Please help to answer box key at the bottom.

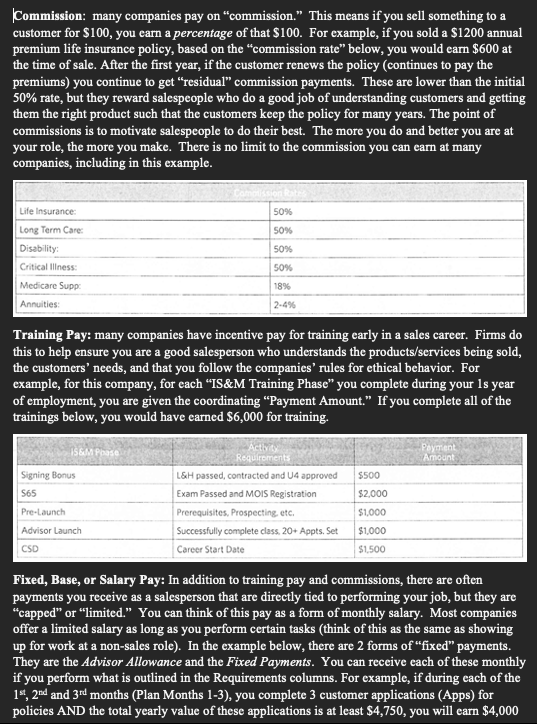

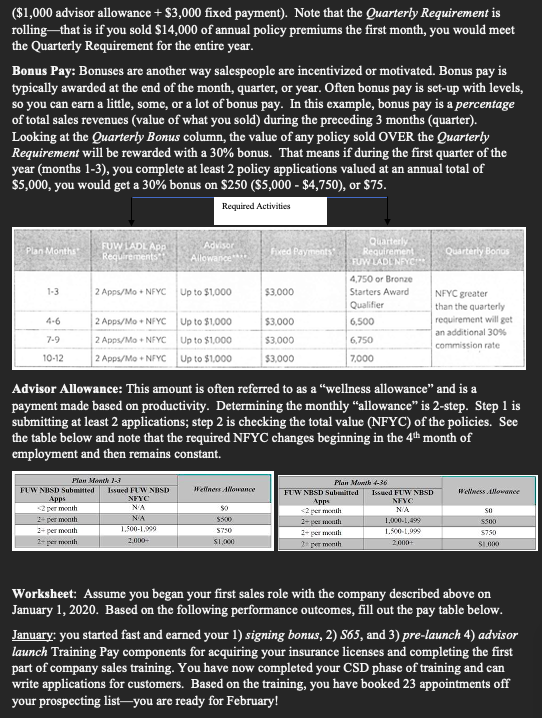

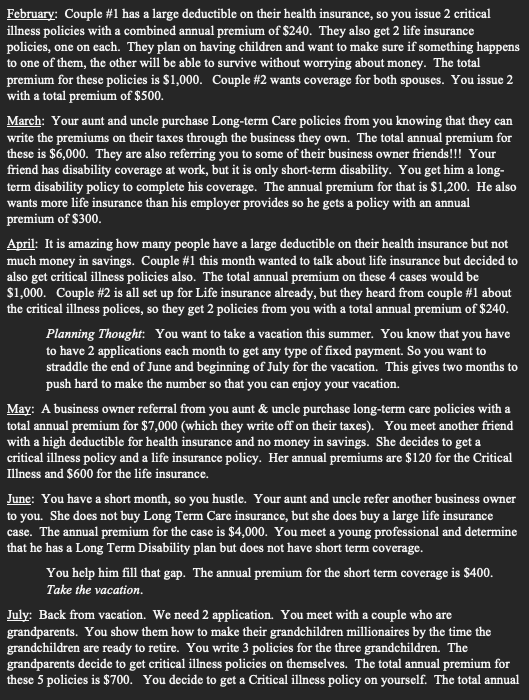

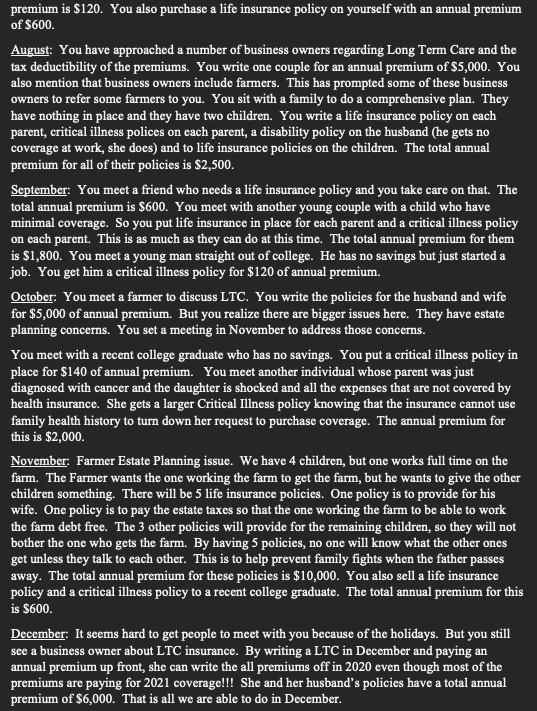

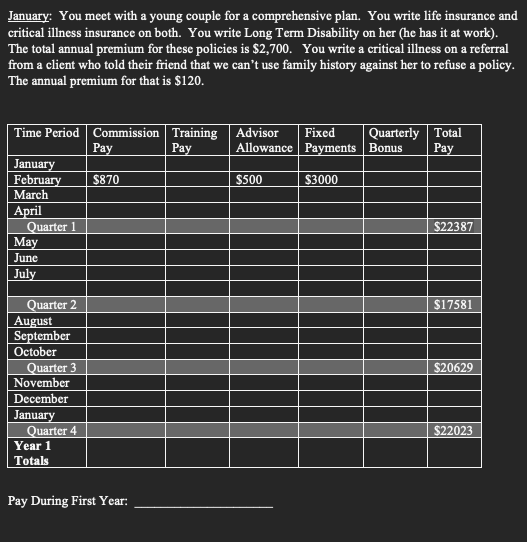

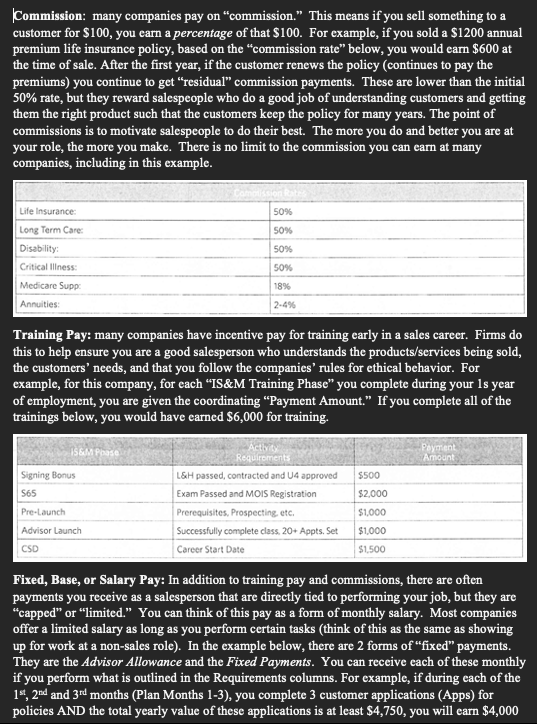

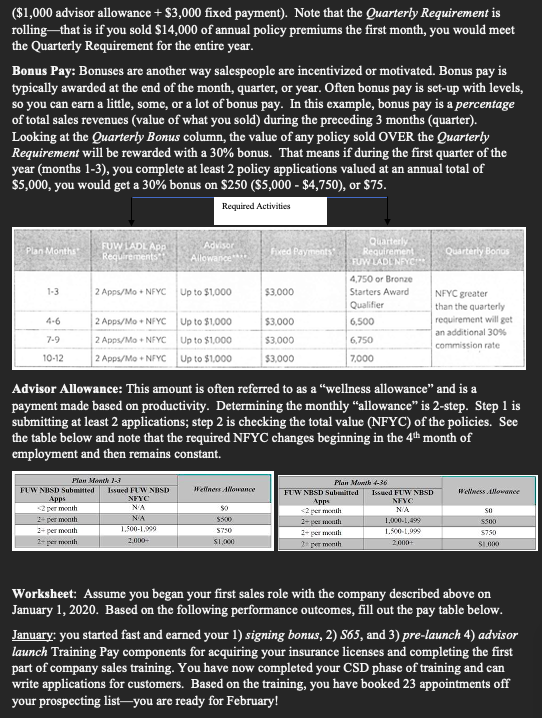

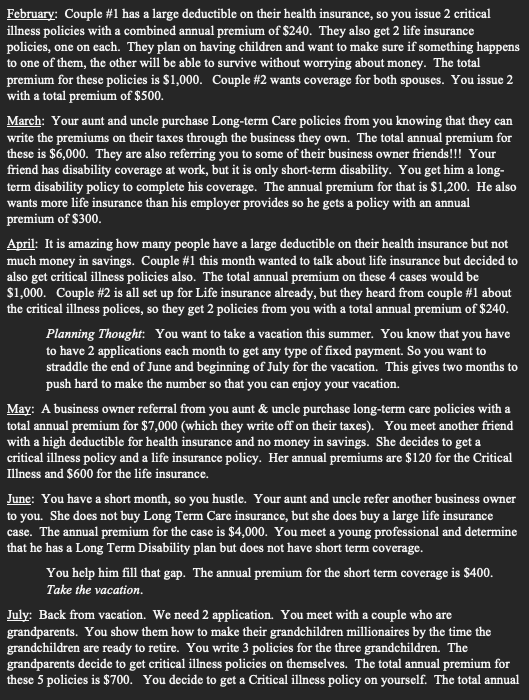

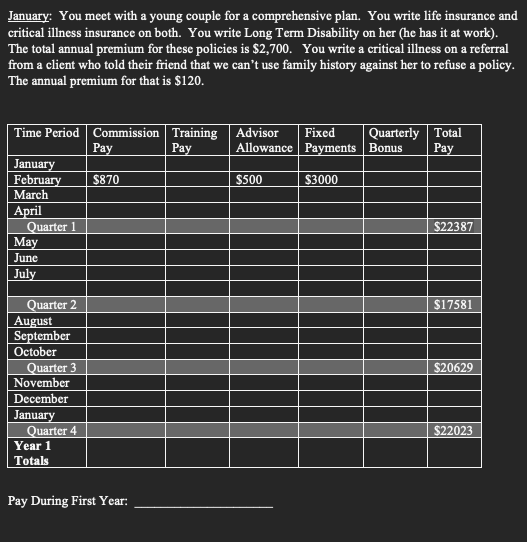

Commission: many companies pay on "commission." This means if you sell something to a customer for $100, you earn a percentage of that $100. For example, if you sold a $1200 annual premium life insurance policy, based on the "commission rate" below, you would earn $600 at the time of sale. After the first year, if the customer renews the policy (continues to pay the premiums) you continue to get "residual" commission payments. These are lower than the initial 50% rate, but they reward salespeople who do a good job of understanding customers and getting them the right product such that the customers keep the policy for many years. The point of commissions is to motivate salespeople to do their best. The more you do and better you are at your role, the more you make. There is no limit to the commission you can earn at many companies, including in this example. 5096 50% 50% Life Insurance Long Term Care Disability Critical Illness Medicare Supp: Annuities 50% 18% 2.4% Training Pay: many companies have incentive pay for training early in a sales career. Firms do this to help ensure you are a good salesperson who understands the products/services being sold, the customers' needs, and that you follow the companies' rules for ethical behavior. For example, for this company, for each "IS&M Training Phase" you complete during your ls year of employment, you are given the coordinating Payment Amount." If you complete all of the trainings below, you would have earned $6,000 for training. 15&M Phase Payment Amount $500 Signing Bonus 565 Activity Requirements L&H passed, contracted and U4 approved Exam Passed and MOIS Registration Prerequisites, Prospecting, etc. Successfully complete class. 20+ Appts. Set Career Start Date Pre-Launch $2.000 $1,000 $1,000 Advisor Launch CSD $1,500 Fixed, Base, or Salary Pay: In addition to training pay and commissions, there are often payments you receive as a salesperson that are directly tied to performing your job, but they are "capped" or "limited." You can think of this pay as a form of monthly salary. Most companies offer a limited salary as long as you perform certain tasks (think of this as the same as showing up for work at a non-sales role). In the example below, there are 2 forms of "fixed" payments. They are the Advisor Allowance and the Fixed Payments. You can receive each of these monthly if you perform what is outlined in the Requirements columns. For example, if during each of the 1st, 2nd and 3rd months (Plan Months 1-3), you complete 3 customer applications (Apps) for policies AND the total yearly value of these applications is at least $4,750, you will earn $4,000 ($1,000 advisor allowance + $3,000 fixed payment). Note that the Quarterly Requirement is rollingthat is if you sold $14,000 of annual policy premiums the first month, you would meet the Quarterly Requirement for the entire year. Bonus Pay: Bonuses are another way salespeople are incentivized or motivated. Bonus pay is typically awarded at the end of the month, quarter, or year. Often bonus pay is set-up with levels, so you can earn a little, some, or a lot of bonus pay. In this example, bonus pay is a percentage of total sales revenues (value of what you sold) during the preceding 3 months (quarter). Looking at the Quarterly Bonus column, the value of any policy sold OVER the Quarterly Requirement will be rewarded with a 30% bonus. That means if during the first quarter of the year (months 1-3), you complete at least 2 policy applications valued at an annual total of $5,000, you would get a 30% bonus on $250 ($5,000 - $4,750), or $75. Required Activities Plan Months FUW LADL App Requirements: Advisor Allowance *** Fixed Payments Quarterly Bonus Quarterly Requirement FUW LADENFYC 4,750 or Bronze Starters Award Qualifier 6,500 1-3 2 Apps/MoNFYC Up to $1,000 $3.000 4-6 2 Apps/Mo+NYC Up to $1,000 2 Apps/Mo+NFYC Up to $1,000 2 Apps/MoNFYC Up to $1.000 $3.000 $3.000 NFYC greater than the quarterly requirement will get an additional 30% commission rate 7-9 6,750 7.000 10-12 $3,000 Advisor Allowance: This amount is often referred to as a "wellness allowance" and is a payment made based on productivity. Determining the monthly allowance" is 2-step. Step 1 is submitting at least 2 applications; step 2 is checking the total value (NFYC) of the policies. See the table below and note that the required NFYC changes beginning in the 4th month of employment and then remains constant Wellness Allowance Weless. Illower Prou Monik 1-3 FUW NUSD Submitted Issued FUW NBSD Apps NFYC PTVT TP Minh NA 2- per maith NA 1.500-1999 2.000- Plan Mub-36 FUW NBSD Submitted Issued FUW NASD Arms NFYC 2 oth NA 2-pesmith 1.000-1,499 2- 1.500-2.999 2 h 2000: so 5:00 5750 SI.000 SO 5500 5750 SIMO Worksheet: Assume you began your first sales role with the company described above on January 1, 2020. Based on the following performance outcomes, fill out the pay table below. January: you started fast and earned your 1) signing bonus, 2) S65, and 3) pre-launch 4) advisor launch Training Pay components for acquiring your insurance licenses and completing the first part of company sales training. You have now completed your CSD phase of training and can write applications for customers. Based on the training, you have booked 23 appointments off your prospecting list-you are ready for February! February: Couple #1 has a large deductible on their health insurance, so you issue 2 critical illness policies with a combined annual premium of $240. They also get 2 life insurance policies, one on each. They plan on having children and want to make sure if something happens to one of them, the other will be able to survive without worrying about money. The total premium for these policies is $1,000. Couple #2 wants coverage for both spouses. You issue 2 with a total premium of $500. March: Your aunt and uncle purchase Long-term Care policies from you knowing that they can write the premiums on their taxes through the business they own. The total annual premium for these is $6,000. They are also referring you to some of their business owner friends!!! Your friend has disability coverage at work, but it is only short-term disability. You get him a long- term disability policy to complete his coverage. The annual premium for that is $1,200. He also wants more life insurance than his employer provides so he gets a policy with an annual premium of $300. April: It is amazing how many people have a large deductible on their health insurance but not much money in savings. Couple #1 this month wanted to talk about life insurance but decided to also get critical illness policies also. The total annual premium on these 4 cases would be $1,000. Couple #2 is all set up for Life insurance already, but they heard from couple #1 about the critical illness polices, so they get 2 policies from you with a total annual premium of $240. Planning Thought: You want to take a vacation this summer. You know that you have to have 2 applications each month to get any type of fixed payment. So you want to straddle the end of June and beginning of July for the vacation. This gives two months to push hard to make the number so that you can enjoy your vacation. May: A business owner referral from you aunt & uncle purchase long-term care policies with a total annual premium for $7,000 (which they write off on their taxes). You meet another friend with a high deductible for health insurance and no money in savings. She decides to get a critical illness policy and a life insurance policy. Her annual premiums are $120 for the Critical Illness and $600 for the life insurance. June: You have a short month, so you hustle. Your aunt and uncle refer another business owner to you. She does not buy Long Term Care insurance, but she does buy a large life insurance case. The annual premium for the case is $4,000. You meet a young professional and determine that he has a Long Term Disability plan but does not have short term coverage. You help him fill that gap. The annual premium for the short term coverage is $400. Take the vacation July: Back from vacation. We need 2 application. You meet with a couple who are grandparents. You show them how to make their grandchildren millionaires by the time the grandchildren are ready to retire. You write 3 policies for the three grandchildren. The grandparents decide to get critical illness policies on themselves. The total annual premium for these 5 policies is $700. You decide to get a Critical illness policy on yourself. The total annual premium is $120. You also purchase a life insurance policy on yourself with an annual premium of $600. August: You have approached a number of business owners regarding Long Term Care and the tax deductibility of the premiums. You write one couple for an annual premium of $5,000. You also mention that business owners include farmers. This has prompted some of these business owners to refer some farmers to you. You sit with a family to do a comprehensive plan. They have nothing in place and they have two children. You write a life insurance policy on each parent, critical illness polices on each parent, a disability policy on the husband (he gets no coverage at work, she does) and to life insurance policies on the children. The total annual premium for all of their policies is $2,500. September: You meet a friend who needs a life insurance policy and you take care on that. The total annual premium is $600. You meet with another young couple with a child who have minimal coverage. So you put life insurance in place for each parent and a critical illness policy on each parent. This is as much as they can do at this time. The total annual premium for them is $1,800. You meet a young man straight out of college. He has no savings but just started a job. You get him a critical illness policy for $120 of annual premium. October: You meet a farmer to discuss LTC. You write the policies for the husband and wife for $5,000 of annual premium. But you realize there are bigger issues here. They have estate planning concerns. You set a meeting in November to address those concerns. You meet with a recent college graduate who has no savings. You put a critical illness policy in place for $140 of annual premium. You meet another individual whose parent was just diagnosed with cancer and the daughter is shocked and all the expenses that are not covered by health insurance. She gets a larger Critical Illness policy knowing that the insurance cannot use family health history to turn down her request to purchase coverage. The annual premium for this is $2,000. November: Farmer Estate Planning issue. We have 4 children, but one works full time on the farm. The Farmer wants the one working the farm to get the farm, but he wants to give the other children something. There will be 5 life insurance policies. One policy is to provide for his wife. One policy is to pay the estate taxes so that the one working the farm to be able to work the farm debt free. The 3 other policies will provide for the remaining children, so they will not bother the one who gets the farm. By having 5 policies, no one will know what the other ones get unless they talk to each other. This is to help prevent family fights when the father passes away. The total annual premium for these policies is $10,000. You also sell a life insurance policy and a critical illness policy to a recent college graduate. The total annual premium for this is $600. December: It seems hard to get people to meet with you because of the holidays. But you still see a business owner about LTC insurance. By writing a LTC in December and paying an annual premium up front, she can write the all premiums off in 2020 even though most of the premiums are paying for 2021 coverage!!! She and her husband's policies have a total annual premium of $6,000. That is all we are able to do in December. January: You meet with a young couple for a comprehensive plan. You write life insurance and critical illness insurance on both. You write Long Term Disability on her (he has it at work). The total annual premium for these policies is $2,700. You write a critical illness on a referral from a client who told their friend that we can't use family history against her to refuse a policy. The annual premium for that is $120. Time Period Commission Training Advisor Fixed Quarterly Total Pay Pay Allowance Payments Bonus Pay January February $870 $500 $3000 March April Quarter 1 $22387 May June July $17581 $20629 Quarter 2 August September October Quarter 3 November December January Quarter 4 Year 1 Totals $22023 Pay During First Year: Commission: many companies pay on "commission." This means if you sell something to a customer for $100, you earn a percentage of that $100. For example, if you sold a $1200 annual premium life insurance policy, based on the "commission rate" below, you would earn $600 at the time of sale. After the first year, if the customer renews the policy (continues to pay the premiums) you continue to get "residual" commission payments. These are lower than the initial 50% rate, but they reward salespeople who do a good job of understanding customers and getting them the right product such that the customers keep the policy for many years. The point of commissions is to motivate salespeople to do their best. The more you do and better you are at your role, the more you make. There is no limit to the commission you can earn at many companies, including in this example. 5096 50% 50% Life Insurance Long Term Care Disability Critical Illness Medicare Supp: Annuities 50% 18% 2.4% Training Pay: many companies have incentive pay for training early in a sales career. Firms do this to help ensure you are a good salesperson who understands the products/services being sold, the customers' needs, and that you follow the companies' rules for ethical behavior. For example, for this company, for each "IS&M Training Phase" you complete during your ls year of employment, you are given the coordinating Payment Amount." If you complete all of the trainings below, you would have earned $6,000 for training. 15&M Phase Payment Amount $500 Signing Bonus 565 Activity Requirements L&H passed, contracted and U4 approved Exam Passed and MOIS Registration Prerequisites, Prospecting, etc. Successfully complete class. 20+ Appts. Set Career Start Date Pre-Launch $2.000 $1,000 $1,000 Advisor Launch CSD $1,500 Fixed, Base, or Salary Pay: In addition to training pay and commissions, there are often payments you receive as a salesperson that are directly tied to performing your job, but they are "capped" or "limited." You can think of this pay as a form of monthly salary. Most companies offer a limited salary as long as you perform certain tasks (think of this as the same as showing up for work at a non-sales role). In the example below, there are 2 forms of "fixed" payments. They are the Advisor Allowance and the Fixed Payments. You can receive each of these monthly if you perform what is outlined in the Requirements columns. For example, if during each of the 1st, 2nd and 3rd months (Plan Months 1-3), you complete 3 customer applications (Apps) for policies AND the total yearly value of these applications is at least $4,750, you will earn $4,000 ($1,000 advisor allowance + $3,000 fixed payment). Note that the Quarterly Requirement is rollingthat is if you sold $14,000 of annual policy premiums the first month, you would meet the Quarterly Requirement for the entire year. Bonus Pay: Bonuses are another way salespeople are incentivized or motivated. Bonus pay is typically awarded at the end of the month, quarter, or year. Often bonus pay is set-up with levels, so you can earn a little, some, or a lot of bonus pay. In this example, bonus pay is a percentage of total sales revenues (value of what you sold) during the preceding 3 months (quarter). Looking at the Quarterly Bonus column, the value of any policy sold OVER the Quarterly Requirement will be rewarded with a 30% bonus. That means if during the first quarter of the year (months 1-3), you complete at least 2 policy applications valued at an annual total of $5,000, you would get a 30% bonus on $250 ($5,000 - $4,750), or $75. Required Activities Plan Months FUW LADL App Requirements: Advisor Allowance *** Fixed Payments Quarterly Bonus Quarterly Requirement FUW LADENFYC 4,750 or Bronze Starters Award Qualifier 6,500 1-3 2 Apps/MoNFYC Up to $1,000 $3.000 4-6 2 Apps/Mo+NYC Up to $1,000 2 Apps/Mo+NFYC Up to $1,000 2 Apps/MoNFYC Up to $1.000 $3.000 $3.000 NFYC greater than the quarterly requirement will get an additional 30% commission rate 7-9 6,750 7.000 10-12 $3,000 Advisor Allowance: This amount is often referred to as a "wellness allowance" and is a payment made based on productivity. Determining the monthly allowance" is 2-step. Step 1 is submitting at least 2 applications; step 2 is checking the total value (NFYC) of the policies. See the table below and note that the required NFYC changes beginning in the 4th month of employment and then remains constant Wellness Allowance Weless. Illower Prou Monik 1-3 FUW NUSD Submitted Issued FUW NBSD Apps NFYC PTVT TP Minh NA 2- per maith NA 1.500-1999 2.000- Plan Mub-36 FUW NBSD Submitted Issued FUW NASD Arms NFYC 2 oth NA 2-pesmith 1.000-1,499 2- 1.500-2.999 2 h 2000: so 5:00 5750 SI.000 SO 5500 5750 SIMO Worksheet: Assume you began your first sales role with the company described above on January 1, 2020. Based on the following performance outcomes, fill out the pay table below. January: you started fast and earned your 1) signing bonus, 2) S65, and 3) pre-launch 4) advisor launch Training Pay components for acquiring your insurance licenses and completing the first part of company sales training. You have now completed your CSD phase of training and can write applications for customers. Based on the training, you have booked 23 appointments off your prospecting list-you are ready for February! February: Couple #1 has a large deductible on their health insurance, so you issue 2 critical illness policies with a combined annual premium of $240. They also get 2 life insurance policies, one on each. They plan on having children and want to make sure if something happens to one of them, the other will be able to survive without worrying about money. The total premium for these policies is $1,000. Couple #2 wants coverage for both spouses. You issue 2 with a total premium of $500. March: Your aunt and uncle purchase Long-term Care policies from you knowing that they can write the premiums on their taxes through the business they own. The total annual premium for these is $6,000. They are also referring you to some of their business owner friends!!! Your friend has disability coverage at work, but it is only short-term disability. You get him a long- term disability policy to complete his coverage. The annual premium for that is $1,200. He also wants more life insurance than his employer provides so he gets a policy with an annual premium of $300. April: It is amazing how many people have a large deductible on their health insurance but not much money in savings. Couple #1 this month wanted to talk about life insurance but decided to also get critical illness policies also. The total annual premium on these 4 cases would be $1,000. Couple #2 is all set up for Life insurance already, but they heard from couple #1 about the critical illness polices, so they get 2 policies from you with a total annual premium of $240. Planning Thought: You want to take a vacation this summer. You know that you have to have 2 applications each month to get any type of fixed payment. So you want to straddle the end of June and beginning of July for the vacation. This gives two months to push hard to make the number so that you can enjoy your vacation. May: A business owner referral from you aunt & uncle purchase long-term care policies with a total annual premium for $7,000 (which they write off on their taxes). You meet another friend with a high deductible for health insurance and no money in savings. She decides to get a critical illness policy and a life insurance policy. Her annual premiums are $120 for the Critical Illness and $600 for the life insurance. June: You have a short month, so you hustle. Your aunt and uncle refer another business owner to you. She does not buy Long Term Care insurance, but she does buy a large life insurance case. The annual premium for the case is $4,000. You meet a young professional and determine that he has a Long Term Disability plan but does not have short term coverage. You help him fill that gap. The annual premium for the short term coverage is $400. Take the vacation July: Back from vacation. We need 2 application. You meet with a couple who are grandparents. You show them how to make their grandchildren millionaires by the time the grandchildren are ready to retire. You write 3 policies for the three grandchildren. The grandparents decide to get critical illness policies on themselves. The total annual premium for these 5 policies is $700. You decide to get a Critical illness policy on yourself. The total annual premium is $120. You also purchase a life insurance policy on yourself with an annual premium of $600. August: You have approached a number of business owners regarding Long Term Care and the tax deductibility of the premiums. You write one couple for an annual premium of $5,000. You also mention that business owners include farmers. This has prompted some of these business owners to refer some farmers to you. You sit with a family to do a comprehensive plan. They have nothing in place and they have two children. You write a life insurance policy on each parent, critical illness polices on each parent, a disability policy on the husband (he gets no coverage at work, she does) and to life insurance policies on the children. The total annual premium for all of their policies is $2,500. September: You meet a friend who needs a life insurance policy and you take care on that. The total annual premium is $600. You meet with another young couple with a child who have minimal coverage. So you put life insurance in place for each parent and a critical illness policy on each parent. This is as much as they can do at this time. The total annual premium for them is $1,800. You meet a young man straight out of college. He has no savings but just started a job. You get him a critical illness policy for $120 of annual premium. October: You meet a farmer to discuss LTC. You write the policies for the husband and wife for $5,000 of annual premium. But you realize there are bigger issues here. They have estate planning concerns. You set a meeting in November to address those concerns. You meet with a recent college graduate who has no savings. You put a critical illness policy in place for $140 of annual premium. You meet another individual whose parent was just diagnosed with cancer and the daughter is shocked and all the expenses that are not covered by health insurance. She gets a larger Critical Illness policy knowing that the insurance cannot use family health history to turn down her request to purchase coverage. The annual premium for this is $2,000. November: Farmer Estate Planning issue. We have 4 children, but one works full time on the farm. The Farmer wants the one working the farm to get the farm, but he wants to give the other children something. There will be 5 life insurance policies. One policy is to provide for his wife. One policy is to pay the estate taxes so that the one working the farm to be able to work the farm debt free. The 3 other policies will provide for the remaining children, so they will not bother the one who gets the farm. By having 5 policies, no one will know what the other ones get unless they talk to each other. This is to help prevent family fights when the father passes away. The total annual premium for these policies is $10,000. You also sell a life insurance policy and a critical illness policy to a recent college graduate. The total annual premium for this is $600. December: It seems hard to get people to meet with you because of the holidays. But you still see a business owner about LTC insurance. By writing a LTC in December and paying an annual premium up front, she can write the all premiums off in 2020 even though most of the premiums are paying for 2021 coverage!!! She and her husband's policies have a total annual premium of $6,000. That is all we are able to do in December. January: You meet with a young couple for a comprehensive plan. You write life insurance and critical illness insurance on both. You write Long Term Disability on her (he has it at work). The total annual premium for these policies is $2,700. You write a critical illness on a referral from a client who told their friend that we can't use family history against her to refuse a policy. The annual premium for that is $120. Time Period Commission Training Advisor Fixed Quarterly Total Pay Pay Allowance Payments Bonus Pay January February $870 $500 $3000 March April Quarter 1 $22387 May June July $17581 $20629 Quarter 2 August September October Quarter 3 November December January Quarter 4 Year 1 Totals $22023 Pay During First Year