Answered step by step

Verified Expert Solution

Question

1 Approved Answer

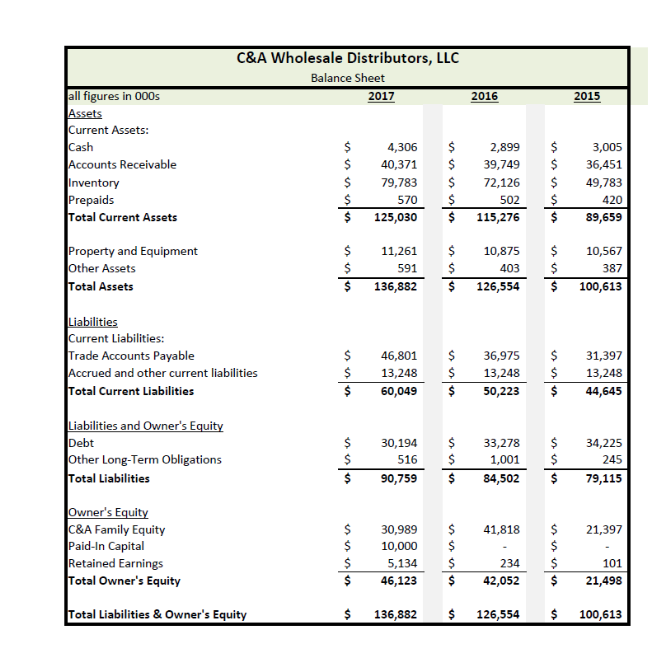

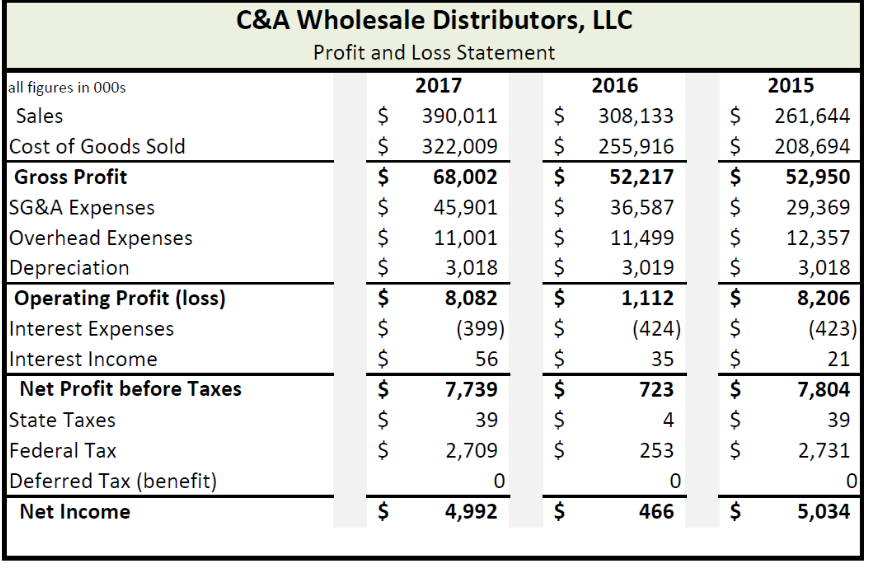

Please help to create a Cash Flow Statement for year 2016 and 2017 using information provided above!!!!! C&A Wholesale Distributors, LLC Balance Sheet all figures

Please help to create a Cash Flow Statement for year 2016 and 2017 using information provided above!!!!!

C&A Wholesale Distributors, LLC Balance Sheet all figures in 000s 2017 2016 2015 Current Assets: Cash Accounts Receivable nventory Prepaids 3,005 40,371 39,749 36,451 $79,783 72,126 49,783 420 $125,030 115,276$89,659 4,306 2,899 570$ 502$ otal Current Assets Property and Equipment Other Assets 11,261 10,875 10,567 387 $136,882 126,554 $100,613 591$ 403$ otal Assets Current Liabilities: Trade Accounts Payable Accrued and other current liabilities 46,801 36,975 31,397 $13,248 13,248 13,248 60,049 50,223 44,645 otal Current Liabilities Liabilities and Owner's Debt Other Long-Term Obligations $30,19433,278 34,225 1,001 $ $90,759 84,502 79,115 516 245 otal Liabilities Owner's E C&A Family Equity Paid-In Capital Retained Earnings 30,989 41,818 21,397 101 $46,123 $ 42,052 21,498 10,000 5,134 S 234$ otal Owner's Equity otal Liabilities & Owner's Equity $136,882 $126,554 100,613 C&A Wholesale Distributors, LLC Profit and Loss Statement 2017 all figures in 000s 2016 2015 Sales Cost of Goods Sold Gross Profit SG&A Expenses Overhead Expenses Depreciation Operating Profit (loss) Interest Expenses Interest Income $ 390,011 $308,133 261,644 322,009 $ 255,916 208,694 $68,002$52,217 $52,950 45,901 $ 36,587 29,369 $11,001 $11,499 12,357 $3,018 $3,019 $3,018 $8,082$1,112$8,206 (423) (399)$ 56 S $7,739 $ (424) $ 21 723$7,804 39 253 2,731 35 Net Profit before Taxes State Taxes Federal Tax Deferred Tax (benefit) 39 4 $2,709 $ 0 0 0 Net Income 4,992 $ 466$ 5,034Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started