Chapters 1-5 (Student Input Forms) 100points Adjustments: 1. Sales earned but not billed yet $1800 2. Additional $225 in sales salaries has been accrued, but not yet recorded 3. Depreciation expense on the store equipment for the month is $135 4. Insurance expired for the month is $54 5. Store Supplies on hand at end of the month is $45 6. $900 of the unearned rent has now been earned 7. Physical count of merchandise inventory on June 30 is $19640 (17 points - 13 points for including correct accounts, 4 points for multistep format) There were no additional shares of common stock issued during the year. joints - 14 points for including correct accounts, 3 for format)